Following recent discoveries of large, deepwater pre-salt oil deposits off Brazil’s coast, the country is set to become one of the world’s largest oil producers if it can attract the necessary foreign investment and technology needed to fully exploit its offshore resources.

State-controlled Petroleo Brasileiro (Petrobras) is the dominant player in Brazil's oil sector and holds prominent positions in the country's upstream, midstream and downstream activities. The company had a monopoly on oil-related activities in Brazil until 1997, when the government opened the country's energy sector to competition. Royal Dutch Shell became the first foreign crude oil producer in the country, later joined by major international oil companies such as Chevron, Repsol, BP, Anadarko, Statoil and Sinopec. Petrobras remains the largest company operating in Brazil.

| Oil production | 3,502 thousand bpd |

| Proved oil reserves (year-end) | 14.86 billion barrels |

| Natural Gas production | 23.9 billion cubic metres |

| Natural Gas proved reserves (year-end) | 704.69 billion cubic meters |

Brazil held the second most crude oil reserves in Central America and South America in 2022, behind Venezuela, with approximately 13.24 billion barrels. Since 2006, vast offshore oil reserves have been discovered deep beneath a layer of salt known as the pre-salt layer off the coast of Brazil, significantly boosting the country's crude oil production. These oil deposits include the pre-salt fields of Tupi, Buzios, and Sapinhoá in the Santos Basin, as well as other deposits in the Campos Basin in the South Atlantic, south of Rio de Janeiro. Brazil’s reserves will likely continue to grow as exploration and development drilling continue.

Country Key Facts

| Official name: | Federative Republic of Brazil |

| Capital: | Brasilia |

| Population: | 221,002,398 (2024) |

| Area | 8,547,403 sq kms (3,300,169 sq miles) |

| Government type: | Federal Republic |

| Language: | Portuguese |

| Religion: | Christianity |

| Currency: | real (BRL) |

| Calling code: | +55 |

Brazil- Key Oil & Gas Players

Alvopetro Energy

Alvopetro Energy is a Canadian-based oil and gas exploration and production small cap operating in Brazil, with 95% of its revenue derived from natural gas.

Through the redetermination of the Caburé unit, their stake increased from 49.1% to 56.2%. Alvopetro aims to further expand unit capacity to reach their near-term goal of 18 MMcfepd (3,190 boepd), twice current levels. Concurrently, ALV is independently developing an additional 5,460-acre deep basin gas resource, called the Murucututu field.

bp

bp has been present in Brazil since 1957 and currently operates in lubricants (Castrol) and biofuels (BP Biofuels) production, oil and natural gas exploration and production (BP Energy), distribution of aviation (Air BP) and marine fuel (BP Marine/NFX).

In May 2024, bp started drilling the Pau Brasil prospect in the Pau Brasil pre-salt block offshore Brazil. This marks bp's re-entrance in Brazil as an operator after 11 years. The company acquired the licence in the PSC Round 5 bidding round in 2018, holding 50% interest in the block, together with CNOOC which holds 30% and Ecopetrol with the remaining 20%.

Bioenergy

In July 2020, BP agreed to form a 50:50 joint venture with Bunge – a leader in agriculture, food and ingredients - that will create a leading bioenergy company in one of the world’s largest fastgrowing markets for biofuels.

BP will combine its Brazilian biofuels and biopower businesses with that of Bunge to create a world-scale, highly-efficient producer of sugarcane ethanol in Brazil, BP Bunge Bioenergia. BP’s interest in the new venture will grow its existing biofuels business by more than 50%.

Brava Energia

Brava Energia is the new name of the company formed from the merger between 3R Petroleum and Enauta.

Later in 2024, Brava is set to begin the first phase of development of the Atlanta field in the Santos Basin. The floating production storage and offloading vessel (FPSO) was anchored in July. The FPSO is expected to reach its maximum capacity of 50,000 barrels of oil per day by the first quarter of 2025.

