WTI (Oct) $62.26 +39c, Brent (Nov) $66.02 +52c, Diff -$3.09 +4c

USNG (Oct) $3.09 +4c, UKNG (Oct) 81.2p, TTF (Oct) €33.12 +€0.7

Oil price

Oil rallied yesterday but was on the tracks to be higher after the better than expected result from the Opec meeting but with the Saudis cutting prices to Asian and NW European clients it lost the highs.

Today it is a dollar to the good after news of an attack on Hamas leaders in Doha was deemed to be inflammatory…

Diversified Energy Company

Diversified has announced that it has entered into an agreement to acquire Canvas Energy for total consideration of approximately $550 million. The Acquisition adds complementary operated producing properties and acreage positions in Oklahoma, concentrated in Major, Kingfisher, and Canadian Counties. Included in the Acquisition are approximately 23 high quality wells that have been turned to sales in the last 12 months.

The Acquisition complements Diversified’s existing Oklahoma asset portfolio and is underpinned by high EBITDA margins(a) of ~70%, contributing an estimated $155 million of NTM Adjusted EBITDA(c) before any anticipated synergies. Diversified’s established integration playbook and corporate infrastructure are anticipated to unlock significant and sustainable value with fast, effective and efficient integration. Familiarity with the asset base and the combined operational density provides for significant expense saving opportunities supporting Diversified’s cash flow optimization focus.

TRANSACTION HIGHLIGHTS

- Purchase price of ~$550 million with a purchase price multiple of ~3.5x on NTM EBITDA(c)

- Current net production of ~147 MMcfepd (24 Mboepd)(b)

- ~13% increase to stand alone Diversified(b)

- Proved PV-10 of ~$690 million(h), and ~200 MMBoe of Total Reserves(g)

- Estimated NTM EBITDA of ~$155 million(c), before anticipated synergies

- ~18% & ~29% expected increase in Adj. EBITDA and Free Cash Flow, respectively

- Anticipate meaningful annual run rate synergies

- Significant operational overlap in Central Oklahoma, with a combined ~1.6 million net acres

- Acquisition includes commercially attractive undeveloped acreage with meaningful development locations, providing optionality for portfolio optimization activities

- Purchase price to be funded through a privately rated bilaterally structured asset-backed securitization originated by Carlyle, existing liquidity, and issuance of ~3.4 million Diversified shares to the Seller with an expected close of the Acquisition during the fourth quarter of 2025

| USD Millions unless otherwise noted | Diversified | Canvas |

| Current Production (MMcfe/d)(b) | ~1,135 | ~147 |

| Commodity Mix | ~73% Natural Gas ~27% Liquids | ~43% Natural Gas ~57% Liquids |

| 2025E Adj. EBITDA / NTM EBITDA(c) | ~$850 | ~$155 |

| 2025E Free Cash Flow / NTM FCF(d) | ~$420 | ~$123 |

| EV/2025E Adj. EBITDA / NTM EBITDA(e) | ~4.5x | ~3.5x |

| Leverage(f) | 2.6x | 0.6x |

| PV-10 of Total Proved Reserves(g) | ~$5.8 Billion | ~$1.4 Billion |

| PV-10 of PDP(h) | ~$5.4 Billion | ~$0.7 Billion |

The Acquisition is, in the Board’s opinion, in the best interests of the shareholders of the Company as a whole.

Commenting on the Acquisition, CEO Rusty Hutson, Jr. said:

“This purchase strengthens Diversified by further expanding our footprint in our Oklahoma operating area with targeted assets that are a perfect fit for increasing our scale, allowing for synergy capture and providing meaningful opportunities for margin enhancement, that ultimately will grow and bolster our cash flow. We are excited to leverage our strategic partnership with Carlyle for funding accretive acquisitions and are pleased with the collective team’s collaboration. This initial transaction serves as an important milestone in our relationship and we look forward to growing our combined portfolio of high quality assets. Importantly, this acquisition extends our proven track record of acquiring cash generating energy assets at attractive valuations. We remain committed to our capital allocation strategy and believe the accretive nature of this transaction on per share metrics creates significant long-term value for shareholders.”

