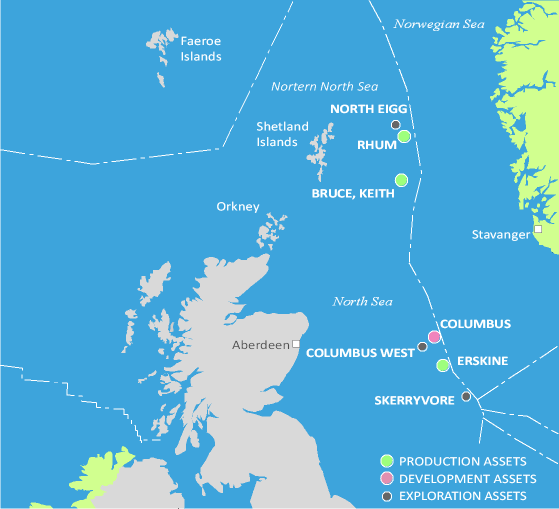

Serica Energy, a British independent upstream oil and gas company with operations in the UK North Sea, provides the following operations and financial update.

Guidance

- Production guidance is unchanged at 41,000 boe/d to 46,000 boe/d.

- Operating costs for the year to date are consistent with the target of US$20 per boe.

Production

- Average net production for the year to date(1) is 43,781 boe/d.

Bruce Hub production has been steady year to date. The uptick in June reflects the impact of the recent Light Well Intervention Vessel (“LWIV”) campaign on Bruce. More production history is required to estimate the ‘steady’ state levels of production from the worked over wells.

The well intervention to reinstate production from the Keith field has also been successfully completed. Production from the K1 well restarted on 8 June but has been intermittent to date while topsides operations are optimised.

This summer’s programme of Bruce field platform well interventions is on track to commence in mid-July. The programme has a planned duration of ninety days and includes a range of activities designed to enhance production and routine monitoring.

A brief routine outage of the Forties Pipeline System is scheduled in July. We plan to take advantage of this to carry out some maintenance work on Bruce. The Bruce Hub is scheduled to be shut-in for seven days to carry out these activities.

At our Triton Hub, the Triton FPSO is currently operating with a single gas export compressor with repairs to restore two-compressor operations due in October. A trip on the available compressor during May led to no production via the Triton FPSO for three weeks. Full production has been re-established but this operating vulnerability will remain until the second compressor is repaired. The planned 2024 summer shutdown of the Triton FPSO remains at forty days commencing on 1 July.

In our Other Assets, we are seeing generally good performance in line with or above our targets. The exception is Erskine which was shut-in on 26 January 2024 due to a problem with a compressor on the host Lomond platform. Although production was re-established in early May, it has since been taken offline for the planned Lomond turnaround. Erskine production is scheduled to restart in late July.

Triton Area drilling

The reservoir section of the B1z sidetrack (re-named as the “B6” well) on the Bittern field has been drilled successfully. Initial well logging has given good indications of high quality, oil filled reservoir, consistent with pre-drill expectations. The forward plan is to complete the well and to commence testing in August 2024 after the planned Triton summer shutdown.

Following completion of the B6 well, the COSL Innovator rig will move to the Gannet E field in order to drill the GE-05 well. Production from this well is expected to start in November 2024.

Financial

At 26 June 2024 the Company held cash and cash equivalents of £301.6 million and debt drawings of US$231.0 million (£182.0 million) respectively. This is after 2023 final tax payments of £58.3 million, capital spending of £80.0 million, asset acquisition costs of £17.3 million (including completion of the Greater Buchan Area transaction and ‘BKR’ transaction related payments) and the share buyback of £15.0 million. Following the sanction of the Belinda development, estimated cash spend on capital items during 2024 as a whole is currently estimated at about £200 million pre-tax. It should also be noted that the schedules for tax payment in respect of 2024 and dividends mean these cash items fall disproportionately into the second half of the year.

(1) Year to 23 June 2024

KeyFacts Energy: Serica Energy UK country profile

KEYFACT Energy

KEYFACT Energy