During 2024, Brava expect to see the resumption of production at the onshore Papa-Terra field, which has been suspended for equipment maintenance, as well as the conclusion of an agreement with QatarEnergy to acquire a 23% stake in Block BC-20 in the Parque das Conchas.

BW Energy

In March 2019, BW Offshore entered into an agreement to acquire 70% of the Maromba field offshore Brazil for a total acquisition cost of USD 90 million from Petrobras.

The Maromba discovery is located approximately 100 kilometers offshore in the southern part of the Campos Basin. The water depth in the area is approximately 160 meters. Maromba lies within a 375 square kilometer "ring-fence" carved out of the former BC-20 exploration block, called the BC-20A concession. Nine wells were drilled in the license between 1980 and 2006, and oil has been found in eight of these across various reservoirs including in the Eocene, Maastrichtian, Albian, Aptian and Barremian levels.

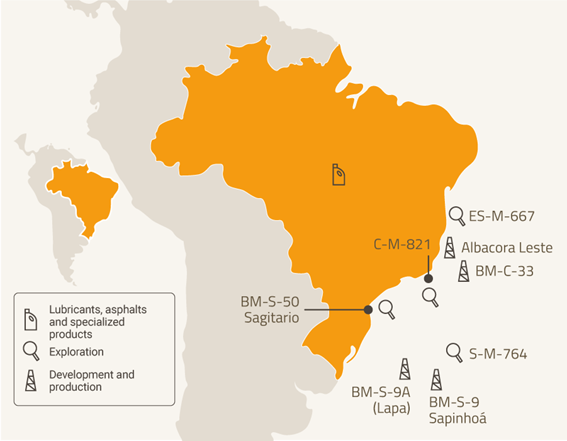

Chevron

Chevron have been in Brazil for over 100 years, initially selling Texaco products, and since 1997 also focusing on upstream. The Company currently have interests in 19 oil and gas exploration blocks in deep waters off the coast of Rio de Janeiro, São Paulo and Rio Grande do Sul.

In Brazil’s 16th Bidding Round for oil and gas exploration blocks, Chevron was awarded two offshore blocks in the Santos and Campos basins with its partners Wintershall Dea (now Harbour Energy) and Repsol.

The blocks are located 150 kilometers south-east of the pre-salt discovery Libra, in a new emerging area. They are adjacent to the exploration blocks S-M-764, C-M-821 and C-M-823 where Harbour Energy, Chevron and Repsol are already partners.

CNOOC

CNOOC International holds a 10% working interest in the Mero block – a deepwater pre-salt project located in Brazil’s Santos Basin – alongside operator Petrobras (40%), and partners Shell (20%), Total (20%) and CNPC (10%). In 2017, the block achieved first production through the Pioneiro de Libra FPSO, with the purpose of evaluating the dynamic behavior of the oil reservoir and deepening the knowledge on the characteristics of the deposit.

Between 2017 to 2018, CNOOC International added three more blocks: two of these blocks are located in the Santos Basin – Alto de Cabo Frio Oeste (20% interest) and Pau Brasil (30% interest) – and the third block is located in the Espirito Santo Basin (Block 592). In the deepwater Block 592, CNOOC International has begun exploration as the operator of the Block holding 100% interest.

The Mero field is approximately 180 kilometres from Rio de Janeiro, Brazil, and is one of the largest offshore oil fields in the world. The commercial viability of the Mero oil field was declared in November 2017. The field holds approximately 3.3 billion barrels of oil equivalent in high quality, high yield carbonate reservoirs.

Ecopetrol

Ecopetrol’s strategy focuses on the incorporation of assets through purchases, farm-ins and participation in exploration rounds. The Company managed to be included in the Pau Brasil and Saturno exploration prospects, and acquired as well 30% of the Gato do Mato discovery located in blocks BM-S-54 and in the Sul de Gato do Mato production-sharing agreement.

