A flash blog today as I am travelling and hoping to keep you in touch with everything from Colombia.

Chariot

Chariot has provided an update on the outlook for 2024 and near-term plans across its three pillars, Transitional Gas, Transitional Power and Green Hydrogen.

Transitional Gas

Onshore Morocco

Loukos Licence (Chariot, Operator 75%, ONHYM, 25%)

- First drilling campaign of two wells is on track to commence around the end of Q1 2024.

- Planning activity is well advanced including

- signature of a contract with Star Valley Drilling, for provision of the 101 rig which is already operating in country

- imminent approval expected of the environmental permit for up to 20 well operations across the licence area, allowing flexibility and efficient planning of future campaigns

- delivery of long lead items to Chariot's newly established storage yard

- land access approvals nearing completion, with site construction activities to commence thereafter

- Planning activity is well advanced including

- Gaufrette prospect confirmed as the first drilling target

- up dip of an existing gas discovery and supported by similar seismic anomalies to those successful in Chariot's offshore operations

- success will potentially unlock multiple similar prospects totaling 26 Bcf of Best Estimate recoverable prospective resources (preliminary internal estimate)

- Dartois prospect has been high-graded as the most likely second drilling target

- located along trend from a historic gas discovery which tested gas from the same reservoir interval

- has the potential to unlock a trend of prospects with over 20 Bcf of total Best Estimate recoverable prospective resources (preliminary internal estimates)

- Early fast-track product from the 3D seismic reprocessing project has allowed identification of secondary objectives for the upcoming wells, which are under evaluation.

- Precise timing for the drilling campaign will depend upon rig schedule and further updates will be provided in due course, along with any further updates regarding the reprocessed 3D seismic data analysis.

- Work is also continuing with our partner ONHYM on success-case fast-track industrial commercialisation opportunities, with the possibility to deliver near-term cash flows.

Offshore Morocco

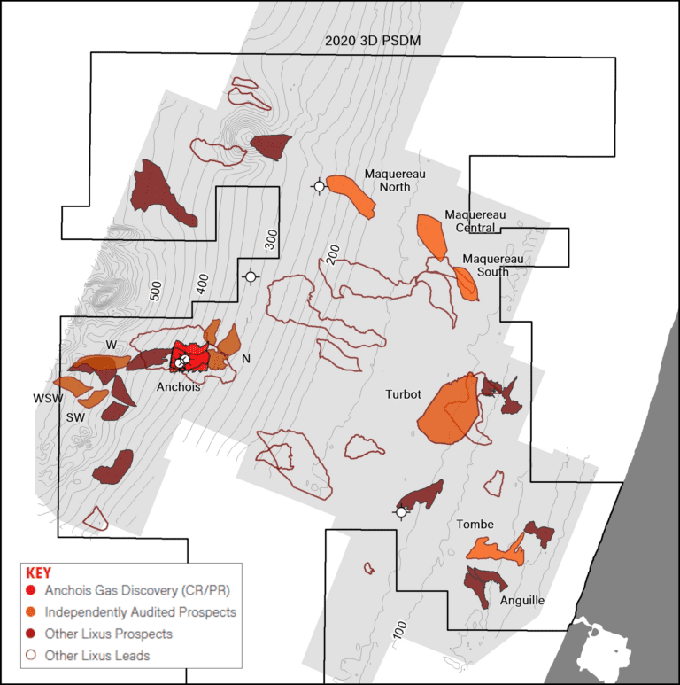

Anchois Gas Development Project within the Lixus licence (Energean, Operator 45%, Chariot 30%, ONHYM 25%); Rissana licence (Energean, Operator 37.5%, Chariot 37.5%, ONHYM 25%) - working interest post-completion of transaction

- Moroccan regulatory approval of the Energean partnership transaction is expected shortly. On completion, US$10 million will be payable to Chariot.

