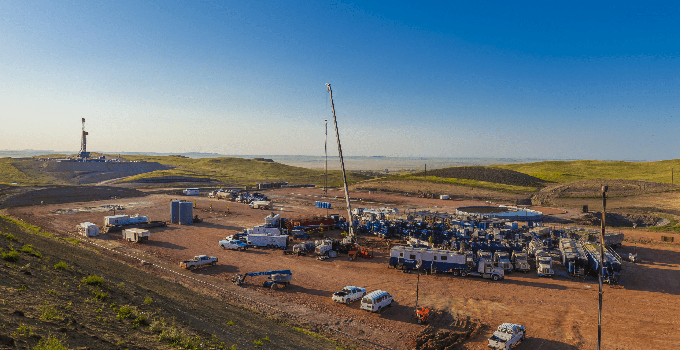

Chord Energy Corporation this week announced that a wholly owned subsidiary of Chord has entered into a definitive agreement to acquire assets in the Williston Basin from XTO Energy Inc. and affiliates, subsidiaries of Exxon Mobil Corporation, for total cash consideration of $550 million, subject to customary purchase price adjustments. The consideration is expected to be funded through a combination of cash on hand and borrowings.

Acquiring core acreage in Williston Basin:

- Acquired Acreage: 48,000 net acres in the Williston core (86% operated working interest, 82% 8/8ths net revenue interest, 100% held by production);

- Inventory Depth: 90 net 10,000 foot equivalent locations (72 net operated) extend Chord's inventory life; includes interests in Chord-operated wells and new DSUs, plus royalty interests;

- Inventory Quality: Low average NYMEX WTI breakeven economics ($40s) compete at the front-end of Chord's program and lower the weighted-average breakeven of Chord's portfolio;

- Long-Lateral Development: The contiguous nature of the DSUs and proximity with Chord's exiting footprint will facilitate 3 and 4 mile lateral development when operated by Chord;

- Expected Near-Term Production: ~9 MBoepd (78% oil) with a projected low base decline rate of ~23%. Significant opportunity to enhance operating margins on PDP;

- Highly Accretive: Expected to be accretive to all key metrics including cash flow, free cash flow1 and NAV in both near and long-term;

- Balance Sheet Strength: Post-transaction adjusted net leverage expected to be approximately 0.5x to 0.6x.

"We are excited to announce the acquisition of these high-quality assets," said Danny Brown, Chord Energy's President and Chief Executive Officer. "The acquired assets are in one of the best areas of the Williston Basin and have significant overlap with Chord's existing footprint, setting the stage for long-lateral development. The assets have a low average NYMEX WTI breakeven and are immediately competitive for capital. We expect that the transaction will create significant accretion for shareholders across all key metrics, while maintaining pro forma leverage below the peer group and supporting sustainable FCF generation and return of capital. I'm thankful for the hard work of all those involved in this transaction and look forward to Chord operating this asset in a safe and sustainable manner while continuing our strong relationship with the Three Affiliated Tribes on the Fort Berthold Indian Reservation."

Mr. Brown continued, "This acquisition is consistent with our strategic objectives, and we look forward to incorporating the assets into the Chord portfolio given our established history of successful integration and execution. Chord has demonstrated an impressive ability to improve economics by optimizing spacing and lateral length while driving efficiencies through the base business. Our track record of exceeding production expectations while lowering capital and improving margins has supported sustainable free cash flow and high return of capital. Chord has lengthened its inventory runway through adopting new technologies, improving operational efficiency and strategic M&A. We remain focused as an organization on disciplined capital allocation, driving continuous improvement through the business, and delivering even better efficiency going forward."

The effective date for the transaction is September 1, 2025. It is expected to close by year-end.

KeyFacts Energy Industry Directory: Chord Energy l KeyFacts Energy: Acquisitions & Mergers news

KEYFACT Energy

KEYFACT Energy