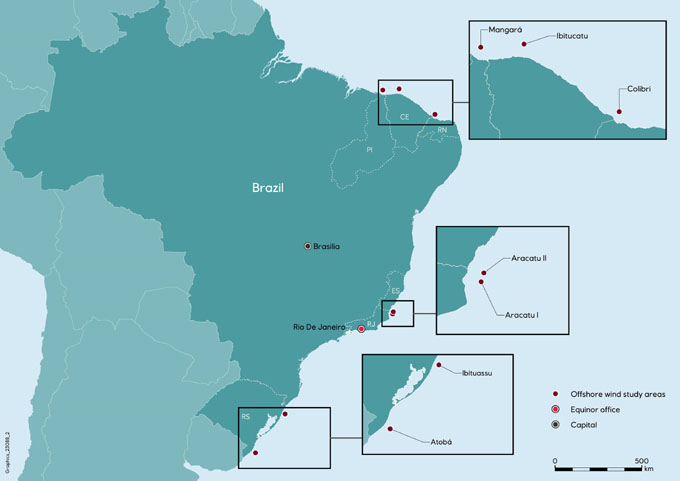

Equinor

Equinor have been present in Brazil since 2001, focusing on exploration and production of oil and gas, and on renewable energies.

In September 2023, Equinor declared commerciality for fields in the BM-C-33, in the Campos Basin, offshore Brazil. The company has submitted the Declarations of Commerciality and Plans of Development for two fields in the area. BM-C-33 is owned by the consortium partners Equinor (operator), Repsol Sinopec, and Petrobras and is located 200 kilometers from Rio de Janeiro, in water depths of up to 2,900 meters. The two fields will be named Raia Manta and Raia Pintada and contain natural gas and oil/condensate recoverable volumes of above one billion barrels of oil equivalent.

Renewable Energy

Equinor’s renewables position in Brazil includes three assets in commercial production: the 162 MW Apodi solar plant (44%), the 531 MW Mendubim solar plant (30%) and the 223 MW Serra da Babilônia 1 onshore wind farm (100%). There is also an over 1,5 GW pipeline of solar and onshore wind projects being matured by Equinor’s fully owned subsidiary Rio Energy.

ExxonMobil

ExxonMobil was the first oil and gas company to set up operations in Brazil. The Company arrived in the country on January 17, 1912, under the name of Standard Oil Company of Brazil, and since then have kept uninterrupted activities in the country.

In recent years, ExxonMobil have participated in the public bidding processes conducted by the National Agency of Petroleum, Gas and Biofuels (ANP) and acquired offshore exploration blocks in Brazil. Currently, the Company have participation in 17 blocks in the Campos, Santos and Sergipe-Alagoas sedimentary basins in partnership with Petrobras, Equinor, Galp, Qatar Energy, Enauta, Murphy and PPSA. Of the 17 blocks, ExxonMobil are operators of 14.

Galp Energia

Present in Brazil since 1999, Galp is involved in various projects in the country in different phases of exploration, appraisal, development and production.

Galp’s offshore portfolio includes stakes in the prolific Santos basin, such as the Tupi/Iracema project and Bacalhau project, among many others.

GeoPark

GeoPark is a Latin American oil and gas explorer, operator and consolidator with assets and growth platforms in Colombia, Argentina, Ecuador and Brazil.

In Brazil, GeoPark have a non-operated interest in the shallow offshore Manati Field, one of Brazil’s largest field.

Brazil production in 2023 was 1,027 boepd.

IBV Brasil Petróleo

IBV Brasil Petróleo Limitada, founded in 2005, is a 50/50 Brazilian oil and gas exploration and production joint venture between Bharat PetroResources (BPRL), a subsidiary of the Indian firm Bharat Petroleum, and Videocon Energy Brazil, a subsidiary of Videocon Industries. Headquartered in Rio de Janeiro, IBV Brasil Petróleo holds equity stakes in several offshore exploration blocks in Brazil, including 40% in the SEAL-M-349, 426, 497, and 569 blocks Sergipe basin, and 20% of blocks POT-M-760 and POT-M-663, Potiguar basin, all of them operated by Petrobras; and 25% of the C-M-101 block, in the Campos basin, operated by Anadarko.

Karoon Energy

BM-S-40, Santos Basin

In November 2020, Karoon completed the acquisition of 100% of Concession BM-S-40, comprising the Baúna and Piracaba producing oil fields and the Patola discovered resource (collectively known as Baúna) from Petrobras.

Petrobras discovered the Baúna and Piracaba fields, located approximately 210 kilometres offshore Brazil in the southern Santos Basin, in 2008. Production commenced in 2013, with rates peaking at approximately 70,000 bopd before the field entered its natural decline phase. In 2019, Baúna was listed for sale, as production rates were no longer considered material to Petrobras. At the time of completion of Karoon’s acquisition in November 2020, production was averaging 14,800 bopd and, of the initial 170 MMbbl 2P recoverable reserves, approximately 138 MMbbl had been produced.

Neon

In March 2008 Karoon was awarded 100% participation in five offshore exploration blocks in the Santos Basin, located approximately 200 kilometres off the coast of the State of Santa Catarina, Brazil. One of these blocks was S-M-1037 (Neon formerly known as Echidna).

The Neon oil field is located 60 kilometres north-east of Baúna. It was discovered in 2015 by the Echidna-1 exploration well, which was part of Karoon’s Appraisal and Exploration drilling campaign. The exploration well encountered 100 metres of oil-bearing reservoir and on test, flowed 4,650 bopd of high quality, 39 deg API oil.

Substantial analysis, engineering and technical work has subsequently taken place on the potential development of the Neon resource, aimed at establishing how to maximise recovery rates and assessing the commercial potential of the discovery.

S-M-1356, S-M-1482

In December 2023, Karoon was successful in securing 100% interests in two deepwater blocks (S-M-1536 and S-M-1482) in the ANP 4th Permanent Offer Bid Round for Concession Contracts. These blocks are located approximately 80 kilometres south-east of the Baúna Project in the Santos Basin.

Murphy Oil

Murphy holds a 20% non-operated working interest in nine blocks in the offshore regions of the Sergipe-Alagoas Basin (SEAL) in Brazil (SEAL-M-351, SEAL-M-428, SEAL-M-430, SEAL-M-501, SEAL-M-503, SEAM-M-505, SEAL-M-573, SEAL-M-575 and SEAL-M-637).

Murphy has a 100% working interest in three blocks in the Potiguar Basin (POT-M-857, POT-M-863 and POT-M-865).

Murphy’s total acreage position in Brazil as of December 31, 2023 is approximately 2.5 million gross acres, offsetting several major discoveries. There are no well commitments.

ONGC Videsh

BC-10

The BC-10 Project is a deep-water project covering an area of 2961.67 Sq. Km. located in the Campos Basin approximately 120 km southeast of the city Vitoria off the coast of Brazil, with water depth ranging from around 1400 to 2100 meters. ONGC Videsh had acquired 15% PI in April’2006 and 12% PI in December’2013. ONGC Videsh has 27% PI and other partners are Qatar Energy with 23% PI and Shell with 50% PI is operator.

Block BM Seal-4

The Block is located in the Sergipe Alagoas Offshore Basin in Northern Brazil and has an area of 320 Sq. Km. with water depths ranging from 1500 to 2700 meters. Exploratory block BM-Seal-4 was originally awarded to Petrobras in August 2000. ONGC Videsh farmed into the block on 04.06.2007 with 25% PI as part of swap agreement between ONGC Videsh and Petrobras (75% PI). Petrobras is the operator of the project.

Partex

Partex started its activities in Brazil when it was qualified by ANP (Agência Nacional do Petróleo) as an onshore authorized operator in Brazil Round 3, in 2001.

Presently, Partex Oil and Gas Group participates in:

Potiguar

In the Potiguar basin, Partex has a 50% share and is the operator in the fields Colibri and Cardial. The other shareholder is Petrobras.

Partex is presently operating the fields development plan, which are producing and exporting to the nearby refinery.

Sergipe – Alagoas

In the Sergipe – Alagoas basin, Partex has a 15% share in the offshore block BM – SEAL – 9, in which Petrobras (the operator) has a 85% share.

