WTI (July) $75.14 +30c, Brent (Aug) $76.70 +25c, Diff -$1.56 -5c

USNG (July) $3.99 +14c, UKNG (July) 92.98p +60.15p, TTF (July) €39.95 +€60.15

Note, most US markets are closed today for Juneteenth Day celebrations

Oil price

Oil has rallied again today, partly ahead of the, almost expected, US attacks on Iran but as ever it could be a short, sharp Lord Mayors Show and we know what comes after that….

But the inventory stats are worth a glance, Macquarie’s call of a draw of 6.2m barrels turned out to be way short as the EIA reported minus 11.473m b’s. whilst the inventory stats are being rather ignored at the moment they won’t always be and world stocks are at a six month low.

Angus Energy

Angus Energy announces that Richard Herbert has tendered his resignation as CEO and a director of the Company with immediate effect.

The Board is in active discussions with Jonathan Tidswell-Pretorius in respect of assuming an interim non-Board COO role.

Krzysztof Zielicki, interim Chairman commented:

“The Board would like to thank Richard for his dedication and hard work in taking the Company through what has been a transformative time in its development. He was responsible for the refinancing of the Company and has set Angus on the course for future growth. We wish him all the best in his future endeavours”

The Company will make further updates as required.

Nothing one can add to this briefest of all statements but I for one had no idea that at this crucial time for Angus, Richard Herbert was planning to step down. Operationally with all the recent compressor work at Saltfleetby the field has notched up improved uptime and will get better.

I know nothing about the potential production deal in the Gulf of Mexico, nor how it may be it was the possible deal that affects this decision, but with the hedges coming off and this deal strengthening the finances I remain very positive about Angus.

Afentra

Afentra has announced that its wholly-owned subsidiary, Afentra (Angola) Ltd, has agreed to jointly acquire, alongside Etablissements Maurel & Prom S.A. (“M&P”), Etu Energias S.A. (“Etu”) 10% interest in Blocks 3/05 and 13.33% interest in Block 3/05A, offshore Angola (the “Etu Acquisition”). Afentra (Angola) Ltd has signed a Sale and Purchase Agreement (“SPA”) with Etu for its 50% share of the acquisition which is subject to customary conditions including government approval.

Transaction Highlights

- Acquisition of additional interests; 5% net in Block 3/05 and 6.67% net in Block 3/05A, offshore Angola.

- Net Initial consideration of US$23 million[1].

- Contingent consideration of up to $11 million1 across both blocks, linked to a combination of oil price thresholds, production performance, and the successful development of key discoveries.

- Effective date of the transaction is 31 December 2023.

- The acquisition will be funded entirely from existing cash resources.

A short presentation has been uploaded to the Afentra website: https://wp-afentra-2025.s3.eu-west-2.amazonaws.com/media/2025/06/2025-Etu-SPA-presentation.pdf.

Strategic Rationale

This transaction represents a further value focused step in Afentra’s strategy to build a high-quality portfolio of cash-generative production and development assets, offering:

- Additional exposure to our high-margin, long-life producing and development assets in Blocks 3/05 and 3/05A.

- Further consolidation of the Joint Venture partnership that is successfully re-developing the very material upside of this multi-billion barrel offshore asset.

- Continued focus on value creation using disciplined transaction structures, combining modest upfront consideration with success-based contingent payments aligned to oil price and asset performance.

Paul McDade, Chief Executive Officer of Afentra plc, commented:

“We are pleased to have signed this SPA with Etu Energias, providing Afentra with additional interest on similar terms to our previous transactions in Blocks 3/05 and 3/05A. This transaction enhances the alignment within the joint venture and reinforces our exposure to these high-quality production and development assets that continue to perform strongly as the partners demonstrate the ability to realise the upside of these world-class assets. The structure of the transaction reflects our disciplined approach to capital deployment, combining a modest upfront payment with a value-linked contingent consideration. We look forward to continuing to work closely with Sonangol and M&P to deliver the material upside in these assets providing long-term value for all stakeholders.”

It was always going to be only a matter of time before Afentra managed to buy some more of the offshore Angola play as I suggested to Paul McDade when we last chatted. Today they announce the purchase of 5% more of block 3/05 and 6.67% more of 3/05A along with Maurel & Prom from Etu Energias at an initial cost of $23m. Contingent consideration of up to $11m will depend on first oil, the oil price itself and production performance.

The deal will be backdated to 31/12/23 as has been done before and will be funded from existing cash resources so no dilution for shareholders. Following this deal Afentra will end up with 35% of 3/05 and 28% of 3/05A as well as the onshore portfolio.

I remain fully convinced that Afentra is one of the best plays in the Bucket List and having flirted with the lower levels this should pick up the share price from the underserved recent lows, my 100p target price remains intact.

Transaction Overview

Afentra has signed a Sale and Purchase Agreement to acquire fifty percent of Etu Energias S.A.’s working interests in offshore Blocks 3/05 and 3/05A (the “Etu Interests”). The Etu interests acquired consist of a 5.0% non-operated working interest in Block 3/05 and a 6.67% non-operated working interest in Block 3/05A. The effective date of the transaction is 31 December 2023. In 2024 profit before tax on the Etu interest was US$14 million[2].

The total headline cash consideration payable by Afentra at completion is US$23 million. This includes US$22 million for the Block 3/05 interest and US$1 million for the Block 3/05A interest. The consideration is on a cash-free, debt-free basis and is subject to customary adjustments for working capital and crude inventory balances between the effective date and completion. Based on current estimates, these adjustments are expected to result in a material reduction to the final cash consideration payable at completion.

Afentra may pay up to US$6 million in contingent consideration for Block 3/05. This applies only to the years 2025 and 2026 with the annual contingent payment capped at US$3million. Payments are based on a sliding scale of average annual Brent oil price between US$75 per barrel and US$123 per barrel, and only if average gross production exceeds 15,000 barrels of oil per day for the relevant year. A further US$5 million in contingent payments may be made in connection with the Caco-Gazela and Punja discoveries. Two payments of US$2.5 million each are payable one year after first oil from each development, subject to a minimum Brent price of US$75 per barrel and gross production averaging at least 5,000 barrels of oil per day during the twelve months following first oil. First oil must occur by 31 December 2029 for the contingent payments to become due.

Following completion of the Etu Acquisition, the joint venture partners across both Blocks 3/05 and 3/05A will be comprised as follows:

Post Completion interest

| Block 3/05 | Block 3/05A | |

| Sonangol (Operator) | 36% | 33.33% |

| Afentra | 35% | 28.00% |

| M&P | 25% | 33.33% |

| NIS Naftagas | 4% | 5.33% |

Next Steps

Completion of the Etu Acquisition remains subject to customary conditions precedent, including government approvals in Angola and finalisation of definitive documentation. The Company expects completion in H2 2025 and will provide further updates in due course.

Star Energy

Star Energy today provides the following trading update in advance of the Company’s AGM, which is being held at 10.30 am today.

Highlights

- Production remains in line with full year guidance at c. 2,000 boepd

- As at 31 May 2025, cash balances were £10.5m and net debt was £1.9m. On track to repay Facility A (€6.7m) by end June 2025

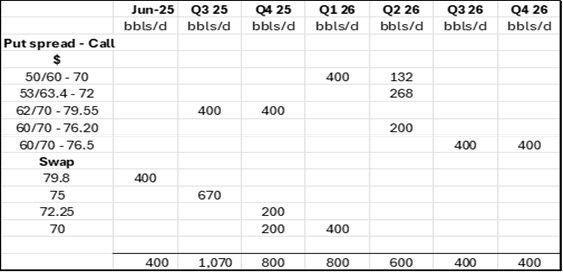

- We have the following hedging in place:

- Capex of c£10m including £5.8m on the Singleton gas-to-wire project.

- Continuing the expansion of our UK geothermal pipeline with MoUs being signed with Bring Energy, to decarbonise and extend the existing Southampton District Heat Network, and Veolia.

- Croatia geothermal portfolio is being matured through the establishment of the exploitation field withini the Ernestinovo licence and through technical de-risking of the Sječe and Pčelić licences.

Ross Glover, Chief Executive Officer, said:

“The core of our strategy is simple: to create value for shareholders through disciplined execution, cash generation, and the creation of long-term growth opportunities.

The past few years – and especially recent global events – have made clear the strategic value of secure, domestic energy production. UK-produced oil and gas are not just geopolitical necessities; they can increase our industrial competitiveness, improve economic resilience, and build geopolitical independence. Our onshore operations provide safe, reliable, domestic energy with local economic benefits – and they generate the cash flow that underpins our reinvestment and shareholder return potential.

We are focused on optimising our existing producing assets, seeking to reduce operating costs whilst future proofing the operations and maintaining our strong HSE record.

At the same time, we are executing on our long-term growth platform: geothermal energy.

The UK geothermal sector is underdeveloped, but the demand drivers heat decarbonisation, energy security, and long-term predictable pricing are all intensifying. Our early entry and technical know-how give us a strong competitive edge. Our pipeline of private and public sector projects is growing, and we are working with credible partners like the NHS, Veolia and Bring Energy to mature the pipeline.

In Croatia, we benefit from a supportive regulatory and investment climate for geothermal. Our licenses cover prospective areas, and we are finalising technical de-risking to enable phased development. The Croatian market offers access to scalable power opportunities in a jurisdiction that welcomes clean energy investment capital.

As we look ahead, our value creation strategy remains clear and focused:

- Maximise cash returns from UK oil and gas operations to fund growth and improve financial resilience

- Grow a high-quality geothermal platform with scalable, de-risked opportunities in the UK and Croatia

- Maintain capital discipline and agility, with focus on value creation

We are uniquely positioned to deliver value from cash-generative UK oil and gas operations, while building a diversified energy business that can thrive in multiple market scenarios. Our geothermal activities are not a pivot away from hydrocarbons they are a logical, deployment of our core strengths in subsurface, permitting, and infrastructure development into a growth area.

This is about building a broader, more resilient business one that can generate sustainable returns across energy cycles and policy environments. Thank you to our shareholders for your continued support. Everything we are doing is focused on protecting and growing shareholder value.”

Star is still something of a tricky call, with cash coming in from the original business to fund the exotica that geothermal might be albeit de-risked in the UK and Croatia according to the company…

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy