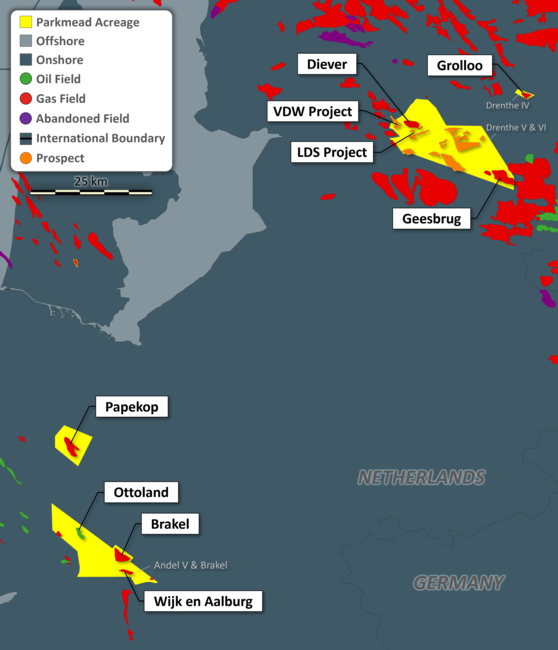

Parkmead, the independent energy group, is pleased to provide an update on gas production following the LDS-01 well being brought into production in Q4 2023.

As previously announced, the Diever-02 well was shut-in in October to allow the successful new discovery well LDS-01 to be brought onstream. Since coming onstream, gas production from LDS-01 has consistently produced at average rates of close to 5,000 boepd (gross) and upwards of 370 boepd (net) to Parkmead throughout November, December and in the year to date. Parkmead's overall average net production over the same period from all the Dutch gas assets continues to exceed 430 boepd. This is Parkmead's highest level of gas production since April 2020.

The total volume of gas produced from LDS-01 to date has now significantly exceeded the predicted P50 (most likely) gas reserves case. A production plan will be confirmed in due course to allow both LDS-01 and Diever-02 production to be optimised together.

This successful drilling has created further upside potential as the above figures exclude gas condensate production from these wells, which is reported separately to the dry gas production. Parkmead's net condensate production has been boosted by LDS-01 to more than twenty times the Company's previous level. This will provide in due course a further additional boost to the net production figure stated above.

Parkmead is also pleased to provide an update on production from its Geesbrug (GSB-01) well. Following a successful mini-coil clear-out in late 2023, production from GSB-01 has come back strongly at rates approximately fifty percent greater than previous. Despite being a tight formation, Geesbrug continues to be Parkmead's biggest producer outside of the prolific Drenthe VI concession.

Update on UK Renewables portfolio

In addition to the excellent progress made in the Netherlands, Parkmead has also benefitted from delivering outstanding operational uptime at its 100% owned Kempstone Hill wind energy company, with revenues from the wind farm continuing strongly. At Pitreadie, commercial discussions are progressing with joint venture partners. Further studies, including environmental surveys, and planning work are scheduled to take place during 2024.

Renewable energy remains a key focus area of growth for Parkmead. In addition to the organic development of the Company's existing portfolio of operating and development assets, the Company continues to actively seek opportunities to acquire value adding wind and solar projects, both in production and under development to provide further diversification to the Company's revenue streams.

Tom Cross, Executive Chairman, commented:

"We are delighted to confirm that the LDS-01 gas well has been brought onstream, on schedule and under budget, and that the early production data has demonstrated further reserves potential.

Parkmead's Dutch gas assets continue to yield successful discoveries and enhanced production from some of the most prolific onshore fields in the Netherlands. These fields perform exceptionally well with very low operating costs. Furthermore, work is progressing on the potential development of the Papekop gas field targeting 35.6 Bcf of gross gas reserves with first production as early as 2027. The upside value of these assets is further underlined by the recent prospectivity review carried out by the partnership, which has identified a number of exciting new leads and prospects which will be matured through a work programme in 2024."

KeyFacts Energy: Parkmead Group Netherlands country profile

KEYFACT Energy

KEYFACT Energy