WTI (Oct) $63.30 +61c, Brent (Nov) $67.44 +45c, Diff -$4.14 -16c

USNG (Oct) $3.04 +10c, UKNG (Oct) 78.65p -0.44p, TTF (Oct) €31.725 -€0.64

Oil price

Oil is quiet today with all the same influences on the oil price which led to last week’s rise.

Arrow Exploration

Yesterday I managed to pin down Marshall Abbott, CEO of Arrow Exploration and spoke to him at Core London. I have long believed in the Arrow story and remain convinced that after production increased by some 50%y/y and they have completed a 3d seismic programme which has produced ‘liquid gold’.

With an exciting exploration programme starting today and maybe followed up by four horizontal wells plus more to come Abbott and the first class team has much to do. This interview explains why the plan is to change the face of the company and prepare for more growth. Here is the link to the interview.

Core Finance CEO Interview: Marshall Abbott of Arrow Exploration

Eco (Atlantic) Oil & Gas

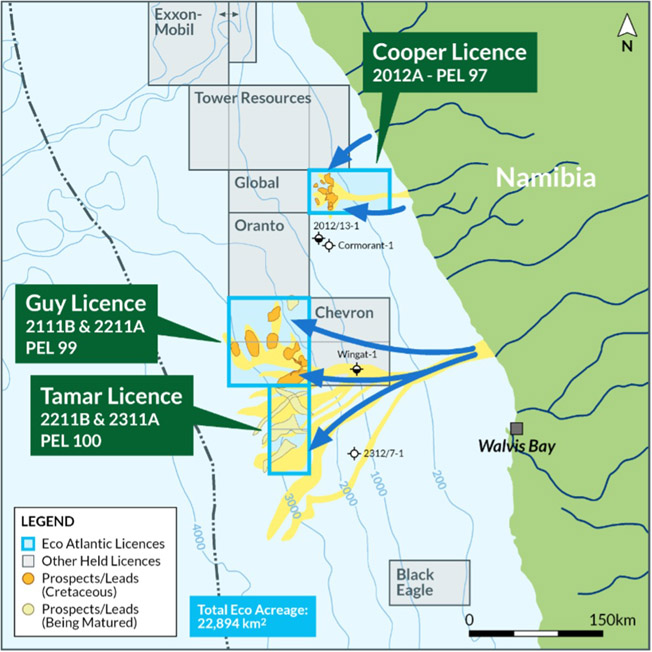

Eco has announced key developments in its Namibian portfolio aimed at optimising operations and exploration focus.

Eco has signed deeds of amendments and secured license extensions across all four of its Petroleum Exploration Licences (“PEL”s) in Namibia. In addition, Eco has farmed out its total 85% Working Interest, pending government approval, in PEL 98 (Block 2213 “Sharon Block”) to an arms-length wholly Namibian-owned company, Lamda Energy (Pty) Ltd (“Lamda Energy”).

These strategic developments allow Eco to focus on unlocking the hydrocarbon potential of its highly prospective and deeper water acreage in Namibia while continuing to support local ownership and operational leadership. The Company is currently receiving interest to farm down the extended licenses and their revised work programmes.

Namibia Optimisation Highlights:

- One (1) year extension granted to the Initial Exploration Period for PELs 97, 98, 99 and 100 now continuing to September 2026 (the “Initial Extension Year”)

- Optional First Renewal Period of two (2) years following the Initial Extension Year (the “First Renewal Period”)

- Optional Extension of the First Renewal Period of additional one (1) year, following completion of the initial First Renewal (the “First Renewal Extension”)

- Optional Second Renewal Period of two (2) additional years, commencing after the completion of the First Renewal Extension

- New Negotiated Schedule and Work Programmes for PELs 97, 99 and 100

- Farm-out of all of Eco’s 85% interest in PEL 98, subject to government approval, to Lamda Energy, a 100% Namibian-owned company

- Eco received Environmental Clearance Certificate for planned seismic surveys across the Namibian portfolio on 15 June 2025

- Eco is engaged in farm-down and seismic operations discussions with potential new partners.

Farm-Out of PEL 98 to Lamda Energy:

As Eco shifts its geological focus to deeper proven plays in Namibia, the Company has approved the Farm-Out of its entire 85% Participating Interest in the shallower PEL 98 Block 2213 to locally owned Lamda Energy.