Perenco

Perenco Brazil holds a 100% stake in the Pargo Cluster Concession, which comprises the Pargo, Carapeba and Vermelho fields located offshore in the shallow waters of the Campos Basin, off Rio de Janeiro’s coast. The concession area holds eight fixed platforms in up to 100 meters depth. Production reached 13,000 barrels of oil per day in 2023, up from 2,800 barrels when Perenco took over operations in October 2019. The Pargo Cluster Development Plan was formally approved by the Brazilian authorities in early 2021, along with extension of Perenco’s rights on the concessions until 2040.

In May 2024, Perenco Brazil announced that hook-up of the Floating Storage and Offloading (FSO) vessel, “FSO PARGO”, was successfully completed on the Pargo Cluster in the Campos Basin. Perenco will now submit final documents to the regulatory authorities in Brazil, with a view to being granted its Operations Licence for the FSO.

Petro Victory

Petro-Victory Energy holds 38 concessions located in the onshore portion of the Potiguar and Barreirinhas basins, located in the Northeast of Brazil.

Potiguar Basin onshore

The Potiguar Basin is located in the most eastern portion of the northeast region of Brazil extending through the states of Rio Grande do Norte and Ceará.

Petro-Victory holds a 100% interest in and operation of 34 blocks and three fields in the basin.

Barreirinhas Basin onshore

The Barreirinhas Basin is located on the Brazilian equatorial margin on the coast of the state of Maranhão. In addition to oil, the asset has non-associated gas. Proven and probable reserves (2P) 1.9 million barrels of oil, NPV10 valuation of US$ 72.4 million and best estimate development pending risked contingent resources of NPV10 US$ 97.3 million.

Petro-Victory holds 100% of the interest and operation of the field.

Petrobras

Petróleo Brasileiro - Petrobras, was founded in 1953 to operate in the Brazilian oil sector. Over more than four decades the company has become the country's leader in the distribution of oil products and is now one of the largest twenty major oil companies in the world today, leading the sector in the implementation of the most advanced deep-water technology, for oil production.

Petrobras has been the primary operator in charge of exploring and developing the pre-salt reserves. In 2010, Brazil introduced the Pre-Salt Law. The legislation established primary guidelines for exploration and production, including the use of production-sharing agreements (PSAs) rather than concession agreements. Petrobras was designated as the operator in the pre-salt oil region, with a minimum 30% stake. It also appointed the public company Pré-Sal Petróleo SA (PPSA) as the manager of all PSAs in 2013 and required all foreign companies wishing to drill in the area to join a consortium with Petrobras and PPSA. Following criticism, the Pre-Salt Law was amended in 2016 to relieve Petrobras of its obligation to hold a 30% operating interest in future projects, but it also granted the company an optional right of preference.

Petronas

16th bid round

In October 2019, Petronas secured a 100% stake in the Campos Basin's C-M-661 block in Brazil's 16th bid round. Petronas agreed to pay a Real 1.1 billion signing bonus and drill a single well in the block. Petronas also won 100% development rights to the Campos Basin's C-M-715 block

Sépia Field discovery

In November 2022, QatarEnergy announced an oil discovery in the 4-BRSA-1386D-RJS well in Brazil’s world class Sépia oil field, which is located in the prolific Santos Basin in water depths of about 2,000 meters off the coast of Rio de Janeiro.

Agua Marinha block

In December 2022, TotalEnergies, and its co-venturers QatarEnergy and Petronas Petróleo Brasil Ltda (PPBL) won the Agua Marinha block in the Open Acreage under Production Sharing Regime – 1st Cycle held by Brazil’s National Petroleum Agency (ANP). Petrobras has exercised their right to take 30% Participating Interest and Operatorship. In May 2023, Petrobras and partners signed the Production Sharing Contract (PSC) for the Agua Marinha block.

PetroRecôncavo

Ativo Bahia

Operations at Ativo Bahia began in 2000, through a production contract with a risk clause signed with Petrobras.

