History

Argentina (the Argentine Republic) is a federation of provinces sharing the southern cone of South America with Chile to the west. It borders Bolivia and Paraguay (north) and Brazil and Uruguay (east).

Country Key Facts

| Official name: | República Argentina (Argentine Republic) |

| Capital: | Buenos Aires |

| Population: | 45,739,887 (2024) |

| Area | 2,766,889 km² |

| Government type:: | Federal Republic |

| Language: | Spanish |

| Religions: | Roman Catholic |

| Currency: | Peso (P) = 100 centavos |

| Calling code: | +54 |

People had inhabited Argentina for over 50,000 years before the Spanish arrived in 1502. Spain took over the region, establishing the Governorate of Río de la Plata from 1549, which became part of the Viceroyalty of Peru and then, in 1776, the Viceroyalty of Río de la Plata. Revolution in 1810 led to a Declaration of Independence in 1816 followed by civil war lasting until 1861 when the Argentine federation came into being. Immigrants from Europe, encouraged by the liberal economy, saw the new country become very wealthy. However, in 1930 a military coup caused political instability and then steady economic decline.

Neutral in both World Wars, in 1946 Juan Peron came to power, improving the economy. A coup led him to flee to Spain in 1955 and political instability returned, along with state terrorism from 1969 to 1983 when the military was forced out following defeat by the UK in the Falklands War. Since then the country has seen economic crisis and default (in 2001) but is now much improved. It has rich natural resources, diversified industries, and an export-oriented agricultural sector.

Energy

Argentina possesses the world’s fourth-largest shale oil and second-largest shale gas reserves. The Vaca Muerta shale formation is located in the provinces of Neuquén, Mendoza, and Rio Negro, and only a fraction has been developed for oil and gas production. Vaca Muerta’s shale quality, production incentives, tax exemptions, and negotiated labor concessions have contributed to lowering operational costs and increased efficiency. Investments have slowed because of Argentina’s broader economic challenges as well as policy uncertainties that include foreign exchange controls that hinder repatriation of dividends. Major global exploration and production companies including Chevron, ExxonMobil, Petronas, Raizen (Shell), and Total are present along with many local firms. Argentina’s majority state-owned energy company, YPF, holds the largest upstream sector market share. Industry reports a continued need for small- and medium-sized service companies with shale expertise to enter the market to further improve efficiency and lower costs.

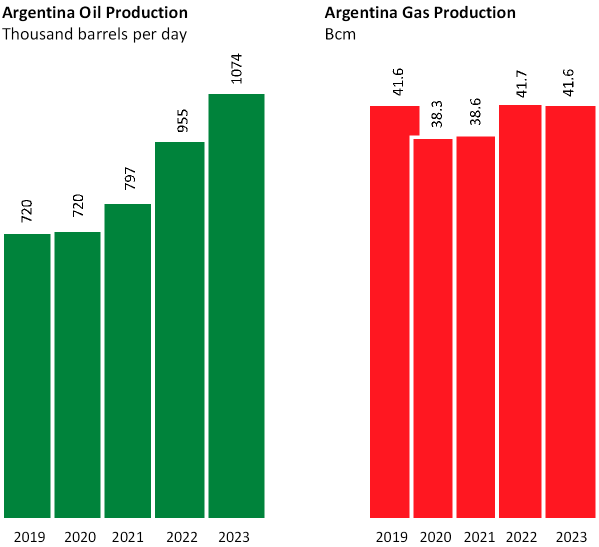

| Oil production | 765,000 bpd |

| Proved oil reserves (year-end) | 2.82 billion barrels |

| Natural Gas production | 42.72 Bcm |

| Natural Gas proved reserves (year-end) | 423 Bcm |

Key Oil & Gas Players

Black Gold Exploration

BGX - Black Gold Exploration is an oil and gas exploration company dedicated to creating shareholder value through the acquisition, exploration and development of oil and gas projects. It is currently developing the El Carmen Project located in the San Jorge Basin in the Chubut Province of Argentina with proximity to existing and functioning pipelines in a well-established oil production area.

