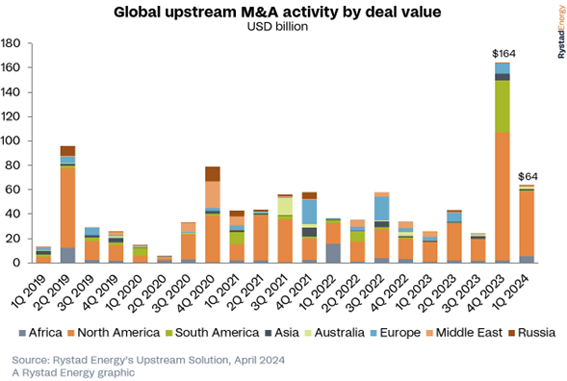

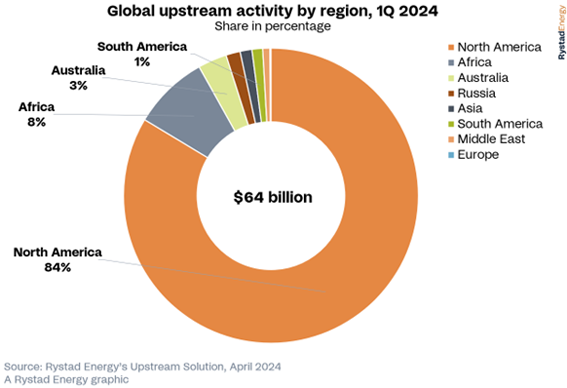

After the biggest first quarter for global upstream dealmaking in five years, the industry could see another $150 billion of merger and acquisition (M&A) deals in the remainder of 2024. With global M&A deal value crossing the $64 billion mark already this year, it represents the strongest first-quarter performance since 2019 and a 145% increase on the first quarter of 2023, fueled primarily by consolidation in the US shale patch.

Deals in North America totaled $54 billion in the first quarter of the year, about 83% of the worldwide total, with the region continuing to be the driving force for the remainder of 2024, with nearly $80 billion of assets still on the market. The US shale sector is expected to be the engine driving this activity, accounting for 66% or slightly more than $52 billion of assets on the market.

The Permian Basin has dominated recent dealmaking, but other shale plays look set to attract significant investments in the near future, with about $41 billion of non-Permian opportunities on the market. This includes the potential sale of Bakken-focused Grayson Mill Energy, Uinta-focused XcL Resources, ExxonMobil's Bakken portfolio, EQT's remaining non-operated Marcellus portfolio and certain Haynesville assets from Shell and BP.

ExxonMobil, Chevron, Occidental Petroleum (Oxy) and Diamondback Energy's portfolio adjustments are set to invigorate short-term M&A activity. These companies have all made significant recent acquisitions and now plan to divest non-core assets, paving the way for growth among regional upstream players. For instance, Chevron intends to divest approximately $10 billion to $15 billion of assets by 2028, while Oxy plans to divest between $4.5 billion and $6 billion.

The Permian has been the focal point for M&A activity in recent times, but that focus is waning as available assets in the basin become scarce. But with appetite still strong, deal-hungry players are looking outside the basin for acquisitions. A power shift could be on the cards, with non-Permian assets taking center stage in the future North American deals pipeline.

- Atul Raina, Vice President of Upstream Research, Rystad Energy

Learn more with Rystad Energy’s Upstream Solution.

Outside the US, deal activity also remained strong in the first quarter of this year, with $10.5 billion changing hands, a 5% year-on-year increase. This was dominated by oil and gas upstream majors BP, Chevron, Shell and TotalEnergies, which collectively accounted for $5.2 billion. Demand for gas-producing resources is high, representing about 66% of total resources bought and sold in the first quarter of 2024.

Although North America dominated the global M&A landscape, Africa saw notable activity, with transactions surpassing $5.3 billion, fueled by oil and gas upstream majors. The largest deal was Shell’s divestment of its 30% stake in the SPDC joint venture in Nigeria to the Renaissance consortium, which includes about 520 million barrels of oil equivalent (boe) of gas resources, for $2.4 billion. The region also witnessed oil and gas majors’ appetite for exploration opportunities, with TotalEnergies acquiring a 33% operated stake in Block 3B/4B offshore South Africa and an additional interest in two blocks offshore Namibia.

South American M&A ticked up in the first quarter of 2024, with a total of $752 million-worth of assets changing hands. This follows a quiet period of dealmaking as only $790 million was spent in the full year of 2023, excluding Chevron’s $53 billion acquisition of US independent Hess. This decline was primarily due to a divestment halt at Brazilian national oil company (NOC) Petrobras.

However, this halt has fueled regional growth opportunities, as Brazilian upstream companies are pursuing alternative expansion plans. Merger negotiations involving four of Brazil's top 10 independents — 3R Petroleum, PetroReconcavo, Enauta and Seacrest Petroleo — are ongoing, indicating a possible consolidation wave to come. While these deals in isolation cannot cement a broader trend, these discussions emphasize the independents' objectives of replenishing reserves and grouping them together to reduce costs.

In light of continued fossil fuel demand, Middle Eastern NOCs, including ADNOC, Saudi Aramco and QatarEnergy, are bolstering their gas and liquefied natural gas (LNG) portfolios, allowing them to cut emissions and diversify their domestic economies away from a reliance on oil revenues. ADNOC and Aramco are actively exploring further expansion opportunities in the LNG sector, including potential investments in the West.

QatarEnergy announced the North Field West (NFW) development earlier this year, aimed at boosting Qatar’s LNG capacity to 142 million tonnes per annum (Mtpa), surpassing the previous target of 126 Mtpa. Echoing QatarEnergy’s approach with previous expansion projects like the North Field East and North Field South, the NOC is expected to seek international operators' participation in the NFW project. Simultaneously, ADNOC and QatarEnergy are pursuing international expansion alongside their longstanding partners, BP and TotalEnergies.

KeyFacts Energy Industry Directory: Rystad

KEYFACT Energy

KEYFACT Energy