In the following years, PetroRecôncavo acquired another 5 concessions, operated by the subsidiary Recôncavo E&P, and focused on the development of water injection projects for secondary recovery and the drilling of wells for mesh densification.

In two decades, the Company have already produced more than three times the volume of reserves that were initially certified and there are still more than 23 million barrels of oil equivalent in proven gross reserves.

Potiguar

The Potiguar Asset began operations on December 10, 2019, when the first transaction resulting from the Topázio Project, a divestment program in onshore assets initiated by Petrobras in 2016, was concluded. The cluster, which has 34 concessions, of which 30 are operated by subsidiary company Potiguar E&P, is approximately 50 km south of the city of Mossoró and comprises a considerable proportion of the Potiguar Basin.

The development of these fields was initiated by Petrobras in 1984 and their combined production has already exceeded 17,000 barrels/day of oil and 900,000 cubic meters/day of natural gas, produced through more than 700 wells in the concessions. Since the start of operations by Potiguar E&P, a development program similar to that of the Bahia Asset has been developed, guided by the return to production of idle wells, reopening of zones, drilling of new wells, development of new injection projects, surface facility projects, among others.

PRIO

PRIO is the largest independent oil and gas company in Brazil. With a focus on efficient reservoir management and redevelopment of mature fields, the Company draw new frontiers of innovation for the entire oil and gas market.

QatarEnergy

In March 2018, Qatar Petroleum won exploration rights in 4 offshore blocks in Brazil, as part of two bidding consortia.

Agua Marinha block PSC

In May 2023, Petrobras and partners TotalEnergies, QatarEnergy, and Petronas signed the Production Sharing Contract (PSC) for the Agua Marinha block, which was awarded in the Open Acreage under Production Sharing Regime – 1st Cycle in December 2022. The 1,300 sq km block is located in the pre-salt Campos Basin south of the Marlim Sul field and about 140 km from shore. The work programme includes drilling one firm exploration well during the exploration period. The block contains the Touro prospect. Petrobras operates the block with 30% interest. TotalEnergies also holds 30% interest, while QatarEnergy and Petronas each hold 20%.

5th Pre-Salt Bid Round

In September 2018, Qatar Petroleum increased its holdings in Brazil’s pre-salt basins after it won the Titã exploration block with co-venturer ExxonMobil during Brazil’s 5th pre-salt bid round.

Sépia Field discovery

In November 2022, QatarEnergy announced an oil discovery in the 4-BRSA-1386D-RJS well in Brazil’s world class Sépia oil field, which is located in the prolific Santos Basin in water depths of about 2,000 meters off the coast of Rio de Janeiro.

QatarEnergy acquired a working interest in the Sépia Co-Participated Area in December 2021 during the 2nd Transfer-of-Rights Surplus Bidding Round, which was organized and managed by Brazil’s National Agency for Petroleum, Natural Gas and Biofuels (ANP). The Area is operated by Petrobras (with a participating interest of about 52%) in partnership with TotalEnergies (19.2%), QatarEnergy (14.4%) and Petronas Petróleo Brasil Ltda (14.4%), with Pre Sal Petróleo S.A. (PPSA) as manager.

Agua Marinha block

In December 2022, TotalEnergies, and its co-venturers QatarEnergy and Petronas Petróleo Brasil Ltda (PPBL) won the Agua Marinha block in the Open Acreage under Production Sharing Regime – 1st Cycle held by Brazil’s National Petroleum Agency (ANP).

Repsol

Repsol arrived in Brazil in 1997 as one of the first companies to address the technological and operational challenges in the area. Since 2010, the company have been developing their consortium Repsol Sinopex Brazil, and forming one of the largest private or independent energy companies in Latin America. Over the last two decades Repsol have participated in the entire oil and gas value chain, in addition to the importing, sales, and distribution of basic oils and petrochemical products.

Seacrest Petroleo

Seacrest Petroleo is an upstream oil and gas company that specializes in operating mid-life oil and gas fields in Brazil.

The portfolio consists of the Cricaré Cluster and the adjacent Norte Capixaba Cluster. Both Clusters are owned 100% and operated by the Group. Cricaré was acquired in December 2021 and Norte Capixaba in April 2023.

The company’s focus is on maximizing production from mature fields through a combination of enhanced oil recovery techniques and operational efficiencies.

Shell

Shell's operated assets in Brazil consist of the Bijupirá and Salema fields (Shell interest 80% each), which are being decommissioned; the producing BC-10 field (Shell interest 50%) in the Campos Basin; the Gato do Mato and the adjacent Sul de Gato do Mato areas in the Santos Basin (Shell interest 50%), subject to unitisation and with development options under evaluation. We also hold interests in exploration blocks: 11 in the Santos Basin (Shell interests 70% to 100%), six blocks in the Barreirinhas Basin (Shell interests 50% to 100%), five blocks in the Campos Basin (Shell interests 40% to 100%) and one block in the Potiguar Basin (Shell interest 100%).

The Company’s non-operated portfolio consists of eight producing fields in the offshore Santos Basin: the Sapinhoá field (Shell interest 30%, operated by Petrobras and straddling the BM-S-9 and Entorno de Sapinhoá blocks already unitised); the Lapa field (Shell interest 30% in Block BM-S-9A, operated by TotalEnergies); the Berbigão and Sururu fields (Shell interest 25% in Block BM-S-11A, operated by Petrobras and subject to ongoing unitisation agreement discussions); the Atapu field (Shell interest 16.7% and straddling the BM-S-11A and Atapu PSC area already unitised); the Tupi field (Shell interest 23%, already unitised, in Block BM-S-11 and operated by Petrobras); the Iracema field (Shell interest 25% in Block BM-S-11 and operated by Petrobras); and the Mero field in the Libra PSC area (Shell interest 19.3%, already unitised with an adjoining open area and operated by Petrobras).

In addition to the producing assets, Shell hold interests in five non-operated exploration blocks: three in the Santos Basin (Shell interests 20% to 40%, operated by Petrobras) and two in the Potiguar Basin (Shell interests 40%, both operated by Petrobras).

In December 2023, the Sepetiba FPSO production started in the Mero field. Mero is expected to receive two more FPSOs and start producing from these by the end of 2025.

TotalEnergies

TotalEnergies has been operating in Brazil for over 40 years, and now employs more than 3,000 people across its business segments, covering activities in exploration and production, gas, renewable energies, lubricants, chemicals, and distribution.

TotalEnergies’ Exploration & Production portfolio currently includes ten licenses, of which four are operated. In addition, TotalEnergies was awarded in December 2022 a new deep-water exploration non-operated block in the Campos basin (Agua Marinha, 30%).

In 2017, TotalEnergies and Petrobras formed a Strategic Alliance in exploration and production, and gas, renewables and power activities. The Alliance allows the two companies to implement R&D projects in fields such as artificial intelligence, to generate efficiency gains, with direct applications in Brazil.

Mero field

In January 2024, production started from the second development phase of the Mero field on the Libra block located more than 180 kilometers off the coast of Rio de Janeiro, Brazil, in the pre-salt area of the Santos Basin.

The Mero filed is a unitized field, operated by Petrobras (38.6%), in partnership with TotalEnergies (19.3%), Shell Brasil (19.3%), CNPC (9.65%), CNOOC (9.65%) and Pré-Sal Petróleo S.A (PPSA) (3.5%).

Atapu-2 and Sépia-2 Oil Developments

In May 2024, TotalEnergies, together with the operator Petrobras and their partners in the Atapu and Sépia consortiums, took the Final Investment Decision (FID) for the second development phase of Atapu and Sépia fields, located in the prolific pre-salt Santos Basin

Trident Energy

Building on their success with the Ceiba and Okume Assets in Equatorial Guinea, Trident Energy have an ambitious plan to increase the production from Pampo-Enchova to above 40,000 bopd.

These fields are located in the Campos basin, in water depths ranging from 85m to 780m. Trident Energy owns 100% working interest and is the operator of all 10 concessions.

KEYFACT Energy

KEYFACT Energy