Since 2015, the exploration industry has roughly halved the number of high impact exploration wells being drilled and is finding less than half of the volumes.

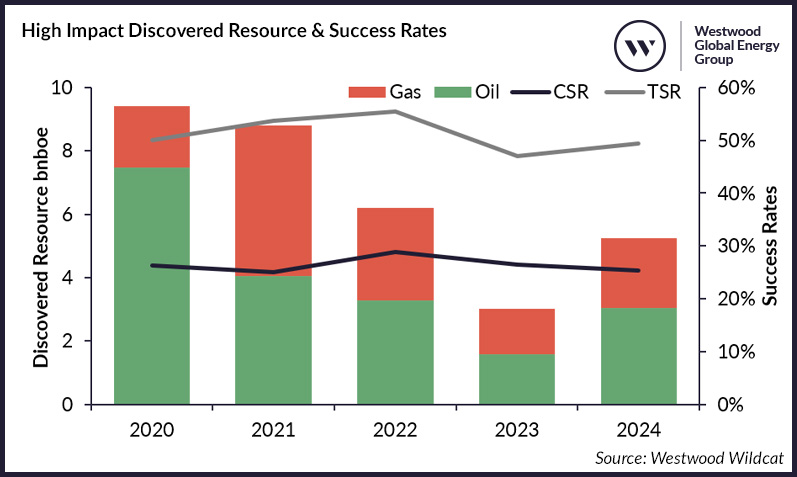

Success rates have improved as the well count has fallen, but the discovered volume from high impact exploration wells drilled in the 2020-2024 period fell by 62% compared to 2010-2014. The contribution to replacement of global hydrocarbon production from conventional high impact exploration fell from 33% to only 11% as production continued to grow. Exploration has become more efficient but the decline in discovered resource reflects a diminishing global opportunity set which is not being renewed with sufficient large scale drilling opportunities.

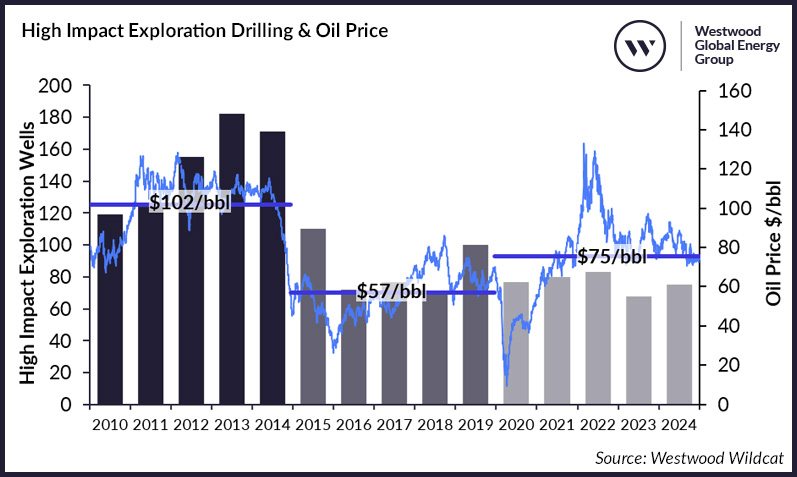

Figure 1: High Impact Exploration Drilling & Oil Price. Source: Westwood Wildcat

High impact exploration drilling has been remarkably stable in the last five years, averaging 77 wells per year and varying by less than 15% each year from 2020-2024 despite volatility in commodity prices with companies exercising capital discipline in the face of uncertainty in the long scale demand outlook. 75 high impact exploration wells completed in 2024, delivering 19 potentially commercial discoveries totalling 5.2bnboe at a 25% commercial success rate. Key discoveries in 2024 were made in Kuwait, Russia, Cote d’Ivoire and Namibia.

Figure 2: High Impact Discovered Resource & Success Rates. Source: Westwood Wildcat

The company landscape has been transformed since 2015 with half the number of companies drilling high impact wells. National Oil Companies dominated exploration in 2024, accounting for 51% of high impact well equity and 67% of the discovered resource in the year. The supermajors, however, had a difficult year, only delivering a 5% net commercial success rate with only one clear commercial success out of the 29 high impact wells that the five companies participated in.

High impact exploration drilling has moved into ever deeper water, with 9% of wells drilled in >2500m water depth in 2020-24 compared to 6% in 2010-14. Results have been disappointing, however, with commercial success rates in ultra-deepwater >2500m falling from ~20% in 2010-14 to only 3% in 2020-24, with only a single success from 35 wells drilled in the period. A rethink may be needed to address possible systemic flaws in the play concepts that were tested.

The industry delivered a 27% commercial success rate in 2020-2024, significantly higher than the 21% achieved in the 2010-2014 period despite exploration drilling declining by 49%. This suggests that the increase in efficiency is due to an element of ‘quality through choice’ with only the best prospects being selected for drilling. The average discovery size, however, fell from 545mmboe to 320mmboe with fewer >1bnboe scale discoveries.

High impact exploration drilling will remain stable in 2025 with ~75 wells expected to complete. The exploration industry has settled at roughly half the size it was a decade ago and it has become more efficient whilst also more reliant on National Oil Companies and the bigger IOCs for investment. To turn around the decline in the volumes being discovered, success is needed in new basins and plays that will require creative thinking, use of new technologies and a continued appetite for risk.

Jamie Collard, Exploration Research Manager

jcollard@westwoodenergy.com

The State of Exploration 2025 report is available now for subscribers to Westwood’s Wildcat product. Non-subscribers can purchase the full report here.

KEYFACT Energy

KEYFACT Energy