WTI (Jan) $70.02 -27c, Brent (Feb) $73.41 -11c, Diff -$3.39

USNG (Jan) $3.46 +8c, UKNG 106.3p -4.0p, TTF (Jan) €43.16 -€1.23

Oil price

Oil is up today and will likely be up on the week, albeit modestly. A more positive stance from the reporting agencies tied with more positive help for the Chinese economy is peeping through.

The EU sanctions on Russia have helped and the US are joining in, funny thing that Sleepy Joe is playing hard ball again. Also the US is specifically hard on the Iranian nuclear industry and for good reason. Our old friends at the IAEA have warned that Iran are enriching fuel and the country have apparently opened their doors at the Fordow Fuel enrichment plant, my guess is that this push is coming from Mar Lago not Pennsylvania Avenue…

And note that Kosmos are in talks with Tullow to take them over, no surprise, the TLW CEO is off the debts are huge and the assets similar, great news for Kosmos to put them out of their misery.

Touchstone Exploration

Touchstone has announced that its wholly owned subsidiary, Touchstone Exploration, has entered into an agreement with BG Overseas Holdings Limited to acquire all the share capital of Shell Trinidad Central Block Limited.

Under the terms of the Acquisition, TETL will pay BG Overseas Holdings Limited $23 million consideration in cash prior to closing adjustments. Completion of the Acquisition is subject to customary regulatory and partner approvals, including the approval of the Ministry of Energy and Energy Industries. Touchstone is in active discussions with its Trinidad-based lender, Republic Bank Limited, to fund the Acquisition upon closing. The Acquisition will have an effective date of January 1, 2025, has a four-month long stop date, and is expected to close during the second quarter of 2025.

STCBL holds a 65 percent operating working interest in the Central block exploration and production licence and gas processing plant in the Republic of Trinidad and Tobago with Heritage Petroleum Company Limited (“HPCL”) holding a 35 percent working interest. Current gross production from the Central block is approximately 18.0 MMcf/d of natural gas and 200 bbls/d of natural gas liquids (approximately 3,200 boe/d).

Acquisition Highlights

- Access to Atlantic LNG: STCBL is a party to natural gas sales contracts for the Central block asset, providing access to both local and LNG world gas market pricing.

- Opportunity for Development: Touchstone has identified numerous infill well locations as well as a deeper Cretaceous prospect at Central block.

- Strategic Infrastructure: The midstream assets of STCBL include an 80 MMcf/d gas processing plant (the “Evergreen Facility”), field natural gas and liquids flowlines, and a gas export pipeline to both the domestic market and the Atlantic LNG facility.

- Increased Production: The Acquisition increases Touchstone’s base net production by approximately 2,080 boe/d (94 percent natural gas) at current field estimated rates and provides incremental corporate cash flows.

Paul Baay, President and Chief Executive Officer, commented:

“We are pleased to enter into an agreement to purchase the Central block asset. The asset is a strategic fit with Touchstone’s current land base and provides us access to world LNG prices for natural gas. The infrastructure associated with the assets provides processing and takeaway capacity for natural gas in the Herrera fairway. During 2025 we will consider pursuing an infill development drilling program at Central block and look to boost production and LNG sales.“

Well this announcement bookends a remarkably busy week for TXP in which they have given guidance for 2025, had two major meetings on the Capital Markets Day, a major TV interview with CEO Paul Baay and many shareholder meetings. I had planned to publish my wrap-up note this morning, headlined 8 big ticks in the boxes, it is a summation of the chat I had with Paul and will now appear at a later date.

And that is due to todays announcement with regard to the potential but agreed deal with Shell to buy their Central block asset for $23m in cash. The deal brings an increase in production of some 2,080 boe/d of which is 94% natural gas, a meaningful addition to their current 6,294 boe/d. Almost as importantly, it brings strategic infrastructure for example, the midstream assets of STCBL include an 80 MMcf/d gas processing plant, field natural gas and liquids flowlines, and a gas export pipeline to both the domestic market and the Atlantic LNG facility all that will be a natural fit with the TXP asset base.

But most importantly it is a game-changer for Touchstone with regard to gas pricing in Trinidad, box number 8 ticked in my list and one which I discussed at some length with Paul Baay in our interview, the link is below. In the note, and our chat I look at the change that is occurring for natural gas producers, created by the additional potential route of selling to BP or Shell at Point Fortin, the destination here being the higher priced LNG market rather than existing sales to the government at Point Lisas. Originally selling at c.$2.30, the change to the Atlantic LNG facility could increase that number substantially.

During this week I have been talking about Touchstone it seems like most of the time, and at least one subject has of course been about the Trinity deal falling. Today’s deal is of course is a much more exciting and financially valuable transaction, whilst it adds about the same in b/d it comes with it a great infrastructure package.

