WTI (Jan) $58.65 +70c, Brent (Jan) $63.13 +65c, Diff -$5.48 -5c

USNG (Jan) $4.56 +3c, UKNG (Dec) 75.6p -1.3p, TTF (Jan)* €29.185 -€0.08

*Denotes expiry of December contract

Oil price

A very Happy Thanksgiving to all my friends and readers in the USA.

With markets shut and others very quiet ahead of the weekend in which it shouldn’t be forgotten that that there is an Opec+ meeting although the market is not expecting any release this month.

The UK budget was very much in line with expectations, Rachel from accounts showed that she and the Government are totally incapable of running what should be a profitable industry with the ability to provide vital hydrocarbons when we will need them. The idea that net zero will provide all the jobs that will go with the oil & gas industry is laughable and the smile will be on the other side of their faces when the bill comes in for their share of the decommissioning bill.

The EIA stats were not as good as the API where a draw in crude was reported, showing a build of 2.7m barrels as well as builds in gasoline and distillates the EIA showed products building ahead of the winter and the cold weather.

Arrow Exploration Corp

Arrow has announced the filing of its Interim Condensed (unaudited) Consolidated Financial Statements and Management’s Discussion and Analysis (“MD&A”) for the three and nine months ended September 30, 2025, which are available on SEDAR (www.sedar.com) and will also be available shortly on Arrow’s website at www.arrowexploration.ca.

Q3 2025 Highlights:

- Average corporate production of 4,214 boe/d (Q3 2024: 4,124 boe/d).

- Recorded $18.5 million of total oil and natural gas revenue, net of royalties.

- Realized corporate oil operating netbacks(1) of $38.21/bbl.

- Cash position of $6.3 million at the end of Q3 2025.

- YTD generated operating cashflows of $25 million.

- Drilled two additional development wells in the Carrizales Norte (CN) field in the Tapir block, and an exploration well in Mateguafa Oeste (MO).

- Net YTD income of $4.8 million.

(1) Non-IFRS measures

Post Period End Highlights:

- Drilled the Mateguafa Attic wells: Mateguafa-5 (M-5) and Mateguafa-6 (M-6), and spud the Mateguafa-7 Horizontal well (M-HZ7)

Cash Balance:

On November 1, 2025, the Company’s cash balance was US$8.2 million. This reflects an intensive period of capital outlay as the Company contracted a second rig during Q2 and Q3 and built access roads and drill pads at Carrizales Norte, Mataguafa Oeste, Mataguafa Attic and preliminary works at the highly prospective Icaco project. The Company has now reverted to operating one rig, and the site preparation and seismic costs are largely met, this provides a foundation for future development and exploration activities., Both production and net backs remain robust at current market prices.

Tapir Extension and COR-39 Block

The Company is engaged in continuing discussions with authorities on the Tapir block extension. Arrow considers that all requirements for the extension have been met. Furthermore, the Company is in discussions with regulatory bodies on the termination of COR-39 Block license obligations (where activity has been suspended since November 2017). Discussions with authorities are going well and Arrow will keep the market updated in future releases.

Upcoming Drilling

The Company has spud the M-HZ7 well, which is expected to be put on production in mid-December 2025. Thereafter, the Company expects to drill another well at its Mateguafa Attic field and initiate civil works in preparation to drill its first exploration well in the Icaco prospect in Q1 2026.

Marshall Abbott, CEO of Arrow Exploration Corp., commented:

“The third quarter of 2025 has been very busy for Arrow. We completed two development wells in Carrizales Norte and drilled the Mateguafa Oeste exploration well as well as setting up infrastructure for the discovery at Mateguafa Attic and the upcoming exploration well at Icaco. The Mateguafa Attic discovery could become a major production platform and have a material impact on the Company, and the Icaco prospect is another near term catalyst that we expect will be drilled in the first quarter of 2026.”

“The Company continues to work with regulatory authorities on the extension of the Tapir block. The Company considers it has met all of the requirements for an extension and discussions with regulatory officials continue to progress.”

“Arrow has invested heavily into roads, pads and water infrastructure in both Q2 and Q3 and the results can be seen with a significant decrease in the Company’s operating cost in Q3 when compared to Q2 2025. This investment will continue to payback over the life of the Tapir pads.”

“The focus for the remainder of 2025 will be to drill low risk wells at the Mateguafa Attic pad in the Tapir block and to get all preliminary works in place to drill our first exploratory well at the Icaco prospect.”

