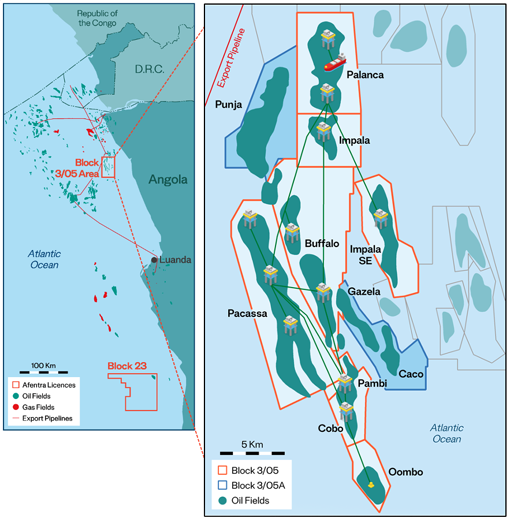

Afentra, the upstream oil and gas company focused on acquiring mature production and development assets in Africa, announces that its wholly-owned subsidiary, Afentra (Angola) Ltd, has agreed to jointly acquire, alongside Etablissements Maurel & Prom S.A. ("M&P"), Etu Energias S.A. ("Etu") 10% interest in Blocks 3/05 and 13.33% interest in Block 3/05A, offshore Angola (the "Etu Acquisition"). Afentra (Angola) Ltd has signed a Sale and Purchase Agreement ("SPA") with Etu for its 50% share of the acquisition which is subject to customary conditions including government approval.

Transaction Highlights

- Acquisition of additional interests; 5% net in Block 3/05 and 6.67% net in Block 3/05A, offshore Angola.

- Net Initial consideration of US$23 million[1].

- Contingent consideration of up to $11 million1 across both blocks, linked to a combination of oil price thresholds, production performance, and the successful development of key discoveries.

- Effective date of the transaction is 31 December 2023.

- The acquisition will be funded entirely from existing cash resources.

Strategic Rationale

- This transaction represents a further value focused step in Afentra's strategy to build a high-quality portfolio of cash-generative production and development assets, offering:

- Additional exposure to our high-margin, long-life producing and development assets in Blocks 3/05 and 3/05A.

- Further consolidation of the Joint Venture partnership that is successfully re-developing the very material upside of this multi-billion barrel offshore asset.

- Continued focus on value creation using disciplined transaction structures, combining modest upfront consideration with success-based contingent payments aligned to oil price and asset performance.

Paul McDade, Chief Executive Officer of Afentra plc, commented:

"We are pleased to have signed this SPA with Etu Energias, providing Afentra with additional interest on similar terms to our previous transactions in Blocks 3/05 and 3/05A. This transaction enhances the alignment within the joint venture and reinforces our exposure to these high-quality production and development assets that continue to perform strongly as the partners demonstrate the ability to realise the upside of these world-class assets. The structure of the transaction reflects our disciplined approach to capital deployment, combining a modest upfront payment with a value-linked contingent consideration. We look forward to continuing to work closely with Sonangol and M&P to deliver the material upside in these assets providing long-term value for all stakeholders."

Transaction Overview

Afentra has signed a Sale and Purchase Agreement to acquire fifty percent of Etu Energias S.A.'s working interests in offshore Blocks 3/05 and 3/05A (the "Etu Interests"). The Etu interests acquired consist of a 5.0% non-operated working interest in Block 3/05 and a 6.67% non-operated working interest in Block 3/05A. The effective date of the transaction is 31 December 2023. In 2024 profit before tax on the Etu interest was US$14 million[2].

The total headline cash consideration payable by Afentra at completion is US$23 million. This includes US$22 million for the Block 3/05 interest and US$1 million for the Block 3/05A interest. The consideration is on a cash-free, debt-free basis and is subject to customary adjustments for working capital and crude inventory balances between the effective date and completion. Based on current estimates, these adjustments are expected to result in a material reduction to the final cash consideration payable at completion.

Afentra may pay up to US$6 million in contingent consideration for Block 3/05. This applies only to the years 2025 and 2026 with the annual contingent payment capped at US$ 3 million. Payments are based on a sliding scale of average annual Brent oil price between US$75 per barrel and US$123 per barrel, and only if average gross production exceeds 15,000 barrels of oil per day for the relevant year. A further US$5 million in contingent payments may be made in connection with the Caco-Gazela and Punja discoveries. Two payments of US$2.5 million each are payable one year after first oil from each development, subject to a minimum Brent price of US$75 per barrel and gross production averaging at least 5,000 barrels of oil per day during the twelve months following first oil. First oil must occur by 31 December 2029 for the contingent payments to become due.

Following completion of the Etu Acquisition, the joint venture partners across both Blocks 3/05 and 3/05A will be comprised as follows:

Post Completion interest

| Block 3/05 | Block 3/05A | |

| Sonangol (Operator) | 36% | 33.33% |

| Afentra | 35% | 28.00% |

| M&P | 25% | 33.33% |

| NIS Naftagas | 4% | 5.33% |

Completion of the Etu Acquisition remains subject to customary conditions precedent, including government approvals in Angola and finalisation of definitive documentation.

[1] The upfront and contingent considerations represents 50% of the total considerations agreed by Afentra and M&P to acquire 100% of ETU's interests in Block 3/05 and 5A.

[2] Based on management estimate derived from joint venture accounts.

KeyFacts Energy: Afentra Angola country profile l KeyFacts Energy: Acquisitions & Mergers news

KEYFACT Energy

KEYFACT Energy