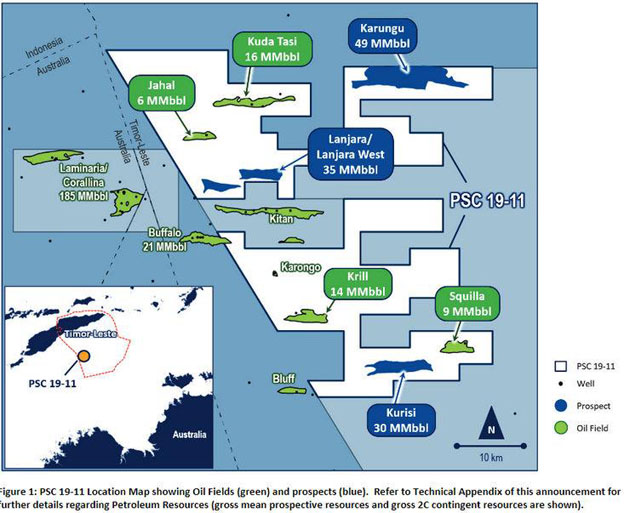

Finder Energy has entered into conditional sale agreements with Eni International and Inpex Offshore Timor Leste to acquire a 76% interest in, and operatorship of, PSC TL-SO-T 19-11, offshore Timor-Leste. The remaining 24% is held by TIMOR GAP PSC 11-106, Unipessoal, Limitada (TIMOR GAP), the national oil company of Timor-Leste.

The PSC contains four discovered undeveloped oil fields, including the fully-appraised Kuda Tasi and Jahal fields, enabling rapid progress to production with additional upside provided by low-risk appraisal and exploration opportunities.

Highlights

Transformational

- Transforms Finder into a balanced explorer and developer with 45 MMbbl Gross 2C Contingent Resources

Discovered Resources & Upside

Significant discovered resources and upside potential:

- Discovered & appraised Kuda Tasi & Jahal Oil Fields with combined 22 MMbbl Gross 2C Contingent Resources

- Discovered Krill & Squilla Oil Fields with combined 23 MMbbl Gross 2C Contingent Resources

- Low-risk, near-field exploration potential with combined 116 MMbbl Gross Mean Prospective Resources

Rapid Development Potential

- Cost-effective and efficient work program designed to rapidly progress development

- Strong support from Timor-Leste Government, the regulator Autoridade Nacional do Petróleo Timor-Leste (ANP) and TIMOR GAP for Finder’s plan to rapidly bring on new oil production

Acquisition Terms

- Upfront acquisition cost of US$2 million payable on completion

- Additional consideration of up to US$6.5 million is contingent on reaching a Final Investment Decision (FID) for development plus a 5% royalty on production

Timor-Leste

- New country entry adds further low-risk geographic diversity to Finder’s portfolio

- Timor-Leste is a stable, developing nation whose future prosperity is closely tied to the development of its oil and gas resources

Entitlement Offer

- Finder is undertaking a 1 for 1.26 Entitlement Offer at $0.048 per new share to raise up to approximately $6.0 million (before costs)

- Major shareholder, Longreach Capital Investment Pty Ltd (Longreach), has provided an irrevocable commitment to take up its full entitlement (approximately $3.2 million) under the Entitlement Offer

- The Entitlement Offer permits existing eligible shareholders to participate in the proposed capital raising and is priced at an 18.64% discount to the last closing price on 6 August 2024 and a 15.67% discount to the 15-day VWAP prior to the announcement of the Acquisition

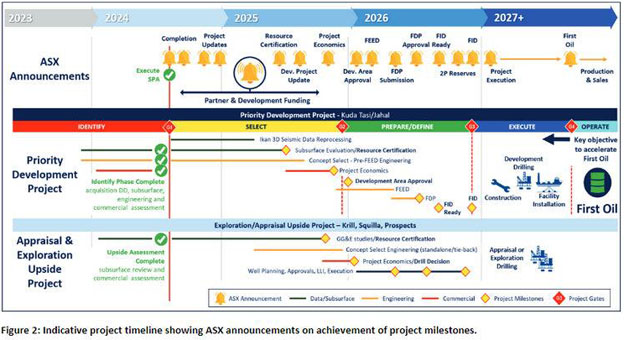

STRATEGY, TIMELINE & CATALYSTS

The Acquisition transforms Finder into a balanced explorer and developer with 34 MMbbl3 of discovered, undeveloped net contingent oil resources and introduces multiple near-term value catalysts into the forward outlook (see Figure 2). The Acquisition is consistent with Finder’s investment criteria which seeks low-cost entry opportunities with potential for high value creation.

Finder’s strategic objectives in PSC 19-11 are:

- To pass through the project development gates summarised below in order to achieve FID and First Oil by developing Kuda Tasi and Jahal (the Priority Development Project); and

- To unlock the upside potential of the low-risk appraisal and near-field exploration opportunities (the Appraisal & Exploration Upside Project).

- The forward work program has been designed to achieve these objectives quickly and cost-effectively. The technical work streams for the Priority Development Project and the Appraisal & Exploration Upside Project as well as indicative timing of ASX announcements as these projects progress through the milestones is outlined in Figure 2 below.

Finder follows a Quality Assurance System which requires the completion of necessary work, processes and assurance checks to progress through project decision gates and into the next phase (marked G1 to G4 in Figure 2). Finder completed the Identify Phase requirements to proceed past the first decision gate (Gate 1) with completion of the Acquisition. Key work carried out during the Identify Phase included:

Subsurface geological and geophysical evaluation and resource estimation;

- Reservoir engineering evaluation including production profile modelling of Kuda Tasi and Jahal development scenarios; and

- Preliminary development concept studies and costings undertaken by Petrofac and project economic modelling

As shown in Figure 2, the remainder of CY2024 and CY2025 will see work undertaken to progress the Priority Development Project through to completion of the Select Phase. The Select Phase includes key project milestones such as approval of the development concept (pre-FEED engineering) and associated project economics. The total budget for the Select Phase is approximately A$3 million. At the completion of the Select Phase a decision will be made on whether to proceed through Gate 2 into the Prepare/Define Phase which concludes with approval of a Field Development Plan and FID.

With a high starting equity position (76%) Finder will seek a partner through a partial divestment process to commence immediately and targeting completion prior to Gate 2. A partial sell down will provide a ‘look-through value’ for the asset and seek to address funding requirements for the development (including the Prepare/Define and Execution Phases) and unlock the upside through appraisal and/or exploration drilling.

Finder has a strong track-record of completing value accretive deals with industry partners to secure funding. Finder believes PSC 19-11 will be seen as a very attractive asset by potential partners.

KEY ACQUISITION TERMS

Finder has entered into Sale and Purchase Agreements (SPAs) with each of Eni and Inpex. The Eni SPA is structured as a share sale whereby, Finder’s wholly owned subsidiary, Finder Operations Pty Ltd, will acquire all of the shares in Eni JPDA 11-106 B.V which holds a 40.53% working interest (and operatorship) of PSC 19-11. Under the Inpex SPA, Finder’s indirectly wholly owned subsidiary, Finder PSC 19-11 Pty Ltd, will acquire Inpex’s 35.47% underlying interest in PSC 19-11.

For the purposes of the summary which follows, Finder has combined those transactions and refer to Eni and Inpex as the Sellers. The commercial terms of each of the SPAs are equivalent to the Sellers’ existing interests in PSC 19-11 on a pro rata basis.

The consideration payable by Finder to the Sellers comprises:

- US$2.0 million on completion, subject to completion adjustments for prepayment of licence fees by the Sellers; and

- subject to a Final Investment Decision (FID) being made for a development within the PSC, reimbursement of up to US$6.5 million in relation to Kuda Tasi-2 well abandonment works and local content contributions towards a Data Tape and Core Storage Facility in Timor-Leste to be performed by the Sellers; and

- a 5% gross royalty on production from the PSC.

The SPAs contain a number of conditions precedent for completion of the Acquisition, the main outstanding conditions under both SPAs include:

Timor-Leste Government and regulatory approvals of the Acquisition and change of operatorship from Eni to Finder; and

ANP’s formal approval of the work program proposed by Finder and the corresponding 3 year extension of the PSC to 29 August 2027.

Finder anticipates completion of the Acquisition will occur in August 2024. Completion under both SPAs will occur concurrently. Subject to any extension, the SPAs will terminate if all conditions precedent to the Acquisition have not been satisfied or waived by 29 August 2024. The completion payment to the Sellers will be funded from Finder’s existing cash reserves.

The SPAs otherwise contain terms typical of arrangements of this nature, including the assumption by Finder of current and future liabilities in connection with the PSC.

ENTITLEMENT OFFER

Finder is conducting a capital raising via a pro-rata non-renounceable entitlement offer which will be offered to eligible shareholders (Entitlement Offer). Finder’s Board has determined to structure the capital raising as an Entitlement Offer to ensure our shareholders receive the benefit of an attractive pricing point and have the opportunity to avoid future dilution by participating pro-rata in the Entitlement Offer. The details of the Entitlement Offer will be released to the ASX platform immediately following this announcement. The Entitlement Offer is not conditional on completion of the Acquisition.

The Company has appointed Euroz Hartleys Limited and JP Equity Holdings Pty Ltd to act as joint lead managers and bookrunners to the placement of any shortfall.

Finder’s major shareholder, Longreach Investment Capital Pty Ltd, has provided an irrevocable commitment to take up its full entitlement under the Entitlement Offer, representing approximately A$3.2 million.

KeyFacts Energy: Finder Energy Timor-Leste country profile l KeyctFas Energy news: New Kid on the Block

KEYFACT Energy

KEYFACT Energy