PetroNor E&P, listed on Oslo Børs (PNOR), is an independent oil and gas exploration and production company led by an experienced Board and management team, with substantial experience in oil and gas exploration, appraisal, development and production.

The company's area of focus is on Sub-Saharan Africa and, more specifically, proven and producing assets in the region with development and IOR potential.

PetroNor is present in West Africa with 2P reserves at year end 2022 of 19.1 MMbbls and an average production for 2022 of 4,688 bopd. In addition, the company holds the A4 exploration licence in The Gambia.

Production

2024 First quarter average net working interest production was 5,025 bopd, compared with 5,295 bopd in the previous quarter and 5,237 bopd in the same period in 2023. Production efficiency during the quarter averaged 84%, which is lower than normal (92%) due to 3rd-party power import interruptions and planned shut-downs associated with the laying of a new gas line from Tchibeli NE to Tchendo.

Overview of Operations

Republic of Congo (Congo Brazzaville)

The Republic of Congo (Congo Brazzaville) is the third largest producer of crude oil in Sub-Saharan Africa after Nigeria and Angola, representing around 90 per cent of the exports of the country. The majority of the production in Congo is located offshore, with approximately half in deep water. Congo Brazzaville is an established oilproducing country and a core country for PetroNor, both for production as well as for regional development.

PetroNor holds a 16.83 per cent indirect participation interest in the licence group of PNGF Sud (Tchibouela II, Tchendo II and Tchibeli-Litanzi II) through Hemla E&P Congo SA. In addition, the group holds a right to negotiate, in good faith, along with the contractor group of PNGF Sud, the terms of the adjacent licence of PNGF Bis. If the group is able to secure entry into a production sharing contract, the group expects to be granted a 23.6 per cent indirect interest in PNGF Bis.

PNGF Sud is operated by Perenco, a world-leading specialist in low-cost brownfield optimisation of mature production assets like PNGF Sud.

Production has continued to grow and operating cost per unit production has been significantly reduced, all achieved through improving maintenance routines, production processing capacities along with field integrity investments in a stepwise and prudent manner.

The license partnership is now well underway on its announced 17 well infill drilling programme with a three-year investment programme of some USD 400 million to deliver increased production and reserves.

PNGF SUD Licence overview

Since the entry of the new contractor group in early 2017, incremental improvements via well workovers, surface production process improvements and structural integrity and HSE improvements have resulted in year-on-year growth in production at a relatively low CAPEX spending. The goal has been to optimise the existing well stock by re-activating producers and injectors, re-allocating production intervals, increasing well lift capacities as well as increasing and managing production capacities and intra-field power consumption between the 8 wellhead-platforms in PNGF-Sud.

Licence activity

The average gross PNGF production was 23,891 bopd in 2022 with a continued low lifting cost of $12.4/bbl. The workover programme continued successfully in 2022. On the surface side, significant investments were made on additional water handling capacity, additional export pumps plus starting the commissioning on additional generators for intra-field power generation. Correspondingly, integrity improvements were made on several steel structures.

The 17 well infill drilling programme started in 2021. A total of 6 wells on Litanzi and Tchibeli NE were drilled between November 2021 and November 2022. Drilling progress was initially significantly delayed due to failure of equipment such as the top-drive system and generators. The effect of these delays on the field was however offset by significantly better production performance than expected including the addition of an exploration discovery in the pre-salt (Vanji) in Tchibeli NE which was immediately put on production.

Production capacity thus increased from an average 20.6 kbopd in 2021, via an average 2022 production of 23.9 kbopd to a current production capacity significantly above 30 kbopd in the initial period of 2023.

PNGF BIS Licence overview

Located North-West of PNGF Sud, PNGF Bis license contains two discoveries, Louissima and Loussima SW. The two discoveries are proven by three wells drilled between 1985 and 1991.

The three discovery wells tested from 1,150 to 4,700 bopd of light, good quality oil. Perenco has recently made a detailed reinterpretation, 3D modelling and facilities study for the Loussima SW discovery, yielding >100 MMbbl of in-place resources and a possible tie-back to PNGF Sud via pipeline.

AGR Petroleum Services warrants 2C resources of 29 MMbbl including verification of the tie-back scenario given above.

Congo PNGF Bis update:

On December 27th, 2023, the Council of Ministers in the Republic of Congo met and approved a number of energy projects. This included the award of the PNGF Bis licence to a contractor group led by Perenco as an operator and with PetroNor, represented through its Congolese subsidiary, Hemla E&P Congo, as a partner with a net interest of 22.7%. This approval will clear the path for signing of a production sharing agreement in early 2024. PNGF Bis containsNet 2C resources of 6.6 mmbo in PetroNor’s 2023 Competent Person’s Report.

Nigeria

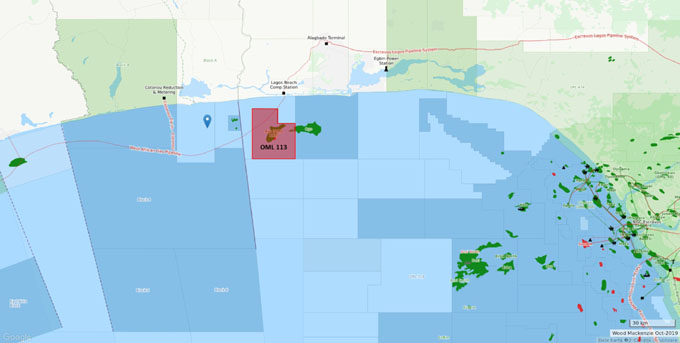

In January 2022, PetroNor received from the Nigeria Upstream Petroleum Regulatory Commission (NUPRC replacing the DPR) the approval for the transaction between Panoro Energy and PetroNor for the acquisition of all its interest in the Aje Field asset. This transaction was completed with Panoro in July 2022. PetroNor now directly holds 6.502 per cent participating interest, with a 16.255 per cent cost-bearing interest, representing an economic interest between 12.1913 per cent and 16.255 per cent in OML 113, containing the Aje oil and gas field.

The Aje oil and gas field was discovered in 1996 with Aje-1 well. After several appraisal wells, the field started production in May 2016 via the Front Puffin FPSO. There were two producing wells in 2021 prior to suspending production, the Aje-4 with oil production and Aje-5ST2 with oil and gas production.

In addition to the oil, there is a significant gas-condensate column ready for further development. The oil production stopped in November 2021 due to the terminated contract with the FPSO.

In October 2023, PetroNor entered into a binding agreement with New Age (African Global Energy) to acquire New Age’s interests in OML 113 in Nigeria which contains the Aje Field. This acquisition not only strengthens the company’s position in OML 113 but also opens up exciting possibilities for future growth in the energy transition and strategic flexibility.

According to the agreement, PetroNor will pay New Age USD 6 million cash plus a deferred future gas production payment up to a maximum of USD 20 million to acquire New Age’s entities holding a project economic and voting interest in the OML 113 Joint Operation Agreement (“JOA”) of 32%. Subject to completion, the agreement will not only increase PetroNor’s economic stake but also reinforce the company’s active involvement and influence in the licence partnership to plan for the re-development of the Aje field.

PetroNor’s existing position in OML 113 was achieved through the acquisition of Panoro Energy ASA’s Nigeria interests in a transaction which completed in 2022. PetroNor is working with the OML 113 operator, Yinka Folawiyo Petroleum (“YFP”), to create a jointly owned company, Aje Production AS, which will hold a project economic and JOA voting interest of 39%.

Following completion of these transactions, PetroNor and YFP related entities will have a project economic and JOA voting interest of 71%.

The Aje field is estimated to contain recoverable resources of 480 BCF of gas, 54 mmbbls oil, condensate and LPG. The acquisition of New Age’s Aje interests will increase PetroNor’s net 2C contingent resources in Aje from 27.1 mmboe to 70.1 mmboe.

The Gambia

PetroNor E&P's A4 license is located within the same proven play trend as Senegal and the Sangomar field, a play which is expected to extend southward into The Gambia.

In November 2022, the company was awarded a new 30-year lease for the A4 licence with terms based on the newly developed Petroleum, Exploration and Production Licence Agreement – PEPLA model. A proportion of prior sunk costs associated with Block A4 have been carried into the new agreement. The first three-year period of the licence has been split into two 18 month periods. The first period involves an extensive work program with a drill or drop decision in May 2024.

PetroNor has licenced additional 3D PSDM seismic data (TGS Jaan 3D) to give an enhanced regional perspective and to better understand recent well results both successes and failures in this part of the MSGBC Basin. PetroNor is seeking a partner to join the company in drilling one exploration well in this highly attractive acreage 40kms to the South of the Sangomar fieldin Senegal. The key prospects in A4 are the ‘Lamia-South’ prospect (net mean prospective recoverable resource 295mmbo) and the ‘Rosewood’ prospect (net mean prospective recoverable resource 350 mmbo), both with commercial volumes and attractive probability of success. PetroNor considers Lamia South to be a genuine analogue for the Sangomar Field (unlike recent wells in adjacent acreage). PetroNor aims to participate in any future well at an equity level of 30-50 per cent and hopes to drill in 2024 upon entering the second phase of the first exploration period.

LEADERSHIP

Eyas Alhomouz Chairman

Jens Pace Interim CEO

Claus Frimann-Dahl CTO

Michael Barrett Exploration Manager

Emad Sultan Strategy and Contracts Manager

Chris Butler Group Financial Controller

CONTACT

Oslo

Frøyas gate 13,

0273 Oslo

Norway

+47 22 55 46 07

info@petronorep.com

London

48 Dover Street

London, W1S 4FF

United Kingdom

+44 203 655 7810

Abu Dhabi

M Floor, Al Heel Tower

Al Khalidiya

Abu Dhabi

United Arab Emirates

P.O.Box 35491

KeyFacts Energy: PetroNor Republic of the Congo country profile l PetroNor Nigeria country profile

PetroNor Gambia country profile l KeyFacts Energy: Company Profile

If you would like to discover more about KeyFacts Energy, contact us today and we can arrange a 15-minute online meeting to review our database of over 2,600 continually updated 'country-specific' oil and gas and renewable energy profiles from a selection of 144 countries. Find out how you can instantly identify companies with operational activity in your chosen country, 'fine-tune' your news or company selection based on industry category, energy type or regional location and additionally benefit from one to one contact with us to ensure maximum online and social media exposure for your company.

KEYFACT Energy

KEYFACT Energy