October brought both turbulent policy development and tangible progress for the European hydrogen market. In this edition of Hydrogen Compass, we explore how delayed international frameworks, recalibrated national strategies, and new legislative moves reveal a region still defining its hydrogen future. However, as governments debate the path forwards, developers are pressing ahead, moving projects from planning to execution and signalling that Europe’s hydrogen market is still taking shape.

Project developments press ahead

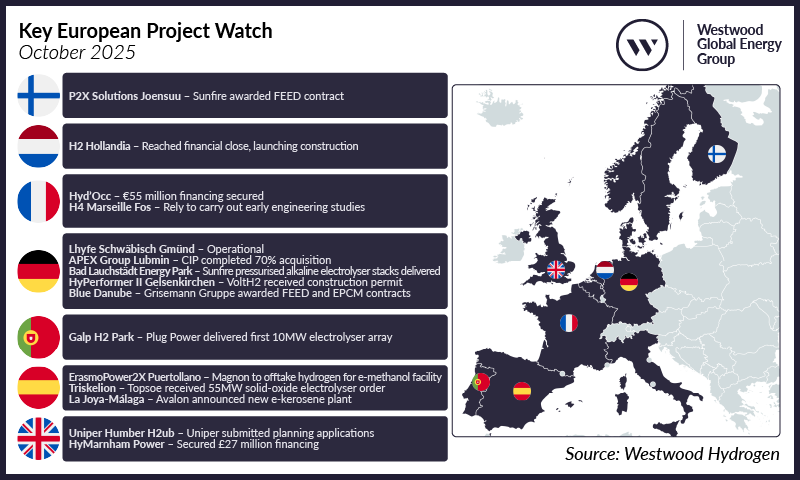

Across Europe, developers pressed ahead with major projects. From refinery decarbonisation in Portugal and large-scale e-fuel initiatives in Spain, to new electrolysis plants in Germany and the UK, investment continued and key milestones were reached. This momentum reflects the relative resilience of the industry, even as regulatory and commercial challenges persist. Against this backdrop of positive progress, it is important to acknowledge that policy uncertainty is ongoing, shaping the pace and structure of future developments overall.

Policy turbulence across Europe

Policy delays and uncertainty have continued to define the pace of the European hydrogen market and October was no exception. While the EU advanced key regulatory frameworks, national governments took divergent paths. Meanwhile, international developments, particularly in maritime regulation, added further complexity.

IMO delays net-zero framework

The International Maritime Organisation (IMO) voted in October to delay its Net-Zero Framework (NZF) by one year. This delay could significantly impact future demand for hydrogen and green ammonia in the maritime sector. Originally designed to accelerate the uptake of renewable and low-carbon fuels, the NZF’s postponement introduces further uncertainty for developers and investors.

The delays followed intense opposition from the US, Saudi Arabia, Iran and Russia. The US president publicly condemned the NZF, calling it a ‘Global Green New Scam Tax on Shipping’ and reportedly threatened visa restrictions and higher trade costs for countries supporting the framework.

IMO Secretary General Aresenio Dominguez and International Chamber of Shipping (ICS) Secretary General Thomas Kazakos both expressed disappointments, calling the outcome a setback for zero-carbon shipping and investment in green fuels.

With the NZF now on hold, demand forecasts for hydrogen-derived marine fuels are likely to be revised downward, potentially slowing investment in hydrogen supply projects and green ammonia production capacity.

Diverging national strategies in Europe

While the EU continues to refine its hydrogen policy framework, national governments are taking varied approaches, with some accelerating and others reassessing.

EU: The European Parliament approved the EU’s Delegated Act on low-carbon hydrogen in October. The Act, originally adopted by the Commission in July, sets a 70% emissions reduction threshold for low-carbon hydrogen compared to fossil fuels.

It aims to provide clarity on CCS-enabled hydrogen and non-renewable-powered electrolysis and allows such project to access funding under the European Hydrogen Bank. Commissioner Dan Jørgensen confirmed that projects making investment decisions now won’t be subject to future revisions of the Act, which creates an important reassurance for developers.

By expanding eligibility and establishing clear emissions criteria, the Delegated Act is expected to strengthen investor confidence and maintain momentum in Europe’s hydrogen market, particularly as the sector seeks greater flexibility in production pathways.

Portugal: Portugal’s Secretary of State for Energy, João Barroca, criticised the previous government’s heavy focus on renewable hydrogen last month, calling it a misguided priority that diverted resources from more practical decarbonisation options like biomethane. He warned that an export-driven hydrogen strategy has failed to create domestic value or support Portuguese industry.

Reflecting this change in direction, the government revised its electrolyser capacity target down from the previous administration’s 5.5GW target to 3GW in the October 2024 climate plan. Despite this recalibration, Portugal has continued to progress key infrastructure projects, including a 10% hydrogen blending trial in the gas grid and the CelZa pipeline linking to Spain as part of the H2Med corridor.

This more pragmatic stance signals a strategic pivot, focused on aligning hydrogen policy with domestic industrial needs and long-term economic resilience.

Finland: In October, the Finnish government announced plans to finalise its dedicated hydrogen law by the end of 2025, with implementation scheduled for 2026. The legislation will clarify rules for production, transmission, ownership, pricing and safety, replacing the current reliance on natural gas regulations.

State-owned Gasgrid is already progressing with the national hydrogen network and the 2,500km Nordic-Baltic Hydrogen Corridor. Environmental assessments have also begun, with Worley appointed to lead front-end engineering through 2028.

Finland’s proactive approach aims to provide greater regulatory certainty, supporting its position as a key player in Northern Europe.

Germany: Germany’s hydrogen strategy came under scrutiny in October following a report from the federal audit office, which called for a revision to safeguard both climate and economic goals. The report criticised slow progress towards the country’s 10GW (6.6 GW(LHV)) 2030 target and flagged financial risks associated with the planned 9,000km hydrogen core network.

Despite these concerns, the German government advanced several key measures last month. The federal cabinet approved the draft Hydrogen Acceleration Act, which aims to streamline permitting for hydrogen production, imports, storage, and infrastructure. The law will designate hydrogen projects as being of ‘overriding public interest,’ giving them priority in planning and legal processes. Amendments to the Federal Mining Act will also permit natural hydrogen exploration in the country.

Germany also plans to review and potentially overhaul its renewable hydrogen support framework. The Ministry of Economic Affairs and Energy (BMWK) acknowledged that the market has underperformed, prompting a review of funding schemes and a shift toward imports and cost-efficiency. Current programmes include €2.6 billion for H2Global import auctions, €4.6 billion for the Hy2Infra network, €30 million per project for overseas hydrogen investments, and a €6 billion Carbon Contracts for Difference (CCfD) to support industrial decarbonisation, which opened for applications for its second round in October.

Looking ahead, policy is expected to focus on reducing system costs by optimising electrolyser siting and utilising excess renewable power. Germany also plans to open capacity reservations for its hydrogen core network in 2026, a key enabler for market activation. The country’s hydrogen policy is shifting towards ensuring execution, focusing on cost discipline, infrastructure readiness, and streamlined governance to restore investor confidence.

Jun Sasamura, Manager – Hydrogen

jsasamura@westwoodenergy.com

Original article l KeyFacts Energy Industry Directory: Westwood Global Energy

KEYFACT Energy

KEYFACT Energy