- Chariot and Energean technical teams are working closely together on the Anchois development project delivery, including:

- Negotiation of the offshore drilling rig contract and services for the 2024 drilling and testing campaign, which is targeting the increase of the development to >1 Tcf

- Field development FEED updates

- Gas commercialisation agreements, including anchor contract negotiations with ONEE

- Progressing exploration work programme plans across the wider Lixus and Rissana acreage

Transitional Power

- Having increased our stake in the South African electricity trading platform, Etana Energy (Pty) Limited ("Etana") in December 2023, Chariot now owns 49% of this business alongside partners H1 Holdings (Pty) Limited which holds 51%.

- Etana aims to provide competitive and sustainable end to end electricity solutions through connecting new and existing energy generation projects to corporate and industrial users

- With rapid deregulation of South Africa's energy market and high demand for electricity in the country, this "many generators to many customers" business model is well positioned for growth

- Trading platform enables Chariot's participation in large renewable generation projects - 400MW of gross wind generation capacity has been identified

- The Etana team is currently securing multiple electricity offtake agreements with a range of consumers

- Project, mezzanine and other debt finance options to fund the above are also progressing in Q1

- Operations at the 15MW Essakane solar project in Burkina Faso are running well and the development of the 40MW solar project at Tharisa continues to move forward. Further updates on the projects in development with Karo Platinum and First Quantum Minerals will also follow as they progress towards Final Investment Decision.

Green Hydrogen

- Feasibility Study at Project Nour in Mauritania, in partnership with TEH2 (Total Energies 80%, Total Eren 20%) has now been completed and will be presented to the Government of Mauritania in Q1 2024

- Further studies and pilot projects are also moving forward which include:

- Working with TEH2 and SNIM (Mauritanian National Mining Company) on the decarbonisation of the transport of Mauritania's largest train

- Partnering with Mohammed VI Polytechnic University and Oort Energy on a 1MW electrolyser project in Morocco

- Range of further opportunities under evaluation with focus on nearer term production

Adonis Pouroulis, CEO of Chariot commented:

"We enter the new year with multiple important catalysts for the Group over the coming months. In kickstarting the drilling campaign at the Loukos licence we are focused on unlocking an overlooked onshore basin that has near term production potential with immediate access to industrial markets. Importantly this asset also has a growing portfolio of follow-on opportunities which give meaningful scale and value to the project, at a time when industrial gas demand and associated gas pricing is at an unprecedented high. Drilling at Anchois later in the year will be a key milestone in determining the possibility to scale up this development and we are working closely and constructively with our new partners Energean in preparing all the workstreams necessary to permit a Final Investment Decision post-drilling as soon as feasible. We thank ONHYM and the Ministry of Transitional Energy and Sustainable Development for their continued support for the transaction and look forward to confirming Energean on to the project shortly.

"We are also excited about the opportunities that we see within our Power and Hydrogen businesses. We continue to build on our presence across the transitional energy sector, we remain fully focused on looking to maximise value for all stakeholders and will continue to provide updates on all our further developments."

Union Jack Oil

Union Jack has announced details of its initial expansion into the United States of America, with the purchase of three Mineral Royalty packages, brokered by the Company’s agent and adviser, Reach Oil & Gas Inc.

Union Jack is also poised to complete Joint Venture agreements with Reach, in respect of a number of value accretive, exploration, drilling, development and potential production ventures in Oklahoma, one of the highest ranked hydrocarbon production locations in the United States.

Royalties Purchased to Date

- Cronus Unit, containing a 25 well package in the Permian Basin, Midland County, Texas, (Effective date December 2023); the property is comprised of 9 Chevron and 16 XTO

- (a subsidiary of Exxon) operated wells

- COG Operating LLC (a subsidiary of ConocoPhillips) operated, Powell Ranch Unit, consisting of 15 wells in the Permian Basin, Upton County, Texas (Effective date November 2023); the property is comprised of 7 horizontal and 8 vertical wells

- Occidental operated Palm Springs Unit, containing 10 horizontal wells in the Permian Basin, Howard County, Texas (Effective date January 2024)

- The total cash consideration for the Royalties was US$854,070 (£677,235)

- 10% of consideration earned since December 2023

The Royalties are estimated to have an economic life of more than 26 years and a current Internal Rate of Return in excess of 20%

The Royalties also provide additional upside as new wells are completed and drilled on the properties at no cost to Union Jack. Chevron, one of the associated operators, has publicly stated their commitment to expanding activities in the Permian Basin.

