Angus Energy

Production from the Saltfleetby Field in the Third Quarter of 2025 was 374 million standard cubic feet of natural gas and 6,519 barrels of gas condensate.

- Gas sales of 4.16 million therms were achieved in the Quarter from the Saltfleetby Field.

- Legacy Hedges have rolled off, and Company recorded a hedging profit of £0.152m in the quarter.

- Annual maintenance shutdown completed without incident.

- The Brockham Field produced 3,632 barrels of crude oil during the Quarter.

- Estimated revenues of £3.21m for the Quarter.

- Production uplift due to improved well performance, improvements in well management, and optimisation of Booster Compressor operation with lower well head pressures.

Production and Operations Update

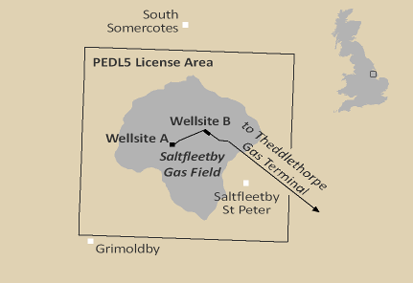

Saltfleetby

Gas sales from the Saltfleetby Field equalled 4.16 million therms in aggregate for the months of July, August and September 2025, compared to 3.90 million therms sold in the second quarter of 2025, an increase of circa 6.7%. Third quarter 2025 production equates to an average of 1.39 million therms per month (up circa 6.9% from 1.30 million therms per month in the second quarter of 2025). Gas condensate (liquid) production averaged 69.5 bbl/day, up circa 3.7% against an average of 67 bbl/day in the second quarter 2025. Saltfleetby operational efficiency remains at 87% for the Quarter.

Higher production at Saltfleetby this quarter reflects improved well performance, improvements in well management, and optimisation of Booster Compressor operation with lower well head pressures.

Well performance under the new operating regime of lower well head pressures continues to be evaluated by the sub-surface team and the operations team with the aim of delivering further increases in production.

The annual maintenance shutdown was delivered two days ahead of schedule, with four days of lost production associated with the shutdown, during the month of July. The annual shutdown was delivered without incident and with no harm to the environment, and all regulatory commitments were met.

Brockham

Oil volumes produced from the Brockham Field equalled 3,632 barrels in aggregate for the months of July, August and September 2025, with an average of 39.5 bbl/day. This is a decrease of circa 6.6% compared to 3,890 barrels for the second quarter of 2025 averaging 43 bbl/day. Brockham operational efficiency remained at 100% for the Quarter.

Finance Update

Estimated revenues during the quarter were £3.21m (Quarter 2: £3.44m), a 7% reduction on the second quarter due principally to lower gas prices which averaged £0.79 per therm (Quarter 2: £0.84 per therm).

As previously announced, low priced legacy hedging volumes rolled off in June 2025. Hedged volume for the quarter was 3,220 million therms at an average price of £0.84 per therm, resulting in a hedging profit of £0.152m for the quarter.

Further to the announcement of 13 October 2025, Angus Energy confirms that positive discussions with its creditors regarding restructuring of its debt remain ongoing. While the Board is encouraged in respect of recent progress in these discussions, the Company cautions that if a suitable agreement is not reached, it would create a material uncertainty around the Company’s ability to continue to operate as a going concern. The Company will inform the market once an agreement has been reached and the terms of such agreement, and in the meantime continues to carefully manage its working capital position in conjunction with its lenders.

Potential Acquisition by Reverse Takeover

Further to the announcement of 13 October 2025, the Company is continuing with its due diligence on the purchase of a group of producing assets located in the Gulf of America. The Board is meeting in the next week to agree whether or not to proceed with the transaction as currently structured. The Company will update the market accordingly in respect of any further developments.

