Tower Resources was first admitted to trading on the London Stock Exchange (AIM) on 13 January 2005. The Company was subsequently re-admitted to AIM on 17 June 2006 following its acquisition of Neptune Petroleum Limited whereby Tower Resources acquired its licenced area offshore Namibia.

Since the time of its listing Tower Resources has undertaken a number of acquisitions and farm-in transactions which have transformed the company’s portfolio to deliver an active and balanced Pan-African asset base.

The management team have focused on delivering a new strategy and business development which also saw the Company enter into a long term strategic partnership agreement with P.D.F. Limited in July 2013. P.D.F. Limited are an international oil and gas exploration advisory group, who provide an Outsourced Exploration Department (OExD™) tailored to the expanding exploration and new ventures needs of the Company. This appointment has added a depth and breadth to the Company’s New Ventures efforts enabling a step-change in the resources necessary to short-list the vast array of opportunities that the Company is presented with in the exploration space.

Tower Resources is building an African-based exploration and production group, which intends to have a balanced portfolio ranging from exploration through appraisal to production, primarily through its own origination of opportunities and their organic development.

OVERVIEW OF OPERATIONS

South Africa operations

- Algoa-Gamtoos Block (50% interest)

- Operator: New Age Energy Algoa (Pty) Ltd (50% interest)

- Licence Size: 9,369km²

- 2nd Renewal Period (2 Years)

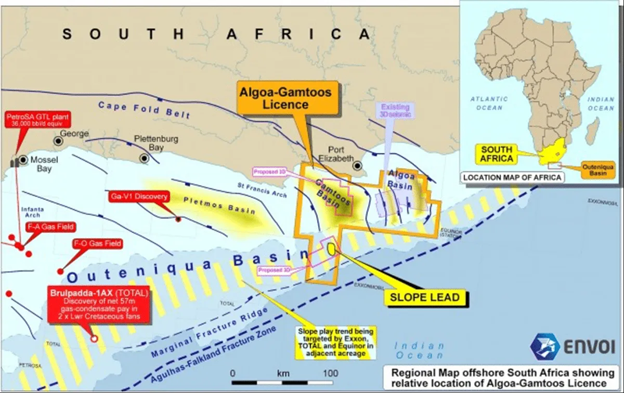

Through its wholly-owned subsidiary, Rift Petroleum Limited, Tower Resources holds a 50% interest in the Algoa-Gamtoos licence, offshore South Africa. Tower acquired its non-operated interest in the Algoa-Gamtoos licence through the all share acquisition of Rift in April 2014.

Overview

The Algoa-Gamtoos licence covers 9,369 km² and is operated by New Age Energy Algoa (Pty) Ltd (“NewAge”) (50%). This acreage straddles the Algoa and Gamtoos basins on the shelf, and the outboard slope edge of the South Outeniqua Basin, where Total has made its Brulpadda and Luiperd discoveries in its Blocks 11B/12B, which are adjacent to Algoa-Gamtoos to the West.

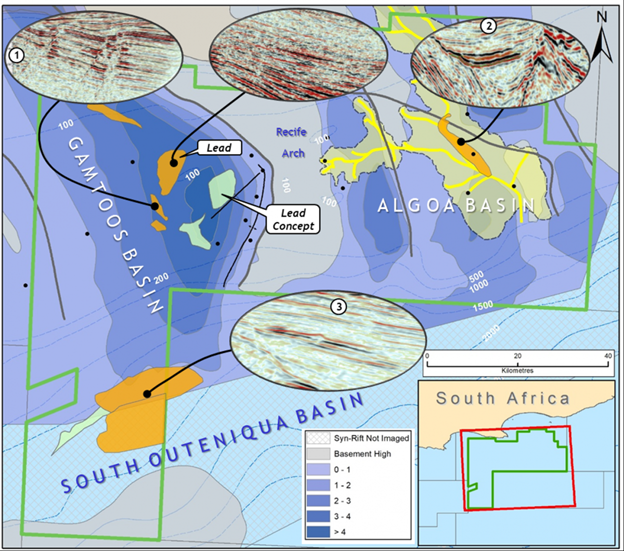

Basin modelling confirms three new stratigraphic and part structural-stratigraphic plays being targeted following the Operator’s recent work, incorporating further 2D data acquisition (including tie lines back to Brulpadda) and reprocessing in addition to the existing 3D data over the Algoa basin area, comprising:

- Syn-Rift Play in the Gamtoos Basin (in the west of the acreage)

- Post Rift Canyon Play in the Algoa Basin (to the east of the acreage)

- Post Rift S. Outeniqua Basin Slope Margin Play (in the south-west of the acreage in deeper water

The three stacked deep-water leads in the Outeniqua basin are estimated by the Operator to be capable of containing mean unrisked Oil in Place of 3.7 Billion bbls (STOIPP) with a mean unrisked prospective recoverable resource potential of 1.4 Billion bbls; while the five primary shallower-water Algoa-Gamtoos leads add a further mean unrisked potential Oil in Place of 1.5 Billion bbls (STOIPP) with a mean unrisked prospective recoverable resource potential in excess of 0.5 Billion bbls.

Location and seismic characterization of new leads post seismic reprocessing

Further 3D seismic-led exploration is now planned, to map more accurately the most promising defined leads and make them ready for drilling.

A farm-out process has commenced to seek a partner for a material share of the licence working interest in return for funding the 3D seismic survey planned for the most prospective parts of the licence, and this process is being managed by ENVOI Limited.

Regional setting and Petroleum Geology

The Algoa and Gamtoos Basins are positioned at the eastern end of a series of en-echelon petroleum basins on the southern margin of South Africa, which developed during the Jurassic break-up that separated southern Africa from the Falklands Plateau of South America. The regions’ subsequent split and prospective syn-rift phase and two subsequent phases of the post-rift (‘Drift’) phases of tectono-stratigraphic evolution were responsible for producing the main hydrocarbon plays now being targeted. These phases of evolution and their petroleum systems can be summarised as follows:

Syn-rift Phase (Middle Jurassic – Middle Lower Cretaceous): Over 1,000 metres of organically rich shales are mapped in the syn-rift sequence of the Valanginian to Hauterivian interval. Burial history and temperature profile predict that peak oil generation and expulsion of hydrocarbons was most likely early Cretaceous and indicate these shales are still in the oil generation window to the present day.

Post-rift (‘Drift’) Phase (Middle Lower Cretaceous – Present): The Lower Cretaceous (Barremian) turbidite channel and fan sands are now primary targets in the area, which locally dominated the early ‘Drift’ deposition within what was an active transform phase of post-rift basin evolution. Analogous Barremian play deposits transported from the northwest are already proven in the producing fields in the southern part of the Bredasdorp Sub-Basin.

These targets are contained and sealed within some 2,000 metres of Cretaceous sediments deposited during a period of relatively high subsidence and sedimentation rates that filled the Algoa and Gamtoos sub-basin areas. This period of basin development is characterised by mostly marine shelf deposition and erosion. Region-wide Aptian organic-rich shales of both marine and terrigenous origin, largely kerogen Type II with a Type I component, have been documented in the Outeniqua and particularly in the Bredasdorp Basin, where they have been found to be over 200 metres thick.

Prospectivity

The mapping and interpretation to date has been reliant on the existing 2D data, which covers the Gamtoos Basin and South Outeniqua Basin slope, and the existing 3D, which covers the northern part of the Algoa Basin area.

Algoa and Gamtoos basins

Although a number of play concepts have been tested by the historic wells, only one was drilled in the Algoa or Gamtoos basins within the last 25 years and none were located using 3D seismic. These wells have nevertheless been instrumental in the new work and a revised understanding of both the basin geology and also the untested play potential now being defined within the grabens. As a result, five undrilled leads have been identified, mostly on the existing 2D data, targeting the new play potential in the Algoa and Gamtoos basins, and these have been much better defined by the further 2D data acquisition and reprocessing during the First Renewal Period. To date, none of the ‘bright’ amplitude events mapped in either basin have been tested by the wells drilled in the past.

Outeniqua basin

On 7 February 2019 Total reported a significant gas condensate discovery in Block 11B/12B, located in the Outeniqua basin, offshore South Africa. The well was drilled to a total depth of 3,633 metres and encountered 57 metres of net pay in Lower Cretaceous reservoirs, and with this discovery opens a new world class gas and oil play. Total have stated that they believe the new discovery could hold over one billion barrels of oil equivalent.

On 28 October 2020 Total reported a second major discovery in the Outeniqua basin with the Luiperd-1X well, which encountered 73 meters of good quality net pay in 85 meters of gross sands in well-developed Lower Cretaceous reservoirs.The well was reported by Total’s partners to have reached a maximum constrained flow-rate of 33 million cubic feet per day of natural gas (‘MMcfpd’) and 4,320 barrels of condensate per day (‘bcpd’), an aggregate of approximately 9,820 barrels of oil equivalent per day (‘boepd’). Current indications are that the Luiperd discovery is larger than the 1 billion boe Brulpadda discovery announced in 2019.

Block 11B/12B is located adjacent to the Algoa-Gamtoos licence and the Algoa-Gamtoos block also contains the southern deepwater basin margin of the Outeniqua Basin that was targeted by Total’s Brulpadda and Luiperd wells and is approximately 150 kms along strike to the east from the those discoveries.

In the deep-water Outeniqua Basin section of the Algoa-Gamtoos license, the Operator has identified three separate prospective reservoir targets along the deep-water slope:

- A shallower section to which the Operator ascribes 470 million boe Pmean recoverable resources (unrisked);

- A deeper slope section to which the Operator ascribes 231 million boe Pmean recoverable resources (unrisked);

- A basin floor fan section to which the Operator ascribes 710 million boe Pmean recoverable resources (unrisked).

Namibia operations

- Entry: November 2018

- PEL 96 Blocks: 1910A, 1911 & 1912B (80% operated interest)

- Operator: Tower Resources (Namibia) Limited

- Total Block Area: 23,297 km²

- Initial Exploration Period: to 31 October 2024 (pending entry into the First Renewal Period of 2 to 3 years)

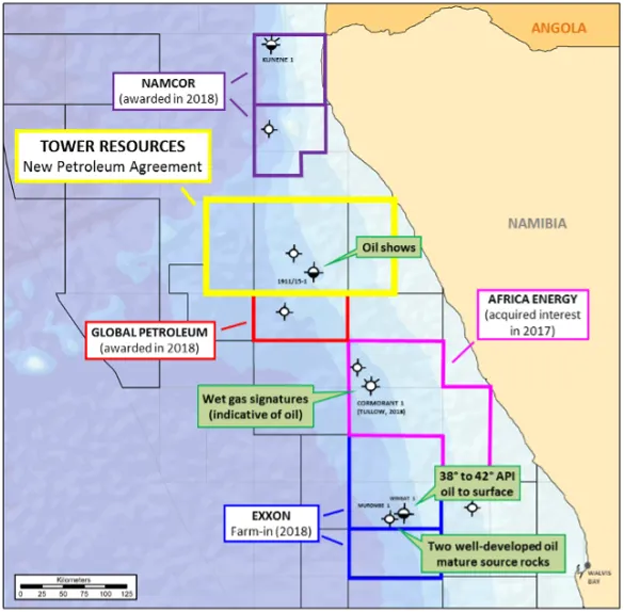

Tower's Namibian Blocks, covering a gross area of 23,297 km², are in the Northern area of Namibia's offshore, in the Walvis basin which is close to the border with Angola and the Namibe basin.

Tower Resources (Namibia) Limited, a wholly owned-subsidiary of Tower Resources plc, signed a Petroleum Agreement covering an 80% operated interest in Blocks 1910A, 1911 and 1912B (PEL 96) in November 2018 with an Initial Exploration Period of four years.

The Initial Exploration Period was subsequently extended to 31 October 2024 by agreement with the Namibian Ministry of Mines and Energy (“MME”) who also invited Tower to apply for entry into the First Renewal Period for a period of 2 to 3 years as announced by the Company on 2 August 2024.

The blocks cover 23,297 km² of the northern Walvis Basin and Dolphin Graben (offshore Namibia), an under-explored region in which recent drilling results have proven the presence of a working oil-prone petroleum system, along with good quality turbidite and carbonate reservoirs. Recent licensing activity in the area has included the farm-in of Chevron to the PEL 82 license to the south.

Albian carbonate and Palaeocene / Upper Cretaceous turbidite reservoirs (proven in offset wells, e.g. 1911/15-1) have been previously identified in structural traps across the blocks. These include giant (>1000 sqkm) 4-way dip closured structures (in the west) and structures within the Dolphin Graben (an area which well results indicate is likely to contain mature source rocks). More recent work has resulted in the identification of a number of potential stratigraphic traps, associated with Cretaceous and Palaeogene basin floor turbidite and channel systems.

Regional Setting & Petroleum Geology

The Walvis Basin and Dolphin Graben are under-explored, with only nine exploration wells drilled to date in >90,000sqkm of basin. Of these wells, five were drilled in the mid-1990s in the Central (Dolphin Graben) and Eastern (continental slope) parts of the basin. Although historic drilling has failed to discover commercial quantities of hydrocarbons to date, wells have proved the presence of an oil-prone petroleum system, along with good quality turbidite and carbonate reservoirs.

Two offset wells (1911/15-1 and 1911/10-1) located within the block were drilled by Norsk Hydro in the mid-1990s. These wells encountered thick Palaeocene, Maastrichtian and Campanian turbidite sands.The 1911/15-1 well recovered oil from Albian carbonates and Palaeocene sandstones. Well failure is likely due to breaching of traps due to Tertiary-aged structural reconfiguration. .

More recently, three wells (targeting Cretaceous turbidite plays) have been drilled in the Walvis Basin, all of which strongly indicated the presence of an oil-prone petroleum system. The Wingat-1 and Murombe-1 (drilled by HRT in 2013) encountered two “well-developed source rocks, which are rich in organic carbon and are both within the oil-generating window”. 38º- 42º API oil was recovered to surface in Wingat-1. The Cormorant-1 well (drilled by Tullow in 2018) reportedly encountered turbidite sandstones reservoirs and wet gas signatures (‘indicative of oil’).

In addition to the Cretaceous turbidite plays being explored for by Tullow and others to the south, the 1911/15-1 well (located in the blocks) demonstrates the presence of good quality Albian carbonates (35m net thickness, 15-20% porosity). Biomarkers from migrated oils recovered from the carbonates indicate the presence of a lacustrine source system in the Dolphin Graben area, which may be analogous to the prolific Lower Cretaceous source systems offshore Brazil and offshore Angola.

The well results, in addition to numerous surface oil seeps identified from satellite data over PEL 96 together with drop core data collected in the northern part of the Walvis Basin, provide clear evidence that potentially significant oil volumes have been generated and migrated in the basin.

Prospectivity

Tower has identified multiple prospects and leads on the existing 2D seismic dataset, the majority of which comprise of multiple stacked reservoir targets, which could be penetrated with a single well.

Stratigraphic Plays

Recent extensive re-interpretation of legacy seismic data has resulted in the identification of a number of basin floor fan leads. Several leads are of possible Albian and Campanian age and display an amplitude response. Stratigraphic pinch-outs of these leads can be defined both landward and also in a seaward direction against the outer high. Further work on stratigraphic leadswill be conducted during the remainder of the Initial work programme that will include extensive seismic reprocessing that will allow AVO analysis.

Outer High Structural Closures

Two giant four-way dip closed structural traps, with billion-barrel potential, have been identified and mapped on 2D seismic data. The anticlinal structures are situated on a regional structural high on the landward crest of the Walvis Ridge, surrounded by potential source kitchens in which mature oil sources have been proven by offset wells. The largest of the structures (the Gamma Prospect), has more than 1100km² of 4-way dip closure, with stacked reservoir targets including Palaeogene turbidites, Albian carbonates, as well as upside potential in deeper undrilled syn-rift Barremian clastics.

Dolphin Graben Structural Closures

Significant potential has also been identified within multiple structural closures (50 km² to 125 km²) identified and mapped across the Dolphin Graben, all of which are located directly adjacent to source kitchens. More than eight 3-way fault dependent and 4-way dip closed structural traps have been identified so far, all of which have multiple stacked targets, which include Palaeogene and Cretaceous turbidites as well as Albian carbonates and deeper syn-rift clastics.

PEL 96 First Renewal

In August 2024, Tower was notified by the Namibian MME of its agreement to the extension of the Initial Exploration Period of PEL 96 to October 31, 2024 and has invited the Company to apply to enter the First Renewal Period of PEL 96, for a period of 2-3 further years. The MME has also agreed to defer the Company's commitment to acquire 1,000 km² of new 3D seismic data to the First Renewal Period.

Farm-in

In January 2025, Tower Resources executed two farm-out agreements and associated documentation with Prime Global Energies for minority, non-operated interests in its Thali license, offshore Cameroon, and PEL96 offshore Namibia.

Via Tower Resources (Namibia), Prime has agreed to farm-in to PEL96, offshore Namibia, for a 25% non-operated interest.

Prime is a UK-incorporated company with more than three decades of upstream operational experience.

Cameroon operations

- Entry: September 2015

- Location: Rio del Rey Basin, Cameroon

- Operator: Tower Resources Cameroon S.A

- First Exploration Period: (Initial 3 year period extended to 4 February 2025)

- Two further Exploration Periods available

Tower Resources Cameroon S.A, a wholly-owned subsidiary of Tower Resources plc, holds a 100% interest in the shallow-water Thali Production Sharing Contract (PSC) in the Rio del Rey basin, offshore Cameroon.

Tower was awarded the PSC on 15 September 2015, and has applied to the Minister of Mines, Industry and Technological Development (“MINMIDT”) for a further one year extension to the First Exploration Period beyond 11 May 2023. The extension enables the Company to finalise the schedule for the drilling and testing of the NJOM-3 well which is expected to occur in the second half of 2023.

Prospectivity

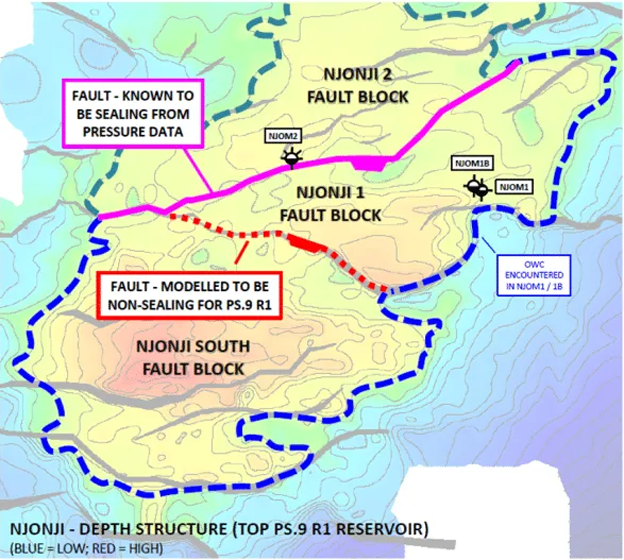

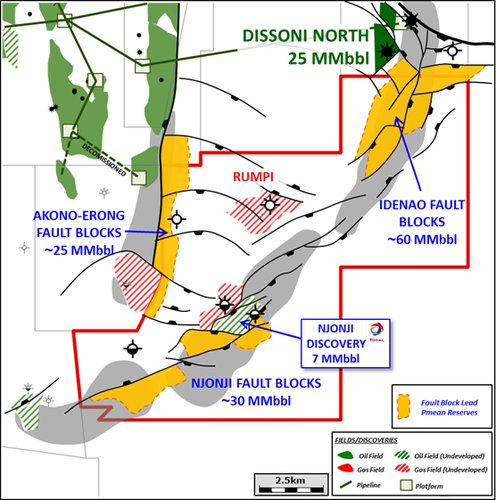

The Thali PSC covers an area of 119.2 km², with water depths ranging from eight to 48 metres, and lies in the prolific Rio del Rey basin, in the eastern part of the Niger Delta. The Rio del Rey basin has, to date, produced over one billion barrels of oil and has estimated remaining reserves of 1.2 billion barrel of oil equivalent (boe), primarily within depths of less than 2,000 metres. The Rio del Rey is a sub-basin of the Niger Delta, an area in which over 34.5 billion barrels of oil have been discovered, with 2.5 billion boe attributed to the Cameroonian section. The Thali Block has the potential to hold at least four distinct play systems, including two established plays in which three discovery wells (Rumpi-1, Njonji-1 and Njonji-2) have already been drilled on the Block.

Tower’s most recent review of the Thali block prospectivity (announced on 27 April 2023) has applied an upgraded attribute analysis of the reprocessed 3D seismic data which Tower obtained in 2018, using the AI-driven Paradise® workbench software from Geophysical Insights to identify the following aspects:

This study was completed with a particular focus on the location of the oil and gas elements of the reservoirs in the Njonji-1 and Njonji-2 fault blocks which were connected to the original NJOM-1 and NJOM-2 wells drilled by Total.

The Paradise AI workbench analysis yielded higher resolution of the PS9 (Sup) and PS3 pay zones in the Njonji-1 fault block which has both confirmed the additional volumes identified in Tower’s previous estimates and also substantially de-risked them. The analysis also provides better resolution of the PS9-R1 reservoir in the Njonji-2 fault block, including identifying an additional potential oil leg below the gas encountered in the NJOM-2 well.

The analysis has also de-risked the prospective resources associated with the proposed NJOM-3 well allowing for the optimisation of its drilling location.

Leadership

Jeremy Asher, Chairman and Chief Executive Officer

Dr Mark Enfield, Executive Director

Paula Brancato, Independent Non-Executive Director

Stacey Kivel, Independent Non-Executive Director

Contact

Tower Resources plc

134 Buckingham Palace Road

Westminster

London SW1W 9SA

Tel: +44 20 7157 9625

KeyFacts Energy: Company Profile

KEYFACT Energy

KEYFACT Energy