BGX holds a 95% interest in the El Carmen hydrocarbon project. The property is located in the Chubut Province, Argentina, about 7 kilometers from the Atlantic coast along the northern margin of San Jorge Cretaceous age sedimentary basin. The San Jorge Basin ranks second of the five producing basins in Argentina, and has proven oil reserves of about 160 million cubic meters (a billion barrels). It is estimated that only 35 percent of the basin has been fully explored, and there exists the possibility that its current oil reserves can be nearly doubled. Intense exploration is taking place. The immediate area of El Carmen is a prolific oil and gas producer with highly developed infrastructure.

bp

In December 2017, bp confirmed the formation of Pan American Energy Group (PAEG). The new company, owned by bp (50%) and Bridas Corporation (50%), is now the largest privately-owned integrated energy company operating in Argentina.

PAEG was formed by the combination of Pan American Energy and Axion Energy. Pan American Energy had been owned 60:40 by bp and Bridas Corporation and Axion wholly-owned by Bridas Corporation.

Central Resources

Central Resources, Inc. is an independent oil and gas producing and operating company with business concerns in the U.S., Argentina, Brazil, and The Netherlands.

South America, and Argentina in particular, is a focal point of Central's diversification efforts. As the economy of Argentina has undergone periods of expansion and contraction over the past 20 years, Central has recognized the potential for oil and gas exploitation and development.

CGC

CGC is a growing Argentine oil company that has vast activity in the exploration and exploitation of hydrocarbons, in national territory and in other Latin American countries, and in trunk gas transportation both within the country and to Chile and Brazil.

CGC was founded in 1920 as a shipping company dedicated to the import and commercialization of fuels. In 2013, Corporación América acquired 70% of CGC, consolidating it as one of the main oil companies in Argentina.

In June 2021, CGC acquired Sinopec Argentina Exploration and Production. With this acquisition, the Company increased their production by more than 50,000 Barrels of oil equivalent per day (boe), balancing their product mix to approximately 63% gas and 37% oil (previously 85% and 15% respectively).

The assets incorporated in the acquisition cover more than 4,600 km², most of them located in Golfo San Jorge basin and Cuyana basin. The acquisition included a stake in Termap, the port terminal operator in Caleta Olivia (Santa Cruz) and Caleta Córdova (Chubut).

Most of the Company's hydrocarbon production and reserves are currently concentrated in the Austral basin. The Austral basin is located in the extreme south of South America, and partially covers the Argentine provinces of Santa Cruz and Tierra del Fuego, the Magellan Strait and the southwest region in Chile. The Austral basin is comprised of approximately 230,000 km², 85% of which are located in Argentina.

Golfo San Jorge Basin

Golfo San Jorge basin is located in the extreme south of South America and covers the north area of the province of Santa Cruz and the south of the province of Chubut. The basin has a surface of approximately 70,022 km², and is 100% located in Argentina.

Approximately 27.3% of CGC's total oil and gas production and 47% of their net proven reserves are located in Golfo San Jorge basin. The Company have direct participation in 15 blocks and operate in approximately 15 oil and gas fields. In December 2021, CGC successfully entered into an agreement with the province of Santa Cruz to extend all the concessions in Golfo San Jorge basin area for another ten years.

Chevron

Chevron ranks among the world's largest and most competitive global energy companies. Headquartered in San Francisco, it is engaged in every aspect of the oil and gas industry, including exploration and production; refining, marketing and transportation; chemicals manufacturing and sales; and power generation.

Chevron produces crude oil and natural gas in Argentina through their wholly owned subsidiary Chevron Argentina.

Chevron Argentina S.R.L. is the eighth-largest producer of oil in the country, with concessions in the Neuquén Basin. Expanded waterflood operations are sustaining oil output at the El Trapial Field, and the company is exploring for unconventional oil and gas resources in the Vaca Muerta Shale.

CNOOC

CNOOC International interests in Argentina stem from the company’s stake in Pan American Energy Group (PAEG), which was formed through the merger of BC Energy Investments Corp. - a 50-50 joint venture of CNOOC International and Bridas Energy Holding - and bp. BC Energy Investments Corp. and BP each hold 50% ownership of PAEG.

Crown Point Energy

Crown Point has a strategy that focuses on establishing a portfolio of producing properties, plus production enhancement and exploration opportunities to provide a basis for future growth.

Crown Point has a 100% working interest in the 101,208 acre Cerro de Los Leones Exploration Concession located in the Neuquén Basin, one of the most prolific basins in Argentina with proven production from multiple oil and gas fields.