Reach has been appointed as agent to act on behalf of Union Jack in the management of the Royalties.

The Royalties acquisition has been completed using existing cash balances.

Gneiss Energy acted as Financial Adviser to this transaction.

Attraction of United States Royalties and Initial Focus Areas

- Exposure to most active basins and largest operators in the United States

- Monthly income with no development or operating costs

- Owned in perpetuity, with no forward liabilities or obligations

- Focus on the Permian Basin, Texas, which produces approximately 6% of the world’s daily oil requirements

- Oil and gas production and drilling anticipated for decades

- Each well can target multiple productive zones, such as the Lower Sprayberry, Wolfcamp A, Wolfcamp B Lower, Wolfcamp B Upper, Wolfcamp C and D, Jo Mill, and Dean and Barnett, amongst others

Future Collaboration with Reach on Drilling Opportunities

In addition to Reach’s role in the management of the Royalties, Union Jack is also poised to complete Joint Venture agreements with Reach, in respect of a number of value accretive, exploration, drilling, development and potential production ventures in Oklahoma, one of the highest ranked hydrocarbon production locations in the United States.

The Company’s rationale in pursuing these investment opportunities is that Union Jack will acquire material interests in projects with near-term planned drilling, a high chance of success and capable of adding significant cash flow, complementing Union Jack’s existing profitable, production and development interests onshore UK.

Due diligence, including a site visit, has been undertaken by Union Jack in respect of certain oil and gas investment opportunities that have received the approval of the Company’s technical team. Terms are being finalised with Reach and when complete will allow the execution of Joint Venture agreements in respect of at least two material drilling programmes in Oklahoma, where the first well is planned for early Q2 2024.

Further details on the proposed future collaboration with Reach on drilling opportunities will follow upon execution of definitive documentation expected to be completed in the coming weeks.

Reach Oil and Gas Inc (https://www.reachoilgas.com)

Reach, and its sister company Reach Energy Limited, established in 2013, are successful private, production, development and exploration entities, based in Oklahoma, with offices in Aberdeen (UK) and Oklahoma City (USA).

The Principals of Reach are:

Miles Newman

- Imperial College London (Geology)

- Britoil plc and Kerr-McGee Corporation – geologist UK, Janice and Gryphon, North Sea

- Geoscientist and Exploration Manager in London, Houston and Aberdeen

- Founder of two successful UK Continental Shelf exploration companies, Reach Exploration (North Sea) Limited and Reach Oil & Gas

Jim McKenny

- Oklahoma University (Geology)

- Represented UK based, Fisherman’s Petroleum Company Ltd for over 30 years

- Represented Caithness Petroleum

- Wide experience of United States onshore oil basins

In addition, the Board of Reach is well supported by numerous, experienced oilfield personnel, which include land rights management, administration, production drilling operations and engineering completions managers.

Union Jack is committed to working with operators such as Reach, who demonstrate a strong commitment to safety, environmental and social responsibility, in all aspects of their operations.

David Bramhill, Executive Chairman of Union Jack, commented:

“In my Chairman’s Statement, contained within the Half Yearly Report, dated 11 September 2023, I indicated that the Company was actively seeking growth opportunities in regimes with sympathetic views towards the hydrocarbon industry, without compromising the world’s environmental objectives and the aim of a Net Zero target by 2050.

“To this end, today, we are announcing a strategic expansion into the United States by investments in Permian Basin focused royalties and an intended future collaboration, with Reach, on oil and gas investment opportunities and drilling projects in Oklahoma.

“Union Jack’s existing onshore UK conventional production, development and exploration activities will remain our core focus for the foreseeable future. This distinct strategy has transformed the Company in to a self-sustainable, dividend paying, profit making entity.

“We have distributed approximately £3,000,000 via dividend payments and share buy-backs in just 15 months, and the intent is to continue share buy-backs and dividend payment programme as and when appropriate.

