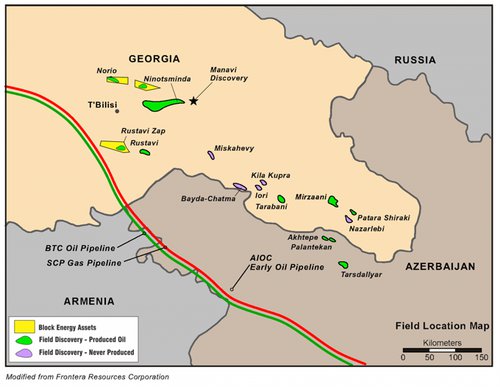

Block Energy plc, the development and production company focused on Georgia, is pleased to announce the interim results for Block Energy plc and its subsidiaries (the "Group") for the six months ended 30 June 2025.

Highlights:

- Operational man-hours worked of 136,065 (1H 2024: 144,072 man-hours) with zero lost time incidents (1H 2024: One).

- Net cashflow remained operationally positive throughout the period.

- The Group recorded a loss for the period of $639,000 (1H 2024: profit of $2,000) and EBITDA of $81,000 (1H 2024: $645,000). The result reflects the fall in oil prices in the period together with reduced oil inventory levels at period end of $498,000 (1H 2024: $23,000), which increased cost of sales.

- Further reductions in G&A spending to $1,010,000 (1H 2024: $1,372,000) demonstrating effective cost control despite ongoing work on strategic projects.

- Production remained stable, with total production of 87.5 Mboe comprising 66.4 Mbbls of oil and 21.1 Mboe of gas (1H 2024: 82.8 Mboe, comprising 61.3 Mbbls of oil and 21.5 Mboe of gas).

- Average daily production of 483 boepd (1H 2024: 455 boepd).

- Oil sales of 49.9 Mbbls with revenue of $3.02 million, representing a weighted average price of $60.5 per barrel (1H 2024: Oil sales of 46.6 Mbbls with revenue of $3.3 million, representing a weighted average price of $71 per barrel). Declines in realised prices were caused by a reduction in the Brent benchmark price.

- Gas sales of 82.2 MMcf with revenue of $0.36 million, representing a weighted average price of $4.4/Mcf (1H 2024: 93.5 MMcf with revenue of $0.38 million, representing a weighted average price of $4.1/Mcf).

- Oil in inventory net to the Company at the end of the period was 8.27 Mbbls (1H 2024: 12.1 Mbbls).

- Cash position of $845,000 as at 30 June 2025 (31 December 2024: $1,136,000).

Good progress was made in advancing the strategic projects in the first half:

- Acquired the operational rights to Samgori South Dome at Lower Eocene and Upper Cretaceous intervals for nil cost through its incorporation into XIB. This acquisition added 574 BCF 2U unrisked mean prospective recoverable resources to Project III.

- Acquired a 10% Participating Interest in the high-impact XIQ PSC located to the north of our XIB licence, adding a net 59 MMboe 2U unrisked mean prospective recoverable resources to Project IV.

- Progressed the CCS project with various studies, lab and operational milestones met.

- Continued to see good engagement on the Project III farm-out.

Post period events:

The Company continued with its strategy of asset development post-period:

- Successfully injected CO2 into the reservoir as part of the ongoing carbon mineralisation pilot.

- Concluded negotiations for the farm-in of a leading international independent E&P company to the XIQ licence, with completion expected Q4 2025 - Q1 2026.

- Spud well KRT-39ST on Project I.

Commenting, Paul Haywood, Block Energy Chief Executive Officer said:

"This has been an important time for Block and since the period end and momentum has accelerated: we have agreed terms with a leading international E&P to farm into Project IV, successfully delivered the region's first CO₂ injection under our CCS pilot, secured the addition of South Dome and significantly boosting Project III's gas resources, as well as spudding KRT-39ST. Together, these achievements represent a major endorsement of our portfolio and Georgia's investment potential, positioning Block strongly for its next phase of growth. Looking ahead, our priorities are clear: complete the Project IV farm-out, progress Project III farmout, advance drilling across our various projects and CCS activity, and evaluate new ventures aligned with our capital-efficient strategy. Each of these represents a catalyst to deliver material shareholder value."

KeyFacts Energy: Block Energy Georgia country profile

KEYFACT Energy

KEYFACT Energy