Buru executes Strategic Development Agreement with Clean Energy Fuels Australia for the Rafael Gas Project

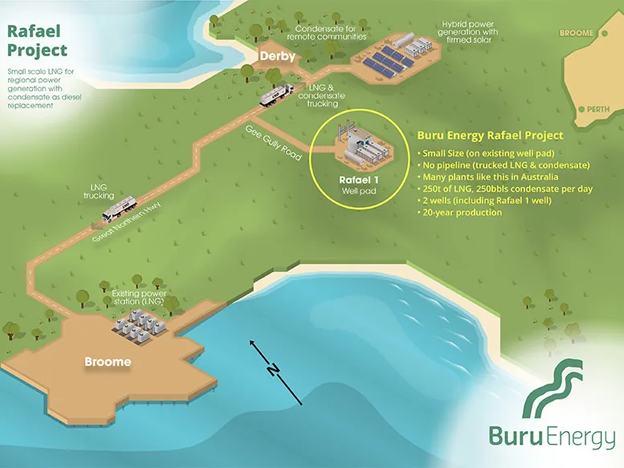

Buru Energy Limited (Buru, Company) (ASX:BRU) is pleased to provide the following update regarding the progress of its 100% owned Rafael Gas Project located in the Canning Basin, approximately 150 km east of Broome and approximately 85 km south of Derby in the Shire of Derby-West Kimberley, Western Australia.

The Rafael Gas Project (Project) is targeting the replacement of long-haul trucked or imported fuel used for power generation and mining in the northwest of Western Australia with a local source of trucked Liquified Natural Gas (LNG) and liquids, supporting the development of new market opportunities in the region, and delivering projected long term cashflows from 2H 2027.

Highlights

- Buru has executed a Strategic Development Agreement (SDA) with Clean Energy Fuels Australia Pty Ltd (CEFA) to co-develop the Rafael Gas Project.

- The SDA provides a clear pathway to building a valuable long-term gas and condensate business in the northwest of Western Australia, combining Buru’s upstream resource and expertise with CEFA’s strong downstream and midstream capabilities, strong financial backing and incumbency in the Western Australian domestic LNG market.

- CEFA, an Octa Group portfolio company has a track record of developing and operating small scale LNG infrastructure assets in Australia. Octa Group is owned by I Squared Capital (ISQ), a top 5 global infrastructure fund with US$40 billion in assets under management.

- Buru and CEFA have agreed a business model as the basis for future binding agreements, expected to be executed in late 2025. CEFA will fully finance, build, own and operate an LNG plant with a capacity of up to 300 tonnes per day and associated condensate infrastructure on the Rafael 1 wellsite.

- CEFA/Octa Group will be responsible for the midstream elements of the Project involving the distribution of LNG and condensate to end users.

- Buru and CEFA will work together to conduct sales and marketing with customers.

- CEFA’s investment in the Rafael Gas Project will be recovered through gas processing fees charged to Buru over an estimated 20-year production life, the terms of which will be negotiated over the coming months.

- Buru is responsible for the financing, construction and operation of the upstream elements of the Project, which currently consist of two wells (including the Rafael 1 discovery well), Native Title negotiations and Western Australian State Government environmental approvals for the small footprint Project.

- Buru is pursuing several options to fund its 2025 Rafael 1 well recompletion and testing program to support independent certification of the Rafael reserves, and the drilling of a development well in 2026. Reserves certification is a key condition precedent to binding agreements with CEFA.

- Final Investment Decision for the Project is planned for late 2025 / early 2026, with robust cashflows targeted to commence from 2H 2027.

Buru CEO, Mr Thomas Nador said:

“The agreement with CEFA is a watershed moment for Buru and the Rafael Gas Project. It marks a clear demonstration of the Company’s gas strategy and transition from explorer to developer and long-term producer. Rafael is the only confirmed source of conventional gas and liquids in onshore Western Australia north of the North West Shelf Project. It is a unique opportunity to provide energy to a growing market that is not connected to a gas pipeline and currently faces challenges with high energy costs and security of supply.

Combining forces with the I Squared backed CEFA/Octa Group is a material development on the path to commercialising the Rafael resource. I look forward to our collective effort to deliver the economically attractive Rafael Gas Project.”

CEFA/Octa Group CEO and Director, Mr Basil Lenzo said:

“We are very pleased to be working with Buru on the Rafael Gas Project as part of our Energy Transition Platform. Our proven virtual pipeline or ‘trucked LNG’ model lowers long-term regional energy costs and emissions and provides a viable alternative to diesel for new and existing energy users."

Agreement Rationale

Executing the Strategic Development Agreement (SDA) with Clean Energy Fuels Australia Pty Ltd (CEFA) is a significant development for the Rafael Gas Project. The terms of the SDA outline the respective and joint roles and responsibilities of Buru and CEFA in working toward the execution of binding agreements in late 2025.

Buru and CEFA will develop gas pricing arrangements to enable competitive LNG sales to customers, provide robust economic returns for each party and include a mechanism to share upside value that may be captured. The parties will also collaborate on condensate production, transport and sales.

Under the binding agreements, CEFA will finance, build, own and operate a small-scale LNG plant with a capacity of up to 300 tonnes per day and condensate facilities situated on the existing cleared Rafael 1 well pad. A processing tariff to be paid by Buru to CEFA will be negotiated.

This structure will materially derisk the downstream/midstream capital components of the Rafael Gas Project for Buru. It means Buru’s upfront costs are limited to the upstream components of the Project which currently consist of 2 wells (including the Rafael 1 discovery well) and the gas and condensate upstream processing facilities.

This LNG processing tariff model will enable predictable, regular long-term cash flows for both Buru and CEFA, which can be beneficial for financing and operational planning. It also provides greater flexibility in managing operational costs and adjusting to market conditions, as fees can be structured to reflect changes in demand or operating expenses.

A processing tariff model will incentivise efficient processing operations, encouraging CEFA as downstream operator to optimise plant performance to minimise costs and maximise throughput.

KeyFacts Energy: Buru Energy Australia country profile

If you would like to discover more about KeyFacts Energy, contact us today and we can arrange a 15-minute online meeting to review our database of over 2,600 continually updated 'country-specific' oil and gas and renewable energy profiles from a selection of 144 countries. Find out how you can instantly identify companies with operational activity in your chosen country, 'fine-tune' your news or company selection based on industry category, energy type or regional location and additionally benefit from one to one contact with us to ensure maximum online and social media exposure for your company.

KEYFACT Energy

KEYFACT Energy