Union Jack Oil, a USA and UK focused onshore hydrocarbon production, development, exploration and investment company, provides the following update on West Newton, including initial plans for early monetisation of gas production through a new cryptocurrency mining operation.

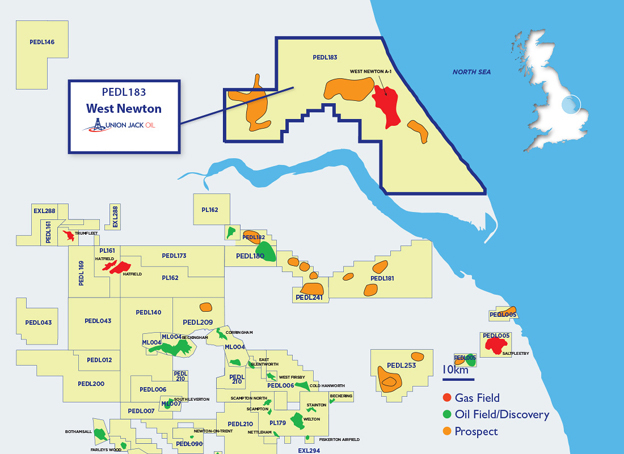

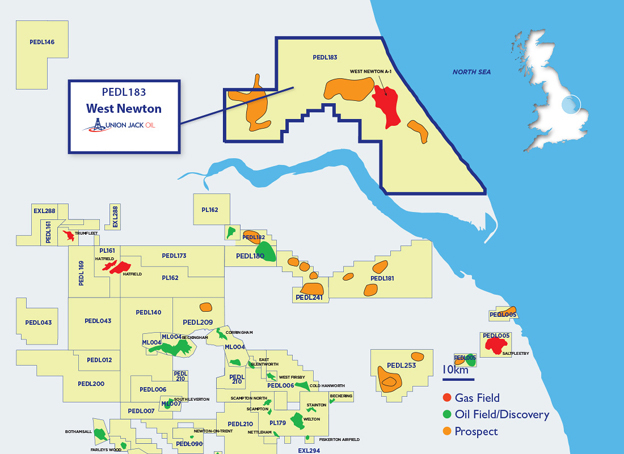

Union Jack holds a 16.665% working interest in PEDL183, that incorporates the West Newton gas discoveries and is operated on behalf of the Joint Venture partners by Rathlin Energy (UK).

- Rathlin has conducted a feasibility study and evaluated the potential for an early development sing gas to be produced from the existing discovery wells to generate on-site electricity to power cryptocurrency mining activities

- Rathlin, on behalf of the Joint Venture partnership which also includes Reabold Resources, has entered into a non-binding Letter of Intent (“LOI”) with a Texas-based company, 360 Energy to design a Bitcoin mining solution at West Newton, subject to regulatory and third-party approvals

- The Joint Venture partners believe that cryptocurrency mining offers an innovative and significant near-term value generating opportunity, providing early production and cash flow in advance of any planned full gas field development decision

Bitcoin Mining Evaluation

Rathlin, along with its Joint Venture partners, has been evaluating ways of generating additional value through early production schemes, ahead of any longer-term full gas field development. In particular, Rathlin has been looking at development concepts that would co-locate gas-powered generators and cryptocurrency mining equipment at the West Newton A and B sites, which would be fuelled by the natural gas produced at those locations.

On behalf of the Joint Venture partnership, Rathlin has entered into a non-binding LOI with 360 Energy, a natural gas offtake and monetisation provider, headquartered in Austin, Texas, USA. Under the terms of the LOI, both parties will work to scope, design and subject to regulatory and third-party approvals, deploy 360 Energy’s proven In-Field Computing (“IFC”) technology, designed to convert natural gas produced at West Newton to power on-site data centres, generating revenues from Bitcoin production. Whilst at an early conceptual stage, preliminary economic estimates indicate that cryptocurrency mining could deliver very attractive returns.

The LOI envisages the IFC initially being deployed at the West Newton A site, converting natural gas from the WNA-2 well into Bitcoin, subsequently being expanded to encompass other discoveries. The relationship with 360 Energy has the potential to enable the Joint Venture partners to realise significant returns from natural gas volumes via wells that would not otherwise contribute to either the early production scheme or the full field development.

