By Chris Seiple, Vice Chairman, Energy Transition and Power & Renewables at Wood Mackenzie

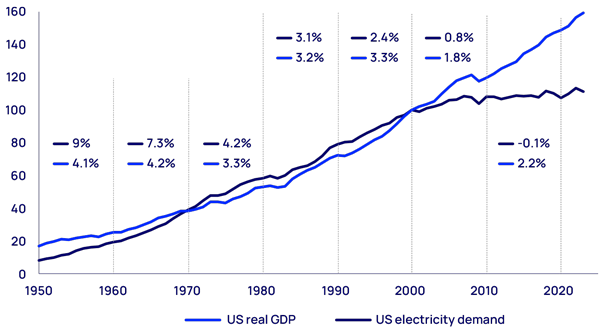

The gradual decoupling of US electricity demand from economic growth underway since 1950 accelerated dramatically in the last two decades. While the US economy expanded by a cumulative 24% in the 2010s, electricity demand remained unchanged. This trend is set to reverse, however, and the US electric utility industry has been caught flat-footed. Burgeoning data-centre development, a resurgence in energy-intensive US manufacturing, and greater transport and heating electrification will result in electricity demand growth not seen since the 1990s.

In most industries, demand growth of 2-3% per year would be easily managed and welcomed. In the power sector, however, new infrastructure planning takes 5 to 10 years, and the industry is only now starting to plan for growth. Moreover, most state public utility commissioners have little experience of regulating in a growth environment. And as technology C-suites realise that energy may be the largest constraint on their growth, they are shocked as businesses that move at light speed learn about the pace at which electric utilities move.

While the challenges of meeting electricity demand growth loom large, the prize for both utilities and developers that can adapt most quickly will be substantial. The new demand growth also heralds an era of upward pressure on wholesale power prices.

Figure 1: Electricity demand growth vs. real GDP growth index (2000 = 100)

Source: Energy Information Administration and Federal Reserve Bank of St. Louis

The potential sources of US electricity demand growth

Uncertainty abounds as to how much electricity demand will grow in the future and where it will come from. We are at the start of a new demand era, with no historical trend line to consult and a wide range of potential outcomes.

Data centres

It is estimated that data centres accounted for 20 to 25 GW of hourly average demand, or 4% to 5% of US electricity consumption, in 2023. This is expected to grow due to the need to power the adoption of artificial intelligence (AI) and complex large language models used by ChatGPT and similar bots.

The adoption of AI software powered by large language models is expected to be one of the fastest adoption curves the market has ever seen, on a par with mobile phones. And the race is on to add more data-centre capacity and computational power fast. Tech company executives fret that if they don’t move fast enough, they will miss out on one of the greatest business opportunities of all time.

Analyst growth estimates

As this is a new technology, there is a large amount of uncertainty over what future demand for data-centre capacity will be. Analyst and consultants tracking the technology sector have forecast electricity demand growth from data centres to range from 10-20% per year through 2030. Ten per cent growth would add about 13 GW of demand over the next five years; 20% would add 35 GW.

Another angle to consider is the capital expenditure plans of big tech companies. Amazon, Meta, Google and Microsoft are forecasting average annual capex increases of 16% per year through 2025, within the mid-range of analyst estimates.

Data-centre project tracking

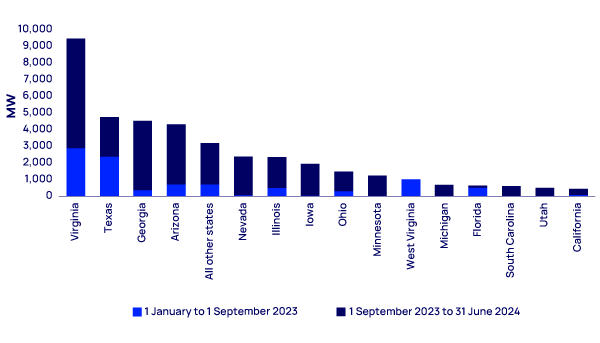

The pace of announced new data-centre capacity exceeds the highest growth forecasts of industry analysts, however. We have identified 51 GW of new data-centre capacity announcements since January 2023, although this is probably only a sample of total project development.

