From a selection of 144 Energy Country Profiles, KeyFacts Energy today feature Mexico in our series of 'at-a-glance' reports, with selected information taken from our 'Energy Country Review' database.

Historically, Mexico discovered oil in the early 20th century, leading to the establishment of the state-owned company Petróleos Mexicanos (Pemex) in 1938 after the nationalization of foreign oil assets. This marked a significant juncture in the nation’s energy narrative. Pemex grew to be one of the largest oil producers globally, becoming synonymous with Mexican nationalism and often perceived as the backbone of the national economy. Over decades, the company became a significant revenue source for the government, funding various social and infrastructural projects.

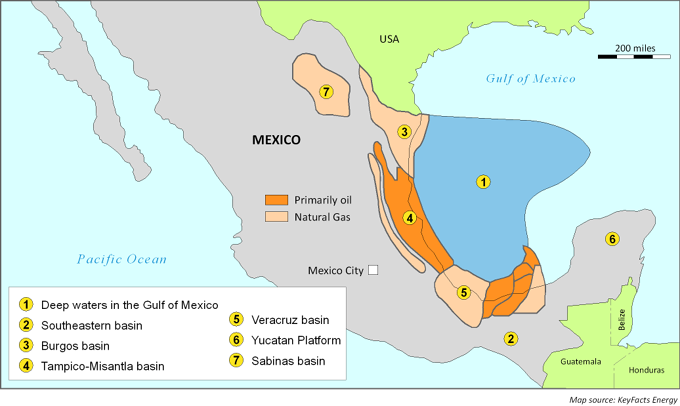

Today, Mexico is one of the world’s largest untapped resources of oil and gas. Recent significant discoveries in the Perdido and Sureste Basins are key indicators that the petroleum potential is definitive and with substantial rewards. In addition to its geological potential, recent changes to regulation and fiscal terms have been designed to bring international interest to Mexico.

Mexico is now one of the largest producers of petroleum and other liquids in the world, the fourth-largest producer in the Americas after the United States, Canada, and Brazil, and an important partner in U.S. energy trade.

Country Key Facts

| Official name | Estados Unidos Mexicanos |

| Capital | Mexico City |

| Population | 131,946,900 (2025) |

| Area | 1,964,375 square kilometers |

| Form of government | Federal Republic |

| Language | Spanish, various Mayan, Nahuatl |

| Religions | Roman Catholic, Protestant |

| Currency | Mexican Peso |

| Calling code | +52 |

Key oil and gas players in Mexico

Cheiron

In October 2017, Cheiron was awarded a 50% share and the operatorship in a production sharing agreement covering the Cardenas Mora fields, with PEMEX holding the remaining interest. The Concession is valid until 2042 with the option of two extension periods of five years each.

The Altamira field is a heavy oil, mature and shallow onshore reservoir in the contractual area of the same name in Northern Mexico. The service contract for the exploration, development and production of hydrocarbons at Altamira was awarded to Cheiron’s Mexican subsidiary in 2012.

Citla

In September 2017, Citla Energy signed three hydrocarbon exploration and production contracts as part of Mexican Round 2.1. The blocks were awarded under production sharing contracts with a duration of up to 40 years (30 years plus two 5 year extensions) and are located in the south east of the Gulf of Mexico, one of the most prolific and under explored shallow water basins in the world.

In April 2018, Citla won its fourth production-sharing contract as part of Round 3.1 of the Mexican Energy Reform. The newly won contract is associated with "Block 15," a geographic area located in the Tampico Misantla basin of the Gulf of Mexico, covering about 962 km².

In March 2023, Eni and Citla announced a new discovery on the Yatzil exploration prospect in Block 7, located in the mid-deep water of the Cuenca Salina in the Sureste Basin. The new finding is estimated to contain around 200 million barrels of oil (MBoe) in place.

CNOOC

CNOOC International has 100% working interest in two deepwater exploration blocks – Block 1 and Block 4 – in the Gulf of Mexico’s Cinurón Plegado Perdido, located in the offshore segment of the Burgos geological province, containing mostly oil.

In 2017, CNOOC International entered a 35-year licensing contract for the exploration and production of the block. The exploration period has been divided into three stages, for a total of ten years. Over the next few years, CNOOC International will complete the commitment of the voluntary workload in accordance with the requirements of the contract and will strive to obtain commercial discovery through drilling activities.

Eni

Eni has been present in Mexico since 2006 and established its wholly owned subsidiary Eni Mexico S. de R. L. de C.V. in 2015. Currently Eni holds rights in eight exploration and production blocks (six as the Operator), all located in the Sureste Basin in the Gulf of Mexico.