Lamda Energy is a privately owned and operated offshore oil and gas company with an experienced Operating Team. Lamda Energy will become a wholly Namibian-owned qualified offshore Operator upon Ministerial approval. This Farm-Out aligns with Eco’s longstanding commitment to advancing local participation and partnerships in Namibia’s oil and gas sector.

Under the terms of the Farm-Out Agreement, Lamda Energy will make an up-front payment to Eco for administrative costs, and, on completion, will assume all obligations and liabilities associated to PEL 98. In addition, in the event of a future farm-out by Lamda Energy to a third party, Lamda Energy will be required to make certain payments to Eco at a fixed quantum per percentage interest farmed out, up to a maximum of US$2 million.

Eco will retain a board seat at Lamda Energy to support a comprehensive transition and knowledge transfer ensuring a smooth and responsible handover. This marks a significant milestone in building local capacity and advancing inclusive energy development.

Portfolio-Wide Newly Negotiated Schedules and Work Programmes:

The Ministry of Industries, Mines and Energy of the Republic of Namibia has formally approved a 12-month extension to the First Renewal Exploration Period for all four licenses, granted under Section 30 (2A) of the Petroleum (Exploration and Production) Act. The revised expiry date for the First Renewal Exploration Period is now September 2026. In summary: one (1) year extension granted to the Initial Exploration Period for PELs 97, 98, 99 and 100; Optional First Renewal Period of two (2) years, after extension year; Optional Extension of the First Renewal Period of additional one (1) year, after First Renewal; Optional Second Renewal Period of an additional two (2) years, after First Renewal Extension. These extended schedules provide Eco and its partners additional time to pursue enhanced exploration activities and attract new farm-in partners to the licenses.

The updated and approved Work Programmes include on PEL 97 3D seismic reprocessing, and a ~1000 km² 3D seismic survey and processing on each of PEL 99 and 100. An Environmental Clearance Certificate, issued on 15 June 2025 by the Ministry of Environment, Forestry and Tourism, authorises Eco to undertake the planned seismic activities across its licenses in the deepwater Walvis Basin offshore Namibia.

Gil Holzman, President and CEO of Eco Atlantic, commented:

“These developments represent an important step in our tactical vision and an optimisation of our Namibian portfolio and work programmes. I want to sincerely thank our dedicated team and our key stakeholders within the Ministry of Industries, Mines and Energy, who have worked tirelessly over the past 12 months to ensure a mutually beneficial plan and a smooth transition for the Farm-Out of PEL 98 (Sharon Block). Their support has been instrumental in the alignment of our efforts on our deeper water PEL’s 97, 99 and 100 which have been the recent focus of industry partners.

“This strategy builds on Eco’s long-standing history of pioneering and supporting local involvement and contributions, beginning with the first proposal of NAMCOR as a 10% carried interest partner in 2011. And additionally with our new license issuance in 2021 adding a further 5% Local Partner (carried) on each of our blocks, we remain firmly committed to promoting local content and ensuring equitable partnerships for Namibian stakeholders and colleagues. With these license extensions and updated work programmes, we are now well-positioned to unlock further value in Namibia. I would also like to thank the Ministry of Mines, Energy and Industries Petroleum Commissioner for her collaborative work and guidance, as well as to our Namibia country manager Tironenn Kauluma for his ongoing leadership and stakeholder engagement efforts.”

As ever Eco are continually tweaking the portfolio in order to stay on a strong financial footing, the farm-out here will for example mean fewer financial commitments and the company receiving stage payments for the assets.

The 1 year extension to first exploration will allow for the seismic shoot and processing of the data which in turn will give the potential farminees ‘comfort’ and a bit more time to join. This should mean that Eco can scale up its plans and will have bigger fish to fry in the basin.

I’m also pleased about the farm-out, the company taking it on seems to be a genuine local oil & gas company that Eco will maintain ties with and the ability to concentrate on the deeper water PEL’s 97, 99 and 100 which have been the recent focus of plenty of industry partners.

Expect optimisation of the portfolio, delivery of the work programmes and ultimately the realisation of the substantial value that patient shareholders, and sundry followers have been waiting for.

Figure 1: Eco Atlantic’s Namibia acreage following approval of PEL 98 farmout

Corcel

Corcel has announced that, through its subsidiary Atlas Petroleum Exploration Worldwide Ltd (“APEX”), it has awarded the upcoming 2D seismic acquisition program within the KON-16 Block, onshore Angola, to B.G.P. GEOPHYSICAL LIMITADA, LDA, and BGP INC., CHINA NATIONAL PETROLEUM CORPORATION (“BGP”) after a competitive bidding process.

Highlights:

- BGP to acquire 326-line km of 2D seismic data over the KON-16 block, onshore Angola

- 2D seismic campaign targeting areas high-graded by the Corcel team to advance subsurface prospectivity to drill ready status

- Acquisition is expected to start in Q4 2025 and is expected to finish before year-end, subject to receipt of certain permits and approvals

- Seismic processing scheduled to occur during Q1 2026, with results expected to follow in Q2 2026

- Acquisition of 2D seismic data will allow the company to move to drilling preparation in 2026 with the aim to drill a high-impact well within KON-16

Corcel currently have 143 line-km of good quality 2D data over KON-16, which was acquired in 2010. Acquiring 326-line km of new 2D data will provide a 227% increase in seismic coverage inside KON-16 which will greatly increase the subsurface imaging and prospect definition.

The 2D seismic acquisition project at KON-16 is essential to progress the asset to drill ready status. Current modern 2D line spacing averages 14 km in the areas of interest, and while this is sufficient to identify prospectivity, especially when integrated with the eFTG (high resolution gravity gradiometry) data acquired in 2024, a closer 2D line spacing is desirable when moving on to drilling.

The seismic campaign has been designed to cover specific prospects high-graded by the Corcel team, and to build on the work done this year integrating the legacy 1970’s 2D data, the modern 2010 2D seismic data (which was recently reprocessed), and the 2024 eFTG data. BGP were selected to complete the work at KON-16 after the results of a competitive bidding process where multiple companies bid to participate in the project at KON-16. BGP are an experienced seismic acquisition company, with a team already active in the Kwanza Basin, Angola.

Richard Lane, Chief Operating Officer at Corcel commented:

“We are extremely pleased to have awarded the seismic acquisition work to BGP. BGP has extensive experience in onshore seismic acquisition across Africa and recently completed 2D programs in the Kwanza Basin, minimizing execution risk for this project. The seismic acquisition campaign has been designed to complement the geological model established by the team. By integrating legacy seismic data with historical well information and the 2024 eFTG data, we are confident that the forthcoming acquisition will identify and support several drilling opportunities within KON-16. We will provide shareholders with timely updates as activities commence.

Yet again Corcel has brought good news to shareholders and will acquire significant data on the KON-16 block with the survey starting imminently and results in by mid 2026. It will help add to existing data and point to areas for the drilling programme in the Kwanza Basin completing the jigsaw of 3D and eFTG data.

What I like most about Corcel, the portfolio aside that is, is the way that the management are putting together the operational side along with leading industry and financial partners who have backed the set-up from day one when I heard about them.

This transposes into strong finances for a young explorer and with raises previously carrying warrants that convert at prices that are not too demanding, and I can see happening, meaning there is a good chance that Corcel wont be needing to raise money any time soon.

I put Corcel into the Bucket list at the mid year stage and performance has been excellent, up 81% over 6 months and 245% over a year which is partly why I’m guessing that the warrants will be a boost for company finances, all in all a very strong position for an exciting company.

About KON-16:

Corcel holds an operated and controlling interest in KON-16, which is a large (1000 sq. km) block in the onshore Kwanza Basin. KON-16 has benefited from high quality regional scale modern 2D seismic acquisition in 2010-2012, which identified significant post and pre-salt prospectivity that was previously not imaged. Despite the large scale of the KON-16 area, only 1 historic well has been drilled inside the block (Tuenza #1, in 1960) and therefore significant potential is believed to remain. Prospectivity ranges from shallow oil-prone targets analogous to the nearby Tobias and Galinda fields, to the deeper pre-salt play, which is analogous to the deep-water Kwanza Basin discoveries (TotalEnergies Kaminho Project).

For further information, please contact:

Scott Gilbert, Corcel Plc, CEO & Director

Development@Corcelplc.com

Europa Oil & Gas

Europa yesterday announced its unaudited interim results for the eleven-month period ended 30 June 2025.

