Europa Oil & Gas, the AIM quoted UK, Ireland and West Africa focused oil and gas exploration, development and production company, has announced its unaudited interim results for the eleven-month period ended 30 June 2025.

Financial Performance

- Revenue £2.6 million (11 months to 30 June 2024: £3.2 million)

- Gross profit £0.4 million (11 months to 30 June 2024: £0.2 million)

- Pre-tax loss of £1.2 million (11 months to 30 June 2024: pre-tax loss £6.6 million)

- Net cash used in operating activities £0.1 million (11 months to 30 June 2024: £0.4 million)

- Cash balance at 30 June 2025: £0.9 million (31 July 2024: £1.5 million)

Operational Highlights

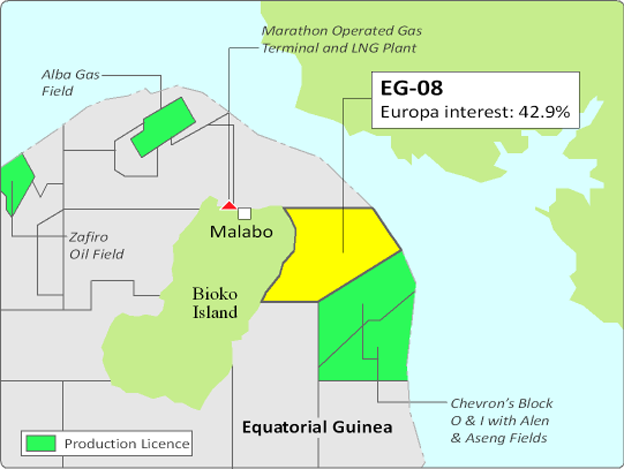

Equatorial Guinea

- In Q4 2024, the Company, through its 42.9% stake in Antler Global ("Antler"), launched a farmout process for its EG-08 asset, which holds an internally estimated 2.2 TCF Pmean of gross prospective resources.

- The EG-08 licence is highly prospective, with three drill-ready prospects which contain an estimated Mean Prospective resource of 1.48 TCF of gas equivalent. A further six leads and prospects contribute an estimated 0.72 TCF, bringing the total mean prospective resource to 2.2 TCF of gas equivalent. The chance of success is high (estimated at 80% for Barracuda), due to direct hydrocarbon indications on the seismic.

- Post period end in August 2025, the Company announced that Antler had entered detailed commercial discussions and signed a non-binding Heads of Terms with a major energy company regarding the farm-out of an interest in the EG-08 production sharing contract (PSC). Although there are no guarantees that discussions will conclude successfully, Europa has made significant progress on the farmout agreement and is working towards signing in the coming months and drilling of the Barracuda well will commence as soon as possible thereafter.

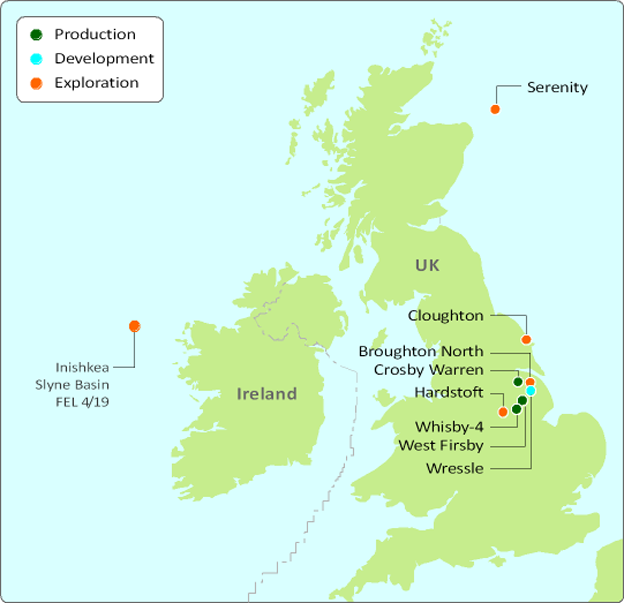

Offshore Ireland

- Europa holds a 100% interest in Licence FEL 4-19, which contains the Inishkea West gas prospect, with an estimated Pmean prospective resource of 1.5 TCF. The project offers strong economics, with an estimated post-tax NPV10 of US$2.0 billion. It also features an exceptionally low carbon intensity of 2.8 kg CO2/boe, compared to 36 kg CO2/boe for UK-imported gas in 2022.

- The Company is actively seeking a farm-in partner to drill an exploration well on the prospect. Given its scale, low emissions, and robust economics, the Company believes that the prospect presents a highly attractive risk-reward opportunity for potential farminees.

- Inishkea West is strategically located near the producing Corrib gas field, enabling potential use of existing infrastructure and offering low carbon-intensity gas-significantly lower than imported UK gas. Europa believes a successful discovery could potentially supply over two-thirds of Ireland's gas demand by 2030.

- The Irish government has signalled concern over energy security, raising hopes for increased support for domestic gas development.

Onshore UK

- Cloughton gas field appraisal

- Progress on the Cloughton asset (Europa interest: 40%) has been steady during the year, with the planning application for the Cloughton appraisal well submitted to North Yorkshire Council in March 2025 and a planning decision expected in Q4 2025

- Thirteen independent reports commissioned in support of the planning application confirm that the selected pad location is well-suited for this well and for potential development of the 137 BCF GIIP, pending confirmation of commercial flow rates from the appraisal well. Europa expects to shoot a seismic programme towards the end of 2025, with appraisal drilling anticipated in 2026.

- Due to the field's high-quality natural gas and close proximity to the UK gas network, a successful appraisal well could be brought into production quickly, which would displace LNG imports and thus lowering global emissions.

- Europa was pleased to launch a dedicated community engagement website on its Cloughton gas field appraisal project to provide local residents and stakeholders with information on the project and how the project partners intend to work with local communities. This site, which can be found at https://cloughton-community.co.uk/, is also intended to help prevent misinformation and address frequently asked questions about Europa's planned operations.

- Total average net production of 114 bopd was produced from Europa's UK onshore fields during the 11-month period with Wressle contributing roughly 82% of this and the remainder coming from the two older fields. Lower production levels and the lower average oil price of US$73 (11 months to 30 June 2024 average was US$82) resulted in the reduction in revenues compared to the prior period

- Wressle production

- Gross production averaged 311 bopd throughout the period (11 months to 30 June 2024: 354 bopd), with Europa's net share equating to 93 bopd (11 months to 30 June 2024: 106 bopd)

- The Wressle field development plan continues to be progressed. This includes a development well to target the Penistone Flags reservoir in 2026. The existing Wressle production is complemented by a gas monetisation solution that will be developed in parallel with the Penistone well. The gas monetisation solution is expected to enhance oil and gas production from the field and substantially increase revenues, as well as eliminate routine flaring. Planning consent was received for the project in September 2024, however North Lincolnshire Council's ("NLC") decision to grant planning permission was subsequently rescinded following a third-party challenge in light of the Finch Supreme Court judgement. The Wressle Joint Venture subsequently completed and submitted the newly required Scope 1, 2 and 3 (Category 11) greenhouse gas emissions assessments such that the planning application could be redetermined by NLC. The wells will be drilled at the earliest opportunity, once the necessary regulatory consents and approvals have been received.

- In May 2025, Europa announced that it had entered into a Revenue Swap Agreement ("RSA") with a Canadian investment company. Under the terms of the RSA, Europa received an upfront payment of US$500,000 in exchange for 4.5% of the remaining gross revenues generated from oil production at the Wressle 1 well.

- The Company is also looking at optimising production operations at its Crosby Warren site (Europa working interest: 100%), where the existing production could be significantly increased through a simple workover programme that is currently being considered.

- Termination of the Whisby 4 net profits agreement

- The royalty agreement (the "Agreement") related to the Whisby-4 well, held with BritNRG, the operator and licence holder of the Whisby Field, was terminated, as announced in December 2024. The Agreement had not recently generated income for Europa, and further investment would have been required to potentially restore it to a revenue-generating position. Due to the technical risks involved, the Company determined that its capital was better directed toward other assets within its portfolio.

- The Agreement had already been fully written down in Europa's accounts, with a carrying value of nil. Following its termination, all associated liabilities have been written off by the parties, resulting in a net gain of £170,000 to the Company.

- Administrative expenses for the period is £1.3 million, which is one of the lowest in its peer group where the average based on most recent annual financial statements is £2.35 million (adjusted to reflect the 11-month reporting period).

Board changes

- Bo Krøll was appointed to the Board as Non-Executive Director on 12 December 2024 and was subsequently appointed Chairman on 11 February 2025

- Alastair Stuart resigned from the Board on 12 December 2024 but continues to perform the role of Chief Operating Officer

- Brian O'Cathain resigned from the Board on 11 February 2025

Change of accounting reference date

Last year, Europa announced a change to its accounting reference date from 31 July to 31 December. This change aligns the Company's financial reporting period with the calendar year and allows for enhanced comparability with peer companies in the oil and gas industry. It also aligns more closely with industry standard timeframes for project work programmes and budgets. As a result, Europa's next full annual report will be for the 17-month period ending 31 December 2025. In accordance with Rule 18 of the AIM Rules, therefore, the Company has prepared these unaudited results for the 11-months to 30 June 2025, with the comparative period re-presented to reflect the equivalent 11-month period to 30 June 2024.

Will Holland, CEO of Europa, said:

"The past 11 months have been a period of steady progress and strategic positioning across our portfolio. In Equatorial Guinea, we have advanced our EG-08 licence, launching a farmout process and entering into commercial discussions with a major energy company - clear recognition of the asset's scale and potential. In Ireland, our 100%-owned Inishkea West gas prospect continues to attract some interest, offering a compelling combination of scale, low emissions, and proximity to infrastructure.

In the UK, we have made important strides at Cloughton, submitting the planning application for appraisal drilling and engaging proactively with the local community. Meanwhile, at Wressle, we progressed the development plan and secured financing through a non-dilutive revenue swap agreement. Across our UK assets, we remain focused on steadily progressing our assets and managing capital with discipline, including the termination of the Whisby 4 agreement, which delivered a considerable balance sheet gain. We continue to be very cost conscious, which is reflected in the fact that Europa has one of the lowest G&A expenses of its peer group, whilst still offering excellent value upside to its shareholders from numerous potential catalysts across the asset portfolio.

With a reshaped board, progressing farmout discussions in Equatorial Guinea, and steady progress in the UK and Ireland, we remain well-positioned to deliver on our strategic objectives in the year ahead."

KeyFacts Energy: Europa Oil & Gas UK country profile

KEYFACT Energy

KEYFACT Energy