At the start of 2023, the average size of a proposed data centre was about 150 MW of demand. That has since doubled to 300 MW. Notably, while most projects have been announced in traditional data-centre hubs, a long tail of new markets is emerging. With access to electricity potentially a scarce resource, many data centres are looking further afield.

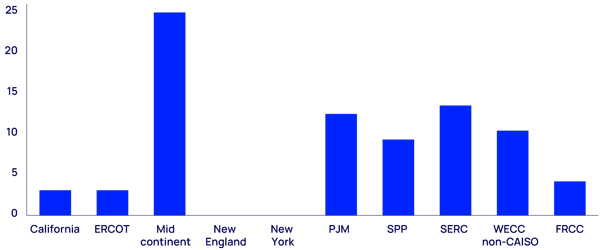

Figure 2: Announced data centres since 1 January 2023 (MW)

Source: Wood Mackenzie

Get in line: data-centre interconnection requests

Utilities’ sizeable large-load interconnection queues also give a picture of data-centre demand:

- Oncor recently said it has 59 GW of data centres seeking to connect to its system.

- Xcel Energy has a pipeline of 6.7 GW of data-centre projects.

- AEP has 15 GW of new load, primarily driven by data centres, wanting to connect to its system by 2030; its peak demand last year was 35 GW.

- PG&E is planning to bring online 3.5 GW of data-centre demand by 2029.

- PP&L has signed deals to add more than 3 GW of data-centre capacity.

- Dominion Energy has customer requests from more than 6 GW of data centres.

This group alone adds up to 93 GW of capacity, nearly four times the total data-centre capacity of 2023. While many of these requests will not materialise, they illustrate the challenge utilities face in processing and responding to interconnection requests and figuring out how much growth to plan for.

In this edition of Horizons, we have considered a scenario in which electricity demand from data centres grows by a mid-range estimate of 15% per year over the next five years. This surge in data-centre development reflects a race to gain access to electricity and, like many renewable projects, may falter due to lack of interconnection. Moreover, data centres are also competing for power with large, new manufacturing facilities.

A manufacturing renaissance

Manufacturing construction spending in 2023 was triple the average of the past decade. Protectionist policies have raised the cost of imported goods such as steel, aluminium, solar panels, electric vehicles (EVs), semiconductors and hi-tech components.

The Creating Helpful Incentives to Produce Semiconductors Act (Chips Act) and Inflation Reduction Act (IRA) subsidise domestic semiconductor, battery, solar and wind manufacturers that make those industries more competitive with imports, especially those with tariffs. And disruptions to supply chains during the Covid pandemic have caused some companies to rethink their supply-chain strategies and localise more purchasing.

Three particularly energy-intensive sectors will be the biggest drivers of manufacturing electricity consumption growth: batteries, solar and semiconductors. In isolation, the increases in demand do not seem that significant, but in aggregate, the growth is material.

Battery manufacturing

Wood Mackenzie is tracking 55 battery manufacturing plants that are either operating, under construction or in development. In 2021, only six plants were operating in the US. As more are built, we expect manufacturing capacity to rise 20-fold to 650 GWh from 2020 to 2030.

We estimate that this new manufacturing capacity will operate at a 50-60% utilisation rate and generate 3,500 MW of near around-the-clock new electricity demand. While that may not sound like much, it is almost three times the consumption of a typical city with a population of 500,000. It is also very regionally concentrated in the Southeast, the Southwest and the Midwest.

Solar manufacturing

The IRA has prompted an explosion of proposed solar manufacturing facilities. Wafer and cell manufacturing are the most energy-intensive elements of making a solar panel. Prior to the IRA, no cell or wafer manufacturing took place in the US. There are now proposals for facilities that would make 44 GW of wafers and 75 GW of cells annually.

While we expect only 7% of the proposed cell and 25% of the proposed wafer manufacturing capacity to be built, that will still increase demand by nearly 7,000 MW. Similar to battery manufacturing, a large portion of this future demand is concentrated in the Southeastern US. If all these proposed facilities – including proposed module manufacturing facilities – were built and operated at full capacity, it would add nearly 30,000 MW of new demand.

Semiconductor manufacturing

Large amounts of electricity are needed to provide constant air filtration and temperature controls to prevent contamination of chips during production and to power the high temperatures involved. Wood Mackenize is tracking nine projects that could add demand of 3,000 to 5,000 MW to the grid. One of the largest, if all of its phases go forward, would add 1,200 MW of new demand, equivalent to 15% of its host utility’s peak demand and 30% of overall energy consumption.

In sum, we expect energy-intensive large loads from battery, solar and semiconductor manufacturing to add up to 15,000 MW of high-load-factor demand over the next few years. It is important to note, however, that the resurgence of manufacturing activity extends beyond these sectors. Large manufacturing investments often attract an accompanying ecosystem of buyers and vendors, so overall industrial growth is likely to be higher.

The wider electrification of the economy

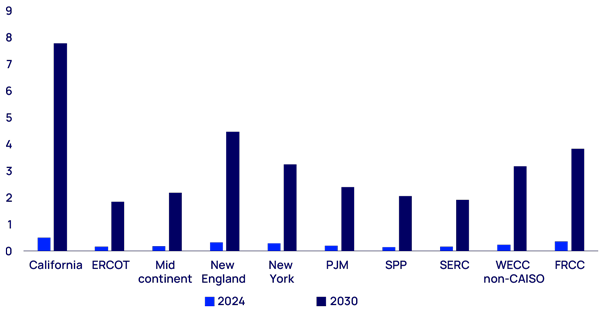

The electrification of heating and transport and the nascent hydrogen economy are the other major drivers of US electricity demand growth. Through 2030, the electrification of heating and transport will only be a material driver of demand growth in the regions that have policies promoting the sales of EVs and the electrification of heating – namely, the Northeastern US and the West.

Today, demand for electricity from EVs constitutes less than 1% of electricity demand in nearly all regions. By 2030, it could account for as much as 8% of electricity demand in California and 3-4% in the Northeast. The Northeast is also the region most likely to see higher growth from the electrification of heating.

Lastly, while we do not expect green hydrogen connected to the grid to scale rapidly over the coming decade, it will be another source of demand competing for supply. We estimate that electrolysers connecting to the grid could add another 7,000 MW of demand through 2030.

Figure 3: Percentage of electric demand from EVs (GWh)

Source: Wood Mackenzie

Putting together the pieces of the demand growth puzzle

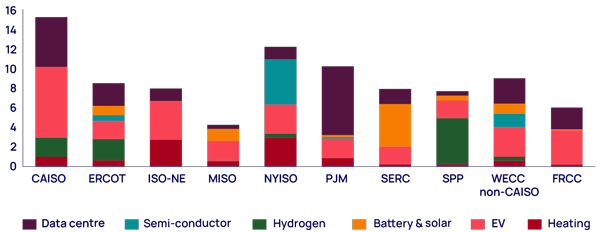

The cumulative impact of these drivers could result in US electricity demand growth of anywhere between 4% and 15% through 2029, depending on the region. Key assumptions here are that data-centre demand will double and occur proportionally to where data-centre demand exists today.

The inability to connect load quickly enough is likely to result in greater geographic dispersion of data-centre growth. Indeed, this growth may not materialise – not because it does not exist, but because utilities cannot move quickly enough.

Much uncertainty exists as to what future growth will look like. What the following graphic makes clear is that it is not just about data centres. In the Southeast and New York, manufacturing is a big driver. In New York, semiconductors also play a major role. In New England, it is the electrification of heating and transport. In the PJM grid region, data centres dominate.

Because of the nature of large loads, some of this demand growth will be highly concentrated in specific areas. For instance, much of the manufacturing renaissance in the Southeast is happening in Georgia, while much of the growth in the Western US outside California is in Arizona. Due to the connectivity requirements, data-centre markets are extremely localised. Development is often concentrated not only near a city, but in the same region of a city.

Figure 4: 2024-29 GWh demand growth as a percentage of 2024 GWh demand

Source: Wood Mackenzie

Power market context

The power market context in which this demand growth is happening raises unique challenges. First, changes in capacity accreditation rules, along with planned retirements, are reducing supply. Second, shortages of key equipment will make it more challenging to add new supply.

Capacity accreditation

Capacity accreditation is the method used to measure the reliability of individual resources in collectively meeting the needs of the entire system. Rapid deployment of intermittent renewables and extreme weather events pose a formidable challenge to legacy capacity accreditation approaches that are not always well connected to generator performance when the system is constrained. Renewable generator accreditation has often been based on historical capacity factors. Fossil-fuelled assets have struggled during weather extremes.

Nearly all regional grid operators are now adopting new approaches to capacity accreditation that aim to more accurately and dynamically capture resource reliability values. Wood Mackenzie research finds the result to be downgrades in the amount of capacity actually available to the market when it is most needed.

PJM’s recent capacity market auction is a perfect example of how these accreditation rules are impacting markets: capacity prices were nearly 10 times higher than the previous auction. While multiple factors contributed to the market tightening, capacity accreditation changes played a large role. Gas combined-cycle plants, which could typically count more than 90% of their capacity as “accredited”, were downgraded to 79%. The reduction for combustion turbines was even steeper. Essentially taking this capacity out of the market has played a material role in driving down supply and driving up prices.

System constraints

Three major constraints are impacting the system’s ability to meet demand growth. First is the slow pace at which interconnection studies are completed and transmission capacity is added to the grid. From now to 2030, we forecast annual utility-scale renewable additions to grow from around 29 GW to 40 GW per year. The constraint is not the demand for renewables, but the ability to get through permitting, interconnection and building out the transmission system accordingly. All things being equal, our forecast additions would accommodate electricity demand growth of about 2% per year.

Manufacturing and data-centre demand also present unique challenges. They typically consume equal amounts of energy all hours of the year, while renewables operate intermittently. Also, renewables are most often not built near the new large loads, so additional transmission capacity is needed to move the power.

The second constraint is the scale of planned coal retirements. In theory, new plants need to be built not just to meet demand growth, but to replace retiring capacity. There is precedent for the opposite, however: a data centre displacing a coal plant to leverage its interconnection facility. A trend of this sort would exacerbate the growing demand-supply imbalance.

In grid regions like PJM and SERC, the US could face demand growth of 10% over the next few years, while there are also plans to retire coal capacity equal to 10% of demand. In reality, one likely result of increased demand growth will be the deferral of planned retirements.

Figure 5: Planned coal retirements as a percentage of peak demand

Source: Wood Mackenzie

The third constraint is the availability of the transformers and breakers needed to interconnect new plants and large loads. Wood Mackenzie software, used by nearly 50% of US utilities to manage their equipment procurement, gives real-time visibility on lead times and prices. We are typically seeing lead times now averaging three years for particularly large transformers (greater than 500 MVA). In some cases, we have seen suppliers quote lead times as long as five years. While manufacturers are now making investments to expand manufacturing capacity, we expect it will take a few years for supply to catch up with demand.

New types of customer require new responses

The type of demand growth occurring in the electricity industry right now is bringing a new class of customer to most utilities – extra-large, high-load-factor ones with unique challenges. Accommodating them requires significant planning and investment. There is also a large degree of uncertainty surrounding each load. Clearly, not all 59 GW of data centres requesting power from Oncor will happen. But how does Oncor decide which projects to prioritise? How does it recoup its investment and protect ratepayers if a project stalls?

Manufacturing load also presents unique challenges. Not all manufacturing projects will happen. The electricity needed to scale up manufacturing may differ from what was planned. In an intensely competitive business, plants built today could shut down in future, especially in industries that require tariffs and subsidies to be competitive.

Nearly all of these new customers want zero-emissions energy and are willing to pay a premium for it.

What’s more, nearly all of these new customers want zero-emissions energy and are willing to pay a premium for it. Meeting around-the-clock, high-load-factor demand with renewables is challenging. And because large renewable plants are sited based on the availability of land and natural resources, significant transmission investment will be required for large loads to offtake their capacity.

Implications for utilities, developers and large loads

The implications of this large-load growth in the current power market context will be significant.

A new paradigm, with upward price pressure

For the past 15 years, there has been no electricity demand growth in the US, yet the country has continued to add new supply – mainly renewables – to replace existing fossil generation. This has resulted in significant pressure on power market prices and made it challenging to profit from coal, gas and nuclear plants, absent abnormal events such as Russia’s war on Ukraine or extreme weather.

With new demand growth comes a new era. Electricity prices will be under upward pressure. Valuations of fossil and nuclear assets are increasing as the market absorbs this new paradigm. More announcements of deferred coal plant retirements and efforts to reopen previously closed nuclear plants may follow. What will be most interesting is how this plays out in markets where there is no retail choice versus markets where it does exist. In the former, utilities will be better able to refrain from adding new load without adequate additional generation to support it. Deregulated markets are likely to be more volatile, with load growth potentially outpacing supply additions, boosting and unsettling power market prices.

Substantial opportunity for renewable developers

There is no easy solution to closing the supply gap. “Hydrogen-ready” gas-fired plants are a likely contributor, benefitting the natural gas industry, and there will be renewed focus on nuclear and geothermal, but these will not help this decade. Renewable developers will still benefit from demand growth.

These large loads want renewable power, are far less price sensitive than most customers and have proven themselves willing to pay a premium for a constrained amount of renewable supply. And as utilities respond by building new gas assets, they are also likely to increase their commitments to renewable power. A large prize awaits the renewable developer that finds a way to meet data-centre demand with a renewable behind-the-meter supply option.

Establishing a large-load interconnection process

Utilities are faced with hard choices – do they prioritise the data centre, the cell manufacturer or the chip manufacturer? Which data centre do they choose? How do they avoid being left with a stranded investment? How do they sidestep proposals that will never go forward?

Over the past 30 years, the industry has evolved the process of large-generation interconnection. It now needs to do the same for large loads to protect the financial interests of utility shareholders and ratepayers, to provide a transparent, non-discriminatory process for large loads competing for access to energy and to provide transparency to market participants on possible demand growth.

New innovations and behind-the-meter generation

Manufacturers and data-centre companies are looking for ways to better cooperate with utilities, as well as ways to work around them. Utilities that establish innovative programmes – such as Nevada Power’s Clean Transition Tariff, which enables a large load to pay a premium for round-the-clock power from clean energy sources without impacting existing ratepayers – are more likely to stay out of the crosshairs of politicians and customers and attract large loads to their territory. AES’s utility subsidiaries and Dominion Power are moving ahead of other utilities with large-scale grid-enhancing technology deployments. Utilities will need to adopt an all-hands-on-deck approach to accommodate this growth as quickly as possible.

However, we have also heard of many instances of data centres, in particular, looking for ways to avoid utilities out of frustration with the pace of interconnection. One route has been to build behind-the-meter, typically gas-fired generation that can provide primary power until the data centre can connect to the utility system. These tend to be smaller data-centre projects.

A second is building data centres at existing nuclear and even fossil-fired plants, essentially taking that capacity off the grid. This has prompted fierce backlash from utilities, with Exelon and AEP protesting the avoidance of transmission charges, and concern from regional transmission organisations over the fact that these deals can happen on a faster timescale than their system planning processes.

We have recently heard of gas-fired generators seeking to run reverse auctions to sell their power to the data centre willing to pay the biggest premium. We would not be entirely surprised to see more lobbying for the introduction of retail choice into states that do not currently have it, and an all-hands campaign by utilities to prevent it.

Collaboration between data centres and utilities will be key

There is a lot that data centres and utilities need to do to better understand mutual needs and capabilities. Relocating or delaying the demand for training large language models, for instance, may help a utility better accommodate demand growth. It may be possible to use a portion of the backup generation at data centres to help meet emergency utility or market demand. We are not aware of hyperscalers offering ancillary services to the market today, but standard operating procedures for data-centre backup testing have aligned well with emergency demand response test events, making capacity market participation relatively straightforward. It is possible that the high load factors of both the manufacturing and data centres could result in overall better transmission and distribution asset optimisation for the utility and reduce costs for other customers.

Transmission planning, permitting and building are centre stage

Transmission planning, permitting and construction are the biggest bottlenecks to meeting future demand growth. Federal Energy Regulatory Commission Order 1920, which adopts requirements on how transmission providers conduct long-term regional transmission planning and allocate the costs of transmission facilities planned through those processes, will go a long way towards achieving the needed buildout. Alas, the pace at which that order will make its way into actual processes at independent system operators is too slow. A more integrated approach that considers interconnection requests in tandem with large-load growth and state policy objectives is pressing.

Original article l KeyFacts Energy Industry Directory: Wood Mackenzie

KEYFACT Energy

KEYFACT Energy