Amanda Iacone, Senior Reporter, Bloomberg

- Europe, California roll out corporate climate reporting rules

- Accountants add carbon metrics to their professional toolkit

As US companies prepare for looming climate disclosure mandates in Europe and California, corporate accountants are quickly adding carbon accounting to their toolkit—wrangling greenhouse gas emissions along with traditional finance figures like revenue and assets.

Corporate accountants are digging into environmental details that companies already publish voluntarily and looking for gaps they’ll have to fill to meet new European Union requirements, which take effect in 2024. Under the rules, companies will disclose any material risks from climate change and their business’s impact on the environment.

Europe’s far-reaching reporting mandate will eventually cover US companies operating in the economic bloc. California’s new emissions reporting law will apply to firms with at least $1 billion in revenue doing business in the state.

US companies also face a narrower proposal targeting climate risk reporting that the Securities and Exchange Commission will continue to fine-tune next year.

“We have to have reliable, comparable carbon data as well as revenue and expense data,” said Billy Scherba, vice president of regulated reporting solutions at Persefoni, a climate data management platform. “It’s the accountant’s job to manage publicly available information.”

Accountants need to know how to measure carbon emissions to provide investors with figures they can trust while also addressing any resulting financial risks, said Mahfuja Malik, associate accounting professor at Sacred Heart University.

At stake will be a company’s reputation. New climate figures could put valuations at risk or dent earnings as investors and creditors take stock of the company’s position, Malik said.

Turning Transactions Into Carbon

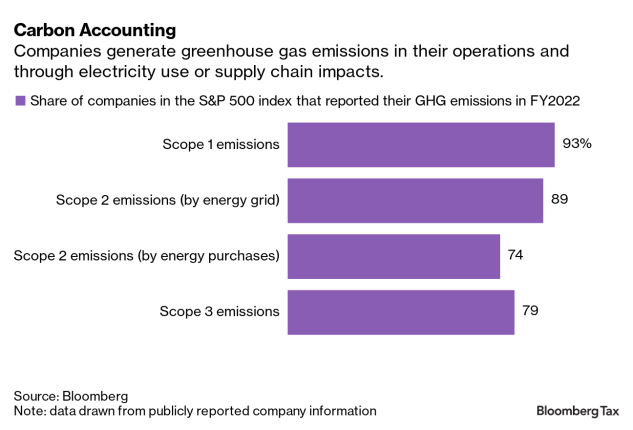

At its core, carbon accounting converts business activities like manufacturing or buying electricity into metrics that gauge a company’s carbon footprint. Those calculations also reflect indirect emissions created by suppliers and customers under the Greenhouse Gas Protocol—a framework for measuring a company’s contribution to climate-warming pollutants.

In addition to carbon dioxide, those calculations also measure methane, nitrous oxide, and other gases that trap heat from the sun in the Earth’s atmosphere. The goal of reporting is to spur companies to curb their emissions and collectively slow or even reverse rising global temperatures.

Carbon accounting “is all about creating accountability,” said Alyssa Rade, chief sustainability officer at Sustain.Life, a decarbonization tracking platform. “It is about understanding these are the activities that we do as a business. This is the energy we consume, these are the businesses we engage, these are the things we buy.”

Business advocates and lawmakers, both Democrats and Republicans, have lobbied the SEC to free public companies from disclosing the emissions of their suppliers, often farmers and other small businesses. The European Commission faced similar pushback and provided companies with more flexibility to decide what to report.

To United Airlines Chief Sustainability Officer Lauren Riley, emissions reporting and other environmental indicators offer a new tool to weigh a company’s performance. She called it a new form of currency.

To put that measuring stick to work, however, requires the skills of accountants who can assess which figures are significant to the business or put a price tag on climate risks.

“If we’re going to be successful in reaching our climate targets, we absolutely need the finance community, accounting,” Riley said. “There’s this crucial role right now in particular for accountants, CFOs, the whole finance team to engage in helping to define how is climate going to impact our business.”

Complex Estimates

Much like traditional accounting figures such as revenue or depreciation, carbon emissions are complex estimates to calculate.

The key question for accountants will be how reliable those figures are, said Shari Littan, director of corporate reporting research for the Institute of Management Accountants.

A new role, the environmental, social, governance—or ESG—controller, has emerged to help companies ensure that investors can rely on figures that will soon jump from voluntary reports published on corporate websites to highly scrutinized securities filings. Google and Bank of America are among the companies that have created a new controllership dedicated to ensuring compliance with the incoming ESG reporting mandates that also will require a third party like auditors to verify the results.

“You need someone with the capabilities, the talent resources to understand data quality, to understand the process of information, the governance,” Littan said.

Accountants need to know which data are important to their business and where to find the underlying information such as travel receipts or utility bills. They’ll also need to know which methods a company uses to come up with its estimated carbon footprint, Scherba said.

That could include formulas based on a company’s spending to estimate indirect emissions, drawing from information that accountants have at their fingertips.

“The consistency, the traceability, the controls around those metrics that are disclosed is a very natural extension of what the CPA’s role has always been,” Scherba said. “And then making sure that’s presented fairly to investors is squarely in the role of the accountant.”

Developing metrics for emissions that stem from banks’ financing, such as underwriting oil projects or gas pipelines, is especially complicated. Demand for help with these thorny calculations spurred the Partnership for Carbon Accounting Financials to create a learning academy geared toward accountants, consultants, and other advisers to lenders.

The partnership of more than 400 financial institutions around the world has committed to disclosing the emissions of portfolios including loans and insurance products.

Accountants have a broader role to play linking climate reporting with traditional corporate accounting, said Angélica Afanador, the organization’s executive director.

“If we really want to achieve that theory of change of getting non-financial disclosures aligned with the financial disclosures, then we need accountants to understand how the balance sheet is paired with that climate impact in the real economy,” Afanador said.

To contact the reporter on this story: Amanda Iacone in Washington at aiacone@bloombergtax.com

To contact the editors responsible for this story: Andrea Vittorio at avittorio@bloombergindustry.com; Amelia Gruber Cohn at agrubercohn@bloombergindustry.com

KEYFACT Energy

KEYFACT Energy