Financial Performance

- Revenue £2.6 million (11 months to 30 June 2024: £3.2 million)

- Gross profit £0.4 million (11 months to 30 June 2024: £0.2 million)

- Pre-tax loss of £1.2 million (11 months to 30 June 2024: pre-tax loss £6.6 million)

- Net cash used in operating activities £0.1 million (11 months to 30 June 2024: £0.4 million)

- Cash balance at 30 June 2025: £0.9 million (31 July 2024: £1.5 million)

Operational Highlights

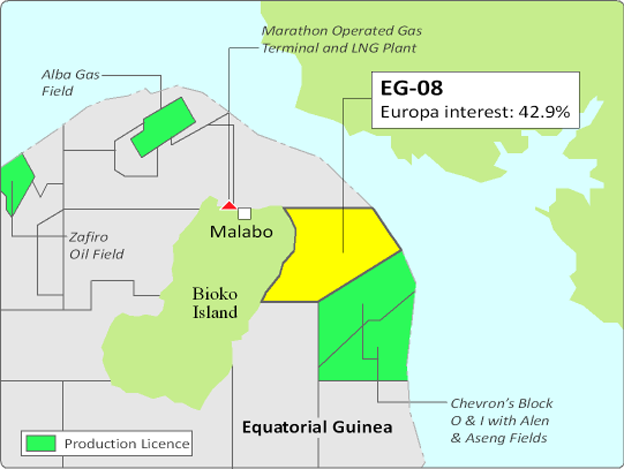

Equatorial Guinea

- In Q4 2024, the Company, through its 42.9% stake in Antler Global ("Antler"), launched a farmout process for its EG-08 asset, which holds an internally estimated 2.2 TCF Pmean of gross prospective resources.

- The EG-08 licence is highly prospective, with three drill-ready prospects which contain an estimated Mean Prospective resource of 1.48 TCF of gas equivalent. A further six leads and prospects contribute an estimated 0.72 TCF, bringing the total mean prospective resource to 2.2 TCF of gas equivalent. The chance of success is high (estimated at 80% for Barracuda), due to direct hydrocarbon indications on the seismic.

- Post period end in August 2025, the Company announced that Antler had entered detailed commercial discussions and signed a non-binding Heads of Terms with a major energy company regarding the farm-out of an interest in the EG-08 production sharing contract (PSC). Although there are no guarantees that discussions will conclude successfully, Europa has made significant progress on the farmout agreement and is working towards signing in the coming months and drilling of the Barracuda well will commence as soon as possible thereafter.

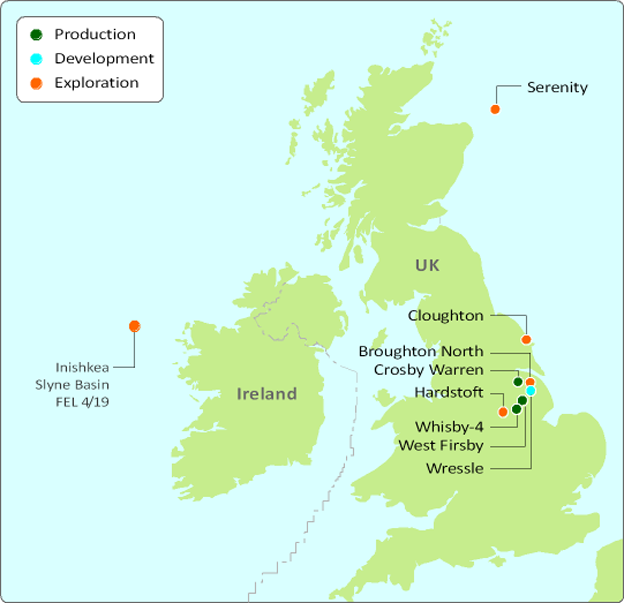

Offshore Ireland

- Europa holds a 100% interest in Licence FEL 4-19, which contains the Inishkea West gas prospect, with an estimated Pmean prospective resource of 1.5 TCF. The project offers strong economics, with an estimated post-tax NPV10 of US$2.0 billion. It also features an exceptionally low carbon intensity of 2.8 kg CO2/boe, compared to 36 kg CO2/boe for UK-imported gas in 2022.

- The Company is actively seeking a farm-in partner to drill an exploration well on the prospect. Given its scale, low emissions, and robust economics, the Company believes that the prospect presents a highly attractive risk-reward opportunity for potential farminees.

- Inishkea West is strategically located near the producing Corrib gas field, enabling potential use of existing infrastructure and offering low carbon-intensity gas-significantly lower than imported UK gas. Europa believes a successful discovery could potentially supply over two-thirds of Ireland's gas demand by 2030.

