United Oil & Gas, the full-cycle oil and gas company with a portfolio of production, development, exploration and appraisal assets, issues the following update in relation to their Jamaican and Egyptian assets.

Jamaica Update

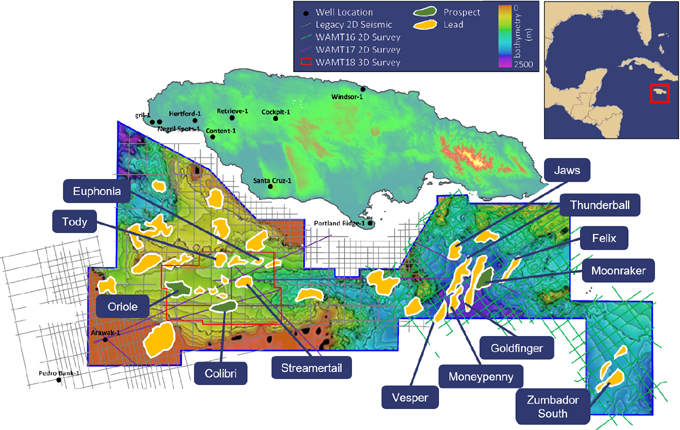

The Company is currently engaged in discussions with a preferred potential partner that has been identified through the farmout process, to participate alongside United in the Walton Morant Licence in Jamaica. Furthermore, the Company is engaging with the Jamaican authorities to secure an extension to the current licence period which expires at the end of January 2024, so as to provide sufficient time to progress additional technical work on the block to support the drilling of an exploration well. Additional updates on both the farmout process and licence extension will be provided in due course.

Egypt Update

The Group’s working interest production averaged 1024 boepd (946 bopd oil and 78 boepd gas) for the year to 5 November 2023, which is in line with full-year 2023 production guidance of between 930 and 1,030 boepd, which remains unchanged. The full-year guidance includes production from the current wells and contributions from workover activity currently being undertaken on the fields.

Kuwait Energy Egypt, (“Kec”) as the operator of the Abu Sennan licence, has notified the Joint Venture partners that drilling of the ASD S-1X well is expected to commence over the coming days, using the ECDC-6 rig. This exploration well is the final well of the 2023 drilling campaign and is targeting an un-risked STOIIP estimated by United at c. 10mmbbls gross across multiple reservoirs intervals, including the primary Abu Roash-C and Abu Roash-E intervals. The ASD S Prospect has been de-risked by the ASD Field, located ca. 2km to the north, which currently produces oil from the same primary reservoirs that are targeted in the well. The well is expected to take ca. 40 days to drill and log, and if positive indicators for the presence of moveable hydrocarbons are seen, the well will be completed and tested.

As previously announced, the macroeconomic issues in the Egyptian economy have resulted in reduced USD liquidity and have impacted the Company’s ability to repatriate funds from Egypt. This situation has further deteriorated over the last month with the onset of renewed conflict in the region which has exacerbated challenges to repatriate funds. Whilst EGPC has continued to make regular payments to the Company against the receivable balance, including Egyptian pound payments equivalent to $1.8m since the 31 October, no USD payments have been received since August 2023.

United Chief Executive Officer, Brian Larkin commented:

“We are encouraged by the continued progress in relation to the farmout process in Jamaica, as we look to unlock the material value contained in this block and deliver value to our stakeholders, including the people of Jamaica. We are entering a critical stage in the farm-out process and will provide an update to the market as this progresses.

"In relation to our position in Egypt, we believe our assets there hold substantial value including the potential value from the upcoming exploration well, but the current economic conditions in Egypt present challenges. We will continue to work with all our local Egyptian stakeholders including EGPC and Kec to maximise value for our shareholders from these assets.”

KeyFacts Energy: United Oil and Gas Egypt country profile l Jamaica country profile

KEYFACT Energy

KEYFACT Energy