Opportunity Highlights

High impact, moderate risk play opening opportunity in an under-explored basin

Analogous to multi-billion-barrel play fairway in Yemen

Success de-risks significant running room on block

An additional ~4.6 billion barrels of Pmean prospective resource across the portfolio

Drill ready prospect to spud in Q4 2025

Toosan-1 well will target prospective resources of 650 million barrels of oil

Identified route to commercialisation

Expedited first oil and downside mitigation through a phased, low risk development model utilizing existing infrastructure

Low minimum economic field size

OPIC (CPC Taiwan) is an experienced, committed and supportive partner with a 49% equity

Executive Summary

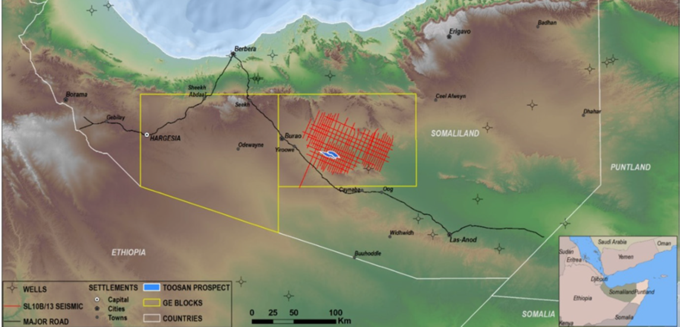

Genel Energy is offering selected companies the opportunity to acquire a significant interest in the highly attractive SL10B/13 block, onshore Somaliland. Genel currently holds a 51% operating interest in SL10B/13, in partnership with OPIC Somaliland Corporation (CPC Taiwan) who farmed into the block at the end of 2021 for a 49% non-operated interest.

Preparations are currently under way for the drilling of the Toosan-1 well, which targets 650 million barrels (MMbbl) of Pmean prospective resources across multiple reservoirs, with an estimated spud date of December 2025. Success at Toosan-1 would represent a play opening well and potentially unlock a multi-billion-barrel play fairway across multiple prospects within the block.

Genel’s History in Somaliland

Genel is the longest continuous acreage holder in Somaliland, entering the region in August 2012 when it farmed into the exploration licences blocks SL10B and SL13. Genel extended its presence in November 2012 with the acquisition of 50% participating interest in the Odewayne PSC, immediately west of block SL10B/13, and which it currently operates.

In December 2021 Genel announced the signing of a non-operated 49% farm-out agreement relating to the SL10B/13 block with OPIC Somaliland Corporation, with all its share of future capital investment coming from CPC Corporation, the state-owned enterprise of Taiwan.

Block SL10B/13 Geology & Prospectivity

The prospectivity targeted in Somaliland consists of stacked Jurassic and Cretaceous classic and carbonate reservoirs charged by Upper Jurassic source rocks (supported by recovery of oil to surface from Daga Shabel-1 in 1958, the presence surface seeps and outcrops) and trapped in 3-way and 4-way dip fault related closures. All of these play elements are proven present in Somaliland, either at outcrop or within the well penetrations.

Prospects & Commercialisation

Seven high graded prospects have been identified on block SL10B/13. Toosan is the largest and is a 4-way dip closure with a footwall and hangingwall segment. Basin modelling suggests the presence of source kitchens both to the north and south of the structure, which entered the oil window after the trap formation.

Toosan-1 will target a footwall closure (~ 50 sq km) which contains four reservoir targets totaling ~ 650 MMbbl (mean prospective resources), with 192 MMbbl in the primary Qishn Fm target. The principal risk element is assessed to be fault seal, but the stacked nature of the reservoirs allows testing of multiple targets with a single well, therefore increasing the chance of success. Success at Toosan-1 would derisk significant running room with six additional prospects each exceeding 300 MMbbl mean prospective resource identified.

A clear line of sight to commercialisation of a discovery exists via export of oil through the port of Berbera, using existing infrastructure, to international markets. A fast-track pilot production model has been developed to minimise time to first oil, and downside mitigation is provided by low a minimum economic field size and a phased development model.

Farm-in opportunity

Genel is willing to farm out up to 25% working interest of its existing 51% working interest in the block. The PSA

commitment for the current 2nd Exploration Period, is to drill a single exploration well. This well, testing the

Toosan prospect, is currently planned for a December 2025 spud.

As a farminee you would:

- Join Genel and partner OPIC Somaliland (CPC Taiwan) on the SL10B/13 licence in the 2nd Exploration Period

- Provide proportionate reimbursement of Genel’s share of back costs

- Be required to meet your share of all licence and drilling costs to test the Toosan prospect

Interested parties would firstly be required to put in place a Confidentiality Agreement (“CA”) to commence access to Virtual and Physical Data Rooms and commence discussion of a Sales and Purchase Agreement.

Progress and Forward Activity

Well planning is at an advanced stage. Well design, pore pressure prediction and subsurface data acquisition plan are complete within the approved well proposal. Long lead item orders have been placed, with the OCTG delivered to Jebel Ali, and wellheads and liner hanger delivery by August 2024. In the field, 75% of the civils activity has been completed, including 17km of access road and well pad / camp clearance and preparation. Tendering for rig and well services commenced in 2023 and will resume in early 2025. Robust security and HSE policies and procedures are in place, along with ongoing community engagement and corporate social responsibility projects overseen by the local office staff based in

Hargeisa.

Dataroom & Timing

- Execution of CA will allow access to Virtual and Physical Datarooms and a Management Presentation

- Indications of interest due on 1st September 2024

For more info or to request a confidentiality agreement, please contact:

Maureen Macaulay A&D, BD

mmacaulay@moyesco.com

+1 (713) 851 4643

Ian Cross MD

icross@moyesco.com

+44 7398 815690

KeyFacts Energy Industry Directory: Moyes & Co l KeyFacts Energy: Farm-in opportunities

KEYFACT Energy

KEYFACT Energy