Pardon me boy, is that the acquisition special? This looks like another beauty for Rusty and the team who have plucked a highly accretive deal out of the adjacent acreage and makes Oklahoma even more of Diversified’s back yard than before.

Indeed this deal ‘complements Diversified’s existing Oklahoma asset portfolio’ and what I like most of all is that it is underpinned by EBITDA margins of c.70%, up there and above some of DEC’s own margin before synergies.

Looking closely at the statement the numbers here don’t include any synergies although Rusty alluded to them in the webcast. I think that given what we have been told there won’t be much G&A carried forward and that there could be substantial and meaningful synergies yet to be established and certainly not in the valuation paid.

The deal is funded by cash (c.$100m), and DEC shares (c.$50m worth) and with Carlyle putting funding in place (c.$400m) the strategic partnership has its first major outing and with some ABS funding which is comfortable to all parties.

I expect also to see some further accretion from what is a decent portfolio of undeveloped acreage and that can be used as a steady feed of added value as and when the company elects to pick that fruit.

The shares today are up 5% at 1160, over 6 months are up 31% and 36% y/y, to me there is still huge potential upside for the shares especially as US investors get to like deals like this and of course like me, just love the DEC model. I remain a committed follower and the Bucket List is better off with it in there.

TRANSACTION CONSIDERATION

The Acquisition will be funded through a combination of the issuance of approximately 3.4 million new U.S. dollar-denominated ordinary shares direct to the Seller, a privately rated and bilaterally structured asset-backed securitization originated by Carlyle of up to $400 million supported by the Assets, along with the balance in cash from existing liquidity under the Company’s borrowing capacity, subject to any purchase price adjustments. The ordinary shares will be subject to a customary commercial registration lock-up agreement. The Company expects to close the Acquisition during the fourth quarter of 2025.

Challenger Energy Group

Challenger has provided the following operational and corporate update.

Highlights

- Uruguay, AREA OFF-3:

- The first phase of the Company's technical work programme has successfully been completed, with multiple new seismic attribute supported anomalies identified

- Material aggregate resource potential from two primary prospects, comprising a best estimate (Pmean) of ~380 million barrels oil recoverable, and an upside (P10) case of ~980 million barrels oil recoverable

- Shallow water and reservoir depths of these primary prospects underpin relatively low development costs, and thus commerciality at even modest discovery volumes

- Considerable additional exploration potential, including possible slope turbidite and low stand fan play exposure in the north-east of the block

- The planned farmout process for AREA OFF-3 has commenced

- Uruguay, AREA OFF-1:

- 3D seismic acquisition expected to commence in late 2025, pending final environmental permitting

- Corporate:

- Sale of the Company's Trinidad and Tobago business has been finalised, resulting in a complete exit from all operations and exposures in that country

- The Company reports a strong cash position, with all planned operations fully-funded into 2027

Eytan Uliel, CEO of Challenger Energy, said:

“There is strong momentum across our business as we continue to execute our plan – advancing exploration activities in Uruguay, optimizing our portfolio, and continuing to execute on our business strategy. We have completed the first phase of technical work on AREA OFF-3 with encouraging results, and our farm-in process for this block has now commenced. Meanwhile AREA OFF-1 remains on track to see 3D seismic acquisition commence at the end of this year, we completed our full exit from Trinidad and Tobago, and prudent cash management means we have sufficient funds for everything we plan to do over the next 18 months. Overall, therefore, the upcoming period promises to be busy and exciting for Challenger Energy – I look forward to updating shareholders as to our continued progress”.

We have been waiting on CEG to publish some data that the company has been promising and very much worth the wait it is. In Uruguay AREA OFF-3 the first phase of the Company’s technical work programme has successfully been completed, with multiple new seismic attribute supported anomalies identified.