Management Update

Further to the announcement of 11 July 2025, and as requested by Forum Energy Services Limited (“Forum”), Jonathan Tidswell-Pretorius was appointed as non-board Interim COO. After completing a review of the Company’s operations, Jonathan Tidswell-Pretorius has resigned to pursue other interests. On behalf of the Company the Board wishes to thank him for his guidance and efforts during this time.

This is a very good update from Angus and shareholders will be pleased to see the better delivery from Saltfleetby as well as good all round operational performance. The rollover of the low priced legacy hedging volumes rolled off in June 2025 which had been expected but was no less welcome. Finally, the company confirms that positive discussions with its creditors regarding restructuring of its debt remain ongoing, again good news.

Buccaneer Energy

Buccaneer has announced a successful fundraise supported by institutional investors, Directors and Management, existing shareholders and new investors in order to further evaluate and progress a bitcoin mining operation as part of its planned Fouke area development programme.

The Company has raised approximately £500,000 (before expenses), c.US$675,000, through a subscription and placing of 2,961,185,383 ordinary shares (the “Fundraise Shares”) at a price of 0.017p per share (the “Placing Price”) (the “Fundraise”).

In addition certain suppliers of the Company have elected to receive shares by way of consideration for services provided for which a further 250,000,000 ordinary shares (“Supplier Shares”) will be issued.

Use of Proceeds

The proceeds of the fundraising will be used towards the funding of the Company’s (100% WI) share of a Bitcoin Mining operation in the Fouke area. The Company is seeking to partner with a dedicated Bitcoin Mining operator to implement this project. However, if a suitable partner cannot be secured, the proceeds are expected to be used to progress the set up of a Company-owned Bitcoin Mining operation. Additionally, the Company will establish a Bitcoin Treasury function to manage bitcoin that may be earned through future operations.

The Company notes the inherent risk and volatility of digital assets and draws investors’ attention to the “Risks Associated with Digital Assets” section of this announcement.

Gas Monetisation Strategy

As previously announced, the associated gas produced in the Fouke area has been increasing over time and with volumes provided by the two additional development wells the Company has been evaluating several potential local solutions for reducing gas flaring and monetising the produced gas. The most commercially attractive option was determined to be a local Bitcoin Mining operation.

As previously announced, the Company appointed Appold to act as advisor on the implementation of governance, custody, trading, and risk management frameworks as the Company develops either its partner led or its own bitcoin mining operation. The implementation of a successful strategy to monetise this gas is subject to a number of further steps, including the drilling results from the new development wells, and the funding, acquisition and installation of the necessary equipment (as appropriate).

Adoption of a Bitcoin Treasury Policy

The Company, together with Appold as its adviser, has drafted a suite of policy and procedure documents to implement the Bitcoin Treasury Policy. These include: a risk management framework, trading policy and procedures, custody policy and procedures, governance framework design, operations log and incident response policy.

The Company plans to establish a contemporary corporate treasury function by holding Bitcoin as a core reserve asset and generating yield from it. In the future, the Company may look to acquire Bitcoin strategically and secure it with institutional-grade custody but, unlike passive holders, the Company plans to put the assets to work. By lending a portion of our treasury to vetted institutional partners, providing liquidity in Bitcoin-adjacent markets, and leveraging yield-generating instruments, the Company can generate a consistent cash flow in addition to Bitcoin’s long-term appreciation. This dual engine – yield plus potential growth – would be implemented with a view to using Bitcoin as a productive financial asset. With transparent reporting, strict risk management, and a focus on scalability, the Company is implementing a Bitcoin treasury function that permits exposure to digital assets without sacrificing financial performance.

The Company’s Bitcoin treasury will be managed by the Digital Asset Oversight Committee, which will be chaired by Jim Newman (Non-Executive Director) with Paul Welch (CEO) and Stephen Staley (Non-Executive Chair) as members, together with a representative from Appold. The Company will hold Bitcoin through BitGo, a digital asset infrastructure company, with whom the Company has a previously notified contract, which includes the provision of custody services.