“The evolution of Union Jack, particularly in recent years, in my opinion, has been transformational. Almost every year growth in assets or revenues has been delivered to shareholders. Management has consistently focused on value creation, such as at our flagship, Wressle development, where our interest has increased from just 8.33% to a predominant 40%, due to our acquisitive approach when value can be seen.

“The investment climate for international investment outside of the UK, especially within the United States, has improved significantly, driven primarily by streamlined asset ownership and the evolution of enabling technologies. These factors have been instrumental in Union Jack’s decision to expand its activities in the United States.

“The acquisition of the Royalties provides immediate cash-flow, is without CAPEX exposure and has the scope to grow exponentially, as new wells are drilled and completed within the prolific Permian Basin. The longevity of the Royalties is assured as the economic life of the wells is in excess of 26 years.

“The operators associated with the Royalties are all major producers, ranking highly in the S&P Global (formerly Standard & Poor’s), Fitch and Moody’s credit ratings.

“Reach has presented to Union Jack numerous investment opportunities for direct participation in the drilling of a number of wells during the course of 2024, with the first well planned for early Q2 2024.

“These projects, once finalised, will be funded from current cash balances without recourse to the Capital Markets.

“I look forward to updating shareholders on progress in respect of Union Jack’s development in the United States, that we believe, in time, will replicate our ongoing success seen in the UK.”

This is an interesting move by Union Jack who have indeed been looking for another geography for some time, not to say that UK onshore can’t deliver but given the existing portfolio with a good revenue from Wressle and other upside opportunities further growth has to come from abroad.

A couple of other UK companies are investing in the US which is a very exciting way of diversifying. Some are doing that to provide non-operated cash flow for other projects and here UJO are going to be profitable in Texas and the Oklahoma in partnership with Reach.

They also provide a very interesting way of maintaining UJO’s distinctive way of rewarding shareholders, currently via dividends and share buy-backs which will be cushioned by this investment. This looks to me to be a very canny way of investing and lowers the beta whilst spreading the portfolio risk and is indeed a smart move.

Miles Newman, Chairman of Reach, commented:

“We are very pleased to be working with the Union Jack team in the USA onshore, initially advising on the purchase of Mineral Royalties in Texas, where there remains the opportunity to purchase quality oil rights in the Permian Basin, the fastest growing oil basin in the world and an area in just the mid-stages of development.

“Our team in Oklahoma City is also working on a number of near-term drilling projects which will lead to the expansion of our collaboration with Union Jack in the coming weeks.”

Europa Oil & Gas

Europa has announced, further to its announcement of 2 October 2023, that it has received notification from the Irish Government’s Department of the Environment, Climate and Communications (DECC) that the Minister has given his consent to extend the Phase 1 of FEL 4/19 to 31 January 2026. The Company intends to use the extension to carry out further technical studies and allow more time to secure a partner to advance development of the licence.

Will Holland, Chief Executive Officer of Europa, said:

“I am delighted that our application has been granted and that we can continue with further technical studies of the licence and seeking a project partner. FEL 4/19 contains the large 1.5 TCF, low risk Inishkea West gas prospect which is a strategic asset that can potentially provide a reliable source of low emission energy for Ireland and play a key role in the transition to renewable green power. Given the proximity to existing infrastructure, a discovery at Inishkea West could be brought online quickly and would reduce Ireland’s reliance on imported gas. Domestic gas from Inishkea West would have significantly lower carbon emissions than imported gas from the UK, Norway or further afield.

We look forward to working constructively with DECC as we seek to progress FEL 4/19 to drilling, and to attract additional partners to this prospective licence.”

This is actually very good news indeed for EOG as the potential within FEL 4/19 is huge and as previously commented on, almost impossible to ignore in terms of low carbon energy for a country that is using imported gas.

At the risk of doubling up it is fair to say that it is a genuinely strategic asset and that it more than capable of, as Will Holland says ‘play a key role in the transition to renewable green power’. Europa is building a number of blocks that will define its future and that should see the stock price rise to prove that management is very much doing the right things.

Gulfsands Petroleum

This month marks another sobering milestone for the Syrian people and for Gulfsands.