The Joint Venture partners are working towards entering a binding definitive agreement with 360 Energy that is expected to be based on the terms outlined in the LOI.

David Bramhill, Executive Chairman of Union Jack, commented:

“Alongside our Joint Venture partners, we are delighted to offer a positive update on the possible development of a gas monetisation and Bitcoin mining concept at West Newton. We continue to believe that this asset holds material value which could eventually deliver significant volumes of onshore low-carbon sales gas into the UK`s important domestic natural gas market.

“West Newton is estimated to contain gross recoverable 2C gas resources of almost 200 billion cubic feet, according to an independent assessment undertaken by RPS in 2022.

“Regulatory uncertainty has unduly hampered progress and planning challenges have tarnished somewhat the perception of a number of commercially attractive onshore projects, such as West Newton, however, we are seeing some “green shoots” appearing on the horizon in this respect.

“Onshore developers and producers have been forced to “think outside the box” in order to make progress and deliver growth. The Board of Union Jack believes this proposed concept to produce Bitcoin through mining operations is innovative, offersstrong scope for a sustainable return and could lead to the Company introducing a new Bitcoin Treasury strategy, on success.

“In addition, we believe that 360 Energy’s association with West Newton is complementary to Union Jack’s position as a profitable, transatlantic oil and gas business with production in both the UK and USA.

“I look forward to updating shareholders in the future.”

About 360 Energy

360 Energy provides next-generation solutions for natural gas offtake and monetisation in the hydrocarbon industry. The proprietary IFC platform captures stranded, flared or uneconomic gas and converts it to electricity for powering modular data centres on-site. 360 Energy is at the forefront of integrating advanced computing with traditional energy production to help project partnerships to earn more and flare less.

Company Profile: Union Jack Oil

Union Jack Oil is an oil and gas company with a focus on onshore production, development, exploration and investment opportunities within the United Kingdom and the United States of America hydrocarbon sector.

The Company's portfolio of interests is well balanced with a mixture of production, development and late-stage, potentially high end value exploration.

The ordinary shares of the Company are traded on the Alternative Investment Market (AIM) of the London Stock Exchange and also the independent Aquis Market.

OVERVIEW OF OPERATIONS

United Kingdom

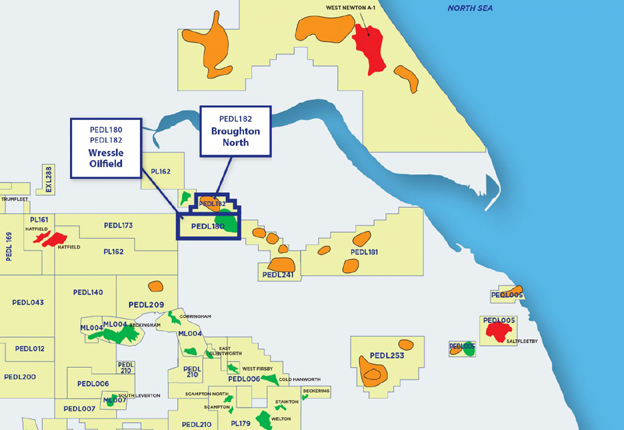

Wressle Development PEDL180 AND PEDL182 (40%)

Wressle is located in Lincolnshire, on the western margin of the Humber Basin.

The Wressle-1 discovery was defined on proprietary 3D seismic data. The structure is on trend with the Crosby Warren oilfield and the Broughton North Prospect, both located to the immediate northwest and the Brigg-1 discovery to the southeast. These wells contain hydrocarbons in several different sandstone reservoirs within the Upper Carboniferous succession. The majority of the Broughton North Prospect is covered by the same 3D seismic survey to that of the Wressle field.

Since the proppant squeeze and coiled tubing operations conducted during August 2021, Wressle has established itself as Union Jack’s flagship project with initial production rates far exceeding original expectations. Wressle has generated revenues in excess of US$19,000,000 net to Union Jack before taxes, allowing the Company to be self-sustaining for almost three years without recourse to external funding from the capital markets. To date, nearly 600,000 barrels of high-quality oil have been produced and sold from Wressle.

Production during 2023, ranged from 500 to 800 barrels of oil per day, accompanied by a water cut which is easily managed and disposed of at a nearby facility. During December 2023, the joint venture partnership received the results of a CPR compiled by ERCE for Wressle and Broughton North Prospect.

The highlights of this report are as follows:

- 263% increase in 2P Reserves

- Reclassification of 1,883 million barrels of oil equivalent (“mboe”) in Penistone Flags Contingent Resources to 2P Reserves

- 59% upgrade to the Ashover Grit and Wingfield Flags Estimated Ultimate Recoverable

- 23% upgrade to Broughton North Prospective 2U Resources

A planning application for the drilling of back-to-back (Wressle-2 and Wressle-3) wells and an upgrade of production facilities, including fluid storage tanks, separator system, surface pump and associated bunds, was submitted by the Operator on behalf of the joint venture partnership to the North Lincolnshire Council for approval, during February 2024.

West Newton Development PEDL183 (16.665%)

PEDL183 is located onshore UK, north of the River Humber, encompassing the town of Beverley, East Yorkshire. The licence area is within the western sector of the Southern Zechstein Basin.

Union Jack entered into a farm-in during 2018 with Rathlin Energy as the Operator, and since that time the West Newton A-2 (“WNA-2”) and West Newton B-1Z (“WNB-1Z”) drilling programmes have yielded substantial hydrocarbon discoveries within the Kirkham Abbey formation.

Throughout 2022 and 2023, data collected during drilling operations and well testing, which included core, oil and gas samples, wireline log and well test records, were analysed by independent laboratories CoreLab, Applied Petroleum Technology (“APT”) and RPS. The results of these analyses, in conjunction with internal evaluations, have been invaluable in informing the upcoming programme of work

and future drilling plans.

Laboratory reports confirm that the hydrocarbon-bearing Kirkham Abbey reservoir is extremely sensitive to aqueous fluids and that previous drilling of the West Newton wells with water-based mud had created near well-bore damage through the creation of very fine rock fragments, affecting the natural porosity and permeability of the formation, which in turn had a detrimental effect on its ability to flow. Further analyses have concluded that the use of dilute water-based acids during well testing would have also affected the flow characteristics of the Kirkham Abbey reservoir.

These tests indicate that by drilling the Kirkham Abbey reservoir with an oil-based drilling fluid, damage to the oil and gas reservoir should be minimised.

The joint venture partners continue to plan the most efficient and economic method to convert the impressive West Newton Contingent Resource into a viable hydrocarbon development within an acceptable time frame.

A future West Newton development will benefit from being located in an area that provides access to substantial local infrastructure and could deliver significant volumes of onshore low carbon sales gas into the UK’s energy market.

Keddington PEDL005(R) (55%)

The Keddington oilfield is located along the highly prospective East Barkwith Ridge, an east-west structural high on the southern margin of the Humber Basin.

A technical review by the Operator has confirmed that there remains an undrained oil resource located on the eastern side of the Keddington field. Planning consent for further drilling is already in place, presenting an opportunity to increase production via a development side-track from one of the existing wells.

To facilitate confirmation of the target definition and well design planning, re-processing of legacy 3D seismic data has been completed.

Modelling indicates that infill drilling is forecast to improve recovery from the Keddington field by between 113,000 to 183,000 barrels of oil, depending on the reservoir permeability model selected and the combination of infill targets.

The sub-surface location of a step-out well has been finalised and it is planned to drill the well, where planning consent is already granted, when the Operator deems appropriate.

There are plans to upgrade the production equipment at Keddington during 2024, the result of which is expected to increase efficiency and production rates.

Biscathorpe PEDL253 (45%)

PEDL253 is situated within the proven hydrocarbon fairway of the South Humber Basin and is on-trend with the Keddington oilfield and the Saltfleetby gasfield.

While drilling the Biscathorpe-2 well, there were hydrocarbon shows, elevated gas readings and sample fluorescence observed over the entire interval from the top of the Dinantian to the total depth of the well, with 68 metres being interpreted as being oil-bearing.

Independent consultants APT also conducted analyses, confirming a hydrocarbon column of 33-34 API gravity oil, comparable with the oil produced at the nearby Keddington oilfield.

Further evaluation of the results of the Biscathorpe-2 well, together with the reprocessing of 264 square kilometres of 3D seismic, indicate a potentially material and commercial hydrocarbon resource that remains to be appraised.

During November 2023, the Planning Inspectorate upheld the appeal against the refusal of planning permission by Lincolnshire County Council for a side-track drilling operation, associated testing and long-term oil production at the Biscathorpe-2 wellsite.

Union Jack’s technical team believe that Biscathorpe remains one of the largest unappraised conventional onshore discoveries within the UK.

North Kelsey PEDL241 (50%)

North Kelsey is a conventional oil exploration prospect on trend with, and analogous to, the Wressle oilfield which lies approximately 15 kilometres to the northwest. The prospect has been mapped from 3D seismic data and has the potential for oil in four stacked Upper Carboniferous reservoir targets.

The Operator estimates that gross Prospective Resources range from 4.66 (P90) to 8.47 (P10) mmbbl.

The Operator has submitted an appeal on behalf of the Joint Venture, against the refusal of an extension of time to the existing planning permission by Lincolnshire County Council to enable the drilling and testing of a conventional exploration well at the North Kelsey site.

Other Licence Interests

Union Jack has interests in a number of other non-core projects, namely PEDL118 (Dukes Wood), PEDL203 (Kirklington), PEDL201 (Widmerpool Gulf) and PEDL209 (Laughton).

These licence interests have all been fully impaired and are at various stages of relinquishment with the exception of Dukes Wood where the geothermal upside potential is being investigated.

Fiskerton Airfield (EXL294) is currently shut in. Longer term potential for the site is to manage produced water through the existing water injection well on site and also for potential geothermal repurposing.

During the year, PEDL181 was relinquished at no cost to the company.

United States of America

During December 2023, for numerous reasons, including the punitive Energy Profit Levy of 35% imposed on profits generated within the UK, the Board commenced the execution of a plan to seek growth opportunities in regimes with sympathetic views towards the hydrocarbon industry, without compromising global environmental objectives and the aim of achieving net zero by 2050.

To this end, Union Jack has, in just the period of a few months, assembled an attractive and growing portfolio of cash generating Mineral Royalties, located in the Permian Basin and Eagle Ford Shale, Texas and Bakken Shale, North Dakota, USA. These are operated by major producers.

The Company has entered into farm-in agreements with Reach to drill two wells, one of which, the Andrews 1-17, has already been drilled and declared a commercial discovery. The other well, the Diana-1, designed to test a Wilzetta Fault play, will be drilled during Q3 2024.

A further agreement was signed to conduct a 3D seismic survey over certain areas of the Wilzetta Fault, in Oklahoma, one of the largest hydrocarbon producing states in the USA.

Union Jack’s strategic partnership with Reach offers the opportunity to access a wider inventory of drill-ready prospects in Oklahoma.

As a result of the initial success of Andrews 1-17, a follow-up well location is currently in the planning phase in readiness for early drilling.

Mineral Royalties

During late 2023 and early 2024, Union Jack acquired six quality Mineral Royalty packages, all brokered by the Company’s Oklahoma based agent and adviser, Reach.

The attractions of USA Mineral Royalties include:

- Exposure to active and productive basins and some of the largest operators in the USA

- Monthly income with no development or operating costs

- Owned in perpetuity, with no forward liabilities or obligations

- Royalties are estimated to have a long economic life, in some cases more than 26 years and an Internal Rate of Return in excess of 20%

The Mineral Royalties portfolio assembled to date is summarised below:

- Cronus Unit, containing a 25 well package in the Permian Basin, Midland County, Texas, (effective date December 2023); the property is comprised of nine Chevron and 16 XTO (a subsidiary of Exxon) operated wells

- COG Operating LLC (a subsidiary of ConocoPhillips) operated Powell Ranch Unit, consisting of 15 wells in the Permian Basin, Upton County, Texas (effective date November 2023); the property is comprised of seven horizontal and eight vertical wells

- Occidental operated Palm Springs Unit, containing 10 horizontal wells in the Permian Basin, Howard County, Texas (effective date January 2024)

- Bakken Shale, a diversified 96 well interest package, located in Dunn, McKenzie and Williams Counties, North Dakota. Quality Operators include Burlington Resources, Continental and Hess (effective date March 2024)

- Permian Basin, an eight well producing unit, located in Howard and Borden Counties, Texas. Operated by Vital Energy Inc, a quoted, Permian Basin focused entity, based in Tulsa, Oklahoma (effective date March 2024)

- Eagle Ford Shale, a nine producing horizontal well package, located in DeWitt County, Texas, operated by ROCC Operating (effective date March 2024)

The Mineral Royalties also provide additional upside as new wells are completed and drilled on the properties at no cost to Union Jack. Chevron, one of the operators, has publicly stated their commitment to expanding activities in the Permian Basin.

The operators associated with the Royalties are all major producers, ranking highly in the S&P Global (formerly Standard & Poor’s), Fitch, and Moody credit ratings.

The Company’s intent is to expand its Mineral Royalty portfolio as and when appropriate acquisition opportunities arise.

West Bowlegs Prospect and Andrews 1-17 Well, Oklahoma (45%)

During January 2024, the Company signed a farm-in agreement with Reach, to acquire a 45% interest in the West Bowlegs Prospect, located in Seminole County, Oklahoma, where the Andrews 1-17 well was subsequently spudded in late March 2024, and drilled to a depth of 4,600 feet.

The primary objective for the Andrews 1-17 well was the Hunton Limestone, a prolific, producing hydrocarbon reservoir in Oklahoma. The Hunton Limestone is unconformably overlain by the main oil-prone source rock, the Woodford Shale, and is in an excellent position for the migration of oil.

The Andrews 1-17 well confirmed the presence of the main objective, the Hunton Limestone, showing high porosity with elevated gas readings, with good reservoir qualities being interpreted on the wireline logs.

The well was completed and placed on production and is currently cleaning up. Oil produced has been sold and permanent oil and gas production facilities are being assembled on site.

Reach and its drilling team conducted activities with precision, below budget and, of key importance, safely and incident free.

The West Bowlegs drilling met our criteria of acquiring material interests in near-term drilling projects and being capable of quickly adding cash-flow.

The Company’s first drilling venture in the USA is a commercial success and an excellent start for Union Jack in its initial enterprise with Reach.

Wilzetta Fault play and Drilling in Oklahoma (75%) During February 2024, the Company signed a farm-in agreement with Reach to acquire a 75% interest in a high-impact well, Diana-1, planned to be drilled in Q3 2024, to test the Footwall Fold Prospect in the Wilzetta Fault play, a proven oil producing location and in an area of associated interest.

The prolific Wilzetta Fault plays are the sites of numerous oilfields across Central Oklahoma which include:

- North-East Shawnee field, three miles south of the Prospect, which has produced more than 5,800,000 barrels of oil to date

- West Bellmont field, adjacent to the Prospect, which has produced more than 580,000 barrels of oil to date

- Arlington Field, ten miles north-east of the Prospect, which has produced more than 1,800,000 barrels of oil to date

Typical wells drilled in the Wilzetta Fault can produce approximately 250 barrels of oil per day providing pay-back within three months.

The initial Wilzetta well will be drilled to a depth of 6,000 feet where the prospect integrity is supported by recently reprocessed 3D seismic data.

Outlook

In the UK, Union Jack will remain focused on the development of its flagship project, Wressle, where the Operator and joint venture partners have ambitious near-term appraisal and development programmes planned. The Board is of the opinion that, within the Wressle development, there remains significant material upside which will support the Company with revenues for at least another decade.

Union Jack’s initial successes in the USA, in just a few months, highlight the ease of entry and ability to execute business in that country, justifying the Board’s decision to seek further growth opportunities internationally to bolster its flagship production and appraisal assets in the United Kingdom.

Contact

Union Jack Oil plc

6 Charlotte Street, Bath BA1 2NE, United Kingdom

Tel:+44 (0) 1225 428139 l info@unionjackoil.com

KeyFacts Energy: Union Jack Oil UK country profile l Union Jack Oil US country profile

If you would like to discover more about KeyFacts Energy, contact us today and we can arrange a 15-minute online meeting to review our database of over 2,600 continually updated 'country-specific' oil and gas and renewable energy profiles from a selection of 144 countries. Find out how you can instantly identify companies with operational activity in your chosen country, 'fine-tune' your news or company selection based on industry category, energy type or regional location and additionally benefit from one to one contact with us to ensure maximum online and social media exposure for your company.

KeyFacts Energy: Union Jack Oil UK country profile

KEYFACT Energy

KEYFACT Energy