Mexico, a core country in Eni's organic growth, is producing more than 30,000 barrels of oil equivalent per day (boed) from Area 1 phased development project

In February 2020, the company announced a new oil discovery on the Saasken Exploration Prospect in Block 10. According to preliminary estimates, the new discovery may contain between 200 and 300 million barrels of oil in place. The discovery is opening a potential commercial outcome of Block 10 since several other prospects located nearby may be clustered in a synergic development.

In March 2023, Eni announced a new discovery on the Yatzil exploration prospect in Block 7, located in the mid-deep water of the Cuenca Salina in the Sureste Basin. The new finding is estimated to contain around 200 million barrels of oil (MBoe) in place.

Fieldwood Energy

Fieldwood Energy E&P México is the operator of the Ichalkil and Pokoch fields, located off the coast of Campeche. Established in 2015, the Company carry out oil and gas exploration and exploitation activities, as a result of the award of contract CNH-R01-L02-A4/2015 by the National Hydrocarbons Commission.

The project for the development and extraction of hydrocarbons in the Ichalkil and Pokoch fields is located in shallow waters, 80 km from Ciudad del Carmen, Campeche, in a northwesterly direction. The contract covers the exploration, development and extraction phases to exploit the hydrocarbon reserves within a period of 25 years, which may be extended for two additional periods of five years each. Contract Area 4 covers 58 km² in the Cuencas del Sureste oil province. The Ichalkil and Pokoch fields contain 2P reserves (proven and probable) estimated at 564.2 million barrels of light oil and 543.1 billion cubic feet of gas, which are located in Cretaceous and Jurassic reservoirs, to be extracted with an average drilling depth of more than 5,500 m and a water depth of 45 m.

In November 5, 2021, Fieldwood Energy, operator of Contract Area 4, and its partner PetroBal, a subsidiary of Grupo BAL, reported commercial production of oil and gas from the Ichalkil and Pokoch fields, located in shallow waters off the coast of Campeche.

Grupo Carso

In June 2024, Grupo Carso completed the acquisition of 100% of the capital stock of PetroBal, an entity that is part of Grupo Bal and owner of PetroBal Upstream Delta 1.

In December 2024, Talos Energy and its Mexican subsidiary, Talos Mexico, sold an additional 30.1% stake in Talos Mexico to Zamajal, which is 90% owned by Grupo Carso and 10% by Control Empresarial de Capitales.

Talos Mexico's assets include a 17.4% interest in the Zama Field.

Harbour Energy

Harbour Energy is one of the leading international upstream companies in Mexico, with interests offshore and onshore and comprising all phases of the E&P value chain with our exploration, development and production assets.

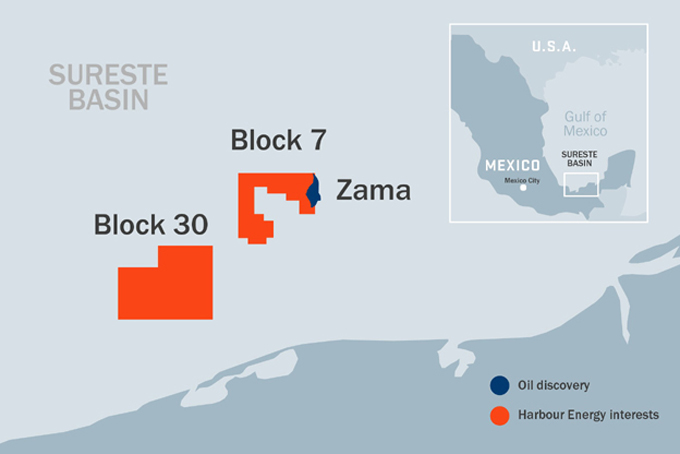

The company has a 25 percent interest in Block 7, in the shallow water Sureste Basin. Block 7 contains the giant Zama field which extends into the neighbouring block which is 100 percent owned by Pemex. The Block 7 partners and Pemex continue to progress Zama towards a targeted late 2021 final investment decision (FID).

Harbour have a 30 percent non-operated interest in Block 30, which is located directly to the south of the Zama field in the Sureste Basin.

The company additionally has a 100 percent interest in Block 11 and Block 13 in the highly prospective Burgos basin inboard of the prolific deep water Peridido fold belt.

International Frontier Resources

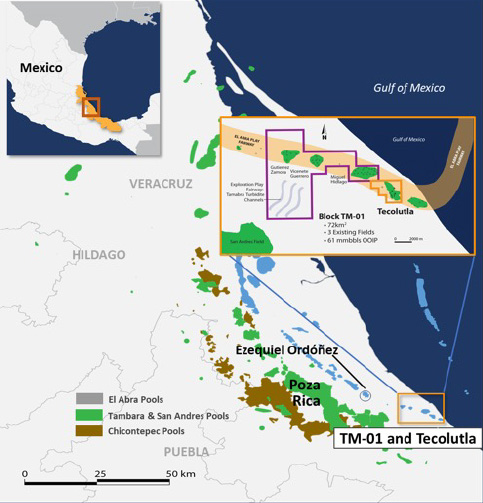

International Frontier Resources ("IFR") was early to identifying the oil and gas opportunities offered by Mexico's historic energy reform. IFR, through its joint venture (JV) Tonalli Energia ("Tonalli"), was awarded Block 24 ("Tecolutla block") by the National Hydrocarbons Commission (CNH) in May 2016, in the onshore Round 1.3 bid process with an incremental royalty rate of 31.22%. Tonalli's royalty was modeled to allow for a competitive rate of return and compares favourably to royalties for other winning bids.

Following this success, IFR became one of the first foreign companies to be awarded an onshore oil and gas development block through a license contract.

Jaguar E&P

In March 2021, Jaguar E&P reported important discoveries of natural gas in the Burgos Basin, in the Dieciocho de Marzo field, and natural gas with light oil in the Spinini prospect, in the Tampico - Misantla Basin.

The blocks containing these fields were awarded to Jaguar in Round 2.2 and 2.3. To date, Jaguar has engaged in exploration activities, including drilling wells at a total cost of over $100 million dollars. Jaguar discovered reserves estimated by management to be between 30 and 50 billion cubic feet (BCF) of natural gas in 18 de Marzo and 160 BCF of gas and between 20 and 30 million barrels of light crude in Spinini (both wells are management estimates of recoverable hydrocarbons on a PMean estimate).

Lewis Energy

In 2004, Lewis Energy Mexico (LEM) signed a Public Works Contract with PEMEX and began a project drilling, completing, and producing wells on an 88,000-acre contract area across the Rio Grande River from Lewis’ South Texas operation, called the “Olmos Block”. LEM has drilled 17 wells in various formations and in 2010 became the first company to drill and complete an Eagle Ford well in Mexico on behalf of PEMEX, resulting in a discovery of two new Eagle Ford fields.

Pan American Energy

PAE participate in the development of areas located in the shallow waters of the Gulf of Mexico through their Mexican subsidiary, Hokchi Energy.

The company operate the Hokchi area and blocks 31 and 2 and were part of the winning consortium for Block 34, in association with Total E&P México and BP Exploration México.

PAE are the first private company to drill in shallow water and to generate income for the Mexican State through a shared production contract. PAE were also the first private operator whose Development Plan was approved by the National Hydrocarbons Commission after the country's Energy Reform.

PEMEX

Mexico nationalized its oil sector in 1938, and Petróleos Mexicanos was created as the sole oil operator in the country. PEMEX is the largest company in Mexico and one of the largest oil companies in the world. The energy sector is regulated by the Secretaría de Energía (SENER), while the Comisión Nacional de Hidrocarburos (CNH) provides additional oversight of PEMEX and its oil and gas activities.

Perenco

In 2018 Perenco acquired 49% of Petrofac Netherlands Holding, which holds Petrofac contracts in Mexico and operates alongside Pemex, the State Company. This partnership has allowed Perenco to invest in the development of the Santuario, Magallanes and Arenque fields.

In November 2020, Petrofac completed the sale of its remaining 51% interest in its upstream IES operations in Mexico, including Santuario, Magallanes and Arenque, to Perenco. Following the sale, Perenco now owns 100% of the operations in Mexico.

Since arriving in Mexico in 2018, initially alongside Petrofac, Perenco has tripled production on the Santuario & El Golpe permit, rising from 5,500 bopd to 17,000 bopd. This significant increase was initially achieved from the existing wells. Using artificial lift technologies, Perenco has converted seven wells to electric submersible pumps (ESP) on the Santuario Main and El Golpe fields, doubling their production since 2018.

Perseus

Perseus is an independent Mexican oil and gas exploration and production company with a focus on two core areas, independent oil and gas production and value added integrated services. With field assets in Mexico, Perseus maintains an efficient Group structure currently employing more than 300 highly experienced professionals.

Perseus participated in the SENER/CNH bidding Round 1.3 and was awarded Licence Contracts for two onshore fields (Tajon & Fortuna Nacional).

PETRONAS

In May 2020, PETRONAS, together with its partners announced successful discoveries with two exploration wells in Block 29 located in the Salina Basin, offshore Mexico. The first exploration well, 'Polok-1', was drilled to a depth of 2,620 meters and encountered approximately 200 meters of net oil pay, followed by the second exploration well, 'Chinwol-1', which was drilled to a depth of 1,850 meters and encountered net oil pay approximately 150 meters.

In March 2024, Petronas, through their our wholly-owned subsidiary PC Carigali Mexico Operations SA de CV (PCCMO), confirmed that it is scaling back its operations in Mexico by exiting eight offshore exploration blocks.

Prior to exiting the eight exploration blocks, Petronas held interest in 10 exploration blocks covering about 22,000 sq km across Mexico’s three main basins. PCCMO was the operator of five of these blocks.

PTTEP

In May 2020, PTTEP and its joint venture partners made two successful deep-water oil discoveries in Block 29, offshore Mexico, with good quality reservoirs. Commercial potential of the new discovery will be assessed in the next phase.

PTTEP’s remaining asset offshore Mexico is Block 12.

QatarEnergy

In February 2018, Qatar Petroleum won the exploration rights for blocks 3, 4, 6, and 7 in the Perdido basin as part of a consortium comprising Shell (operator with a 60% interest) and Qatar Petroleum (with a 40% interest).

Qatar Petroleum also won the exploration rights for block 24 in the Campeche basin as part of a consortium comprising Eni (operator with a 65% interest) and Qatar Petroleum (with a 35% interest).

In December 2018, Eni and Qatar Petroleum signed a sale and purchase agreement to enable Qatar Petroleum to acquire a 35% participating interest in Area 1, offshore Mexico, from Eni. Eni will continue to be the Operator.

In May 2020, Qatar Petroleum entered into three farm-in agreements to acquire about 30 per cent of Total’s participating interest in Blocks 15, 33, and 34, located in the Campeche Basin..

Renaissance Oil

Renaissance was awarded its top three choices in December 2015 in Mexico’s historic first auction of oil and gas properties in 80 years. Mundo Nuevo, Topén and Malva are all in close proximity to each other in the State of Chiapas.

In August 2016, Renaissance acquired the license for the Pontón block from the December 2015 “mature fields” auction to become the fourth license held by the Company.

Repsol

In September 2024, PTTEP divested its entire interest in Mexico Block 29, located in deep waters of the Salina Basin offshore Mexico, to the operator Repsol, which has increased its working interest in the block to 46.67%.

Block 29 project is under exploration phase, and is located off the coast of southern part of Gulf of Mexico, some 88 kilometers from the state of Tabasco.

The Company’s other assets in Mexico include offshore Block 9.

Talos Energy

Talos Energy (operator), together with its joint venture partners Harbour Energy and Sierra Oil & Gas, were awarded Blocks 2 and 7 in Mexico’s Round 1. The Blocks contain numerous leads in established and emerging plays, located in the shallow water Sureste Basin, a proven and prolific hydrocarbon province in the Gulf of Mexico.

Blocks 2 and 7 contain Tertiary clastic plays, typical of the Salinas sub-basin. The forward plan is to acquire, evaluate and reprocess 3D seismic data with a view to firming up drilling locations towards the end of 2016.

The JV comprises Talos Energy (operator, 35 per cent), Wintershall Dea (40 per cent) and Harbour Energy (25 per cent).

In December 2024, Talos Energy and its Mexican subsidiary, Talos Mexico, sold an additional 30.1% stake in Talos Mexico to Zamajal, which is 90% owned by Grupo Carso and 10% by Control Empresarial de Capitales.

TotalEnergies

TotalEnergies operate Block 2 (50%), located in the Perdido Basin in water depths of 2,300 to 3,600 meters and covering a surface area of 2,977 square kilometers and Block 15 (60%), located in shallow water off the coast of the State of Campeche in the country’s southeast.

The company also have interests in Blocks 1 and 3 (33.3%), in the Salina Basin, Blocks 32 and 33 (50%), in shallow water and Block 34 (42.5%), in shallow water.

KeyFacts Energy provide bespoke reports covering key oil and gas players from a selection of 144 countries, allowing users to access valuable 'first-pass' information ahead of more detailed analysis. Contact us for further information.

KEYFACT Energy

KEYFACT Energy