Should Buccaneer pursue a lending strategy, any lending would be focussed in lower-risk opportunities and be undertaken through counterparties under bilateral, off-chain contractual arrangements through BitGo and a regulated partner. The amount of Bitcoin that the Company may seek to lend at any one time would be up to a maximum of 20% of the Bitcoin on the Company’s balance sheet at that time and no single entity would consist of more than 10% of the total loan book.

Risks Associated with Digital Assets

While the Board recognises that the acquisition of digital assets, including Bitcoin, may provide benefits, it also acknowledges the inherent risks associated with such assets. Bitcoin is highly volatile as well as speculative in nature and are subject to significant price fluctuations. In addition, it should be noted that a growing number of publicly traded companies have adopted digital asset focused treasury strategies, and this has sometimes resulted in significant volatility in their share price and a dislocation between their market capitalisation and the underlying value of their assets. Consequently, exposure to digital assets such as Bitcoin may, in turn, amongst other matters, compound and increase the volatility of the Company’s share price.

The Board also acknowledges that the regulatory environment for digital assets remains uncertain and subject to change, which may impact the Company’s ability to hold or transact in Bitcoin. There are also risks associated with custody, security, and accounting treatment of digital assets, any of which could have a material adverse effect on the Company’s operations and investor returns. Similarly, the Company’s intended strategy for producing a yield from its digital assets is a nascent one and subject to additional risks due to the relative immaturity of this market in addition to traditional lending risks (counterparty risk etc).

The Company confirms that the implementation of the Policy does not alter its status under UK financial services law, including the Alterative Investment Fund Managers Regulations 2013. The Policy is a treasury management initiative only and does not constitute a collective investment undertaking or alternative investment fund. Similarly, the Policy represents a financial strategy decision and does not alter, the Company’s core business operations as an exploration and development company focused on oil and gas in the USA. The adoption of the Policy is not intended to result in the Company becoming or being seen as an investing company.

Paul Welch, Buccaneer Energy’s Chief Executive Officer, said:

“I am pleased to announce that we have completed a $675,000 fundraise for the progression of our major operational program at the Fouke Area in East Texas. We have identified two additional development locations in the Fouke area; these locations are within the same reservoir section that the successful Fouke 1 and 2 wells have previously developed, and we look forward to progressing the drilling of these wells. New interpretation of the 3D seismic that covers the area, combined with the existing well performance, has demonstrated that the reservoir section continues to the North of the existing wells and has yet to be drained by the existing wells. This section of the reservoir has been producing at high rates over the last several years with increasing amounts of associated gas. This gas has restricted production in the Fouke 2 and is expected to be prevalent in the next two development locations as well. The gas volumes, however, were determined to be too small to develop a dedicated offtake pipeline. However, they are sufficient to dedicate to a power project that will use the offtake to mine for Bitcoin on location. This is a preferred option to flaring the gas, which was the only other alternative for these gas volumes. We will also set up a Bitcoin Treasury function, in conjunction with our partner Appold, to handle, store, and ultimately sell the Bitcoin revenue generated from this operation.

The Company is looking to partner with a dedicated Bitcoin Mining operator to implement this project; however, if a suitable partner cannot be secured, the Fundraise proceeds will be used to acquire long lead items necessary for the set up of a future Company-owned Bitcoin Mining operation.

“In closing, I would like to thank our new and existing shareholders for their support with this Fundraise. We have ambitious plans for this business, both organic and inorganic, and we look forward to sharing further updates with all our stakeholders in due course.”

I have said for some time that I feel that Paul Welch is doing a good job here and despite some disappointing results gives shareholders the opportunity to make real money, and I like the bitcoin angle, more later.

Jadestone Energy

Jadestone is hosting a site visit this week for analysts at the Akatara gas project in Indonesia.

No new material information will be disclosed.

Presentation slides are available on the Company’s website at:

I am with Jadestone this week and will report back in detail in due course. But the first session of the day was an impressive overall presentation before we fly to Akatara this evening.

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy