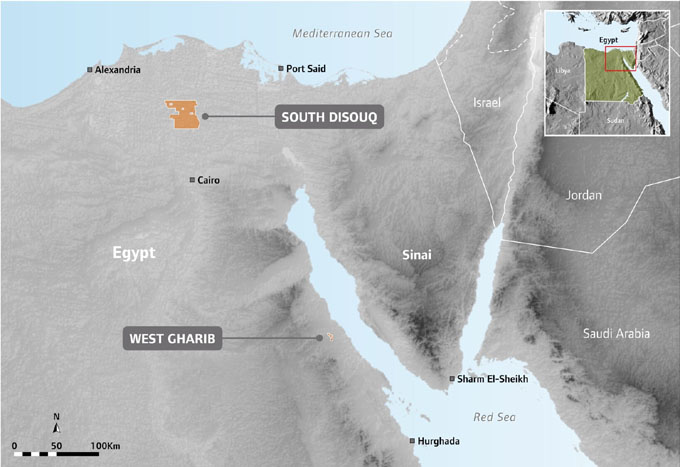

SDX Energy has executed a binding sale and purchase agreement ("SPA") for the disposal of the Company's West Gharib interests in Egypt. The Company also continues to progress the binding documentation for the sale of its South Disouq assets. The Company is focused on delivering shareholder value by focusing its efforts on fully exiting Egypt, growing its Moroccan assets and executing on the energy transition strategy. The board and management will be sharing more details on the continued execution of this wider strategy soon.

The West Gharib assets subject to the SPA comprise (a) 50% of the issued share capital of Brentford Oil Tools LLC, (b) 50% interest in the Exploration and Production Sharing Agreement relating to Sub-Area (A) West Gharib Blocks G, H (including the receivables), and (c) 50% interest in the Joint Operating Agreement relating to the West Gharib Blocks (together the "Assets"). For the year ended 31 December 2023, the unaudited profits attributable to the Assets amounted to $0.9 million. The total amount of sale proceeds to be received from the buyers, New Horizons LLC and NPC Petroleum Services Ltd (together the "Purchasers"), is estimated at US$6.6 million (subject to certain working capital and other adjustments). The Company will receive the following:

(i) c. $3.5 million in USD cash, payable immediately to the Company outside of Egypt;

(ii) c. $0.9 million in USD cash, payable within 5 business days of the deposit by SDX of EGP30 million (c. $0.6 million) into an escrow account; and

(iii) c. $2.2 million in USD cash, payable within 5 business days of the earlier of:

a. the deposit by SDX of a further EGP70 million (c. $1.4 million) into an escrow account; and

b. settlement of any tax liability (if any) in full.

SDX expects to deposit the EGP30 million into escrow immediately using existing EGP cash. The remaining EGP70 million is expected to be deposited by September 2024 using cash generated from Egyptian gas sales. Funds held in escrow will be used to cover potential Egyptian tax liabilities, with any excess being returned to the Company once the tax liability has been settled.

The sale proceeds will be received outside Egypt and will be primarily used to continue to expand SDX's cash generative operations in Morocco, where the Company is the sole independent producer of gas. The Company is leveraging its position and pipeline infrastructure to increase gas supply and deliver other energy sources to its customers in Kenitra. SDX will also repay in full the outstanding secured EBRD reserves-based lending facility.

Daniel Gould, Chief Executive Officer, commented:

"The sale of our West Gharib assets represents a milestone in the execution of our new growth strategy in Morocco. SDX will continue to deliver shareholder value and growth - re-energising and scaling the Company's Moroccan upstream business. We will also continue to carry out due diligence for SDX's medium-term expansion into the vertical adjacencies of gas transportation, gas-to-power, and renewable energy generation."

KeyFacts Energy: SDX Energy Egypt country profile l KeyFacts Energy: Acquisitions & Mergers news

KEYFACT Energy

KEYFACT Energy