Whilst I had expected good performance from TXP earlier this year the god news has arrived, later than I first thought but understandably so and no less welcome, this is a great Christmas gift and in Touchstone with such huge potential upside it looks like a great play for 2025.

The Acquisition

The Central block assets include four wells in the Carapal Ridge, Baraka, and Baraka East liquids rich natural gas pools. In addition to existing low decline field production, the Central block asset base has facility optimization potential, infill drilling opportunities and exploration prospects.

STCBL holds three gas marketing contracts: one accessing the Trinidad domestic market, and two contracts accessing the Atlantic LNG facility in Trinidad. The Central block is situated in the Herrera fairway and is contiguous with Touchstone’s Ortoire block, providing strategic potential for natural gas egress and marketing options from future discoveries. Our Coho natural gas production is currently processed at Central block, and the Acquisition provides synergy potential for the field.

The Acquisition is subject to the fulfillment of certain conditions precedent and customary regulatory approvals, including the Company’s ability to receive funding to complete the Acquisition. Hence, no assurances can be given that the Acquisition will ultimately be completed. Due to confidentiality terms in the agreement, Touchstone is not able to provide further information to the market on this Acquisition until the transaction is effectively closed, or terminated, as the case may be.

Core Finance CEO Interview: Paul Baay of Touchstone Exploration

Sintana Energy

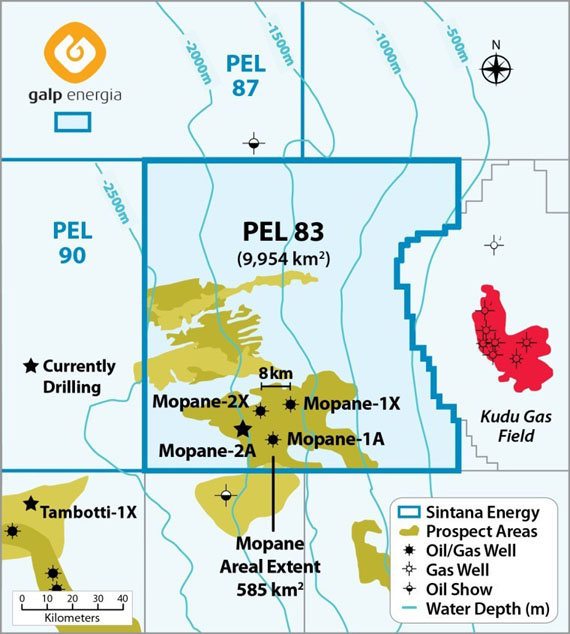

Sintana Energy has provided the following further update regarding the second campaign on blocks 2813A and 2814B located in the heart of Namibia’s Orange Basin. The blocks are governed by Petroleum Exploration License 83 (“PEL 83”) which is operated by a subsidiary of Galp Energia (“Galp”) of Portugal. Sintana maintains an indirect 49% interest in Custos Energy (Pty) Ltd., which owns a 10% working interest in PEL 83. NAMCOR, the National Petroleum Company of Namibia, also maintains a 10% working interest.

With reference to Galp’s updates, Sintana report that further to recent successful appraisal operations conducted at the Mopane 1-A location as announced on December 2nd, Galp and its partners decided to retain the Santorini drillship to continue the ongoing exploration and appraisal campaign during the southern hemisphere summer whilst avoiding mobilisation and de-mobilisation costs.

Specifically, Sintana note that the Mopane-2A (well #4) has been spud in nearby AVO-3, and Mopane-3X (well #5) is expected to be spud in early 2025 in AVOs 10 and 13 (stacked) taking advantage of newly processed 3D seismic. The upcoming activities also include a high-density and high-resolution proprietary 3D development seismic campaign over the Mopane complex set to start in December 2024.

Results of Mopane-1A (well #3) released on December 2nd noted that the well encountered light oil and gas-condensate in high-quality reservoir-bearing sands, once again indicating good porosities, high permeabilities, and high pressures, as well as low oil viscosity characteristics with minimum CO2 and no H2S concentrations. Together with the Mopane-1X (well #1) and Mopane-2X (well #2) findings, this appraisal well confirmed the extension and quality of AVO-1 and supported the acceleration of the program.

“The acceleration of operations in this second campaign is emblematic of the ongoing progress at Mopane. We look forward to the exploration and appraisal activities anticipated over coming months to further unveil its world class scale and quality,” said Robert Bose, Chief Executive Officer of Sintana.

I have recently written about the Mopane-1A well but thought I would just note this announcement by Sintana as it brings together a good amount of information about the Orange Basin. I am planning a bigger piece about the area soon and in that I will be able to put all my own favourites into geographical context.

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy