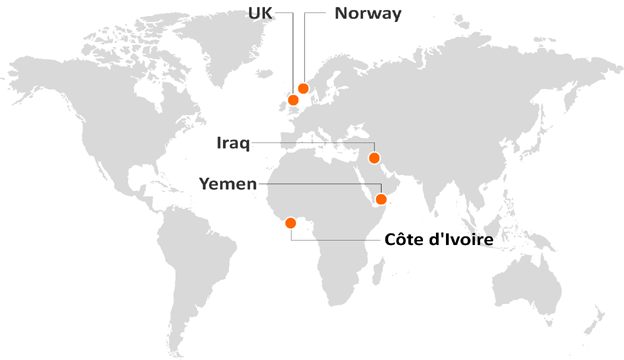

DNO ASA is a Norwegian oil and gas operator active in the Middle East, the North Sea and West Africa. Founded in 1971 and listed on the Oslo Stock Exchange, the Company holds stakes in onshore and offshore licenses at various stages of exploration, development and production in the Kurdistan region of Iraq, Norway, the United Kingdom, Côte d’Ivoire, Netherlands and Yemen.

History

DNO are Norway's oldest oil and gas company. Their 53-year history has taken them from the North Sea to the Middle East. The company was founded in 1971 by a group of young, adventurous shipowners and industrial leaders, just as Norway’s oil adventure was taking off.

Since then, DNO has continued to attract the type of people who are willing to take chances, venturing into new activities and new geographic areas, both onshore and offshore. DNO has been an oil and gas explorer with a global mindset from the start. Following forays into the Norwegian and UK sectors of the North Sea and later East and West Africa, DNO evolved into a significant Middle East player.

DNO kicked off its activities in the Middle East with its entry into Yemen in 1998. In 2004, DNO were the first international oil company to enter the Kurdistan region of Iraq, at a time when the Kurdish region’s oil industry was virtually non-existent.

DNO re-entered the North Sea with the acquisition of offshore exploration and production licenses in Norway and the UK commencing in 2017. Additional offshore exploration and producing assets offshore Côte d'Ivoire followed in 2022.

In March 2025, DNO reached agreement to acquire 100 percent of the shares of Sval Energi Group AS from HitecVision for a cash consideration of USD 450 million based on an enterprise value of USD 1.6 billion.

The Sval Energi assets are complementary to DNO’s North Sea portfolio and will add scale and diversification to solidify the Company’s position as a leading listed European independent oil and gas company.

OVERVIEW OF OPERATIONS

North Sea (Norway and UK)

Since re-entering the North Sea in 2017, DNO has been one of the most active and successful explorers on the Norwegian Continental Shelf.

In June 2025, DNO completed a transformational acquisition of Sval Energi Group AS that brought scale, diversification and balance to the Company.

The acquired portfolio comprises 16 producing fields in Norway, quadrupling DNO’s North Sea production to 80,000 barrels of oil equivalent per day (boepd). On a yearend 2024 pro forma basis including Sval Energi, the Company’s North Sea proven and probable (2P) reserves swell to 189 million barrels of oil equivalent (MMboe), also a fourfold increase. Contingent resources (2C) total 316 MMboe.

Following the acquisition, Norway and the United Kingdom represent nearly 60 percent of the Company’s global production and about 45 percent of its global reserves, with the balance predominantly in the Kurdistan region of Iraq.

Supported by ongoing field development projects with multiple discoveries currently being matured for project sanction, DNO is well placed to grow North Sea production organically in the years ahead. The combined North Sea 2P reserves and 2C resources equal 15 years of production at the current run rate.

Prior to the acquisition, DNO’s North Sea net production averaged 15,201 boepd in 2024, up from 14,203 boepd in 2023. Of the total, 13,057 boepd were attributable to Norway and 2,144 to the UK (13,926 boepd and 277 boepd, respectively, in 2023).

DNO is taking part in four ongoing North Sea field development projects expected to come online between 2025 and 2028 that represent proven and probable reserves of 26.2 MMboe net to the Company. These are Andvare (32 percent), Bestla (39.2 percent), Verdande (10.5 percent) and Berling (30 percent). In addition, DNO continued to mature other discoveries towards project sanction.

Reserves: At year-end 2024, DNO held 85 licenses in Norway in various stages of exploration, development and production (73 licenses at year-end 2023). Across its Norway portfolio and on a net basis, DNO’s 1P reserves totaled 27.7 MMboe, 2P reserves stood at 44.9 MMboe, 3P reserves totaled 66.0 MMboe and 2C resources stood at 144.0 MMboe. The comparable year-end 2023 figures were 1P reserves of 23.7 MMboe, 2P reserves of 34.8 MMboe, 3P reserves of 49.0 MMboe and 2C resources of 132.0 MMboe. In 2024, reserves in Norway increased with the sanctioning of the Bestla field development and the acquisition of Norne area assets.

In the UK, DNO held seven licenses at yearend 2024 (four licenses at year-end 2023). On a net basis, 1P reserves totaled 1.9 MMboe, 2P reserves stood at 2.8 MMboe, 3P reserves totaled 4.1 MMboe and 2C resources of 22.1 MMboe at year-end 2024. The comparable yearend 2023 figures were 1P reserves of 0.1 MMboe, 2P reserves of 0.3 MMboe, 3P reserves of 0.4 MMboe and no 2C resources, all on a net basis. The increase in reserves and resources was due to both the acquisition of the Arran field and the inclusion of the license containing the Agar discovery, the latter formally allocated to DNO in February 2024.

Kurdistan region of Iraq

The DNO-operated Tawke license, containing the Tawke and Peshkabir oil fields, continues to be a core asset for DNO and for Kurdistan.

Tawke license

Both the Tawke field (discovered in 2006) and Peshkabir field (discovered in 2012) are characterized by complex structural geology. While the Tawke field predominantly features the Cretaceous Bekhme and Qamchuqa formations, with some contributions from the younger Tertiary Jeribe formation, hydrocarbons from the Peshkabir field reside in the Cretaceous Shiranish and also Qamchuqa formations. All these formations are characterized as naturally fractured carbonate reservoirs containing medium gravity crude.

Gross production from the Tawke license averaged 78,615 barrels of oil per day (bopd) during 2024 (46,276 bopd in 2023). The Tawke field contributed 29,153 bopd (26,577 bopd in 2023) and the Peshkabir field contributed 49,462 bopd (19,699 bopd in 2023). Gross Tawke license production was up 70 percent year-on-year as output was held steady in 2024 following the disruptions caused by the closure of the Iraq-Türkiye Pipeline (ITP) export route in 2023.

DNO sold its oil at its Fish Khabur terminal as the ITP remained shut. Maintaining strict capital spending discipline, DNO drilled no new wells on the Tawke license in 2024. Notwithstanding, output was kept at a high level by bringing three previously drilled wells onstream, by workovers and interventions on more than 20 other wells across the license, and by gas injection into the Tawke field.

DNO holds a 75 percent operated interest in the Tawke license with partner Genel Energy International Limited holding the remaining 25 percent.

Reserves: On a net basis at year-end 2024, 1P reserves in the Company’s Kurdistan portfolio totaled 142.8 MMbbls (175.1 MMbbls at

year-end 2023), 2P reserves totaled 224.9 MMbbls (244.5 MMbbls at year-end 2023) and 3P reserves totaled 257.9 MMbbls (298.0 MMbbls at year-end 2023). Net 2C resources were 59.5 MMbbls, unchanged from year-end 2023 level.

The Company’s Kurdistan reserves relate entirely to the Tawke license. Out of the net 2C contingent resources in the Kurdistan

portfolio, the Baeshiqa license represented 38.1 MMbbls (39.1 MMbbls at year-end 2023).

Baeshiqa license

On DNO’s other Kurdistan license, Baeshiqa, 2024 gross operated production averaged 5 bopd (224 bopd in 2023). The 2024 production resulted from well testing programs conducted in the fourth quarter of the year. Based on the test results, DNO took a partial impairment on the asset and is currently minimizing running costs while determining its future work program.

DNO holds a 64 percent operated interest in the Baeshiqa license (80 percent paying interest) with partners including the Turkish Energy Company Limited (TEC) with a 16 percent interest (20 percent paying interest) and the Kurdistan Regional Government (KRG) with a 20 percent carried interest.

Côte d'Ivoire

DNO entered West Africa in October 2022 by acquiring stakes in producing gas assets offshore Côte d'Ivoire.

In October 2022, DNO acquired Mondoil Enterprises LLC and its 33.33 percent indirect interest in privately-held Foxtrot International LDC whose principal assets are operated stakes in offshore production of gas and associated liquids in Côte d'Ivoire. In 2024, these assets contributed 3,103 barrels of oil equivalent (boepd) of net production from equity accounted investment (3,513 boepd in 2023).

Foxtrot International holds a 27.27 percent interest in and operatorship of Block CI-27 containing the country’s largest reserves of gas, produced together with condensate and oil, from four offshore fields tied back to two fixed platforms, meeting more than three-quarters of the country’s gas needs.

In addition to the Foxtrot gas field, which began production in 1999, Block CI-27 contains the Mahi gas field, developed in 2012, the Manta gas field which began production in 2016 and the Marlin oil and gas field placed on production in the same year. Gas produced from these fields is transported by pipeline to fuel power stations in Abidjan pursuant to a gas sale and purchase (take-or-pay) agreement put into force in June 1999 and since extended.

Reserves: In West Africa, DNO held year-end 2024 1P reserves of 6.4 MMboe, 2P reserves of 9.4 MMboe, 3P reserves of 12.0 MMboe and 2C resources of 5 MMboe. The comparable year-end 2023 figures were 1P reserves of 7.6 MMboe, 2P reserves of 10.5 MMboe, 3P reserves of 13.2 MMboe and 2C resources of 8.6 MMboe, all on a net basis.

Yemen

Production start-up at the Yaalen field at Block 47 in Yemen, currently under force majeure, remains on hold. At year-end 2024, 2C resources at Block 47 stood at 4.8 MMbbls on a net basis, unchanged from yearend 2023.

2024 operational highlights

DNO recorded 2024 revenues of USD 667 million on the back of stellar production in the Kurdistan region of Iraq in a year also marked by continuing North Sea expansion. Net production climbed nearly 50 percent year-on-year to 77,300 barrels of oil equivalent per day (boepd), to which Kurdistan contributed 59,000 boepd, North Sea 15,200 boepd and West Africa 3,100 boepd.

At Kurdistan’s Tawke license (75 percent and operator), DNO increased gross production from the Tawke and Peshkabir fields by nearly 70 percent year-on-year to 78,600 boepd, with oil sold at its Fish Khabur terminal as the Iraq-Türkiye export pipeline remained shut in. Sales prices averaged USD 35 per barrel with payments deposited into DNO’s international bank accounts ahead of deliveries.

In 2024, DNO took steps to expand its North Sea business by acquiring a 25 percent interest in the producing Arran field in the United Kingdom and interests in four producing fields and one development asset in the Norne area offshore Norway. Following these acquisitions and restart of production at the Trym field following a five-year shutdown, DNO’s North Sea production climbed to 19,000 boepd in the fourth quarter of the year.

DNO is taking part in four ongoing North Sea field development projects expected to come online between 2025 and 2028 that represent proven and probable reserves of some 30 million barrels of oil equivalent (boe) net to the Company. Among the exploration highlights in a year of multiple discoveries was the play-opening Othello light oil discovery (50 percent and operator), Norway’s second largest find in 2024.

Leadership

Chris Spencer, Managing Director

Erlend Einum, Chief Business Development Officer

Halvor Engebretsen, Managing Director, DNO Norge AS

Tonje Pareli Gormley, Group General Counsel

Sameh Hanna, General Manager, Middle East

Linn Hoel, Chief Commercial Officer

Haakon Sandborg, Chief Financial Officer

Geir Arne Skau, Chief Human Resources and Corporate Services Officer

Erling Moen Synnes, Chief Information Officer

Kjersti Kaurin, Corporate Counsel and Secretary

Contact

DNO ASA (Oslo Headquarters)

Dokkveien 1, 0250 Oslo

P.O. Box 1345 Vika, 0113 Oslo, Norway

Email: dno@dno.no

Tel: +47 23 23 84 80

DNO Norge AS/ DNO North Sea (Norge) AS (Stavanger Office)

Badehusgata 37, 4014 Stavanger

P.O. Box 404, N-4002 Stavanger

Norway

Tel: +47 23 23 84 80

DNO Technical Services AS (Dubai Office)

Office 1201, Boulevard Plaza 2, P.O Box 25353, Downtown Dubai, United Arab Emirates

Tel: +47 23 23 84 80

KEYFACT Energy

KEYFACT Energy