Serica Energy has signed a sale and purchase agreement ('SPA') to acquire further interests in the Bruce and Keith fields and associated infrastructure in the UK North Sea.

Under the SPA, Serica UK will acquire a 16.00% interest in the Bruce field and a 31.83% interest in the Keith field and associated infrastructure from BHP Billiton Petroleum Great Britain. The structure of the Transaction is the same as the deals entered into by Serica with BP and Total whereby Serica will acquire interests variously in the Bruce, Keith and Rhum fields.

The Transaction has an effective date of 1 January 2018 and completion is subject to completion of the previously announced acquisition of interests in the Bruce, Keith and Rhum fields from BP ('BP Transaction'). The Transaction is also subject to inter alia certain regulatory, government and partner consents with completion targeted for 30 November 2018.

The Transaction together with the previously announced purchases from BP and Total will result in Serica consolidating its ownership of the Bruce and Keith fields to 94.25% and 91.67% respectively post-completion.

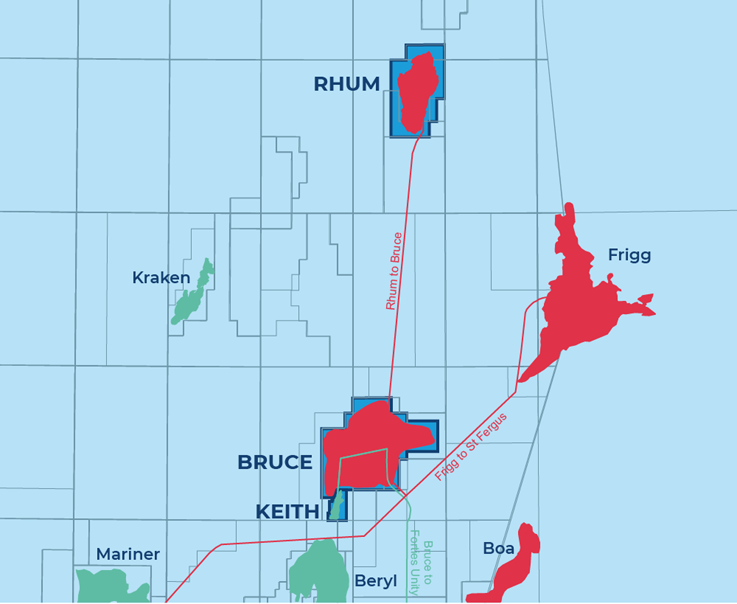

Location of Bruce and Keith fields (Source: Serica Energy)

Transaction highlights

Following completion of the BP Transaction and acquisition of further interests in the Bruce and Keith fields from Total E&P UK Limited ('Total E&P Transaction') and transfer of operatorship of the Bruce, Keith and Rhum fields to Serica UK, the board believes the Transaction will further strengthen Serica's position as one of the leading mid-tier independent oil and gas producers on the UK Continental Shelf and will provide incremental benefits to the Company.

Further increase in reserves and production

- Serica's pro-forma net 2P reserves as at 1 August 2018 are expected to increase by approximately 4.0mmboe from approximately 58.7mmboe[i] post completion of the BP Transaction and Total E&P Transaction to approximately 62.7mmboe post completion of this Transaction

- Net production in 1H 2018 from the BHP Assets was approximately 1,760boe/d, of which 81% was gas

- The Transaction is expected to be immediately cash flow and value accretive following completion

Structured to mitigate financial risk and maintain balance sheet resilience

- The bulk of the consideration under the Transaction is deferred and the initial cash consideration is expected to be funded by Serica UK's share of net cash flows between 1 January 2018 and completion

Further increased scale in line with strategic growth plans

- The Transaction will enhance the value Serica expects to unlock from the Bruce/Keith/Rhum areas

- No additional management and administrative resources will be required.

- The Transaction will further increase Serica's scale and profile, providing a broader base from which to attract funding and pursue investment opportunities

Principal terms of the Transaction

The initial cash consideration is £1 million, to be adjusted for working capital and 40% of post-tax cashflows from the effective date of 1 January 2018. The net 2P Reserves attributable to the BHP Assets as at 1 August 2018 are estimated to amount to approximately 4.0mmboe.

BHP will also receive a share of pre-tax net cash flow from the BHP Assets under a Net Cash Flow Sharing Deed ('NCFSD') on the same terms as the net cash flow sharing deed entered into as part of the BP Transaction. BHP will receive a share of pre-tax net cash flow from the BHP Assets of 60% for the remainder of 2018, 50% in 2019 and 40% in each of 2020 and 2021. The net cash flow shares are calculated on a monthly basis. No amounts are payable by Serica UK unless this cash flow is positive and amounts are repayable to Serica UK in the event of negative cash flow, up to the amount of prior payments made to BHP in the same year. Excess losses in a year are carried forward to be offset against future income. As a constituent part of the calculation of the Monthly Net Cash Flow Payment, Serica shall, subject to the terms of the NCFSD, be entitled to propose the carrying out of Necessary Investment Works and / or Discretionary Investment Works.

BHP is retaining liability for the costs of decommissioning facilities and wells already in place. Serica will pay deferred consideration to BHP in respect of 30% of BHP's share of future decommissioning costs when due, reduced by the tax relief attributable to BHP on such costs. This element of consideration is capped by the amount of cumulative net cash flow received by Serica UK, as a result of the Transaction. Deferred consideration will also be payable in respect of the realised value of oil in the Bruce pipeline at the end of field life.

Completion of the Transaction is conditional inter alia on:

- Completion of the BP Transaction;

- Relevant third-party consents;

- OGA approval;

- HMRC clearance with respect to the tax treatment of the NCFSD; and

- The execution of certain decommissioning documents.

The BHP SPA also contains customary warranties in relation to the BHP Assets from BHP for a transaction of this nature.

Mitch Flegg, Chief Executive of Serica Energy, commented:

"We are delighted to have agreed with BHP to acquire their stakes in Bruce and Keith and to be consolidating our ownership in the fields to 94.25% and 91.67% respectively. This acquisition, in addition to the previously announced transactions with BP and Total, place us in an even better position to unlock increased value from the assets and benefit from economies of scale."

"Completion of the Transaction with BHP is anticipated to take place immediately after the respective completions of the BP and Total E&P Transactions. This will represent a major transformation for Serica in becoming one of the leading UK independent offshore operators and producers in the North Sea."

KEYFACT Energy

KEYFACT Energy