Crown Point has a 34.74% non-operated working interest in the Rio Cullen, La Angostura, and Las Violetas Exploitation Concessions in the Austral Basin of Tierra del Fuego, representing a total of 489,000 gross acres (169,880 net acres). Crown Point’s strategy is to grow production from its assets in Tierra del Fuego via exploration and development drilling, supported by extensive 3D seismic coverage.

Crown Point has a 50% non-operated working interest in the Chañares Herrados Exploitation Concession in the Cuyano Basin representing a total of 10,057 gross acres (5,029 net acres). Crown Point’s strategy is to grow production through well workovers, a multi-well drilling program and facilities optimization supported by its 100% 3D seismic coverage over the concession.

ENAP

Located in the Austral Marina Basin, ENAP Argentina acts as operator for the exploitation concessions in the Magallanes Area and CAM 2/A Sur (Poseidon Lot), with a 50% stake in partnership with YPF, who holds the remaining 50% in both concessions .

In the San Jorge Gulf Basin, ENAP participates as a partner, with a 50% stake in the exploitation concession of Campamento Central - Cañadón Perdido, where YPF serves as operator.

As part of the growth plan initiated by the subsidiary, in 2017, a new onshore area, El Turbio Este, was tendered and awarded in the southern area of the Province of Santa Cruz.

Additionally, in 2018, ENAP completed the purchase of 100% of the Octans Pegaso block from a consortium led by Total Austral. This block is an offshore block with an area of 886 km² and an average water depth ranging from 10 to 60 meters, where gas discoveries exist.

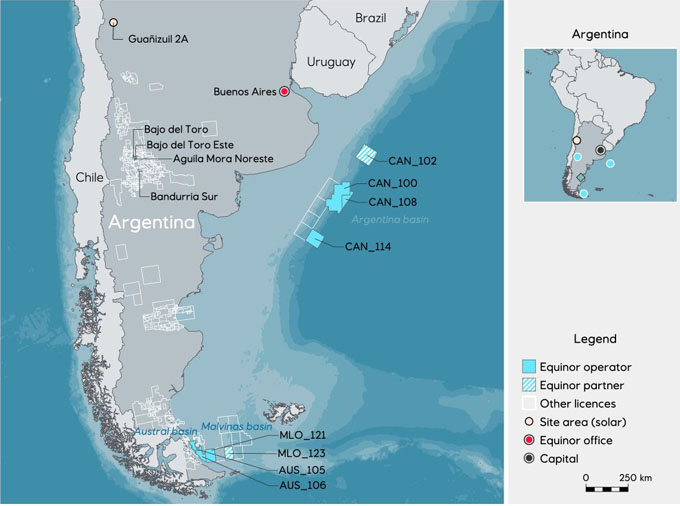

Equinor

The story of Equinor in Brazil started with Peregrino, a field that many did not consider possible to develop and where we established a solid foundation to grow in the country.

More than 230 million barrels have been safely produced in Peregrino since 2011. It is the largest production field operated by Equinor outside Norway, with daily production of 110,000 barrels of oil.

Located in the Campos Basin, Raia comprises three different pre-salt discoveries: Pão de Açúcar, Gávea and Seat. They contain natural gas and oil/condensate recoverable reserves of above 1 billion barrels of oil equivalent (Boe). The gas export capacity is 16 MSm3/d and may represent 15% of the total Brazilian gas demand at start-up, which is expected in 2028.

Raia is operated by Equinor (35%), in partnership with Repsol Sinopec (35%) and Petrobras (30%).

Together with partners, Equinor announced the investment of approximately USD 9 billion to develop the project. Raia is one of the main gas projects in the country being a key contributor to the further development of the Brazilian gas market.

Bacalhau will be important not only for Brazil but also for the global market. The field is located in the Santos Basin, and operated by Equinor (40%), in partnership with ExxonMobil (40%), Petrogal Brasil (20%) and PPSA (Government Company). Equinor acquired the operatorship in 2016, and first oil is expected in 2025.

Roncador was the largest offshore discovery in Brazil in the 1990s and has a current production of almost 150,000 barrels of oil equivalent per day (boe/d), as well as being the largest producing field outside the pre-salt area, with approximately 10 billion barrels of oil equivalent originally in the reservoir.

Operated by Petrobras (75%), in partnership with Equinor (25%) since 2018, the ambition is to reach an additional 1 billion barrels of oil equivalent.