With the success of the M-6 well at the Mateguafa Attic announced yesterday the outlook for Arrow looks very exciting both in the short term as the programme continues and over the long term as the infrastructure pays back as a major discovery. Along with the upcoming exploration well at Icaco which is another ‘near term catalyst that the company expect to drill in 1Q 2026’ the positives are stacking up.

The third quarter figures today are historic and show a very active period as we have seen, I expect to see progress on all these fronts, horizontal drilling, testing of the hydrocarbon zones and thus paying back the heavy investments of this year.

As I said yesterday, I am confident that the campaign will bring cash flow and a consequent rerating upwards of the shares, Arrow has an exceptional portfolio and good prospects of an extension at the Tapir block which bodes well for the future.

Jersey Oil & Gas

Jersey has noted the UK Government’s response to the consultation concerning future changes to the UK oil and gas tax regime. The subject of the consultation was the development of a permanent successor to the Energy Profits Levy (“EPL”), in the form of the Oil and Gas Price Mechanism (“OGPM”).

The consultation response states that:

- The OGPM will come into effect either on 1 April 2030 or earlier if the existing price floors that pertain to the EPL are passed (being $74/bbl and 57p/therm in the last financial year)

- The Government has decided to adopt a revenue-based model for the calculation of windfalls under the OGPM, with a 35% tax being levied only on the revenues generated above the threshold prices

- Two independent threshold price points will be set annually, one for oil (in dollars per barrel) and one for gas (in pence per therm)

- The thresholds in financial year 2026-27 have been set at $90/bbl for oil and 90p/therm for gas – they will be adjusted annually in line with CPI inflation and are projected to be around $98/bbl and 98p/therm by 2030

- The OGPM when in effect returns the tax rate to the 40% headline rate in the permanent regime, with the OGPM only applying to oil or gas revenues in the event the respective commodity price is unusually high

With clarity on the longer-term tax regime now provided, the Company will be working with the Buchan joint venture partners, NEO Next Energy and Serica Energy, to assess the impact of these changes on the Buchan project.

As I have already said through today’s comments about the budget the news was disappointing but JOG is clearly keen to get on with the process at Buchan. They have quite correctly waited for the news about the EPL and the subsequent OGPM and its ramifications for the partners.

Accordingly I think that it has been wise for them to remind the market of the situation and of course to indicate that ultimately the project will be driven by the partners investment decisions but clarity on the EPL replacement is. a step forward.

JOG shares are up over 100% so far this year but concerns about recent Government policy has seen the price fall back a little recently. This news should arrest that fall and show just how attractive the shares are, I remain convinced that once the Buchan development goes ahead the upside is substantial.

Serica Energy

Serica has issued the following trading and operations update in respect of the third quarter and first nine months of 2025.

Chris Cox, Serica’s CEO, stated:

“Production rebounded in November to once again average above 50,000 boepd, a level that more accurately reflects the potential of our portfolio. The expected near-term addition of Lancaster production, following completion of our acquisition of Prax Upstream, will add a further short-term boost, and the resumption of regular liftings from Triton will return us to significant and sustainable cash generation going forward.

This, in turn, will help us to deliver on our two-pronged growth strategy, as we seek to diversify our production both through investment in our existing portfolio and M&A. While the Budget announcements yesterday were a missed opportunity to kick-start investment across the UK North Sea, we now have greater clarity about the fiscal and regulatory regimes in which our investment decisions will be made. We have multiple, and material, organic growth options, and we will work to high-grade the investments that maximise shareholder value.”

November production of over 50,000 boepd from Serica was very impressive, although guidance for the FY 2025 average of 27,000-28,000 boepd illustrates the impact of the historic downtime from Triton this year. 2026 is well positioned to be much higher, with positive signs that Triton can rebound strongly after the current short-term planned maintenance is complete.

So the outlook for Serica is very good indeed, despite the budget news, where opportunities to give the sector a boost were passed up, and the company remains in a strong position to shape its portfolio for the future. In this respect Serica has the chance to plan its growth through organic and inorganic processes with some confidence.

I would suggest that Serica is still planning to use the fact that, however grim it is for the industry, they are better placed than most to plan for future growth. As Chris Cox summed up above, ‘we have multiple, and material, organic growth options, and we will work to high-grade the investments that maximise shareholder value’. Serica has indeed built up an impressive pipeline of organic growth projects, from infill drilling at Bruce to development opportunities West of Shetland, and I look forward to clarity from the Company about how these opportunities will add to value creation going forward.

They have a lot to high-grade at present, and cash flows next year will help provide the war chest from which they can invest in the projects they cherry pick to deliver. There may also be some further M&A potential in the North Sea now there is clarity.

So looking forward the outlook is bright, the opportunities for tax efficient investment remain, with tax-losses shielding from the worst of the regime and come 2030 and the high tax rate falling away offset by higher production is another positive for the company. I expect Serica to be up there with the best of them and my 350p TP stands.

Update on production and financial performance

|

(boepd) |

Q1 |

Q2 |

Q3 |

Average |

|

Bruce Hub |

17,200 |

16,300 |

15,400 |

16,300 |

|

Triton Hub |

5,100 |

– |

7,700 |

4,300 |

|

Other Producing Assets |

5,200 |

5,600 |

4,400 |

5,100 |

|

Total |

27,500 |

21,900 |

27,500 |

25,700 |

- Production of 25,700 boepd in first nine months of 2025, predominantly impacted by downtime at the Triton FPSO

- Q3 production included the planned annual maintenance periods at the Bruce Hub and across Other Producing Assets

- Following October production of 27,900 boepd, production in November rebounded to average 50,300 boepd prior to the planned outage at Triton, which started on 23 November and is expected to complete in mid-December

- Revenue of $439 million in first nine months of 2025, with $134 million in Q3 (Q3 2024: $139 million)

- Average realised Brent oil price of $70/bbl in first nine months of 2025 (first nine months of 2024: $76/bbl)

- Average realised NBP gas price of 89p/therm in first nine months of 2025 (first nine months of 2024: 71p/therm)

- Capital expenditure of $200 million in first nine months of 2025 (same period in 2024: $202 million), in line with guidance, the majority of which was spent on completion of the Triton drilling programme and ongoing subsea work to prepare Belinda for production

- Cash tax paid of $8.5 million in 2025, benefitting from group relief, which also resulted in a $71 million tax refund being received in June 2025. There are no further tax payments to be made in 2025

- Cash of $41 million as at 30 September 2025 (30 June 2025: $174 million)

- Q3 capital expenditure was $62 million, no payments for liftings were received relating to Triton production, and the final dividend of $51 million was paid in July

- Borrowings of $231 million as at 30 September 2025 (30 June 2025: $231 million), resulting in a net debt position of $190 million as of 30 September 2025

- Total liquidity of $300 million as of 30 September 2025, comprising cash and undrawn committed RBL facility availability of $259 million

Operational update

- Maintenance work at the Triton FPSO completed in July, with subsequent temporary issues relating to the compression train and flare system, resulting in significantly reduced production in Q3

- Production rebounded strongly in November, averaging 25,300 boepd net to Serica prior to the planned subsea work starting on 23 November. This work on the Bittern export pipeline requires production to be shut in from the Bittern, Gannet, and Evelyn fields, and is set to complete in mid-December

- The Triton FPSO is currently running with one compressor online, with maximum production net to Serica of 25,000-30,000 boepd. The start of two compressor operations would facilitate an increase in production through the optimisation of Serica wells, and then production from the Belinda field (Serica 100%). Testing of the second compressor is currently underway, and the operator of the Triton FPSO, Dana, continues to review the start date of two-compressor operations

- Production from the Bruce Hub averaged 22,000 boepd in the period prior to planned annual maintenance, which began on 15 August. Following the completion of maintenance, bull-heading operations (in which gas is pumped into a well to reduce back pressure and enhance production) were only able to resume in November, resulting in curtailed production of 16,100 boepd in October. With the resumption of bull-heading, production has returned to over 20,000 boepd from the Bruce Hub

Update on acquisitions

- The acquisition of Prax Upstream is set to complete in mid-December, at which point production from Lancaster, currently around 5,900 boepd, will be added to the Company total. Completion of the TotalEnergies and ONE-Dyas Acquisitions continues to be expected in H1 2026

- In November, Serica announced the acquisition of a 40% holding in the P2530 Licence from Finder Energy, containing the Wagtail oil discovery and the low-risk Marsh and Bancroft exploration prospects. The addition of the stake in Wagtail will add an operator estimated c.8 MMbbls of net 2C Contingent Resources to the Serica portfolio, and enhanced the already attractive organic growth opportunity set

Update on UK Government consultations

- As announced in the Budget yesterday, the Energy Profits Levy (‘EPL’) will be retained in its current form until 2030

- After EPL ends, or ceases due to average oil and gas prices falling below triggers set under the Energy Security Investment Mechanism (‘ESIM’), currently Brent $76.12/barrel and 0.59p/therm, the government yesterday confirmed that it will be replaced by a new permanent mechanism, the Oil and Gas Price Mechanism (‘OGPM’). Unlike EPL, the OGPM will be applied separately to oil and to gas and will tax only the proportion of revenue earned above new OGPM trigger levels, those being $90/barrel and 90p/therm (for 2026 to 2027, then rising with the Consumer Price Index), at a tax rate of 35% (as opposed to 38% for the EPL)

- Also announced yesterday was the North Sea Future Plan. This reconfirmed the government’s commitment that all existing licences will be honoured, and licence extensions can be granted. It is not therefore expected that, once legislated, the new regime will impact Serica’s current portfolio, future developments, or growth strategy

- The North Sea Future Plan also introduces a new concept of Transitional Energy Certificates which are designed to support further development in currently unlicensed areas adjacent to existing licensed blocks

Outlook and guidance

- Serica expects production for FY 2025 to average 27,000 to 28,000 boepd

- Capital expenditure expected to be around $250 million, in line with guidance

- Opex is expected to be around 10% above the previously guided $330 million, due in part to the relative strength of Sterling against the US Dollar

- Serica continues to analyse multiple M&A opportunities, focused on the UK North Sea, while progressing the numerous organic growth options in the existing portfolio

- Serica remains committed to the move from the AIM to the Main Market of the London Stock Exchange, which continues to be expected following publication of Serica’s audited FY 2025 accounts and consolidated year end CPR information

- In line with previous years, guidance for 2026 will be provided in a Trading and Operations Update to be announced on 21 January 2026

Buccaneer Energy

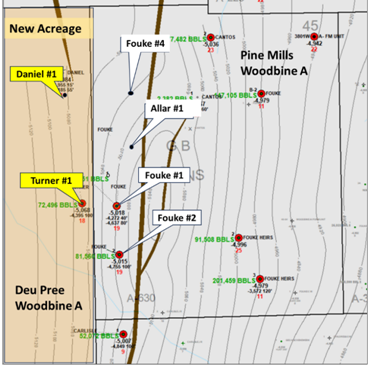

Buccaneer has announced the acquisition of a 32.5% interest in offsetting leasehold acreage in the Fouke area of the Pine Mills field.

Highlights:

- New Acreage: 32.5% working interest in acreage directly west of the Allar #1 location.

- Sidetrack Opportunity: Enables potential westward sidetrack of the Allar #1 away from bounding fault.

- Shut-in Wells: Includes Turner #1 and Daniel #1 wells (32.5% WI each). Turner #1 planned for near-term return to production; Daniel #1 retained as potential injector for future waterflood development.

- Enhanced Recovery Plan: Discussions underway with Texas Railroad Commission regarding formation of an enhanced recovery unit in the Fouke area.

- Next Well: Fouke #4 remains on track to spud in late December 2025.

The following map illustrates the new acreage position, including the location of Allar #1, the Fouke wells, and the area now accessible for a potential sidetrack.

|

|

Paul Welch, Buccaneer Energy’s Chief Executive Officer, commented:

“The addition of this acreage is an important step for Buccaneer as we look to further our development of the Fouke area by unlocking the opportunity to pursue an optimal sidetrack for the Allar #1 well. The Company will now progress preparatory work including reviewing the well plan, cost estimates, and timing in conjunction with its partner. The Turner #1 well provides near-term production potential, while Daniel #1 offers longer-term development optionality.

With this acreage now secured and Fouke #4 progressing toward spud, we are well positioned to continue building production and value across Pine Mills. I look forward to updating investors as we progress these various workstreams.”

I am sticking with Buccaneer after their recent disappointments and this deal seems good enough, I imagine that it is acquired without cost as none is mentioned and it certainly makes sense. The opportunity to sidetrack the Allar #1 well will hopefully happen and develop the area.

The new year offers plenty for Buccaneer on the operational side, I think that more people need to catch up with the play and indeed the management, they need to know that it’s a new team with better assets now on the case. So far maybe they are off the radar screen for the wrong reasons…

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy