From a selection of 144 countries, KeyFacts Energy features Australia in the continuing series of 'at-a-glance' reports, with selected information taken from our popular 'Energy Country Review' database.

In Australia, the first oil well was drilled in Albany Harbour, Western Australia in 1907. Major development of the industry, however, came in the1970s when massive gas and condensate (light crude oil) discoveries were made off the North-west coast of Western Australia.

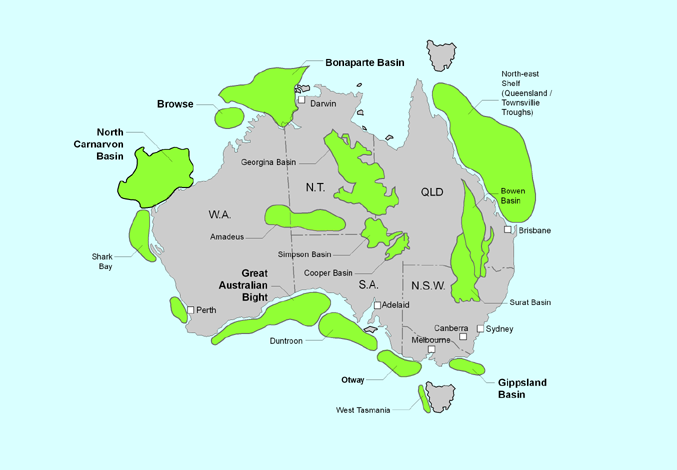

The first major oil fields in Australia were identified in the early 1960’s off the south-east coast of the country, followed by the development of the North West Shelf Project, off the coast of Western Australia (WA), in the 1980s. Geographically, Western Australia is the largest producer (64% of national output), followed by Queensland (11%), South Australia (7%), New South Wales and Victoria each with 6%, Tasmania with 5% and the Northern Territory (1%). Natural gas (LNG) accounts for just under two thirds and crude oil accounts for almost 22% of total production, with the balance being made up by coal seam gas (8.3%), LPG (4.9%) and shale oil and gas (0.2%).

| Capital | Canberra |

| Population | 26,900,230 (2025) |

| Area | 7,692,024 km² / 2,969,907 sq miles |

| Government type | Federal democratic administrative authority |

| Religions | Protestant, Roman Catholic |

| Currency | Australian dollar (AUD) |

| Calling code | +61 |

KeyFacts Energy: Australia News Archive

E&P COMPANIES

3D ENERGI

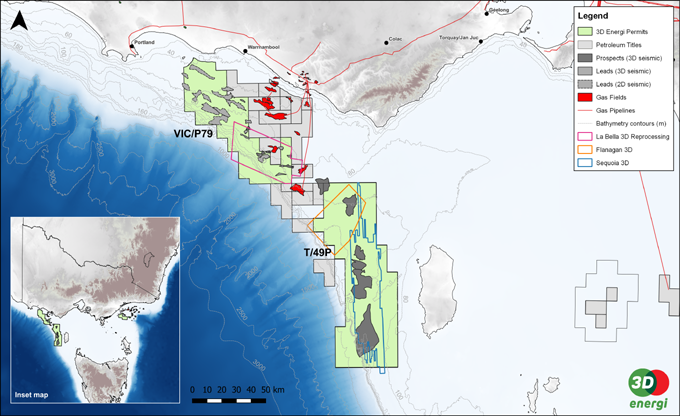

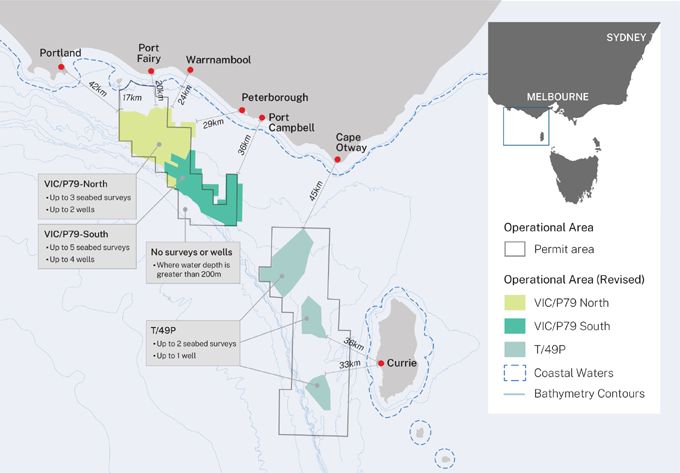

3D Energi has 20 years’ experience specialising in the early identification of high value exploration opportunities with significant commercialisation potential combined with a proven track record of attracting world class industry partners. 3D Energi has developed an impressive portfolio of highly prospective offshore exploration permits in the offshore Otway and Gippsland basins of Southeast Australia, proximal to existing gas fields, associated infrastructure, and an undersupplied east coast gas market.

The Company’s strategy has been to target overlooked or underexplored areas with a favourable technical and commercial considerations, particularly in Eastern Australia, adding value by maturing the understanding of the subsurface and attract oil and gas majors to invest in our work programs. The Company has also diversified its interests into a significant new petroleum province on the Northwest Shelf (Bedout Sub-Basin), as well as onshore gas storage at the abandoned Caroline CO2 field, South Australia.

ADVENT ENERGY

Advent has assembled an attractive portfolio of assets both on and offshore Australia. All permits are located next to a ready market and/or excellent infrastructure, thereby maximising Advent’s ability to optimise any resources. Included in the portfolio is: Petroleum Exploration Permit 11 in the offshore Sydney Basin. This permit has been assessed to contain several multi-Tcf targets adjacent to the major population region of Sydney and excellent port and power infrastructure. Retention Licence 1 (comprising the Weaber Gas Field), in the Onshore Bonaparte Basin. Near term development opportunities of conventional resources for local markets complements the unconventional shale gas resources recently revealed. Advent’s management and board members hold over 75 years combined oil industry experience.

ADZ ENERGY

In Victoria’s Otway Basin, ADZ holds 100% of Petroleum Exploration Permit PEP 169, including the Enterprise North‑1 (EN‑1) exploration prospect. The company acquired a 49% stake in PEP 169 from Lakes Blue Energy in mid‑2024 (a transaction completed in October 2024) and subsequently moved to full ownership. EN‑1 is drill‑ready, and ADZ aims to test for conventional gas with potential for production into the Victorian market.

ADZ’s broader strategy encompasses exploration activity in the Northern Territory's McArthur Basin, where it is advancing seismic and well-testing campaigns to evaluate the Glyde gas discovery. The goal includes supplying nearby industrial clients (e.g. Lucapa Diamond Mine) with gas by leveraging proximity and existing infrastructure.

ADZ has also expanded into the Cooper–Eromanga Basin in South Australia, exploring both conventional and unconventional gas upside. This is supported by its acquisition of several entities (Armour Energy and related affiliates) from Armour Energy Limited in early 2024, effectively migrating those assets—including Surat Basin acreage and other interests—into ADZ’s portfolio.

AMPLITUDE ENERGY

Amplitude Energy operates offshore natural gas operations in Victoria’s Gippsland and Otway Basins through the Sole gas field in Gippsland and the Casino, Henry, and Netherby fields in the Otway Basin. These offshore assets are fully operated by the company, and natural gas and gas liquids extracted are transported via subsea pipelines to onshore processing facilities such as the Orbost Gas Processing Plant (acquired in July 2022) and the Athena Gas Plant (formerly Minerva Gas Plant) near Port Campbell, which serve the Southeast Australia market.

In the Gippsland Basin, Amplitude Energy holds eight offshore tenements, including a 100 % interest in the Sole gas field and the Orbost processing facility. The company handles decommissioning of older assets like the Basker–Manta–Gummy field, with a regulator‑approved plan set out through to 2026.

In the Otway Basin, they operate offshore gas projects including the Casino, Henry, Netherby fields, and support processing via the Athena Gas Plant. They also have exploration and appraisal prospects such as the Annie gas discovery offshore, and other undeveloped resources within the basin.

Amplitude Energy maintains non-operated interests in onshore oil production and exploration projects in the Cooper Basin, spanning northeast South Australia to southwest Queensland. Across several production licences (e.g. Sellicks, Callawonga, Parsons, and others), Amplitude holds roughly 25 % interests. Since their first oil discovery in 2002, these Cooper Basin operations have produced over 20 million barrels of oil, delivering around 500,000 barrels in FY2022—accounting for about 4 % of total company production that year.

ARROW ENERGY

Arrow Energy is a Queensland‑based integrated coal seam gas (CSG) company jointly owned by Shell and PetroChina (50/50), operating since 2000 and supplying gas commercially since 2004. It produces natural gas from five major CSG fields across the Surat Basin (southern Queensland) and Bowen Basin (central Queensland), delivering nearly 20% of the state’s gas supply. The company also owns and operates the 450 MW Braemar 2 gas‑fired power station southwest of Dalby, along with interests in other regional power facilities like Daandine and Townsville, together generating approximately 600 MW and supplying some 800,000 Queensland households.

BASS OIL

Bass Oil is an Australian-listed exploration and production company headquartered in Melbourne, holding a suite of licences in the Cooper Basin, including full ownership of the Worrior and Padulla oilfields.

Although primarily an oil producer in the northern Cooper Basin, the company has been actively pivoting toward gas development. In May 2025, it acquired the Vanessa gas field (PPL 268/PRL 135) from Beach Energy, gaining control of a gas well, processing facility, and a short pipeline connected to the Cooper Basin gas network.

BEACH ENERGY

Beach Energy operates across multiple basins in Australia and New Zealand, with a significant focus on the Cooper Basin, where it has extensive infrastructure and long-term production assets. Beach Energy also holds interests in the Otway, Perth, and Bass Basins. Beach Energy's operations span both conventional and unconventional gas, and the company plays a key role in domestic gas supply, particularly in South Australia and Victoria.

BEETALOO ENERGY

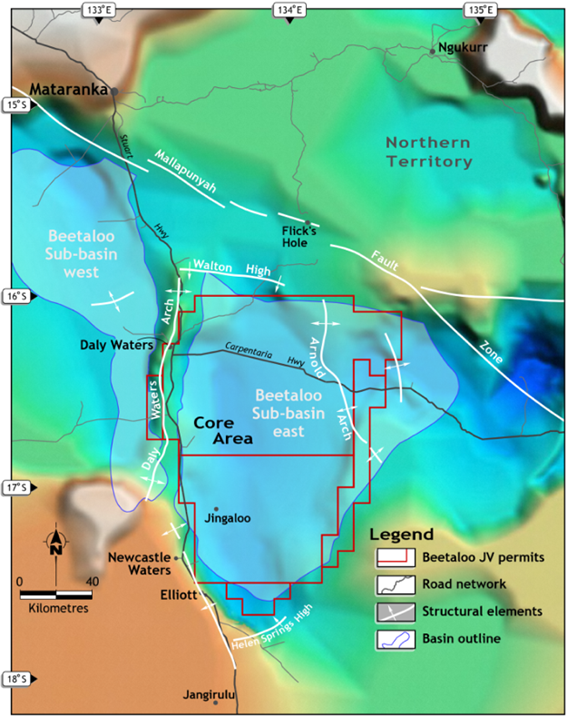

Beetaloo Energy is an ASX‑listed company (ASX: BTL) dedicated to exploring and developing onshore shale gas resources in Australia’s Northern Territory, primarily within the Beetaloo Sub‑basin, part of the extensive McArthur Basin. Its wholly owned subsidiary, Imperial Oil & Gas Pty Ltd, holds more than 28 million acres under licence—making it the largest acreage holder in the basin.

The company’s key asset is the Carpentaria Pilot Project, focused on horizontal drilling and hydraulic stimulation. In July 2025, Beetaloo Energy completed the most extensive fracture stimulation campaign to date in the basin at its Carpentaria‑5H well—spanning 2,955 metres and 67 stages—the longest in Australian history.

BENGAL ENERGY

Bengal's producing and non-producing assets are situated in Australia's Cooper Basin, a region featuring large accumulations of very light and high-quality crude oil and natural gas. The Company's core Australian assets, Petroleum Lease ("PL") 303 Cuisinier, Authority to Prospect ("ATP") 934 Barrolka, Potential Commercial Area ("PCA") 332 (formerly ATP 732) Tookoonooka, and four petroleum licenses are situated within an area of the Cooper Basin that is well served with production infrastructure and take-away capacity for produced crude oil and natural gas. Still in early stages in terms of appraisal and development, Bengal believes these assets offer attractive upside potential for both oil and gas.

Bengal has a 30.375% interest in two PLs on the former ATP 752 Barta block, PL 303 and PL 1028. In addition, the Company has three PCAs associated with ATP 752 which are the Barta block, PCA 206 and PCA 207 and PCA 155 in the Wompi block which contains the Nubba well. Bengal also holds a 100% working interest in four PLs including PPL 138 adjacent to the 100% owned ATP 934.

BHARAT PETRORESOURCES

Bharat PetroResources Ltd (BPRL) is the upstream exploration and production subsidiary of Bharat Petroleum Corporation Ltd (BPCL), created in 2006 to execute global upstream projects. Among its international interests, Australia accounts for a key non-operating position. In 2010, BPRL signed a Letter of Intent with Norwest Energy via a farm‑in agreement covering two shale gas permits in Western Australia’s Perth Basin—EP413 and TP/15—committing up to A$15 million toward exploration and drilling in return for up to 50% interest in each permit.

In EP413, BPRL ultimately secured approximately 27.8% participating interest, while Norwest retained operator status and AWE (via Arc Energy) held around 44%. Early fracturing tests in the Arrowsmith‑2 well delivered encouraging results, showing hydrocarbons across multiple formations—from High Cliff sandstone to Kockatea shale—confirming the presence of recoverable gas and oil potential.

As of 2025, BPRL has diversified its upstream portfolio with overseas interests in Brazil, Mozambique, Indonesia, Russia, UAE, and Timor‑Leste. Within Australia, its footprint remains limited to the EP413/TP‑15 permits from the 2010 farm‑in, without any reported recent drilling or commercial production activity.

BLUE ENERGY

Blue Energy Limited is an energy company that undertakes exploration, evaluation and development of conventional and unconventional oil and gas resources. This activity is carried out in Australia, principally in Queensland and the Northern Territory. In Queensland, Blue Energy has 100% equity holding in all its exploration tenements and is the Operator. In the Northern Territory exploration tenements, Blue Energy is earning an interest through funding a farm in work program but is the Operator. As a result of being the Operator in all of its tenement holdings, Blue Energy is in control of all capital and operating expenditures and is the point of contact for the respective State and Territory Regulators regarding work programs.

bp

bp has maintained a presence in Australia for over a century, with a range of upstream and infrastructure interests focused on natural gas and liquefied natural gas (LNG). In the North West Shelf (NWS) venture—Australia’s largest resource development—bp holds a 15.78 % interest in gas and condensate fields and a 16.67 % interest in the underlying infrastructure, including offshore platforms and pipelines linked to the onshore Karratha Gas Plant operated by Woodside Energy. BP has participated in the project since the 1960s and remains a founding investor in the NWS LNG export hub.

bp is also a major stakeholder in the Browse Basin gas development, holding a 44.33 % interest in the Calliance, Brecknock, and Torosa fields located offshore Western Australia, about 425 km north of Broome. The Browse fields, containing approximately 14.6 trillion cubic feet of gas and 412 million barrels of condensate, are expected to supply both domestic gas markets and LNG exports when developed, with proposed pipelines linking Browse back to the NWS facilities.

BP additionally holds a 20% stake in the Angel Carbon Capture and Storage (CCS) hub near Karratha, which is being developed to provide low‑carbon gas supply and support decarbonisation of the local industrial economy.

BURU ENERGY

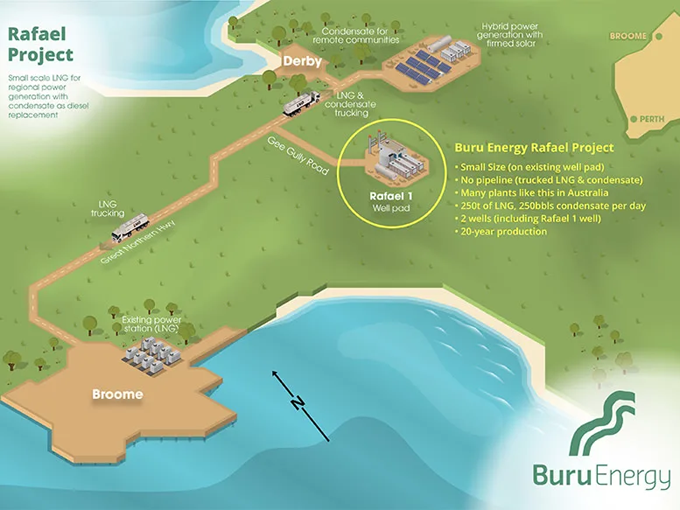

Buru Energy is an ASX listed Australian oil and gas exploration and production company solely focused on exploring and developing the petroleum resources of the Canning Basin, in the southwest Kimberley region of Western Australia. The Company’s flagship high quality conventional Ungani oil field project is owned in 50/50 joint venture with Mitsubishi Corporation. As well as Ungani, the Company’s portfolio includes potentially world class tight gas resources.

Buru holds 100% ownership of the Rafael discovery within permit EP 428. A recent pre-feasibility study—conducted with Transborders Energy and Technip Energies—supports the use of a compact, Kimberley-based floating LNG (FLNG) facility (approx. 1.6 MTPA) combined with onshore processing of condensate and LPG as a commercially compelling development path.

CARNARVON ENERGY

Carnarvon Energy is an independent upstream explorer listed on the ASX, with core assets situated in the Bedout Sub‑basin offshore Western Australia. The company holds interests in the Dorado and Pavo oil and condensate fields—among the largest undeveloped discoveries offshore Australia—with Carnarvon owning roughly 10 % and Santos as operator holding 80%. Since the 2018 Dorado discovery and the 2022 Pavo find, the joint venture has advanced regulatory approvals, achieved appraisal success, and secured a Production Licence in 2022, with an Offshore Project Proposal approved in 2023.

Phase 1 development at Dorado is designed around a floating production, storage and offloading (FPSO) unit tied to a limited network of wells, using gas reinjection for reservoir support. The Pavo field, estimated at about 43 million barrels of oil (gross 2C), is planned for tie-back to Dorado infrastructure to enhance production synergy. Several offshore structures remain at appraisal stage, including high‑graded prospects such as Ara, Wallace, Wendolene, Starbuck, and Pavo South. Collectively, the top prospects in the Bedout acreage hold over 1.5 billion barrels of oil equivalent in mean gross prospective resources, with upside to nearly 9 Tcf of gas and 1.6 billion barrels of oil in the broader permit area.

Despite optimism, the Dorado Final Investment Decision (FID) remains pending. In January 2025, Santos delayed further project advance and capital expenditure, citing the need for additional appraisal evaluation of Bedout resources. This development triggered a roughly 23 % drop in Carnarvon’s share price, as its principal asset lies in Dorado. The company had previously engaged Goldman Sachs and JPMorgan for strategic advice and looked to divest a portion of its stake to de-risk financing, ultimately selling 10 % to Taiwan’s CPC Corporation in a deal including cost carry contributions.

CENTRAL PETROLEUM

Central Petroleum operates the largest onshore gas production fields in the Northern Territory (NT), supplying oil and gas from fields in Central Australia to NT customers and the east coast market. Their key production area is the Amadeus Basin where they produce oil and gas from the Mereenie, Palm Valley and Dingo fields.

Central Petroleum has significant operations within the proven Amadeus Basin, which has some of Australia’s largest prospective onshore resources of conventional gas.

Although the Amadeus Basin has provided reliable, high-quality oil and gas since the 1970s, the basin is relatively under-explored and is believed to hold significant untapped potential for decades of reliable, high-volume gas supply.

CHEVRON

Chevron is one of the world's leading integrated energy companies and through its Australian subsidiaries, has been present in Australia for 70 years. Chevron Australia operates the Gorgon and Wheatstone natural gas facilities; manages its equal one-sixth interest in the North West Shelf Venture; operates Australia’s largest onshore oilfield on Barrow Island; is a significant investor in exploration; and via Caltex and Puma Energy delivers quality fuel products and services across Australia, operating or supplying a network of more than 360 retail locations and an extensive 24-hour hour diesel stop network, as well as 14 depots and three seaboard terminals.

Gorgon Project

- One of the world’s largest LNG vessels, located a short distance offshore Barrow Island. It includes a three-train LNG facility (15.6 Mtpa) and a domestic gas plant capable of supplying approximately 300 terajoules per day to Western Australia .

- The project commenced LNG exports in March 2016 and began supplying domestic gas later that year .

- Operated by Chevron Australia, the Gorgon JV includes partners such as ExxonMobil, Shell, Osaka Gas, MidOcean Energy, and JERA .

- It also hosts the largest carbon capture and storage (CCS) system globally, highlighting its environmental ambition .

Ongoing Infrastructure and Expansion

- Ongoing enhancements through Stage 2 and Jansz-Io Compression projects will add subsea wells and pipeline infrastructure to sustain production levels .

- Chevron has environmental approval for a subsea compression station (SCSt) and floating control station to be installed in the Jansz-Io field. Commissioning is expected from 2026, with full operation targeted around 2027–28 .

Exploration and Carbon Storage Expansion

- Chevron holds substantial exploration acreage in the Northern Carnarvon Basin, covering about 20,000 km² of offshore territory. Its recent addition includes WA-553-P (3,200 km²) .

- Chevron has obtained G-20-AP, a greenhouse gas assessment permit offshore Western Australia, adjacent to Barrow Island, aimed at evaluating the feasibility of subsea CO₂ geological storage .

Other Key Projects and Ventures

- Chevron Australia is a stakeholder and operator in major ventures, including the Wheatstone LNG project, North West Shelf Venture, and onshore oil operations on Barrow Island .

CNOOC INTERNATIONAL

CNOOC International operates in Australia primarily through its involvement in the oil and gas sector, focusing on offshore projects. The company holds interests in major liquefied natural gas (LNG) developments, particularly in the North West Shelf and the Queensland Curtis LNG (QCLNG) project. CNOOC International is a foundation customer of QCLNG and has long-term LNG offtake agreements in place. Its participation in these projects underscores its strategic commitment to securing energy resources and expanding its global LNG portfolio.

COMET RIDGE

Comet Ridge is focused on delivering coal seam gas (CSG) into the domestic east coast energy market. Its core operations are centred around the Mahalo Gas Hub in central Queensland, roughly 240 kilometres west of Gladstone, which encompasses both joint venture and wholly‑owned projects.

At the heart of its business is the Mahalo Gas Project, a joint venture in which Comet Ridge holds approximately 57.14 % equity, and Santos acts as the operator. This project has certified gas reserves and petroleum leases in place. Surrounding this, Comet Ridge retains 100 % ownership of the Northern Mahalo portfolio—comprising Mahalo North, Mahalo East, and Mahalo Far East—which are at various appraisal stages and aimed at adding further gas resources either as standalone contributors or linked to Mahalo Gas Project development.

Comet Ridge plans to advance its Mahalo Gas Hub toward final investment decisions and gas production. The pilot outcomes from Mahalo East, certification and infrastructure planning for Mahalo North, and its foundational gas sales agreements are the key enablers of that transition. Production from Mahalo North is expected around 2026 and could scale through late 2020s to support both domestic and industrial demand.

CONOCOPHILLIPS

ConocoPhillips Australia is exploring for natural gas in the Otway Basin (offshore Victoria) near existing natural gas wells. The drilling program aims to identify viable natural gas reserves to supply the domestic market and support Australia’s current and future energy needs, ensuring reliable power generation, industrial processes, and residential heating. The Environment Plan for the Otway Exploration Drilling Program was accepted by Australia’s independent regulator – the National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) in February 2025.

At the heart of its upstream presence, ConocoPhillips holds a 47.5 percent interest in the Australia Pacific LNG joint venture—alongside Origin Energy (27.5 percent) and Sinopec (25 percent). It operates the LNG export facility on Curtis Island, near Gladstone, Queensland, which houses two liquefaction trains with a combined nameplate capacity of about 9 million tonnes per annum, using its proprietary Optimized Cascade® technology. Origin Energy handles the upstream field operations in the Bowen and Surat Basins as well as the pipeline network. Since first shipping LNG in January 2016, APLNG now supplies roughly 30 percent of Australia’s east coast domestic gas market and has exported over 3,700 PJ of gas to Asia alongside more than 2,100 PJ domestically.

CPC CORPORATION

CPC Corporation (CPC) primarily operates in the oil and gas sector and is Taiwan's state-owned petroleum company. Its operations in Australia are mainly focused on upstream activities, particularly in natural gas exploration and production. CPC has participated as a joint venture partner in several liquefied natural gas (LNG) projects, most notably the Ichthys LNG project in the Northern Territory. In this project, CPC holds a minority stake and has signed long-term LNG offtake agreements, contributing to Taiwan's energy security by securing stable energy imports. CPC's involvement in Australia reflects its broader strategy of diversifying energy sources and securing overseas energy assets through investments in stable and resource-rich countries.

CUE ENERGY

Cue Energy Resources Limited conducts upstream oil and natural gas operations in Australia through its joint venture interests in three onshore gas fields located in the Amadeus Basin of the Northern Territory: the Mereenie, Palm Valley and Dingo fields. Cue holds 7.5% of Mereenie and 15% each of Palm Valley and Dingo, all operated by Central Petroleum. These assets supply gas into the Eastern Australian domestic market, generating steady production and revenue. In 2023 and into 2024, Cue supported drilling campaigns at Mereenie—including the West Mereenie 30 well—and earlier wells such as WM29, which alone produced around 5 terajoules per day; these efforts were completed on time and within budget and are expected to boost output under the Northern Territory Government Gas Sales Agreement.

ECHELON RESOURCES

Echelon Resources’ Australian oil and gas operations combine production from mature fields in the Amadeus Basin—highlighted by active drilling and strong offtake contracts—with exploration upside in both the Perth Basin and new acreage added via EP 145. Their strategic focus is on optimising production and capturing near‑term development potential tied to established infrastructure.

In 2025 Echelon completed the acquisition of permit EP 145 in the Amadeus Basin from Mosman Oil & Gas for AUD 0.40 million, a licence hosting the West Walker‑1 gas discovery adjacent to their core infrastructure. Echelon intends to acquire 3D seismic and drill appraisals with a view to tie-in to the existing gas network.

ELIXIR ENERGY

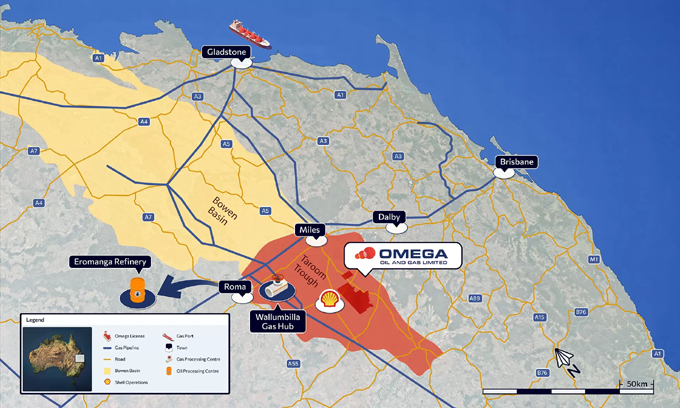

Elixir Energy is a Queensland-focused gas exploration and development company whose core assets lie in the Taroom Trough (southern Bowen Basin), where it is advancing the Grandis Gas Project and an adjacent Diona permit in Queensland.

Elixir holds 100% of ATP 2044 and sub-blocks A & B of ATP 2077 under the Grandis Gas Project, with a certified contingent resource of approximately 1.7 to 3.0 trillion cubic feet equivalent (TCFe). Its appraisal well Daydream‑2, drilled in late 2023, intersected unexpected permeable Permian sandstone zones at around 4,200 m, flowing gas naturally to surface. Flow rates reportedly stabilised at approximately 1.3 million standard cubic feet per day (with peaks up to 2.3 mmscfd), establishing a potential deep tight-gas play in the region.

In early 2025 Elixir secured a farm‑in agreement with Santos’s subsidiary over permits ATP 2056 and ATP 2057, bringing a 50 % interest and adding about 1.2 TCFe to its resource position. That deal made Elixir the holder of the largest net acreage in the Taroom Trough and raised its total certified contingent resources to around 2.6 TCFe.

EMPEROR ENERGY

Emperor Energy is an Australian upstream oil and gas company whose operations are focused on exploration and development rather than current production. Its primary Australian asset is the 100%‑owned exploration permit Vic/P47 in the offshore Gippsland Basin, Victoria, encompassing the Judith Gas Field located approximately 40 km south of the Orbost Gas Processing Plant.

ENI

Eni Australia produces gas from Blacktip, is actively planning development of Petrel with potential tie‑ins to existing infrastructure, holds stakes in other undeveloped Bonaparte Basin permits (Verus, Blackwood, Evans Shoal), and complements its hydrocarbon operations with renewable energy investments and local community programmes.

Eni’s Australian oil and gas operations are concentrated in the offshore Bonaparte Basin and include both active production and undeveloped gas resources. Its primary producing asset is the Blacktip gas field, located about 300 km west-southwest of Darwin in Commonwealth waters (WA‑33‑L lease), which began production in 2009.

EOG RESOURCES

EOG’s Australia footprint consists exclusively of the WA‑488‑P permit offshore Western Australia, holding 100 % equity while advancing towards its first exploration well (Beehive‑1). No commercial production has occurred to date, and the project remains in the pre-drilling exploration and regulatory phase.

EQUINOR

Equinor’s footprint in Australia is restricted to historical and exploratory activity: it withdrew from drilling plans in the Great Australian Bight in early 2020 and holds one offshore Western Australia permit (WA‑542‑P), which remains undeveloped.

No commercial oil or gas production has ever commenced under Equinor in Australia. Following the Bight project exit, Equinor made no further capital investment toward drilling in Australia and retains no producing assets in-country.

EXXONMOBIL

ExxonMobil Australia operates a range of oil and gas projects that are integral to the country's energy supply. The company is involved in the exploration, production, and distribution of oil and natural gas, primarily through its Esso and Mobil brands. Its upstream operations are concentrated in the Bass Strait off the southeast coast of Victoria, where ExxonMobil and its joint venture partner BHP (now Woodside Energy) have produced oil and gas for over 50 years. These operations include offshore platforms, subsea facilities, and the Longford Gas Plants, which process crude oil and natural gas liquids for domestic and international markets.

The company also manages the Gippsland Basin Joint Venture, one of the most significant sources of natural gas in southeastern Australia. In addition to its legacy fields, ExxonMobil is working to extend the life of these resources through redevelopment and maintenance projects, including drilling new wells and upgrading infrastructure.

FALCON OIL & GAS

Falcon Oil & Gas Australia operates through its nearly wholly owned subsidiary, Falcon Oil & Gas Australia, which holds a 22.5 percent interest in three onshore exploration permits in the Beetaloo Sub‑basin in the Northern Territory (EP‑76, EP‑98 and EP‑117), covering over four million gross acres (approximately one million net acres). These licences are operated by Tamboran (B2) Pty Limited, with Falcon maintaining its minority stake while Tamboran leads drilling and production operations.

Falcon Australia is focused on the Shenandoah South pilot project, conducting appraisal and early production testing of the tight gas resource within the Amungee Member B‑shale. The Shenandoah South programme includes wells drilled under EP‑117 and EP‑98. Falcon takes a 5 percent participating interest in pilot wells SS1H, SS2H ST1, SS3H and SS4H.

FINDER ENERGY

Finder Energy, through its Australian subsidiary, focuses on upstream oil and gas exploration in the offshore North West Shelf. The company holds rights to two exploration permits—AC/P 61 and WA‑547‑P—that collectively span about 7,595 km² across the Dampier and Beagle sub‑basins and the Vulcan sub‑basin of the Bonaparte Basin, all within the Carnarvon Basin region of Western Australia. These exploration blocks are 100% owned by Finder and are considered highly prospective, with a portfolio of identified prospects, notably in the Dorado play trend.

One of the standout discoveries includes the Brees, Favre and Brady prospects within WA‑547‑P, which collectively are estimated to contain over 500 million barrels of recoverable oil (2U, P50 basis). The company has secured a three‑year suspension and extension of the licence’s primary term, now valid until 4 January 2027, which provides flexibility to pursue environmental clearances and secure farm‑out partners to fund drilling and seismic activity.

GALILEE ENERGY

Galilee Energy's primary asset is the Glenaras Gas Project, located within ATP 2019 in the western Galilee Basin. Galilee holds 100 percent equity and operates the project, which spans roughly 3,200 km². Extensive investment—over A$150 million—has supported more than 20 exploration wells and coreholes, over 700 km of reprocessed 2D seismic and a 3D seismic survey over the active multi‑well pilot. This infrastructure underpins an independently certified 3C contingent gas resource estimate of 5,314 petajoules in the Betts Creek Beds coal measures. The company is actively dewatering seams in its multi‑well pilot, with pressure data from wells such as Glenaras‑17A indicating progress toward critical desorption pressure. Gas to water ratios are improving, though commercial gas rates have not yet been consistently established.

GSPC (Gujarat State Petroleum Corporation)

GSPC’s footprint in Australia has been minimal and entirely exploratory, confined to equity interests in offshore exploration licences dating back nearly two decades. There are no ongoing operational developments or production activities tied to Gujarat State Petroleum Corporation in Australia today.

HISBISCUS PETROLEUM

Hibiscus Petroleum, through their wholly-owned subsidiary Carnarvon Hibiscus has interests in one licence located in the prolific oil and gas producing province of the Bass Strait of Australia.

The company also have a 9.34% interest in 3D Energi, a company listed on the Australian Stock Exchange. Through 3D Energi, Hibiscus have indirect exposure to five additional exploration licences.

HORIZON OIL

Horizon Oil completed the acquisition of a 25% non‑operated interest in the Mereenie oil and gas field in Australia’s Northern Territory, under development licences OL4 and OL5, in June 2024. It added approximately 6.4 million barrels of oil equivalent (2P reserves), more than doubling Horizon’s reserve base and increasing its net daily production by about 1,100 boepd. Central Petroleum operates the joint venture and handles gas sales under a joint marketing agreement with New Zealand Oil & Gas and Cue Energy Resources.

ICON ENERGY

Icon has 100% interest in, and is Operator of, the ATP 855 tenement and the basin-centred gas resource that it contains.

ATP 855 is located in the Cooper-Eromanga Basin on the eastern side of the Queensland and South Australian border. PRL's 33-49 are adjacent to ATP 855 on the western side of the border and both permits share part of the Nappamerri Trough. ATP 855 is located in the Nappamerri Trough, the largest of the six troughs within the Cooper Basin. The tenement covers the deepest part of the trough, containing the thickest sequence of Permian sediments in the entire Cooper Basin. It is within these sediments that a very large, unconventional, basin-centred gas resource has been discovered that extends across the entire tenement. ATP 855 occupies a total area of 1,679km².

INPEX

INPEX is best known for operating the Ichthys LNG project, one of the largest and most complex resource developments in the country. The project includes offshore central processing and floating production facilities located in the Browse Basin off Western Australia, an 890-kilometre gas export pipeline, and onshore processing facilities near Darwin in the Northern Territory. INPEX extracts natural gas and condensate offshore and transports it to the onshore facilities for processing and export. The company is also involved in exploration and appraisal activities in various parts of Australia and the Timor Sea, focusing on expanding its resource base. INPEX places strong emphasis on environmental management, stakeholder engagement, and sustainable development as part of its operations.

IPB PETROLEUM

IPB Petroleum is an Australian oil and gas exploration company focused on offshore assets in the Browse Basin, located off the northwest coast of Western Australia. The company holds interests in several permits in this region, with its primary asset being the WA-424-P permit, which includes the Idris gas and condensate discovery. IPB Petroleum's strategy centers on the exploration and potential development of hydrocarbon resources in underexplored areas of the Browse Basin. The company aims to attract partners to help fund exploration and appraisal activities, including potential drilling programs. IPB is in the early stages of its project lifecycle and does not currently operate any producing assets, instead focusing on advancing its portfolio through exploration success and farm-out agreements.

JADESTONE ENERGY

Jadestone Energy, a Singapore‑headquartered firm with a focus on the Asia-Pacific, holds several significant offshore oil and gas interests in Australian waters. Its portfolio in this region is centred on the North West Shelf oil project, where it operates non‑producing interests rather than acting as operator.

Across their assets, Jadestone has adopted a strategy of acquiring mature offshore fields from larger operators, applying hands-on cost efficiencies, and pursuing reserve extension opportunities. Its approach combines operational turnaround with strategic asset consolidation. While the company is known for its work in Southeast Asia—particularly developing the Akatara gas project in Indonesia—it treats Australia’s acquisitions as a core part of its production base and cash-flow profile.

KATO ENERGY

KATO Energy is an Australian company, focused on identifying and developing marginal oil fields in the North West Shelf of Australia. Kato Energy has been incorporated following a three-way merger, to combine 100% ownership of the Corowa and Amulet oil fields (our Foundation Fields), with the aim to expand further in the future.

Key to commercially developing the marginal oil fields is the ability to share infrastructure between each field. Significant work has been performed to design and understand the details of a mobile development concept, referred to as Honeybee. KATO will utilize the mobile “honeybee” solution which allows the company to de-risk any one field and reduce capital intensity by providing a highly mobile offshore operation.

KEY PETROLEUM

Key Petroleum's primary focus spans two major basins. In Queensland, the company holds interests in the Cooper–Eromanga Basin through permits ATP 920 and ATP 924. These licenses lie near established infrastructure such as the Inland Oil Refinery, and sit adjacent to producing fields like Cook, Cuisinier, and the Barrolka gas field. Geological evaluation has identified multiple play types in this region—including Jurassic oil and Permian–Triassic gas. Some earlier wells in these permits have produced oil on test, and the company continues to assess its potential resources as part of its exploration strategy.

In Western Australia, Key operates within the Perth Basin under the EP 437 permit, holding a 43.47% interest and serving as operator. The EP 437 area includes the Wye‑1 well, which encountered dry gas flowing at commercial rates from two sandstone reservoirs, along with oil shows—indicating a mixed hydrocarbon system and promising potential for further resource evaluation. The company is actively pursuing a well to test the Wye Knot prospect, aiming to delineate oil-bearing zones below the gas cap and explore deeper Permian targets.

KUFPEC

KUFPEC, a wholly owned subsidiary of Kuwait Petroleum Corporation established in 1981, has been active in Australian upstream oil and gas ventures for decades. Based in Western Australia, its Australian subsidiary KUFPEC Australia Pty Ltd holds interests across both producing and exploration assets.

A cornerstone of KUFPEC’s footprint is its role in the Wheatstone LNG project. As one of the original foundation partners, it holds approximately a 13.4% equity stake—making it the second-largest participant behind operator Chevron Australia. Wheatstone’s dual onshore LNG trains benefit from gas supplied via upstream permits, including WA‑46‑L, WA‑47‑L, and WA‑48‑L, in which KUFPEC retains stakes through its local subsidiaries. Production began in 2017, with expectations that KUFPEC’s sharing of throughput could approach 40,000 barrels of oil equivalent per day at full capacity.

LAKES BLUE ENERGY

Lakes Blue Energy NL, one of Australia’s longest-standing independent petroleum explorers, re-established itself on the ASX in 1985 and has since focused on unlocking gas resources across multiple regions, with a renewed emphasis on Victorian operations following the lifting of the state’s onshore exploration ban in 2021.

In Victoria, the company holds 100% of Petroleum Retention Lease 2 (PRL 2), which encompasses the Wombat and Trifon/Gangell gas fields within the Gippsland Basin. These fields contain independently certified contingent gas resources and have produced gas in the past. Regulatory approval was obtained to drill the Wombat‑5 well in June 2025. Drilling began on 1 August 2025, targeting the gas-rich Strzelecki Formation with expectations of an initial flow around 10 TJ/day, potentially scaling up to 20 PJ/year. Located near existing pipelines, the development could reach production relatively fast and cost-effectively, helping address Victoria’s ongoing gas supply shortfall.

Lakes has also advanced its Portland Energy Project, holding 100% interest in PEP 167 and PEP 175. This southwestern Victorian project targets conventional gas in the Eumeralla Formation. Historical drilling confirmed gas presence, and independent estimates suggest there may be as much as 8.3 trillion cubic feet recoverable from that formation alone.

MELBANA ENERGY

In Australia, Melbana Energy's focus remains on offshore exploration plays, primarily in the northern basins. A core part of its Australian footprint centers around the Beehive prospect contained within permit WA‑488‑P in the Joseph Bonaparte Gulf. Although Melbana identified this major carbonate build-up, known for its resemblance to giant fields in other regions, it sold the license to EOG Resources in 2021. As part of the transaction, Melbana retained contingent cash and royalty rights tied to future exploration success by EOG.

To expand its exploration potential in the same basin, Melbana secured two 100 % owned permits—WA‑544‑P and NT/P87—adjacent to Beehive. These cover shallow waters in the Timor Sea, southwest of Darwin, and host the Hudson prospect as well as the Turtle and Barnett discoveries. Initial assessments estimate that Hudson alone could contain roughly 395 million barrels of oil or 2,034 billion cubic feet of gas, though chances of success are modest. In February 2024, the National Offshore Petroleum Titles Administrator approved an 18-month suspension of work obligations, extending the permit terms to 2028. This gives Melbana breathing room to organize seismic surveys and plan exploration wells before committing to major expenditures.

MITSUI OIL & GAS

Mitsui Oil & Gas’s operations in Australia ar conducted through its subsidiary Mitsui E&P Australia (MEPAU).

Mitsui E&P Australia is the focal point for Mitsui & Co.’s upstream oil and gas business in the region. Growing over two decades, MEPAU has become one of Australia’s substantial energy producers, engaging across exploration, development, production, and emerging energy solutions.

Beyond conventional oil and gas, Mitsui is accelerating its transition into low-carbon solutions in Australia. MEPAU is leading the Cygnus CCS Hub in Western Australia’s Mid West, partnering with Wesfarmers to pilot CO₂ storage in depleted reservoirs—piloting began in February 2024 with injection of 50 tonnes of CO₂. MEPAU's subsidiary Outback Carbon is restoring degraded landscapes to generate Australian carbon credits, while broader Mitsui groups explore renewable hydrogen, ammonia, and related clean energy technologies in Australia.

MOSMAN OIL & GAS

Mosman Oil & Gas has shifted its strategic emphasis away from traditional oil production and toward exploration and development of helium, hydrogen, and hydrocarbons within Australia, particularly in Central Australia’s Amadeus Basin.

OMEGA OIL & GAS

Omega Oil and Gas was listed on the ASX in 2022, having acquired high quality acreage in a frontier basin.

Omega stepped into frontier areas targeting the Taroom Trough in Queensland’s Bowen Basin, a region long recognised for its potential but poorly understood at depth. Early successes at Canyon-1 and Canyon-2 have validated the company’s bold approach, proving both gas and oil potential in an exciting new energy province.

OMV

OMV first entered the Australian market in 1999 by acquiring Cultus Petroleum, which laid the groundwork for its exploration activities in both Australia and New Zealand.

OMV’s activity overall has been strategic rather than expansive in Australia. The company has maintained selective acreage in frontier regions, leveraged early-stage exploration successes in the Carnarvon Basin, and exited certain mature southern assets when it made commercial sense.

ORIGIN ENERGY

Origin Energy, an integrated Australian energy company, has historically played a significant role in the nation’s oil and gas sector by engaging in both upstream production and downstream energy services. Its most prominent oil and gas operations have included involvement in coal seam gas (CSG) fields, offshore production projects, and joint ventures.

Origin Energy’s current oil and gas operations are centered on managing legacy CSG asset production and fulfilling its role in the APLNG venture, while upstream exploration and conventional upstream ownership have been largely phased out. Its evolving focus places greater emphasis on maximizing returns from existing gas infrastructure, supporting the energy transition, and growing its customer energy services portfolio.

PETRONAS

Petronas, the Malaysian national oil and gas company, plays a significant role in Australia's LNG landscape, particularly through its involvement in the Gladstone LNG (GLNG) project in Queensland.

Petronas holds a 27.5% stake in the GLNG venture, a coal seam gas-to-LNG project developed in collaboration with Santos (30%, operator), TotalEnergies (27.5%), and KOGAS (15%). The plant, located on Curtis Island, began operations in 2015 and 2016. With two LNG trains, the facility boasts a combined production capacity of 7.8 Mtpa and reached a reported production plateau in 2024, producing around 101,000 barrels of oil equivalent per day.

Beyond equity ownership, Petronas—through its renewables arm Gentari—has joined forces with TotalEnergies to develop a 100 MW solar farm aimed at decarbonizing operations in the GLNG supply chain, specifically by supplying low‑carbon electricity to gas production and processing facilities in the Roma gas fields.

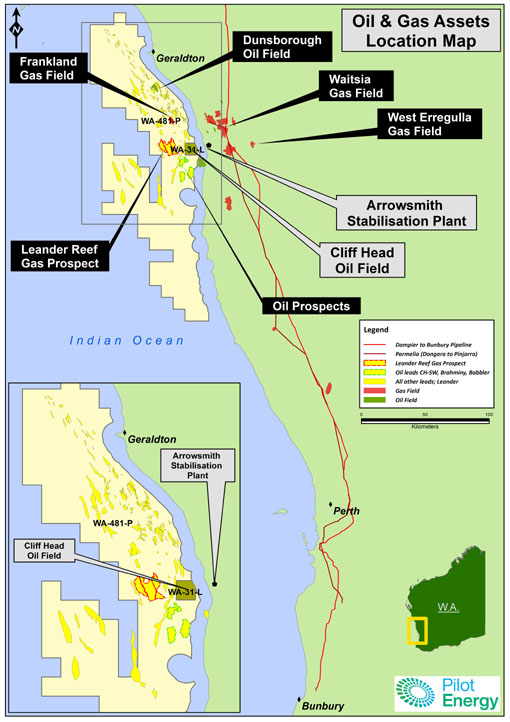

PILOT ENERGY

Pilot Energy is an ASX‑listed junior energy company based in Perth. It holds interests in two major petroleum assets offshore Western Australia. The company owns 21.25 percent of the Cliff Head oil field and associated infrastructure within exploration licence WA‑31‑L. Parallel to this, it has full, 100 percent working interest in the WA‑481‑P offshore exploration permit, a large prospect area north of Cliff Head with significant oil and gas potential.

At the Cliff Head oil field, Pilot’s initial stake has grown significantly following a series of agreements with Triangle Energy (Global). Originally a minority owner, Pilot negotiated to acquire the remaining 78.75 percent interest from Triangle in a structured agreement involving staged payments. Triangle received milestone payments and will benefit from future royalties tied to the project. The transaction, initially agreed in 2023, formally transferred state-jurisdiction (onshore and in‑state offshore) assets in mid‑2025, while Commonwealth‑jurisdiction parts remain subject to approval by regulators such as the National Offshore Petroleum Titles Administrator.

RED SKY ENERGY

Red Sky Energy's core Australian assets are located in South Australia. Its flagship project is the Killanoola Oil Project, which Red Sky acquired from Beach Energy in early 2021. Killanoola lies in the onshore Otway Basin under PRL‑13, and its discovery dates back to 1998. Early flow testing from the original well—Killanoola‑1 DW‑1—revealed production of up to 300 barrels per day. A subsequent sidetrack, Killanoola SE‑1, completed in 2011, uncovered thicker pay zones, with later petrophysical analysis identifying up to 37 metres of oil-bearing Sawpit Sandstone—well above earlier expectations. Independent estimates later raised the petroleum initially in place (PIIP), with the best estimate climbing to about 135 million barrels by April 2023. Red Sky secured a crude oil sale agreement with Viva Energy in August 2023, targeting delivery of all production to Viva’s Geelong refinery once government approvals were in place. Preparations for extended production testing commenced by the end of 2023, including some initial flow—even though operations faced delays when a downhole pump failure occurred, prompting a more conventional workover approach planned for 2024.

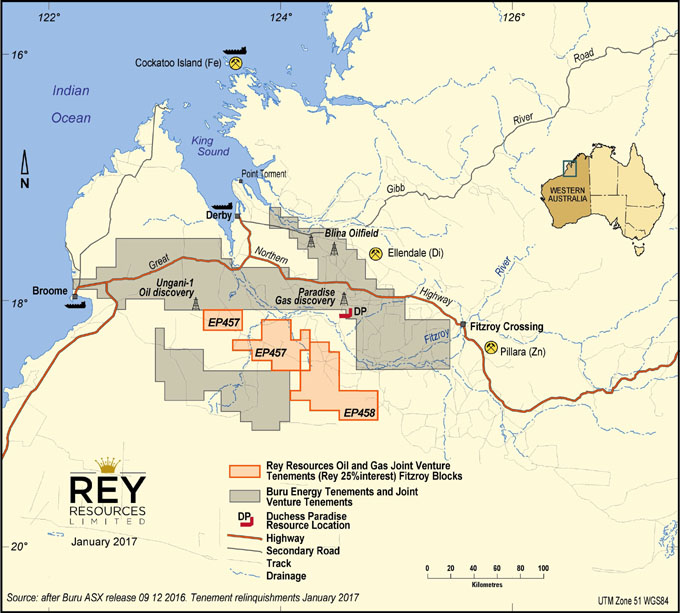

REY RESOURCES

Rey Resources is focused on exploring and developing energy resources in Western Australia’s Canning Basin.

In the Canning Basin, Rey holds a 100% interest in the Derby Block (EP487), encompassing approximately 5,020 square kilometers. Additionally, the company possesses a 40% interest in two prospective petroleum exploration permits, EP457 and EP458, known as the Fitzroy Blocks. Rey also owns a 100% interest in EP104, Retention Licence R1, and Production Licence L15, collectively referred to as the Lennard Shelf Blocks.

ROC OIL

Roc Oil Company Pty Limited, established in Sydney in 1997 and once listed on the ASX, has evolved into one of Australia’s leading independent upstream oil and gas firms. Although now privately held under Fosun International via Hainan Mining, the company maintains operational activities in Australia alongside its international ventures.

Roc Oil maintains its position as a fully integrated upstream operator in Australia—spanning exploration, appraisal, development, and production. While its major Australian assets such as Cliff Head and Ungani are now legacy operations, the company’s broader infrastructure and expertise remain ready to support new opportunities should the strategy evolve.

SANTOS

Santos is an Australian energy pioneer who have discovered, developed and delivered natural gas to the people of Australia and Asia for more than 60 years.

Five core long-life natural gas assets sit at the heart of a clear and consistent strategy to Transform, Build and Grow the business: Western Australia, the Cooper Basin, Queensland and NSW, Northern Australia and Timor-Leste, and Papua New Guinea. Each core asset provides stable production, long-term revenue streams and significant upside opportunities.

With origins in the Cooper Basin, Santos has one of the largest exploration and production acreages in Australia and extensive infrastructure. Their strategy is centred on five core, long-life natural gas and LNG assets. These assets support the company's aim to be a leading Australian domestic gas supplier and a major LNG exporter supplying clean energy to Asia.

SENEX ENERGY

Senex Energy, now privately owned by POSCO International and Gina Rinehart's Hancock Prospecting, is focused exclusively on natural gas development in Queensland’s Surat Basin. Senex Energy, now privately owned by POSCO International and Gina Rinehart's Hancock Prospecting, no longer operates in oil and is focused exclusively on natural gas development in Queensland’s Surat Basin.

The company’s foundational Atlas asset was the first in Australia dedicated to domestic supply. Since acquiring the project, Senex has invested heavily—including more than A$1 billion—to expand production capacity to 60 petajoules per year by the end of 2025. That volume would supply over 10 % of east coast domestic gas demand and about 40 % of Queensland’s needs.

SHELL

Onshore, the company’s dominant platform is QGC (Queensland Gas Company), a Shell majority‑owned subsidiary that extracts coal‑seam gas from the Surat and Bowen Basins in Queensland. QGC channels gas both to domestic markets and to Shell’s Queensland Curtis LNG (QCLNG) plant on Curtis Island near Gladstone. Through QGC’s field wells, compression stations, and processing infrastructure, Shell delivers a substantial share of Queensland domestic gas demand—roughly 40%—and over 10% of east coast demand, amounting to more than 75 PJ per year.

Shell also holds a 50 % stake in Arrow Energy, a joint venture with PetroChina. Arrow is developing the large-scale Surat Gas Project (SGP), aimed at commercialising around five trillion cubic feet of coal‑seam gas. Phase 1, approved in 2020, included more than 600 wells. Phase 2 (SGP North), sanctioned in August 2024, is expected to add around 130 TJ/day (about 22,400 barrels of oil equivalent per day), with first gas targeted in 2026. That gas will support both long‑term domestic gas contracts and QCLNG exports.

Offshore, Shell is actively involved in several major projects. It is the operator of the Prelude FLNG facility in the Browse Basin, holding 67.5 % equity. The floating LNG unit processes gas from the Prelude and Concerto fields and is capable of producing several million tonnes of LNG annually. Despite interruptions from cyclones, safety incidents, and maintenance, Prelude remains one of Shell’s flagship offshore assets. Additionally, Shell operates the Crux development—another Browse Basin gas field—whose environmental plan was approved by NOPSEMA in March 2025. Crux entails installation of pipelines and subsea infrastructure through to 2027, underpinning ongoing offshore gas expansion efforts.

Shell also holds minority stakes in two major LNG ventures: a 16.67 % interest in the North West Shelf (NWS) Venture operated by Woodside, and a 25 % stake in Chevron‑led Gorgon LNG. The Browse joint arrangement (fields such as Brecknock, Calliance, and Torosa) gives Shell an additional 27 % equity share, with Woodside as operator. The Bratwurst field—a 100 % Shell offtake—is under evaluation as potential LNG backfill feedstock.

STRIKE ENERGY

Strike Energy’s operational focus is within the Perth Basin, highlighting key exploration activities around fields such as South Erregulla and West Erregulla, all situated in Western Australia. Their transformation from explorer to producer has been swift and strategic, underpinned by multiple drill targets, resource successes, and a gas acceleration strategy supported by state policy.

TALON ENERGY

Talon Energy, listed on the ASX under ticker TPD, operates primarily as a gas explorer and developer with two strategic energy-focused assets. Their key operation lies within the Perth Basin, where the Walyering conventional gas project has advanced from exploration to near-term production. Talon holds a 45 percent interest, with operator Strike Energy owning the remaining 55 percent. A final investment decision was taken in 2022, following independent certification of approximately 54.2 PJ in 2P reserves, and development capex estimated at roughly A$14 million (Talon’s share around A$6.4 million). The field is connected to the nearby Parmelia Pipeline, facilitating fast-track sales into the domestic WA gas market. First gas sales were targeted for Q1 2023, and by mid-2023 the plant was reportedly close to mechanical completion with commissioning imminent alongside off-take arrangements including Santos under a five-year take-or-pay agreement for 36.5 PJ through 2028.

TAMBORAN RESOURCES

Tamboran Resources holds the largest operated position in Australia’s Beetaloo Basin—around 1.9 to 2 million net acres across key exploration permits such as EP 76, 98, 117, 136, 143, and 161. Operations in this unconventional gas play leverage modern shale drilling and completion technologies drawn from North American expertise, including a U.S.-sourced drilling rig consortium, aiming to advance commercial production with net-zero Scope 1 and 2 emissions ambitions.

Tamboran's strategic focus includes both pilot and broader development phases. The Shenandoah South Pilot Project, on EP 98/117, is central to initial gas production, targeting first gas in mid-2026. A binding Gas Sales Agreement has been secured with the Northern Territory Government for delivering 40 TJ per day from 2026 with options for extension, alongside binding pipeline agreements with APA Group to build and operate the Sturt Plateau Pipeline, connecting Tamboran’s facilities to the Amadeus Gas Pipeline.

TotalEnergies

TotalEnergies maintains a diversified and integrated presence across Australia’s energy sector, spanning oil and gas infrastructure, renewable energy, energy storage, hydrogen development, and nature-based climate solutions. In oil and gas, the company holds a 26% stake in the Ichthys LNG project, an integrated offshore-to-onshore operation that extracts gas and condensate from the Browse Basin, processes it via a subsea pipeline nearly 900 km long, and liquefies it in Darwin with an output of 8.9 Mt per annum. Additionally, TotalEnergies owns 27.5% of the Gladstone LNG (GLNG) project in Queensland, which processes coal seam methane from fields like Fairview, Arcadia, Roma, and Scotia into LNG via two trains, collectively capable of 7.8 Mtpa, connected by a 400 km pipeline.

Beyond hydrocarbons, TotalEnergies is scaling up renewable energy capacity in Australia. The Kiamal Solar Farm in Victoria delivers 256 MWp of solar power and hosts Australia’s largest synchronous condenser unit. Looking ahead, there's a pipeline of nearly 2 GW across solar, wind, and storage projects—including the approved Middlebrook Solar Farm and BESS project in New South Wales (320 MW PV + up to 780 MWh BESS).

TotalEnergies H2 Australia—a joint venture with the Eren Groupe—is spearheading green hydrogen and renewable initiatives: the Darwin H₂ Hub aims to produce over 80,000 tonnes of green hydrogen annually, while the South East Power Hub (SEPHR) proposes up to 600 MW of dispatchable renewable energy to power around 370,000 South Australian homes.

Tri-Star Petroleum

Tri-Star Petroleum Company, part of the family-owned Tri-Star Group, has played a key role in developing Australia's gas and petroleum sector. The company was specifically established in 1988 to pursue oil and gas opportunities across Australia, setting up its Brisbane office in 1990. Just four years later, its exploration in Queensland’s Bowen Basin led to the discovery of major natural gas reserves.

Key Projects & Assets:

In the Australian Petroleum & Coal division, Tri-Star currently manages several core assets:

Gilbert Gully – A coal seam gas (CSG) appraisal block in Queensland targeting the Walloon Coal Measures; features an independently certified resource of 783.2 BCF

Nightingale – Located in South Australia's Eromanga Basin, this project targets a conventional oil play potentially extending the Cooper Basin’s western flank

Stonecroft – A greenfield CSG exploration venture over 2,024 km² in Queensland’s Bowen Basin; plans include drilling stratigraphic wells into the Moolayember Coal Measures

Omega – Tri-Star has an equity interest in ASX-listed Omega Oil & Gas Ltd., whose core Canyon asset is a deep Permian gas and oil play in Queensland’s Taroom Trough. Tri-Star supports Omega through board representation, technical committees, and a services agreement

Vermilion

Vermilion entered Australia in 2005 by acquiring a 60% operated interest in the Wandoo field. The Wandoo field is located approximately 80 km off the northwest shelf of Australia.

In 2007, Vermilion acquired the remaining 40% interest. Production is from two operated off-shore platforms, one of which (Wandoo B) is permanently staffed. Since acquiring the Wandoo asset, Vermilion has conducted a number of drilling campaigns with the long-term goal of managing production volumes to targets while meeting long-term supply requirements of our customers. Many of the wells drilled at Wandoo are extreme long-reach lateral wells. While having true vertical depths of only 600 metres, two recently sidetrack wells have measured depths of nearly 3,000 metres and 3,800 metres, respectively.

Vintage Energy

Vintage Energy's core producing assets are in the Cooper Basin, where the Vali and Odin gas fields supply contracted gas to major customers. Vali, located in ATP 2021 in Queensland and discovered in 2020, began delivering gas to AGL in February 2023 under a long-term agreement, with proven and probable reserves of around 101 petajoules and expected deliveries of 9 to 16 petajoules through to the end of 2026. Odin, in PRL 211 in South Australia and discovered in 2021, started supplying gas to Pelican Point Power in September 2023 under a contract with ENGIE–Mitsui. Production has been enhanced by optimisation at Odin-1 and the commissioning of Odin-2 in late 2024, which significantly increased total field output. Beyond production, the company has secured a six-year extension for ATP 2021 in Queensland, enabling further exploration of more than 20 oil prospects and several gas leads. Vintage also holds assets in the Otway Basin, including PRL 249 and the Nangwarry carbon dioxide discovery, which could support industrial CO₂ sales. Additional exploration interests include the Galilee Basin, where the Albany wells have shown measurable gas flows, and the Bonaparte Basin, where it holds 100 percent of EP 126 with potential oil and gas targets. Through these operations and permits, Vintage Energy has transitioned from an exploration-focused junior to an active producer with a portfolio that supports both current gas supply and future development potential.

WESTERN GAS

Western Gas, a nimble and well-structured WA-based independent, is seeking to capitalise on Australia’s most significant gas region, the Carnarvon Basin. With its substantial Equus gas and condensate resource, proven exploration success, and strategic agreements with established LNG plants, the company is positioning itself as a key player in filling anticipated domestic and export gas demand.

Focus & Portfolio

Western Gas is a Western Australian company dedicated to exploring and fast-tracking the commercialisation of its Equus Gas Project, an independently certified resource estimated at 2 trillion cubic feet of gas and 42 million barrels of condensate.

Whitebark Energy

Whitebark owns the Warro Gas Project located about 200 kilometres north of Perth in Western Australia. This onshore tight gas field is estimated to contain between 4.4 and 11.6 trillion cubic feet of gas in place. The Warro asset is currently in care and maintenance while the company pursues a divestment process, driven in part by regulatory uncertainty over hydraulic fracturing in the state. While these oil and gas operations remain in the portfolio, Whitebark has increasingly shifted its strategy toward geothermal energy and green hydrogen development, marking a transition toward renewable energy alongside its conventional resource base.

Woodside

Woodside Energy is Australia’s largest oil and gas producer, operating a range of significant upstream and downstream projects across the country. Its legacy began in the 1950s in the Gippsland Basin and expanded significantly in the early 1970s with major offshore gas discoveries in Western Australia.

One of its flagship assets is the North West Shelf Project, Australia’s largest resource development, which involves extracting natural gas offshore and processing it at the Karratha Gas Plant on the Burrup Peninsula. The project supplies up to 15% of Western Australia’s gas needs and exports the rest as LNG, with Woodside acting as both operator and substantial stakeholder following its merger with BHP Petroleum in 2022. In May 2025 the federal government approved an extension of this project’s operations through to 2070, a decision that sparked environmental and cultural concerns.

Woodside also operates the Pluto LNG facility on the Burrup Peninsula, which has been producing LNG since 2012 from the Pluto A offshore platform. A second LNG train, enabled by the future development of the Scarborough gas field, is currently under construction and expected to begin production around 2026. The Scarborough project is a major development offshore Western Australia, involving multiple subsea wells tied back via pipeline to the Pluto plant.

Additions to Woodside’s domestic oil portfolio include operated and non-operated assets such as the Enfield, Vincent, and Pyrenees oil fields offshore Western Australia. It also holds interests in the Bass Strait region and contributes to projects like Wheatstone LNG.

In eastern Australia, Woodside is part of a joint venture in the Gippsland Basin, partnering with ExxonMobil (Esso Australia) in fields like Turrum and North Turrum. A final investment decision has been approved to drill five new wells under the Turrum Phase 3 project by 2027, aimed at sustaining domestic gas supply past 2030.

News archive: Australia l KeyFacts Energy: Country Profile

KEYFACT Energy

KEYFACT Energy