Rio Energy

Equinor acquired Rio Energy, a leading onshore renewables company in Brazil, in 2023. The acquired portfolio consists of the 0.2 GW Serra da Babilonia 1, producing onshore wind farm in the state of Bahia, a 0.6 GW pre-construction solar PV portfolio and a project pipeline of about 1.2 GW of onshore wind and solar projects.

ExxonMobil

ExxonMobil affiliates have been operating in Argentina for more than 100 years, and have been part of the country’s oil and gas industry history since its early beginning.

Today, ExxonMobil in Argentina employs approximately 1,500 people through several Exxon Mobil Corporation affiliates: ExxonMobil Exploration Argentina S.R.L, Mobil Argentina S.A., and ExxonMobil Business Support Center Argentina S.R.L.

Since 2010, ExxonMobil Exploration Argentina has had a presence in the unconventional Vaca Muerta shale oil and shale gas play in the Neuquén Province, which is considered one of the most important unconventional resources in the world.

ExxonMobil Exploration Argentina holds interests in approximately 900,000 net acres in the unconventional play of the Vaca Muerta in Neuquén Province. The company have drilled seven wells with their strategic partners and have recently progressed into the ExxonMobil operated program to explore for unconventional resources in the Bajo del Choique and La Invernada blocks, where the Company holds 85% interest and Oil and Gas Provincial Company of Neuquén holds the remaining 15%.

Mobil Argentina S.A (MASA), which is stewarded by ExxonMobil Production Company, holds 51% interest in the onshore field of Sierra Chata, Province of Neuquén, producing natural gas and condensates. Most of MASA’s natural gas is sold to a variety of local distribution companies, industrial users and power generation companies in Argentina.

GeoPark

GeoPark Limited is a Latin American oil and gas explorer, operator and consolidator with oil and gas assets and growth platforms in Chile, Colombia, Brazil, Perú and Argentina.

The Mata Mora Norte producing block and Mata Mora Sur, Confluencia Norte and Confluencia Sur exploration blocks are located in the Vaca Muerta oil window, providing immediate access to a rapidly growing reserves profile -25 mmboe of 1P net reserves, 49.5 mmboe of 2P net reserves, and 102.6 mmboe of 3P net reserves. Spanning 122,315 acres (gross), they are adjacent to ongoing shale operations and two existing oil pipelines, with a third under construction.

Harbour Energy

In Argentina, Harbour are a major supplier of energy and one of the country’s top producers of natural gas. The Company have been active in Argentina for more than four decades and have a long-term operator partnership through TotalEnergies.

Harbour Energy is active in the province of Neuquén in central Argentina, as well as onshore and offshore Tierra del Fuego in the south of Argentina.

Off the coast of Tierra del Fuego, Harbour has an interest in the CMA-1 (Cuenca Marina Austral 1) concession which forms the backbone of the country's energy supply. Today, around 16 per cent of Argentina's natural gas is produced from the CMA-1 concession which includes the Carina, Aries, Vega Pléyade and other smaller fields.

In the Neuquén province, Harbour have interests in the TotalEnergies-operated Aguada Pichana Este (APE) and San Roque concessions. The Company are producing gas from the conventional reservoirs and from the Vaca Muerta shale gas play in APE. Development activities in APE are focused on the Vaca Muerta shale formation. Harbour is currently producing from conventional plays within the San Roque concession and, together with its partners, is evaluating options to proceed with the development of the Vaca Muerta formation.

FÉNIX

In the CMA-1 concession, with operator TotalEnergies and partner Pan American Energy, Harbour are developing the offshore Fénix field. Fénix is the latest incremental development project in the CMA-1 concession and is expected to deliver significant volumes of natural gas for more than 15 years. Production started in September 2024.

Interoil

Interoil has equity interests in one exploration and seven production concessions in the highly prolific Golfo San Jorge Basin, in the Jujuy Province and in the heart of the Austral Basin in southern Argentina.

The Mata Magallanes Oeste (production) and Cañadón Ramírez (exploration) are adjacent blocks, covering nearly 380 square kilometers in the western part of the highly productive Golfo San Jorge Basin in the southern part of Argentina. This basin is said to hold approximately half of Argentina’s gas reserves and twenty per cent of the country’s oil reserves. Interoil is the operator and holds an 80 percent working interest in these licenses in a joint venture with Selva Maria Oil SA and Petrominera SE, the state-owned company of the Chubut Province where the blocks are located.

The La Brea block (production) covers 112 square kilometers in the Jujuy Province in the Northern Argentina, and comprises two promising structures, La Brea Este and El Oculto. Interoil will also become the operator and hold 80 percent working interest in a joint venture with Selva Maria Oil SA and JEMSE, the state-owned company of the Province of Jujuy.

The Santa Cruz region

Interoil Exploration and Production holds a working interest in five producing exploitation concessions contracts in the heart of the Argentine Austral Basin. Geographically the basin lies within Santa Cruz province in the Southern mainland part of Argentina.

These concessions, CA-1 “Campo Bremen”, CA-4 “Moy Aike”, CA-6 “Chorrillos”, CA-10 “Palermo Aike” and CA-9 “Océano”, consist of 13 producing fields with 42 oil wells and 30 gas wells. In addition, Interoil owns an interest in and to the transport concession on the Océano area.

Madalena Energy

Founded in 2005, Madalena Energy Argentina SRL is a national company dedicated to the exploration, development and production of crude oil, natural gas and its derivatives.

Madalena Energy hold exploration and exploitation concessions in two provinces in Argentina, where they focus mainly on the delineation of conventional oil and gas resources. Conventional blocks include Puesto Morales and Rinconada Sur in the Neuquén Basin (Vaca Muerta Zone), and in the Northwest Basin the Surubí area of Formosa and Santa Victoria and Valle Morado of Salta.

Pampa Energia

Pampa Energia explore and produce gas and oil in 11 production areas and 4 exploration areas in the most important basins in the country. The Company co-control Transportadora de Gas del Sur (TGS), which transports 60% of the gas consumed in the country.

In 2023, Pampa's average production in Argentina reached 65.4 kboe/day, 93% corresponding to gas, consolidating the Company as the country’s fifth largest gas producer.

On December 31, 2023, Pampa’s P1 reserves amounted to 199 million boe, 11% higher than volumes recorded on the same date in 2022. Considering production levels and the 2023 incorporations, the reserve-replacement ratio was 1.8, and the average life obtained was approximately 8.6 years.

Pan American Energy (PAE)

In September 2018, Bridas and bp agreed to integrate Pan American Energy and Axion Energy.

The new integrated company, Pan American Energy Group (PAEG), brings together the strengths, knowledge and tradition of investment of both partners, to consolidate the company as a world-class operator. PAEG is owned equally by bp and Bridas Corporation.

PAE has interests in Argentina’s four main hydrocarbon basins, including operating Cerro Dragon, Argentina’s largest oil field, and interests in the prospective Vaca Muerta shale.

Phoenix Global Resources

Phoenix Global Resources is an independent upstream oil and gas private limited company focused on Argentina with interests in the Vaca Muerta shale formation and other unconventional resources.

The Vaca Muerta is the only producing shale outside North America and has attracted significant major entrants including Total, BP, Chevron, ExxonMobil, Qatar, Petroleum, Petronas, Shell and Equinor. PGR currently holds interests and operates several blocks with exposition to Vaca Muerta formation, principally in the Neuquen Province.

The Company also holds interest in conventional assets. The company´s activities are focused on the development of the Mata Mora unconventional field with drilling activity at 3 pads (9 wells) completed in 2022

Phoenix Global Resources has interest in 3 concessions in the Austral Basin located in the Tierra Del Fuego province. The Austral basin assets account for the all of Phoenix’s current gas production.

Pluspetrol

Pluspetrol is a leader in the operation of unconventional fields, in the development of high-pressure gas fields, and the extraction of crude oil in mature fields with secondary and tertiary recovery. The company is making significant investments in the country, and it is particularly well-positioned at the Vaca Muerta formation, one of the largest unconventional oil and gas reservoirs on the planet. The main unconventional oil and gas deposits are La Calera, Loma Jarillosa Este and Sitio Silva Oeste, Aguada Villanueva and Meseta Buena Esperanza.

In addition, Pluspetrol is in the El Corcobo field, located in the provinces of La Pampa and Mendoza, and has an offshore concession in the Malvinas Basin, in the Argentine Sea.

QatarEnergy

In April 2019, Qatar Petroleum won exploration rights in five offshore blocks in the North Argentina, and Malvinas West basins in Argentina.