The company report material aggregate resource potential from two primary prospects, comprising a best estimate (Pmean) of ~380 million barrels oil recoverable, and an upside (P10) case of ~980 million barrels oil recoverable. They also suggest that shallow water and reservoir depths of these primary prospects underpin relatively low development costs, and thus commerciality at even modest discovery volumes which is highly encouraging.

Elsewhere they reckon that there is considerable additional exploration potential ‘including possible slope turbidite and low stand fan play exposure in the north-east of the block’. This substantially discharges all minimum work obligations and accordingly the farm-out process for AREA OFF-3 has been launched.

Elsewhere all is going well, in AREA OFF-1 the 3D seismic acquisition is expected to commence in late 2025 ‘pending final environmental permitting. I commented on the sale of the Trinidad acreage recently which is a useful development and also the company ‘reports a strong cash position with all planned operations fully funded into 2027.

So the hard work starts across the portfolio for Challenger and an exciting time it is going to be for company and shareholders. With my TP of 50p not for one minute worrying me and a strong position in the Bucket List I remain massively positive on CEG with so much good news to come.

Uruguay AREA OFF-3 – “farm-out process launched”

The first phase of the Company’s technical work programme for the AREA OFF-3 block, offshore Uruguay, has now been completed.

That technical work programme consisted principally of reprocessing, interpreting and mapping of 1,250km2 of 3D seismic data, supplemented by a number of other geophysical and geochemical work streams, similar to the technical work processes undertaken on AREA OFF-1 prior to the farmout to Chevron.

The work completed substantially discharges all minimum work obligations for the first exploration period of AREA OFF-3 (completion of two geotechnical desktop reports are the sole remaining work items for the first period minimum work obligation, and can be completed at any time prior to the end of the first exploration period in June 2028).

Highlights from the technical work thus far undertaken on AREA OFF-3 by the Company are:

- Multiple new seismic attribute supported prospects and leads were identified from 2025 reprocessed 3D seismic data, and further corroborated by degree of structural conformance, DHI (flat spot) and amplitude variation with offset (AVO) analysis

- The two primary prospects – Benteveo and Amalia – are material, and comprise an aggregate best estimate (Pmean) of ~380 million barrels recoverable and an upside (P10) case of ~980 million barrels recoverable

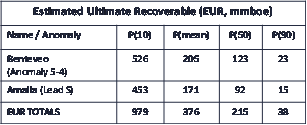

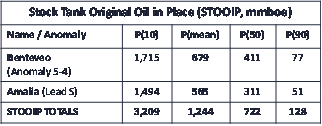

- The Company’s EUR (Expected Ultimate Recoverable) and STOOIP (Stock Tank Original Oil in Place) assessments for these two prospects are summarised as follows:

|

|

|

- Shallow water depth (<350 metres) and reservoir depth (~2,300 metres) underpins relatively low development costs, and thus commerciality at even modest discovery volumes (initial estimates are that 100 - 125 mmboe recoverable would be commercial)

- Technical work has also indicated considerable additional exploration potential on AREA OFF-3, including:

- an inventory of further identified leads that remain to be mapped and interpreted in detail - exploration success with primary prospects would likely derisk several of these leads, and

- in addition to the 1,250km2 of 3D seismic data already reprocessed, mapped and interpreted by the Company, an additional 2,000 km2 of reprocessed 3D seismic data is available for licensing and further analysis, covering the north-eastern segment of the block adjacent to the Brazilian maritime border - regional 2D coverage indicates possible slope turbidite and low stand fan play exposure in this north-eastern segment of the block (a similar play system to that which has yielded many of the recent, major discoveries on the Namibian margin of the South Atlantic basin).

With the first phase of its AREA OFF-3 technical work programme now complete, the Company has launched a formal farm-out process for the AREA OFF-3 block. The initial phase of this process will see multiple parties invited to undertake technical and commercial evaluation of the opportunity. The Company will be seeking initial offers by year-end, with a view to selecting a suitable partner(s) during the first quarter of 2026.

Uruguay AREA OFF-1 - '3D seismic acquisition upcoming'

Public consultations have been held in Uruguay in relation to the award of the requisite environmental permits for 3D seismic acquisition across multiple Uruguayan offshore blocks to various seismic vendors. The award of permits is anticipated in the coming months, facilitating (as previously communicated) 3D seismic acquisition on AREA OFF-1 to commence in late Q4 2025.

Trinidad & Tobago - 'full exit completed'

As advised on 1 September 2025, the sale of the Company's entire business, assets and operations in Trinidad and Tobago has been completed. The sale took the form of a complete exit, such that the Company has not further involvement in, or exposure to, operations in that country. The Company has thus far received approximately $750,000 in cash proceeds from the sale, with a further $1 million due on an unconditional basis in instalments ($500,000 on 31 August 2026, $250,000 on 31 December 2026, and $250,000 on 31 December 2027).

Corporate - 'strong cash position and fully-funded'

The Company's half-year report for the period to 30 June 2025 was published on 3 September 2025. As indicated in that report, the Company's cash position as at 30 June 2025 was approximately $6.6 million, not including $0.7 million in restricted cash holdings, and not including the $1.75 million in proceeds due to the Company from the sale of its business in Trinidad and Tobago. As noted in the half-year report, the Company's overhead 'burn' rate and future capital needs are such that the Company expects to be fully funded for all planned activities for the balance of 2025, all of 2026, and well into 2027, without the need for any additional capital.

Arrow Exploration Corp

Arrow has provided an update on recent operational activity on the Tapir Block in the Llanos Basin of Colombia where Arrow holds a 50 percent beneficial interest.

Highlights

- Four wells brought on production: so far in H2 2025:

o AB-3 vertical well recompletion brought on production on September 5, 2025, and currently producing 840 BOPD gross (420 BOPD net).

o CN HZ13 brought on production on August 28, 2025, and currently producing 1,002 BOPD gross (501 BOPD net).

o CN HZ12 brought on production on August 5, 2025, and currently producing 532 BOPD gross (266 BOPD net).

o RCE HZ10 brought on production on July 16, 2025, and currently producing 200 BOPD gross (100 BOPD net).

- Strong balance sheet, no debt or drilling commitments. Arrow has flexibility in its work program, with multiple drill ready pads, and is actively exploring potential acquisition opportunities.

Production

Total corporate production is currently over 4,800 boe/d net reflecting contributions from wells that have recently been brought on production from the RCE, AB and CN pads.

Additional production is expected to be added during the third and fourth quarters as Arrow focuses on a low-risk exploration activity which has the potential to increase Arrow’s reserves base and build up drilling inventory. During Q2 the Company invested significantly in water disposal infrastructure with Tapir block water disposal capability now over 130,000 barrels of water per day, further enabling the Company to increase production.

Drilling Operations – Tapir Block

Carrizales Norte field

On the Carrizales Norte field, the Company has recently drilled two development wells from the CN pad.

The Carrizales Norte HZ12 (CN HZ12) well was spud on July 18, 2025, and reached target depth on August 2, 2025. CN HZ12 targeted the Ubaque zone at Carrizales Norte field. The well was drilled to a total measured depth of 10,929 MD feet (8,419 feet true vertical depth).

On August 5, 2025, Arrow put the CN HZ12 well on production in the Ubaque formation with a total horizontal oil-bearing section of 423 MD feet. CN HZ12 is producing at a stabilized rate of 532 BOPD gross (266 BOPD net) with a water cut of 75%.

The Carrizales Norte HZ13 (CN HZ13) well was spud on August 6, 2025, and reached target depth on August 23, 2025. CN HZ13 targeted the Ubaque zone at Carrizales Norte field. The well was drilled to a total measured depth of 11,232 MD feet (8,500 feet true vertical depth).