- The Irish government has signalled concern over energy security, raising hopes for increased support for domestic gas development.

Onshore UK

- Cloughton gas field appraisal

- Progress on the Cloughton asset (Europa interest: 40%) has been steady during the year, with the planning application for the Cloughton appraisal well submitted to North Yorkshire Council in March 2025 and a planning decision expected in Q4 2025

- Thirteen independent reports commissioned in support of the planning application confirm that the selected pad location is well-suited for this well and for potential development of the 137 BCF GIIP, pending confirmation of commercial flow rates from the appraisal well. Europa expects to shoot a seismic programme towards the end of 2025, with appraisal drilling anticipated in 2026.

- Due to the field's high-quality natural gas and close proximity to the UK gas network, a successful appraisal well could be brought into production quickly, which would displace LNG imports and thus lowering global emissions.

- Europa was pleased to launch a dedicated community engagement website on its Cloughton gas field appraisal project to provide local residents and stakeholders with information on the project and how the project partners intend to work with local communities. This site, which can be found at https://cloughton-community.co.uk/, is also intended to help prevent misinformation and address frequently asked questions about Europa's planned operations.

- Total average net production of 114 bopd was produced from Europa's UK onshore fields during the 11-month period with Wressle contributing roughly 82% of this and the remainder coming from the two older fields. Lower production levels and the lower average oil price of US$73 (11 months to 30 June 2024 average was US$82) resulted in the reduction in revenues compared to the prior period

- Wressle production

- Gross production averaged 311 bopd throughout the period (11 months to 30 June 2024: 354 bopd), with Europa's net share equating to 93 bopd (11 months to 30 June 2024: 106 bopd)

- The Wressle field development plan continues to be progressed. This includes a development well to target the Penistone Flags reservoir in 2026. The existing Wressle production is complemented by a gas monetisation solution that will be developed in parallel with the Penistone well. The gas monetisation solution is expected to enhance oil and gas production from the field and substantially increase revenues, as well as eliminate routine flaring. Planning consent was received for the project in September 2024, however North Lincolnshire Council's ("NLC") decision to grant planning permission was subsequently rescinded following a third-party challenge in light of the Finch Supreme Court judgement. The Wressle Joint Venture subsequently completed and submitted the newly required Scope 1, 2 and 3 (Category 11) greenhouse gas emissions assessments such that the planning application could be redetermined by NLC. The wells will be drilled at the earliest opportunity, once the necessary regulatory consents and approvals have been received.

- In May 2025, Europa announced that it had entered into a Revenue Swap Agreement ("RSA") with a Canadian investment company. Under the terms of the RSA, Europa received an upfront payment of US$500,000 in exchange for 4.5% of the remaining gross revenues generated from oil production at the Wressle 1 well.

- The Company is also looking at optimising production operations at its Crosby Warren site (Europa working interest: 100%), where the existing production could be significantly increased through a simple workover programme that is currently being considered.

- Termination of the Whisby 4 net profits agreement

- The royalty agreement (the "Agreement") related to the Whisby-4 well, held with BritNRG, the operator and licence holder of the Whisby Field, was terminated, as announced in December 2024. The Agreement had not recently generated income for Europa, and further investment would have been required to potentially restore it to a revenue-generating position. Due to the technical risks involved, the Company determined that its capital was better directed toward other assets within its portfolio.

- The Agreement had already been fully written down in Europa's accounts, with a carrying value of nil. Following its termination, all associated liabilities have been written off by the parties, resulting in a net gain of £170,000 to the Company.

- Administrative expenses for the period is £1.3 million, which is one of the lowest in its peer group where the average based on most recent annual financial statements is £2.35 million (adjusted to reflect the 11-month reporting period).

Board changes

- Bo Krøll was appointed to the Board as Non-Executive Director on 12 December 2024 and was subsequently appointed Chairman on 11 February 2025

- Alastair Stuart resigned from the Board on 12 December 2024 but continues to perform the role of Chief Operating Officer

- Brian O'Cathain resigned from the Board on 11 February 2025

Change of accounting reference date

Last year, Europa announced a change to its accounting reference date from 31 July to 31 December. This change aligns the Company's financial reporting period with the calendar year and allows for enhanced comparability with peer companies in the oil and gas industry. It also aligns more closely with industry standard timeframes for project work programmes and budgets. As a result, Europa's next full annual report will be for the 17-month period ending 31 December 2025. In accordance with Rule 18 of the AIM Rules, therefore, the Company has prepared these unaudited results for the 11-months to 30 June 2025, with the comparative period re-presented to reflect the equivalent 11-month period to 30 June 2024.

Will Holland, CEO of Europa, said:

"The past 11 months have been a period of steady progress and strategic positioning across our portfolio. In Equatorial Guinea, we have advanced our EG-08 licence, launching a farmout process and entering into commercial discussions with a major energy company - clear recognition of the asset's scale and potential. In Ireland, our 100%-owned Inishkea West gas prospect continues to attract some interest, offering a compelling combination of scale, low emissions, and proximity to infrastructure.

In the UK, we have made important strides at Cloughton, submitting the planning application for appraisal drilling and engaging proactively with the local community. Meanwhile, at Wressle, we progressed the development plan and secured financing through a non-dilutive revenue swap agreement. Across our UK assets, we remain focused on steadily progressing our assets and managing capital with discipline, including the termination of the Whisby 4 agreement, which delivered a considerable balance sheet gain. We continue to be very cost conscious, which is reflected in the fact that Europa has one of the lowest G&A expenses of its peer group, whilst still offering excellent value upside to its shareholders from numerous potential catalysts across the asset portfolio.

With a reshaped board, progressing farmout discussions in Equatorial Guinea, and steady progress in the UK and Ireland, we remain well-positioned to deliver on our strategic objectives in the year ahead."

Results which as we all know are historic and the company has been good at updating the market as to current projects. Obviously the EG-08 licence is most important and it was good to see HoT agreed since the interim.

It looks very promising and once these discussions proceed to the next stage and lead to a partner being secured then EOG will have a truly exciting future with the drill bit. Elsewhere energy policy in Ireland is as enigmatic as it ever was and those bountiful resources will have to wait until a dose of common sense breaks out.

Processes still continue on UK domestic prospects, such as Wressle, completing unnecessary paperwork and planning at Cloughton, also something that wouldn’t happen in the USA but ideas of self sufficiency come way down the list for a Government that has its priorities in a weird order…

So it’s possible to see a bright, indeed positive future for EOG, but investors can see clearly what has to happen for those sunlit uplands to be within reach…

Star Energy

Star Energy has announced its unaudited interim results for the six months to 30 June 2025.

Commenting today Ross Glover, Chief Executive Officer, said:

“We welcome the UK government’s recent recognition of domestic energy’s strategic value, as reflected in policy priorities aimed at reducing reliance on imported fossil fuels, enhancing energy security, and creating new green jobs and economic growth. The mission of Great British Energy similarly champions clean, secure, home-grown energy as a catalyst for job creation and energy independence. Our strategy is closely aligned with these objectives: we manage our oil and gas assets responsibly and efficiently, while reinvesting operating cashflows into making our oil and gas business more resilient and maturing our geothermal opportunities.

However, the operating environment remains challenging. Our core oil and gas operations-critical to funding the Group-are under increasing strain from the Energy Profits Levy, which has elevated the headline upstream tax rate to 78%. This, combined with a more complex and costly regulatory environment, creates substantial barriers just as the UK’s dependence on energy imports remains pronounced. In the first quarter of 2025, the country’s net energy imports underscored the urgent need to prioritise and support domestic supply.

Despite these headwinds, we remain committed to developing a robust UK geothermal business and are lobbying the Government to provide consistent and practical policy and regulatory support. With this support, the potential is considerable: geothermal energy offers secure, low-carbon, and price-stable heat at scale. We aim to be a highly active player in the energy transition and are well-positioned to be so.

Promoting genuinely home-grown energy is essential-not only for strengthening the UK’s energy security, but also for supporting skilled employment, generating tax receipts for the government, and fostering regional and national growth. This opportunity is of strategic importance both to the country and to Star Energy, and we are dedicated to realising its potential. Our approach is disciplined and measured. We are focused on operational excellence in our oil and gas business, making selective investments where returns are compelling, and steadily advancing our geothermal development pipeline in the UK and Croatia and generating value for shareholders”

I know that Ross Glover has been working flat out to try and deliver something from the mess he was left with. From a pitifully slow start he is making progress and setting the route for upside which wasn’t always obvious…

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy