- 342 Feet (104 meters) of Total Net Pay Discovered to Date on North Corentyne, Confirming the Significant Potential of the Corentyne Block

- Wei-1 Maastrichtian Rock Quality Analogous to Recent Discoveries Reported in The Basin(1)

- Results Further Demonstrate the Potential for a Standalone Shallow Oil Resource Development Across the Corentyne Block,

- Houlihan Lokey Supporting Active Pursuit of Strategic Options for Corentyne Block Including Potential Farm Down

- Conceptual Field Development Plan Completed

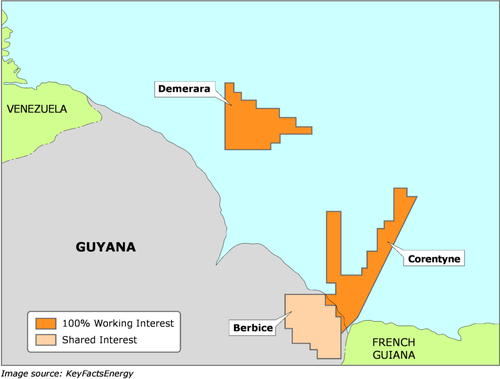

CGX Energy and Frontera Energy Corporation, the majority shareholder of CGX and joint venture partner of CGX in the Petroleum Prospecting License for the Corentyne block offshore Guyana, are pleased to announce today the discovery of a total of 114 feet (35 meters) of net pay at the Wei-1 well on the Corentyne block, approximately 200 kilometers offshore from Georgetown, Guyana.

The Joint Venture believes that the rock quality discovered in the Maastrichtian horizon in the Wei-1 well is analogous to that reported in the Liza Discovery on Stabroek block. Results further demonstrate the potential for a standalone shallow oil resource development across the Corentyne block. The Joint Venture has discovered total net pay of 342 feet (104 meters) to date on the Corentyne block, as summarized below.

| Feet of Net Pay | Wei-1 | Kawa-1 | Total Net Pay by Zone |

| Maastrichtian | 13 | 68 | 81 |

| Campanian | 61 | 66 | 127 |

| Santonian | 40 | 76 | 116 |

| Coniacian* | - | 18 | 18 |

| Total Net Pay | 114 | 228 | 342 |

*Coniacian targeted in Kawa-1 well only

The Joint Venture also announces that Houlihan Lokey, a leading global investment bank and capital markets expert, is supporting active pursuit of strategic options for the Corentyne block, including a potential farm down, as it seeks to develop this potentially transformational oil investment in one of the most attractive oil and gas destinations in the world today, Guyana. There can be no guarantee that the review of strategic options will result in a transaction.

Gabriel de Alba, Chairman of Frontera's Board of Directors, and Co-Chairman o CGX'sf Board of Directors, commented:

“On behalf of the Joint Venture, I am pleased to announce the discovery of 114 feet (35 meters) of net pay at the Wei-1 well. The proven presence of medium sweet crude oil in high-quality Maastrichtian cored reservoir at the Wei-1 well, combined with the previous discovery of 68 feet of hydrocarbon log pay in Maastrichtian blocky sands in the Kawa-1 well in 2022, confirmed the significant potential of the Corentyne block. With the Joint Venture’s two-well drilling program now complete, and as a result of inbound expressions of interest from various global third parties, the Joint Venture is working with Houlihan Lokey to support a review of strategic options for the Corentyne block, including a potential farm down, as it progresses its efforts to maximize value from its potentially transformational investments in Guyana.”

Orlando Cabrales, Chief Executive Officer of Frontera, commented:

“The independent lab results from the Wei-1 well are particularly encouraging for the Maastrichtian zone. Results indicate that the rock quality in the Maastrichtian at Wei-1 is analogous to that reported in the Liza discovery on Stabroek block, further demonstrating the potential for a standalone shallow oil resource development across the entire Corentyne block. In addition, the Joint Venture believes that, further potential upside exists in the Campanian, in which mobile light oil was proven in downhole analysis of samples and the Santonian, which has log pay and remains a potential target for future developments. As is normal course following discoveries such as those made by the Joint Venture at Wei and Kawa, additional appraisal activities will be required to further assess commerciality and as input to optimize subsurface and production system development planning.”

Professor Suresh Narine, Executive Co-Chairman of CGX's Board of Directors, commented:

“These are exciting times for the Joint Venture. The Wei-1 well met the Joint Venture’s expectations with the successful discovery of oil. Wei-1 also delivered a tremendous amount of data, which the Joint Venture is now incorporating into its geologic and geophysical models to update its initial evaluation of Kawa, and the potential in the Maastrichtian in particular, as well as its view of the potential of the remaining undrilled prospects including the prospective areas in between the Wei-1 and Kawa-1 wells. Armed with this information, the Joint Venture is levering Houlihan Lokey’s extensive expertise in the global O&G sector to complete a strategic review of options for the Corentyne block in one of the most exciting exploration basins in the world.”

Wei-1 Results

The Wei-1 well, located approximately 14 kilometres northwest of the Joint Venture's previous Kawa-1 discovery, was safely drilled by the NobleCorp Discoverer semi-submersible mobile drilling unit in water depth of approximately 1,912 feet (583 metres) to a total depth of 20,450 feet (6,233 meters). The Wei-1 well targeted Maastrichtian, Campanian and Santonian aged stacked sands within channel and fan complexes in the northern section of the Corentyne block. As reported on June 28, 2023, the Joint Venture's data acquisition program at the Wei-1 well included wireline logging, MDT fluid samples and sidewall coring throughout the various intervals. Based on this data acquisition program and additional information provided through the independent laboratory analysis process, the Joint Venture is pleased to report the following:

- In the Maastrichtian, Wei-1 test results confirm 13 feet (4 meters) of net pay in high quality sandstone reservoir with rock quality consistent with that reported in the Liza discovery on Stabroek block1 . Fluid samples retrieved from the Maastrichtian and log analysis confirm the presence of sweet medium crude oil with a gas-oil ratio (GOR) of approximate 400 standard cubic feet per barrel.

- In the Campanian, petrophysical analysis confirms 61 feet (19 meters) of net pay almost completely contained in one contiguous sand body with good porosity and moveable oil. Oil sampled during MDT testing as well as samples analyzed downhole confirm the presence of light crude oil.

- In the Santonian, petrophysical analysis confirms 40 feet (12 meters) of net pay in blocky sands with indications of oil in core samples.

- Current interpretation of the Campanian and Santonian horizons show lower permeability than the highquality Maastrichtian, the Joint Venture believes these horizons may offer additional upside potential in the future.

Total costs associated for the Wei-1 well are now estimated to be within $185-$190 million following the successful implementation of several initiatives. Following the agreement reached between CGX and Frontera, the Company will transfer up to 4.7% of its participating interest in the Corentyne block in exchange for Frontera's funding CGX’s unexpected additional costs associated with the Wei-1 well, which amount to approximately $16.5 million. If the maximum transfer occurs, the Company will retain a 27.3% participating interest, while Frontera will hold a 72.7% participating interest in the Corentyne block. We anticipate that this transaction will be completed during December of 2023.

Conceptual Field Development Planning Completed

Based on results from the Wei-1 and Kawa-1 wells, the Joint Venture retained SIA, a Subsea 7 – Schlumberger Joint Venture, to complete a conceptual field development plan for the northern portion of the Corentyne block including subsea architecture, development well planning, production and export facilities and other considerations. As is normal course following discoveries such as those made by the Joint Venture at Wei-1 and Kawa-1 wells, additional appraisal activities will be required before commerciality can be determined. While such additional appraisal activities will be necessary, as a result of the third-party analysis of the Wei-1 well test results, the Joint Venture believes that a potential development of the Maastrichtian horizon may have lower associated development costs and be completed on a faster timeline than a broader development of both the shallow and deep zones on the entire Corentyne block.

KeyFacts Energy: Frontera Energy Guyana country profile l CGX Energy Guyana country profile

KEYFACT Energy

KEYFACT Energy