On August 28, 2025, Arrow put the CN HZ13 well on production in the Ubaque formation with a total horizontal oil-bearing section of 797 MD feet. CN HZ13 is producing at a stabilized rate of 1,002 BOPD gross (501 BOPD net) with a water cut of 32%.

RCE Field

The Rio Cravo Este 10 horizontal (RCE HZ10) well was spud on June 24, 2025, and reached target depth on July 12, 2025. RCE HZ10 targeted the Ubaque zone at Carrizales Norte field. The well was drilled to a total measured depth of 10,940 MD feet (8,014 feet true vertical depth).

On July 16, 2025, Arrow put the RCE HZ10 well on production in the Ubaque formation with a total oil- bearing section of 1,040 MD feet. RCE HZ10 is producing at a stabilized rate of 200 BOPD gross (100 BOPD net) with a water cut of 72%.

Alberta Llanos field

At the Alberta Llanos field, the Company has recently recompleted the AB-3 vertical well targeting the C7 formation.

On September 5, 2025, Arrow put the AB-3 well on production in the C7 formation which has approximately 20 feet (true vertical depth) of oil charged sandstone. AB-3 is producing 840 BOPD gross (420 BOPD net) with a water cut of 73% and continues to clean up load fluid.

Drilling Schedule

Currently the drilling rig is moving to the Mateguafa Oeste field to drill an exploration vertical well (MO-1). The well is expected to spud mid-September and is targeting the Ubaque reservoir. On the basis of a successful exploration well at MO-1, the Company plans to drill four additional horizontal wells on the prospect. The exploration of Mateguafa Attic, Icaco, Macoya and the Capullo prospects are expected to follow the Mateguafa Oeste development.

Marshall Abbott, CEO of Arrow commented:

“The Carrizales Norte field continues to deliver with successful wells CN HZ12 and CN HZ13. Both horizontal wells have further developed the Carrizales Norte field. The success of these two horizontal wells proves future development potential at Carrizales Norte.”

“The RCE HZ10 well drilled into the Ubaque was a successful exploration target. The well is on production, however, the reservoir is tighter than at Carrizales Norte. The Company is exploring completion techniques that could results in higher production results in the Ubaque at RCE.”

“The AB-3 recompletion at the Company’s Alberta Llanos field is on production from the C7 and continuing to clean up. The original vertical well targeted the Ubaque and proved up the reservoir for the AB HZ4 and AB HZ5 wells. The C7 production is highly encouraging for future C7 development at both Alberta Llanos and the northern extent of the CN field.”

“We appreciate the support of our longstanding shareholder base as well as the dedication of our talented staff.”

I wrote about Arrow recently and as expected more wells have come into production and the overall number is now some 4,800 b/d. This is expected to continue to grow throughout the end of the year as the company ‘focuses on a low-risk exploration’ programme which has the potential to increase Arrow’s reserves base and build up inventory.

In a recent chat with management they added to that, the thrust of the recent strategy is to create long term value by this policy which builds up drilling inventory with judicial investment throughout the asset portfolio.

This means that addressing the water disposal infrastructure is of significant importance, in Q2 they note that the Tapir block water disposal capability was over 130,000 barrels of water per day which further enabled increased production.

Under that drilling policy there are fewer exploration wells, certainly when oil prices are at the lower end of the range but one important exception is the Mateguafa Oeste field where the current drilling rig is headed. The well, MO-1 is expected to spud mid-September and is targeting the Ubaque reservoir and if successful the plan is to drill four additional horizontal wells on the prospect. The exploration of Mateguafa Attic, Icaco, Macoya and the Capullo prospects are expected to follow the Mateguafa Oeste development.

Yet again the market has struggled to hear the story, this is a very decent update and builds on the message the company are exuding. I remain very happy that it deserves a space in the Bucket List and the company are doing a great job with what is stil a very substantial portfolio.

Gulf Keystone Petroleum

Gulf Keystone has announced that it is pursuing a potential dual listing of its shares on Euronext Growth Oslo operated by the Oslo Stock Exchange (“OSE”).

As part of the Company’s efforts to increase the liquidity of its issued share capital, attract new institutional and retail shareholders and improve its access to capital markets, Gulf Keystone’s Board of Directors (“the Board”) has conducted a thorough review of potential initiatives to supplement the Company’s existing listing on the London Stock Exchange’s Main Market for listed securities. The Board sees several attractions and potential benefits of a dual listing on the OSE, including:

- The OSE is a leading hub for conventional energy capital markets with a broad group of listed companies within the oil & gas sector

- The Company is well known by equity and debt capital markets in Oslo where investors have an excellent understanding of the Kurdistan oil and gas industry and extensive track record of support for the Company and other international oil companies with operations in the region

- The Company has broad equity research coverage in Oslo, with Norwegian firms accounting for the majority of sell-side analysts currently covering the Company

- Additional reporting requirements and ongoing costs associated with a potential secondary listing are expected to be minimal

David Thomas, Non-Executive Chair, said:

“Oslo’s capital markets have long been supportive of Gulf Keystone, primarily through the historic provision of competitive debt financing, and have a deep understanding of the Company, the Shaikan Field and the broader Kurdistan oil and gas industry.

Following an extensive review of options to improve the liquidity of the Company’s existing share capital, we are today announcing that we are actively considering a dual listing on the Oslo Stock Exchange. The Company is in a strong position, with a world-class asset, material free cash flow generated from local sales, a robust balance sheet, a proven commitment to balancing disciplined investment with shareholder returns and significant potential upside from the restart of Kurdistan crude exports via the Iraq-Türkiye Pipeline.

On behalf of the Company, we look forward to engaging more closely with market participants to discuss Gulf Keystone’s compelling equity story and to further explore the potential for a dual listing in Oslo.”

This is an interesting move by GKP which may have some, albeit not totally immediately obvious benefits. I guess that on the basis that you only meet the best people if you are seen at the best parties, being on the Oslo Exchange can only help.

The company has also identified that a number of analysts will probably join the number already following the company which can only help and of course will definitely add the number of Norwegian investors who look at the company, already a majority I notice.

Of course that only works if you make the offering exciting and potentially profitable, but that’s in their gift and if the plan is to improve the liquidity and by very nature increase free float then this should help.

Finally there are plenty of other reasons to endorse this play, the assets have indeed historically been of interest in the area, there are ties to Kurdistan and of course the Norwegian debt markets have been well known to be lenders of choice to many resources companies over the years. So Worth a look and it will be interesting to see what comes of the, still only potential, dual-listing.

Afentra

Afentra has announced its half year results for the six months ended 30 June 2025 (the ‘Period’ or ‘H1 2025’).

H1 2025 Summary

Key Highlights

- Block 3/24 (Post-Period): HoT signed with ANPG; Afentra to operate with 40% interest, marking first offshore operatorship

- Block 3/05 Acquisition: SPA signed with Etu Energias for additional interests in Blocks 3/05 and 3/05A

- Kwanza Onshore Expansion: KON15 license awarded; KON4 license contract initialled

- H1 2025 Net Average Production: 6,348 bopd

Crude Oil Sales & Revenue

o 0.7 mmbbls sold at $72/bbl average price, generating $52.0 million revenue

o 0.5 mmbbls sold at $70/bbl post period (1st July), additional $35.4 million receivable1

- Borrowings: reduced to $36.3 million, Net Debt of $15.5 million (Net Cash $19.9 million post 1st July lifting)

- 2P Reserve Replacement: >140% over 18-month period; demonstrating reserve growth potential

Financial Highlights

- Revenue of $52.0 million

- Cash resources as at 30 June 2025 of $21.6 million; net debt at 30 June 2025 of $15.5 million

- Borrowings at 30 June 2025: $36.3 million; total debt / annualised adjusted EBITDAX 0.7x

- Adjusted EBITDAX of $27.9 million and profit after tax of $5.7 million

- Two liftings during the period totalling 0.7 million bbls; average price of $72.2/bbl

Operational Highlights

- Gross average combined production for H1 2025 for Block 3/05 and 3/05A was ~21,350 bopd (H1 2024: 22,722 bopd), with rates from late June 2025 exceeding 23,000 bopd following an acceleration of light well intervention activities

- Reserves and resources have materially increased since the last CPR in June 2023, with a 140% reserve replacement ratio, offsetting gross production of ~11 mmbo over the 18-month period to 31 December 2024, highlighting the long-term potential of the asset

- Multi-year redevelopment plan remains on track targeting increased recovery and production growth. Key workstreams progressed in H1 include:

o Water injection ramp-up continued, averaging 35,000 bwpd, with upgrades targeting around 85,000 bwpd consistently by year-end. Maximum injection rates in excess of 100,000 bwpd in H1 2025

o 10 light well interventions delivered to date to underpin production performance

o Infrastructure upgrades across power systems, cranes, subsea lines and risers to enhance safety, reliability, uptime and protect future value

o Platform surveys and access preparation to support rig mobilisation and drilling in 2026

- Asset uptime remained stable throughout the period with no major periods of downtime. Opex continues to track around $23/bbl and we remain on track to deliver the planned $180 million (Net: $54 million) capital investment programme

- Sale & Purchase Agreement signed with Etu Energias in June for an additional 5% net interest in Block 3/05 and 6.67% net interest in Block 3/05A. Completion is expected in late H2 2025

- Onshore Kwanza basin, Block KON15 license formally awarded in February and the KON4 Risk Service Contract was initialled in June, confirming Afentra as operator, with completion of the award expected in Q4 2025

Post Period-End

- Block 3/24 (Offshore Lower Congo Basin): Signed Heads of Terms with ANPG; Afentra to operate with 40% interest. Government approval expected in Q4 2025

- Production: Gross production from Blocks 3/05 and 3/05A during July and August averaged 22,172 bopd (Net: 6,583 bopd)

- Well Interventions: further 8 light well interventions completed in July and August to support ongoing base production

- Crude Oil Sales & Stock position

o Third crude lifting completed on 1 July 2025 (~500,000 bbls at $70/bbl), generating H2 revenue of $35.4 million

o Three liftings completed to date in 2025, totalling 1.2 million bbls, with an average realised price of $71.3/bbl

o Stock position at end-August was 128,745 bbls

- Cash: The lifting on 1 July 2025 resulted in additional cash of $35.4 million received in July

- Debt repayment: Early semi-annual repayment made on the RBL facility in August, reducing the outstanding balance to $31.5 million

Near-term Catalysts

- Next crude cargo lifting (~400,000 bbls) expected late September 2025

- Planned maintenance rescheduled to 2026, reflecting stable operations

- Completion of Etu transaction expected in Q4 2025

- KON4 award expected in Q4 2025

- Block 3/24 award expected in Q4 2025

- 2026 drilling and workover programme under preparation

Paul McDade, Chief Executive Officer, Afentra plc commented:

“Afentra has made meaningful strategic progress in the first half of 2025, expanding our non-operated positions and being awarded our first operated acreage in Angola. The entry into Block 3/24 represents an important milestone as our first offshore operatorship, further strengthening our presence alongside the core assets in Blocks 3/05 and 3/05A. At the same time, our onshore Kwanza basin portfolio has advanced with the award of KON15 and initialling of the KON4 contract, adding near-term redevelopment and exploration potential.

Together, these developments create a balanced portfolio of production, redevelopment and exploration opportunities that underpin our strategy of building a resilient, cash-generative business with material growth potential. Looking ahead, we remain focused on executing our near-term catalysts and positioning Afentra to deliver sustainable value for shareholders.”

These results are historic and as such don’t show anything we dont already know. Add to that there are a number of post results announcements that have been fully covered here and we know that Afentra is a nailed on favourite of mine and right at the top of the Bucket List with its best of brand management.

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy