Ahead of the upcoming African Energy Week (AEW): Invest in African Energies 2025 conference, the African Energy Chamber spoke with Ian Cloke, COO of London-listed global oil and gas upstream firm Afentra – an Associate Sponsor at this year’s event –about the company’s short-to-medium term investment and expansion strategy in Africa.

What does the initialization of the Risk Service Contract (RSC) for Block KON4 mean for Afentra?

The initialing of the KON4 RSC marks the beginning of the formal approval process, it is a significant step in our continued strategy to build a material position in the onshore Kwanza basin in Angola. Under the terms of the proposed KON4 RSC, Afentra will be Operator with a 35% equity interest. The block offers early production and development opportunities with the 200 000 barrels of oil in place in the legacy Quneguela North Oil field. At the same time, we are also pleased to be demonstrating our commitment to the development of Angola’s upstream industry by supporting local companies explore the onshore Kwanza basin. Building on our interests in KON15 and KON19, the initialing of KON4 reflects our belief that the onshore Kwanza basin is an untapped hydrocarbon basin offering an early-stage production opportunity with significant growth potential.

Afentra and Maurel & Prom have announced expanding their stakes in Angola’s blocks 3/05 and 3/05A in June 2025. How do you plan to enhance the value of these assets?

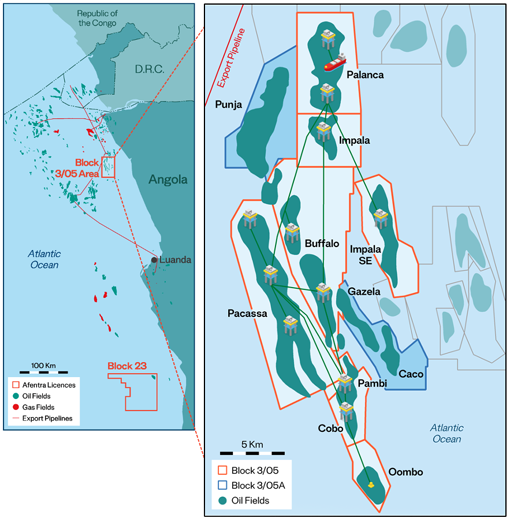

In June 2025, Afentra announced that it had agreed to jointly acquire, alongside Maurel & Prom the interests of Etu Energias in blocks 3/05 and 3/05A. Afentra has signed a sale purchase agreement with Etu for its 50% share of the acquisition which is subject to customary conditions including government approval. This will be the 4th transaction on this high quality, long-life asset which we know well. Following completion of the Etu Acquisition Afentra will hold an interest at 35% in 3/05 and 28% in 3/05A.

Since coming onto the asset in 2021 we have witnessed the JV partnership enhancing value through an optimization program designed to boost production, prove up reserves (with 140% reserve replacement ratio in the last 18 months up to the end of December 2024) and improve the infrastructure to support the activity for the remainder of the license (extended out to 2040). We believe that the asset is capable of producing 30,000-40,000 barrels of oil per day over time as we continue to execute the phased work program with infrastructure upgrades, increasing water injection and light well interventions (LWI) underway, with heavy workovers, infill drilling and development drilling to follow.

What other African markets are you exploring and why?

We have a list of core target markets in West Africa that reflect the same dynamics that attracted us to Angola in terms of mature producing assets, in a stable and attractive fiscal environment, that may become available as a result of the accelerating industry transition that sees assets change hands from IOCs and NOCs to credible Independents like Afentra.

Afentra is participating at AEW: Invest in African Energies 2025 as an Associate Sponsor. How does the event align with your African strategy and what key message are you bringing to the event?

Our purpose is built around the objective of supporting a sustainable and just energy transition in Africa – and enabling the local stakeholders to benefit from the socioeconomic impact of responsible resource development. Angola has been an excellent market through which to grow our business and the country is a template for what collaborative success looks like in terms of encouraging foreign investment to support the future of its upstream industry. AEW provides the platform to engage with the wider industry, share our insights and promote Afentra as a partner of choice to IOCs and NOCs with the commercial and technical capabilities to add value to partners and assets.

KeyFacts Energy: Afentra Angola country profile l KeyFacts Energy: Q&A

KeyFacts Energy Industry Directory: African Energy Chamber

KEYFACT Energy

KEYFACT Energy