Qatar Petroleum won the exploration rights for blocks MLO-113, MLO-117, and MLO-118 in the Malvinas West basin as part of a consortium comprising an ExxonMobil affiliate (operator with a 70% interest) and a Qatar Petroleum affiliate (with a 30% interest).

Qatar Petroleum also won the exploration rights for blocks CAN-107 and CAN-109 in the North Argentina basin as part of a consortium comprising an affiliate of Shell (operator with a 60% interest) and an affiliate of Qatar Petroleum (with a 40% interest).

In March 2024, a consortium formed by ExxonMobil and QatarEnergy decided not to move forward with the second exploration phase of two blocks in the Malvinas Oeste basin.

Shell

Shell Argentina has operated in Argentina continuously since 1914, beginning its hydrocarbon exploration and production activities in 1921. The Company's most recent history in the Upstream began in 2012 when they launched the first Unconventional Oil and Gas exploration projects in the Neuquén Basin.

In December 2016, we commissioned an Early Production Facility (EPF) at Sierras Blancas, which has the capacity to process up to the equivalent of 12,000 barrels of oil per day from the Sierras Blancas, Cruz de Lorena and CASO blocks.

In 2021, a Central Processing Facility (CPF) was commissioned, providing an additional 30,000 barrels per day of processing capacity for a total of 42,000 barrels per day in the combined Cruz de Lorena, Sierras Blancas and CASO area.

Tecpetrol

Tecpetrol explores and produces oil and gas in Argentina, Bolivia, Colombia, Ecuador, Mexico, Peru and Venezuela. With more than 760 wells in production, the areas where it operates are home to plants and facilities for primary and secondary recovery, gas conditioning and processing, and power generation.

Tecpetrol has a concession for a 180 thousand-acre block in Argentina’s shale oil and gas reservoirs, making it one of the top 10 companies operating in the country.

Fortín de Piedra is a 243-km² area in Vaca Muerta, lying in the Neuquén sedimentary basin.

TotalEnergies

TotalEnergies has been operating in Argentina since 1978, and today employs more than 1,100 people in its business segments, in Exploration & Production, renewable electricity (solar and wind), and lubricants.

Through its Total Austral affiliate, it is the country’s leading international gas producer, operating some 25% of production. The Company’s equity share of production averaged 88,000 barrels of oil equivalent per day in 2023.

In Tierra del Fuego, alongside partners Harbour Energy (37.5%) and Pan American Sur (25%), TotalEnergies (37.5%) operates the Cuenca Marina Austral 1 (CMA-1) concession, which includes onshore fields and 6 offshore platforms.

In Neuquen, the Company holds equity interests in five onshore blocks, spanning more than 235,000 net acres, all operated.

Across the country, TotalEnergies operates 3 wind farms and 1 solar plant, with an installed capacity of approximately 300 MW.

In September 2024, TotalEnergies announces the start of production from the Fenix gas field, located 60 km off the coast of Tierra del Fuego in Southern Argentina.

The Fenix field is part of the Cuenca Marina Austral 1 (CMA-1) concession, in which TotalEnergies holds a 37.5% operated interest, alongside its partners Harbour Energy (37.5%) and Pan American Energy (25%).

Tullow Oil

In April 2019, Tullow was awarded three blocks in the Malvinas West Basin, offshore Argentina, in a competitive bidding round.

Tullow obtained an operated 40% interests in Areas 114 and 119 and a 100% interest in Area 122. The contracts were formally ratified in October 2019.

Tullow continues to mature the significant prospective resource base and continues to assess opportunities from these licences.

YPF

YPF, formerly Yacimientos Petrolíferos Fiscales, is a vertically integrated, majority state-owned Argentine energy company, engaged in oil and gas exploration and production, and the transportation, refining, and marketing of gas and petroleum products.

YPF is the largest oil and gas producer in Argentina, with participating interests in more than 100 development concessions and more than 20 exploration permits in the most attractive basins in Argentina.

Founded in 1922, YPF was the first oil company established as a state enterprise outside of the Soviet Union, and the first state oil company to become vertically integrated.

YPF was privatized under president Carlos Menem and was bought by the Spanish firm Repsol in 1999; the resulting merged company was called Repsol YPF.

The renationalization of 51% of the firm was initiated in 2012 by President Cristina Fernández de Kirchner. The government of Argentina eventually agreed to pay $5 billion compensation to Repsol.

KEYFACT Energy

KEYFACT Energy