Equinor and partner Ithaca Energy have taken the final investment decision for Phase 1 of the Rosebank development, while the NSTA has granted regulatory approval (Figure 1). The project is the highest profile sanction in recent years and has been at the heart of media, political and environmental debate. Equinor is targeting recovery of c. 245 mmbbl of oil from the first phase of development, which is the largest standalone field development to be sanctioned in the UK since Culzean in 2016 and the largest West of Shetland development since BP sanctioned both Clair Ridge (the second phase of the Clair development) and the Quad 204 Schiehallion Redevelopment in 2011.

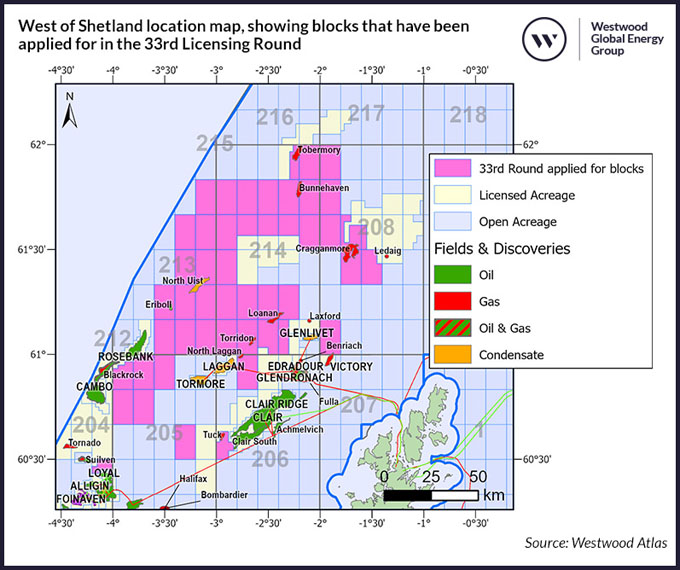

FIGURE 1: WEST OF SHETLAND LOCATION MAP, SHOWING BLOCKS THAT HAVE BEEN APPLIED FOR IN THE 33RD LICENSING ROUND

SOURCE: WESTWOOD ATLAS

Rosebank has had a chequered development history. The field was discovered by Chevron in late 2004 by the 213/27-1Z well and appraised by three wells in 2007. Concept selection was initiated in 2009 and development plans were well underway, and an Environmental Statement was submitted. Plans however were shelved by Chevron in 2013 due to unattractive economics. Chevron made a second attempt to move the development forward, submitting an updated Environmental Statement in August 2018, but with minimal changes to the original submission, economics remained challenging, and Chevron divested its 40% interest to Equinor in October 2018. Equinor acquired a further 40% in its acquisition of Suncor Energy earlier this year for a total consideration of US$850 million, of which US$250 million was contingent on Rosebank FID. Since Equinor became operator of Rosebank, it has progressed the development by revising plans and reducing costs.

Rosebank is planned for development in two phases. The first phase has estimated gross investment of US$3.8 billion with first oil planned for 2026 – 2027. It will comprise four production and three injection wells tied back to the leased Petrojarl Knarr FPSO. The FPSO will be refurbished to include a new process module, structural reinforcements and modifications ready for full electrification, once a power solution is finalised. The second phase of development will comprise a further five wells, three producers and two injectors, but timing will be dependent on reservoir performance. Oil will be exported via shuttle tankers and gas via a new build pipeline into the West of Shetlands Pipeline system via the BP Clair tee-in point. Westwood estimates a total of 320 mmboe (aligned with the Equinor Environmental Statement) will be recovered over the two phases, generating US$3 billion in cumulative pre-tax cashflow, discounted 10% from 2023.

The impact of the field development is important not only for the UK but also for the West of Shetland region. The UK is and will continue to be a net importer of both oil and gas, and the need for continued long term production relies on new field developments such as Rosebank. Based on current investment levels, Westwood forecasts that 70% of the existing 74 hubs in production could cease operations over the next decade and only three are forecast to remain operational by 2043, two of which are in the WoS. Rosebank will add another key hub to the region to help support domestic production and provide tie-back opportunities for undeveloped discoveries and future exploration success.

Another hub to the WoS region will also help the case for a power from shore solution for the region. WoS electrification is complex, and both technically and economically challenging. Delivery prior to 2030 was always going to be ambitious and at Offshore Europe earlier this month, Equinor and BP stated that they were currently looking at a post-2030 timeframe for an electrification solution. The companies outlined that a power from shore concept from Shetland appears most feasible, both technically and economically, with a cable connection of 65-90 km required to supply power to the Clair and Clair Ridge platforms, and a total of 140-160 km of cables needed to also reach Rosebank and Cambo. Delivering an electrification solution to the WoS, will help unlock stranded discoveries and could also increase appetite for exploration in the area.

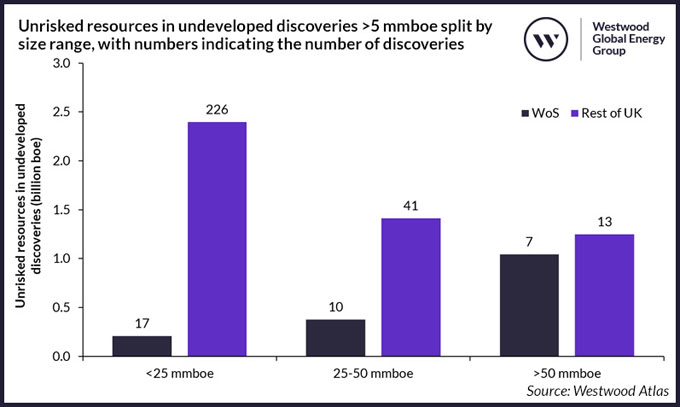

FIGURE 2: UNRISKED RESOURCES IN UNDEVELOPED DISCOVERIES >5 MMBOE SPLIT BY SIZE RANGE, WITH NUMBERS INDICATING THE NUMBER OF DISCOVERIES

SOURCE: WESTWOOD ATLAS

Westwood estimates that there is a total of 6.7 billion boe of unrisked resources in 314 undeveloped discoveries in the UK, of which 1.6 billion boe is in the WoS. The bulk of the resources outside of the WoS are in small discoveries below 25 mmboe, that are reliant on nearby infrastructure to provide tie-back opportunities. Conversely, the bulk of resources in the WoS lies within a smaller number of larger discoveries (Figure 2). Westwood considers c. 1.3 billion boe of this undeveloped resource as commercially viable for development in the UK, of which 40% is in the WoS. The average field size is c. 128 mmboe in the WoS, compared to only c. 25 mmboe for the other UKCS sectors, which makes access to infrastructure in the coming years crucial to fulfil future domestic production.

The development is also likely to have a positive impact on exploration drilling in this part of the West of Shetland. In the 33rd Licensing Round, 49 blocks in the WoS have been applied for, many of which are to the northeast of Rosebank (Figure 1). The first tranche of awards for the Round are due to be announced imminently, with the rest later in October. The WoS applications are likely to contain relatively high-risk prospects, with a likelihood of gas as the expected phase, and although there are potential offtake challenges, developing more hubs in the sector will help unlock opportunities.

UK production is in decline, but the demand for oil and gas will continue and the UK can choose to maximise production domestically or import it. The NSTA and OPRED have rigorous processes in place to ensure that UKCS developments adhere to stringent HS&E guidelines for new field developments. Rosebank is the fifth new field development to be sanctioned to date in 2023 and Westwood expects there could be a further two before the end of the year. However, while the Rosebank sanction is good news for the UKCS, it is not expected to bring a wave of new field development submissions, with fiscal and political uncertainty continuing to hinder future investment plans. With its Norwegian credentials for world-leading, low-carbon oilfield developments, Equinor is well placed to deliver Rosebank, but will be open to reducing its 80% equity and spread its financial exposure. Partner Ithaca will be hoping that the decision on Rosebank could pave the way for its Cambo development to progress too, although now with 100% equity, it will need to find a partner to fund the project.

Yvonne Telford, Research Director – Northwest Europe

ytelford@westwoodenergy.com

KeyFacts Energy Industry Directory: Westwood Global Energy

KEYFACT Energy

KEYFACT Energy