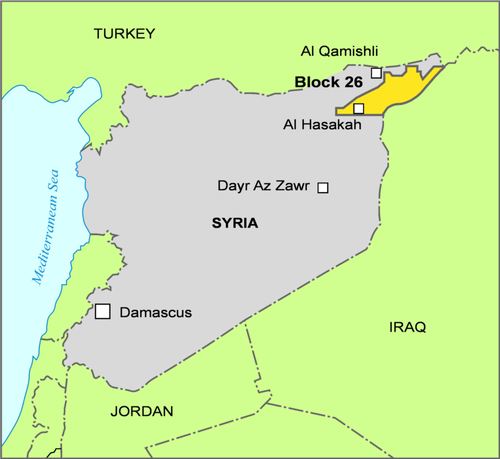

It is now seven years since Gulfsands was informed that its Block 26 fields in North-East Syria, currently under force majeure in order to comply with UK sanctions, had been returned to significant and regular production – unlawfully.

Map source: KeyFacts Energy

It is now common knowledge that the perpetrators of this illicit production were, and continue to be, entities affiliated with the Autonomous Administration of North and East Syria (the “AANES”), Peoples Defence Unit (“YPG”), Syrian Democratic Forces (“SDF”) and Syrian Democratic Council (“SDC”).

We call on this unlawful production to stop immediately.

Since 2017, over 47 million barrels of oil have been unlawfully produced with a value of over US$3.3 billion(*). In the last year alone, we estimate that approximately 5.8 million barrels of oil have been unlawfully produced with a value in the region of US$480 million (at the average 2023 Brent oil price of $82.5 per barrel). The illicit production and ongoing losses continue to be monitored and measured at www.gulfsands.com.

This illicit production from Gulfsands’ Block 26 continues at a rate of approximately 20,000 barrels of oil equivalent per day (“boepd”), but this is just a small portion of the total theft in the northeast region of Syria. It is widely reported that production in North-East Syria is currently estimated to be around four times this amount, at around 80,000 barrels of oil per day (worth over US$6 million per day at today’s oil prices).

The Syrian people, however, see the benefits of only a small proportion of this value. The unlawful oil trade takes place on the black market, away from regulation and oversight, meaning prices are depressed and the potential for corruption is high. The biggest beneficiaries of this illegal production are illicit actors – not the Syrian people.

This also leads to unsafe, unregulated, and hugely environmentally damaging oil field practices which have a catastrophic effect on the health of local communities.

Examples of Environmental Devastation from Unsophisticated Oil Field Practices

The United Nations’ OCHA reports that 16.7 million Syrians are currently in need of humanitarian aid, up from 15.3 million in 2023. The agency also reports that 90% of Syrians now live below the poverty line. 2023’s UN humanitarian appeal for Syria sought US$5.4 billion – the world’s largest such appeal – but only 33% of this has been funded, leaving a shortfall of US$3.62 billion.

The international community has not formally recognised or taken action against this illicit production and this oversight is costing Syria – profits from its national resource endowment could be used to help fill the funding gap in aid. Furthermore, the actions of illicit actors in unlawfully extracting and selling this oil contravenes international law, sanctions and the principles of UNSCR 2254

Project Hope

There is a desperate need for humanitarian and early recovery assistance in Syria.

The devastating earthquakes in early 2023 have only made the situation more acute, as shown in the statistics above.

Gulfsands continues to advocate for a humanitarian and economic stimulus initiative which would pave the way for international energy companies (which have all declared force majeure as result of international sanctions) to return to operations in North-East Syria, with allocated revenues from oil sales disbursed to finance early recovery, humanitarian, economic (including youth employment) and security projects across the country. This initiative is designed to be in line with UNSCR 2254 and to allow all Syrian people to benefit from their country’s national resource endowment to build self-sustainability and resilience for the future, and contribute to the counter terrorism effort in Syria.

We call this initiative Project Hope.

With investment and expertise, we estimate that production in North-East Syria could be increased from 80,000 boepd to around 500,000 boepd and generate in the region of US$15-20 billion per annum. This dwarfs the UN Humanitarian Aid funding shortfall for 2023, and the total funding contributed by the UK’s FCDO to Syria since the crisis began in 2012, (this figure stood at £3.8 billion in September 2022 according to “UKAid Syria Crisis Response Summary – February 2023” and is estimated to be around £4 billion as of today).

Gulfsands continues to work with partners in the international community to raise the profile of this issue and generate support for Project Hope.

Today, Gulfsands reminds us, as it does every January, about the vast quantities of oil that are being unlawfully and unsafely produced in Northeast Syria, with minimal benefit to the Syrian People.

John Bell, Gulfsands’ Managing Director has been, a stalwart supporter, even driver behind this wonderful project for many years. He has always kept me in touch and I am happy to cover the situation at Project Hope.

They report that another US$480m of value has been lost during 2023, taking the total since 2017 to over $3.3 bn. One wonders what good this money could have done, had it been channelled appropriately.

Gulfsands also highlights the environmental devastation caused by the unsophisticated, unsafe and unregulated oil field practices being employed, and the catastrophic effect this has on the health of local communities.

Gulfsands, proposes an alternative approach, Project Hope, where international energy companies (which have all declared force majeure as result of international sanctions) are allowed to return to operations in Northeast Syria, with allocated revenues from oil sales disbursed to finance early recovery, humanitarian and economic stimulus projects across the country.

I believe that this innovative initiative is worthy of attention.

Beacon Energy

Beacon has announced an operational update on the Schwarzbach-2(2.) (“SCHB-2(2.)”) well in the Erfelden field.

SUMMARY

- With the rod pump installed in late 2023, the SCHB-2(2.) well continues to clean-up although production remains at a rate of approximately 40 barrels of oil per day.

- As previously announced, the low production rate indicates that the reservoir near the wellbore has been invaded with drilling fluids which are restricting flow rates. This is not uncommon in situations where hole stability issues have occurred during drilling due to the use of high-density drilling fluids to stabilise the hole.

- The Company has now commenced sand jetting operations with a coiled tubing unit to stimulate the well. Sand jetting will focus on the oil-bearing reservoirs in the Pechelbronner-Schichten (“PBS”) sandstones.

- Sand jetting technology uses a high-pressurised sand slurry with the objective of creating deep perforations beyond the zone invaded with drilling fluids. The expectation is that these deeper perforations will increase communication between the oil-bearing reservoir and the wellbore, and therefore increase production rates.

- The sand jetting operation is expected to take 10 – 14 days, including the time required to re-install the rod pump and recommence production. Once the well is fully clean, which is anticipated to take several weeks, it is expected that the rod pump will be replaced with an Electrical Submersible Pump (“ESP”) to maximise production – this is currently scheduled to take place in April 2024.

- In addition, as part of the sand jetting operation, the Company will recover a downhole pressure memory gauge which will inform our understanding of both formation pressure in the oil-bearing reservoir and the restriction of flow around the wellbore caused by fluid invasion.

- The Company is fully funded to undertake the sand jetting operation which has an estimated cost of less than €500,000.

The Company expects to provide a further update once a stabilised and sustained flowrate from the rod pump has been achieved.

Beacon Energy Chief Executive Officer, Larry Bottomley commented:

“While the SCHB-2(2.) well encountered excellent oil-bearing reservoirs with thickness and properties in excess of pre-drill prognosis, drilling fluids that invaded the reservoir near the well bore during operations are currently impeding production. The retrieval of the downhole pressure data will inform our understanding of the impact that the drilling fluid invasion has had on productivity.

“The Company has moved quickly to implement remedial actions required to improve the productive potential of the well. Sand jetting is a proven technology commonly used in the US which aims to provide deeper perforations than that achievable using the conventional perforation technique used on this well.

“We remain fully focused on establishing optimal production from the SCHB-2(2.) well as quickly as possible through the rod pump and ultimately the installation of the ESP. Despite these operating challenges, the exceptional technical results of the SCHB-2(2.) well have materially increased the potential reserves of the Erfelden field and provided confidence on the productivity potential from this and future wells.

“We look forward to the results of this operation and providing an update on the work-over programme in due course.”

The situation in Germany remains hard going for Beacon as production is proving hard to deliver. It seems that it is only a short term problem and remedial actions should deliver in due course.

KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy