New research from Sulzer reveals widespread inefficiencies across industrial pump fleets, with some operators missing out on energy savings of over $1.5 million per site

New research from Sulzer’s latest whitepaper reveals that pump performance remains a major blindspot for many operators in industrial energy consumption, with operators missing out on significant productivity, cost and sustainability improvements. The study found that two-thirds of industrial pumps are running inefficiently, with optimization opportunities worth millions of dollars in efficiency gains untapped.

Despite accounting for more than 20% of the world’s electricity demand, pumps are rarely prioritized in energy efficiency strategies. While many operators focus on larger assets such as turbines or boilers, pump fleets are often left unoptimized. But as Sulzer’s data shows, most pumps have substantial room for improvement.

Of the 464 pumps sampled, 68% of pumps operated outside of their preferred operating region (POR) for more than half of their run-time, and 44% operated outside POR more than 80% of the time. Over 17% were found to be running in restricted or limited zones for the majority of their operations. This kind of prolonged inefficiency can significantly increase energy costs, shorten equipment lifespan, raise the risk of unplanned downtime and lead to avoidable environmental impact from excess energy-related emissions.

Modest efficiency improvements could unlock substantial cost savings. Sulzer’s analysis estimates average savings of $28,000 per pump per year by operating closer to the pump’s Best Efficiency Point (BEP), without requiring major changes to surrounding systems or processes. More than a quarter of pumps could save $50,000 annually, while one in ten could exceed $100,000. In some cases, individual pumps could deliver between $150,000 and $500,000 in annual savings through targeted, technically feasible upgrades - offering a compelling return on investment.

“These aren’t theoretical numbers, they’re real inefficiencies happening right now,” said Ravin Pillay-Ramsamy, Services Division President at Sulzer. “With energy costs rising and budgets under pressure, this is the low-hanging fruit that many are not picking. Too often, pumps are considered reliable and left alone, but our data shows that there is meaningful value to be gained by re-examining performance. The opportunity is significant and the path to capturing it is simpler than most expect.”

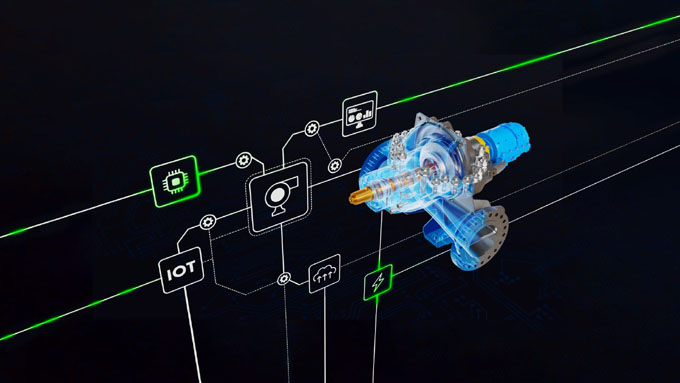

The newly released whitepaper, based on operational data monitored over 12 months using Sulzer’s advanced pump analytics platform BLUE BOX™, also highlights geographic and sector-specific trends. Pumps were assessed across oil, gas and power applications.

Downstream operators were found to have the least efficient pump fleets, with more than 80% of pumps running outside their preferred range for the majority of their operating time. This represents one of the biggest opportunities for improvement. Geographically, the largest savings potential was identified in the Americas, where 42% of pumps analyzed could each save $50,000 or more annually. In one example, pumps across a single US pipeline could save over $1.5 million every year with performance improvements.

To help operators act on these findings, Sulzer’s Energy Optimization Service, launched in April 2025 provides an end-to-end process from digital audit to retrofit implementation and long-term monitoring. The service is compatible with pumps from any manufacturer and is already delivering measurable results for customers across multiple sectors.

To read the full analysis and explore the savings potential by region, sector and pump type, download Sulzer’s whitepaper The Multi-Million-Dollar Pump Efficiency Optimization Opportunity here.

KEYFACT Energy

KEYFACT Energy