Venezuela has been an oil producer since 1914 when the first commercial oil well, Zumaque I, was drilled in the Mene Grande field on the eastern shores of Lake Maracaibo.

Venezuela is a founding member of OPEC and one of the world’s top oil producers. It holds some of the largest proven reserves of petroleum and natural gas, although its production of crude oil has dropped in recent years, largely due to mismanagement by the Venezuelan government.

Country Key Facts

| Official name: | Bolivarian Republic of Venezuela |

| Capital: | Caracas |

| Population: | 28,573,617 (2025) |

| Area: | 916,445 km² (353,841 sq miles) |

| Form of government: | Federal Republic |

| Language: | Spanish |

| Religions: | Roman Catholic |

| Currency: | Bolívar fuerte (VEF) |

| Calling code: | +58 |

Venezuela’s oil and gas industry is the backbone of its economy, historically accounting for around 95% of export earnings, roughly a quarter of GDP, and nearly half of government revenues. The country possesses the largest proven oil reserves in the world, estimated at approximately 303 billion barrels, most of which are heavy and extra-heavy crude concentrated in the Orinoco Belt. Proven natural gas reserves are estimated at 195 to 205 trillion cubic feet, placing Venezuela among the largest holders in South America, though much of this gas is associated with oil production and primarily used domestically.

The modern oil sector began in the early 20th century with foreign-led exploration and production. In 1976, the government nationalized the industry, creating PDVSA (Petróleos de Venezuela, S.A.), which remains the dominant player in all aspects of the sector, from exploration and production to refining and exports. Over the decades, the country’s oil output peaked at around 3.7 million barrels per day in the late 1990s but has since collapsed due to political turmoil, economic mismanagement, underinvestment, sanctions, and aging infrastructure. Recent estimates show production recovering to roughly 863,000 to 1.14 million barrels per day as of 2024–2025, still far below historical highs.

Venezuela collaborates with international partners from China, Russia, and India through joint ventures, primarily in the Orinoco Belt, to maintain and expand production. Downstream operations include domestic refineries and foreign assets, most notably CITGO in the United States, although refinery efficiency is low due to neglect and lack of maintenance. Natural gas production, which currently averages about 3.06 billion cubic feet per day, is largely associated with oil fields and has limited export potential because of underdeveloped infrastructure.

The industry faces significant challenges, including deteriorating infrastructure, sanctions that limit financing and technological access, a shrinking skilled workforce due to emigration, and the technical difficulties of producing heavy and extra-heavy crude. Political and economic instability has further deterred long-term investment, keeping production below potential. Nonetheless, Venezuela holds opportunities for recovery and expansion, especially through development of the Orinoco Belt, modernization of refineries, and eventual monetization of natural gas via LNG projects. With foreign investment, technical upgrades, and political stabilization, Venezuela’s oil and gas sector could regain a more prominent role in the global energy market, though structural and logistical hurdles remain substantial.

| Oil production | 863,000 thousand bpd |

| Proved oil reserves (year-end) | 303.8 billion barrels |

| Natural Gas production | 3.06 Bcf/d |

| Natural Gas proved reserves (year-end) | 5.5 trillion cubic metres |

Venezuela holds the largest proven oil reserves in the world, ahead of Saudi Arabia, Iran, Canada, and Iraq. This figure is reported by major energy statistics agencies including the U.S. Energy Information Administration (EIA) and OPEC‑linked data, and represents about 17 % of global proven oil reserves. Most of these reserves are extra‑heavy crude from the Orinoco Belt, which is technically recoverable but more expensive to produce than lighter crude.

KEY OIL & GAS PLAYERS IN VENEZUELA

State production association Belorusneft was established in 2006 by presidential decree. It comprised Belorusneft enterprise (gas and oil producing unit), state agro-industrial enterprise and affiliated companies for petroleum product sales.

Belorusneft comprises over 40 subdivisions for oilfield services, engineering, design, gas processing, and petroleum product sales in Belarus, Russia, Ukraine, Venezuela, Ecuador, and Poland.

Venezuela operations

Belorusneft’s involvement in Venezuela’s oil and gas sector stems from a long-standing joint venture with the Venezuelan state oil company PDVSA that was established in the late 2000s during a period of close political and economic ties between Belarus and Venezuela. In December 2007 the two governments agreed to form Petrolera BeloVenesolana, a Belarusian-Venezuelan enterprise with Belorusneft holding a 40 % stake and PDVSA 60 %, intended to develop and produce hydrocarbons in Venezuelan fields, particularly in western Venezuela near Lake Maracaibo and in parts of the Orinoco basin. Oreanda News+2Oreanda News+2

In the early years of the venture, Belorusneft and its partner identified several deposits for joint exploration and production, and by around 2010 Belorusneft was reported to be extracting both oil and associated gas through Petrolera BeloVenesolana. The company owned and operated multiple oil and gas deposits, including fields transferred to the venture, and continued geological research and drilling activities. Over the first years of operations it produced millions of tonnes of oil and several hundred million cubic metres of gas, selling output on international markets rather than shipping it back to Belarus.

Belorusneft at times considered expanding its participation to other blocks, including involvement in the Junin-1 area of the Orinoco Oil Belt, but internal business assessments led it to suspend its participation in that project, even while continuing the core Petrolera BeloVenesolana operations.

The scale of Belorusneft’s activities in Venezuela historically made it one of the more significant foreign minority partners in PDVSA’s portfolio of joint ventures, although larger partners such as U.S., European, Chinese, and Russian companies have tended to dominate production volumes. Over the last decade production in Venezuela’s broader oil and gas sector has been affected by economic pressures, sanctions and shifting alliances, which have reshaped foreign involvement in many projects.

KeyFacts Energy: Belorusneft Venezuela country profile

Chevron Corp. ranks among the world's largest and most competitive global energy companies. Headquartered in San Francisco, it is engaged in every aspect of the oil and gas industry, including exploration and production; refining, marketing and transportation; chemicals manufacturing and sales; and power generation.

Worldwide, Chevron is the fourth largest publicly traded company in terms of oil and gas reserves and is the fourth largest producer.

Venezuela operations

Chevron is one of the leading private oil companies in Venezuela. Their presence in the country began with exploration activities in 1923, and the discovery of Boscan field in 1946.

Chevron’s oil and gas operations in Venezuela have been defined by a long, complex history of partnership with the Venezuelan state oil company PDVSA amid shifting political and sanctions environments. Chevron first began activities in the country in the early 20th century, with exploration starting in the 1920s and the significant discovery of the Boscan oil field in 1946. Over decades it became one of the most entrenched international oil companies in Venezuela, participating in a series of joint ventures with PDVSA across onshore and offshore projects, focusing heavily on heavy and extra-heavy crude production as well as some natural gas assets, including a cross-border field shared with Trinidad and Tobago. Through these partnerships, Chevron historically held significant minority stakes in ventures such as Petroboscan in the Lake Maracaibo region and Petropiar in the Orinoco Oil Belt, and maintained interests in Petroindependiente and Petroindependencia alongside associated gas developments.

Chevron’s Venezuelan oil and gas operations have spanned nearly a century and remain one of the most enduring examples of foreign investment in the country’s hydrocarbon industry, but they have been heavily shaped in recent years by U.S. sanctions policy and geopolitical tensions that restrict the scale and nature of its activities.

KeyFacts Energy: Chevron Venezuela country profile

China National Petroleum Corporation (CNPC) is one of the world's leading integrated energy companies. It is a state holding company whose business operations cover a broad spectrum of upstream and downstream activities, domestic marketing and international trade, technical services, and equipment manufacturing and supply.

CNPC serves as China 's largest producer and supplier of crude oil and natural gas, holding a dominant position in domestic petroleum production, processing, and marketing sectors. At the same time, CNPC is also a major producer and supplier of refined oil products and petrochemicals.

Venezuela operations

CNPC has been one of the key foreign partners of PDVSA, mainly through joint ventures focused on heavy crude in the Orinoco Oil Belt and related projects. According to company filings, CNPC’s involvement dates back to at least the early 2000s, when it entered into a joint venture with PDVSA for the Sinovensa block in the Carabobo area of the Orinoco Belt, where it holds a 40% stake while PDVSA holds 60%; this venture produces extra‑heavy crude that is typically upgraded or blended for export and sale.

CNPC’s activities have historically included interests in other Venezuelan fields such as Intercampo in Lake Maracaibo and the Caracoles field in the Eastern Venezuela Basin, and in associated blending or upgrading facilities with PDVSA. Over the years, the CNPC–PDVSA partnerships have faced operational challenges stemming from underinvestment, sanctions, infrastructure issues and maintenance accidents, which have at times led to production interruptions, such as a reported shutdown at the Morichal operations center affecting Sinovensa.

Despite these obstacles, CNPC’s Venezuelan joint ventures have continued to be part of the country’s working oil and gas portfolio, contributing to crude output that feeds export markets, particularly China, under long‑standing energy cooperation agreements.

KeyFacts Energy: CNPC Venezuela country profile

Eni is a major integrated energy company, committed to growth in the activities of finding, producing, transporting, transforming and marketing oil and gas. The company operates in the oil and gas, electricity generation and sale, petrochemicals, oilfield services construction and engineering industries. Eni is active in 70 countries with a staff of about 79,000 employees.

Eni engages in oil and natural gas exploration, field development and production, mainly in Italy, Algeria, Angola, Congo, Egypt, Ghana, Libya, Mozambique, Nigeria, Norway, Kazakhstan, the UK, the United States and Venezuela, overall in 46 countries.

Venezuela operations

Eni’s oil and gas operations in Venezuela have been long-standing and multifaceted, centered on partnerships with the Venezuelan state oil company PDVSA and participation in a range of upstream hydrocarbon projects that include natural gas development offshore and heavy oil production onshore. The Italian energy major has been present in Venezuela since 1998, when it entered into joint ventures under the country’s legal framework requiring majority PDVSA ownership in upstream enterprises, with foreign partners holding minority stakes and operating roles in specific blocks.

A core part of Eni’s Venezuelan portfolio has been its involvement in the Perla super-giant gas field, located offshore in the Cardón IV block in the Gulf of Venezuela. Eni originally held a 50 % interest (alongside Repsol) in Cardón IV, which discovered vast natural gas reserves estimated at about 17 trillion cubic feet (roughly 3.1 billion barrels of oil equivalent). Production at Perla began in 2015, with Eni’s share contributing to substantial gas output intended primarily for PDVSA’s domestic market under a long-term Gas Sales Agreement running through 2036.

In addition to gas, Eni has played a significant role in heavy oil development in the Orinoco Oil Belt. The company holds a 40 % interest with PDVSA holding 60 % in the Junín-5 block, one of the largest heavy oil accumulations in the world. Production from Junín-5 commenced in the early 2010s, and the development is structured through two mixed enterprises—PetroJunín for upstream production and PetroBicentenario for downstream operations including a refinery in the José Industrial Complex.

Eni also has a stake in PetroSucre, the operating company for the Corocoro offshore field in the Gulf of Paria, where it holds around 26 % of the venture alongside PDVSA’s majority share. Corocoro historically produced light crude, and Eni’s involvement there adds to its diversified Venezuelan asset base combining both onshore heavy oil and offshore lighter grades.

KeyFacts Energy: Eni Venezuela country profile

KNOC (Korea National Oil Corporation) is South Korea's state-run oil and gas company responsible for securing stable energy resources for the country. Its operations span exploration, development, and production of oil and gas resources both domestically and internationally. Domestically, KNOC manages oil stockpiling, operates storage facilities, and oversees a small number of production assets, including the Donghae gas field, which has reached the end of its productive life.

Internationally, KNOC holds stakes in various upstream projects across regions such as the Middle East, North America, Southeast Asia, and Central Asia, involving both operated and non-operated assets.

Venezuela operations

KNOC’s presence in Venezuela is concentrated in Block Onado, located in the Maturín Basin in central Venezuela, where it holds a 5.64% working interest. This block is operated through a joint venture managed by Petronado S.A., with PDVSA (the Venezuelan state oil company) holding approximately 60 %, CGC of Argentina 8.356 %, Petroamazonas of Ecuador 26.004%, and KNOC the remaining 5.64%.

Initial production from Block Onado began in 1971. By 2021, the field was producing around 0.2 thousand barrels of oil equivalent per day (mboed), of which KNOC’s share represented roughly 0.011 mboed—equating to a modest fraction of its portfolio in the Americas.

KeyFacts Energy: KNOC Venezuela country profile

Maurel & Prom (M&P) is an oil and gas exploration and production company listed on the Euronext Paris regulated market.

With a history of more than two centuries, Maurel & Prom has, both at its headquarters in Paris and in its subsidiaries, a solid technical expertise and a long operational experience, especially in Africa. The Group has a portfolio of high-potential assets focused on Africa and Latin America, consisting of both production assets and opportunities in the exploration or appraisal phase.

Venezuela operations

Maurel & Prom’s oil and gas operations in Venezuela have centred on its interest in a joint venture with Venezuela’s state oil company PDVSA through the mixed company Petroregional del Lago (PRDL), which operates the Urdaneta Oeste oil field in the Lake Maracaibo region. M&P Iberoamerica, a subsidiary of the French energy company Maurel & Prom, holds a 40 % working interest in PRDL, with PDVSA owning the remaining 60 %. This means M&P’s net interest in production from the Urdaneta Oeste field is 32 %. The field historically produced around 16,000 barrels of oil per day on a 100 % basis, equating to about 6,400 bpd net to M&P at the 40 % interest, although actual production has varied with operational developments.

In November 2023, M&P and PDVSA signed a set of agreements to restart and fully resume operations at Urdaneta Oeste, reflecting M&P’s long-term strategy to tap the field’s potential and support organic growth.

Because of U.S. sanctions on Venezuela, M&P sought regulatory clearance from the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC). In May 2024, M&P received a specific OFAC license that allowed U.S. entities and banks to engage with the company regarding its Venezuelan activities and allowed operations under the agreements with PDVSA through 31 May 2026 (with expectations of renewal).

In March 2025, the OFAC revoked that specific license, issuing a wind-down license that authorised M&P to complete necessary transactions related to its Venezuelan operations only until 27 May 2025. This revocation was part of a broader U.S. policy affecting several foreign firms operating in Venezuela’s oil sector under similar authorisations. During the wind-down period, M&P continued its operational work and product liftings, including production of roughly 8,236 bopd on a working interest basis in Q1 2025, indicating ongoing activity despite regulatory uncertainty.

Following the expiry of the U.S. license at the end of May 2025, M&P adjusted its presence in Venezuela, limiting operations to maintenance and well interventions to ensure safety while production continues, though without a clear path for new commercial oil exports under current sanctions conditions.

KeyFacts Energy: Maurel & Prom Venezuela country profile

Oil India Limited is one of the largest national oil and gas companies in India as measured by total proved plus probable oil and natural gas reserves and production. It is engaged in the business of exploration for oil and gas, production of crude oil, natural gas and LPG and transportation of crude oil, natural gas and petroleum products.

OIL’s domestic exploration activities are spread over onshore areas of Ganga Valley and Mahanadi. OIL also has participating interest in NELP exploration blocks in Mahanadi Offshore, Mumbai Deepwater and Krishna Godavari Deepwater.

OIL has over 50 E&P blocks in India and an International presence spanning Libya, Gabon, USA, Nigeria, Venezuela and Sudan.

Venezuela operations

Oil India has participated in Venezuelan oil operations primarily through a small equity stake in a consortium developing heavy oil in the Orinoco Belt, rather than as a standalone operator. Through its wholly owned subsidiary Oil India Sweden AB and its pro-rata share in the joint venture Indoil Netherlands B.V., OIL holds about a 3.5 % interest in the Carabobo project, a producing heavy-oil block in eastern Venezuela’s Orinoco Heavy Oil Belt operated by a consortium that includes PDVSA as majority partner, ONGC Videsh Limited, Indian Oil Corporation and international partners such as Repsol and Petronas. This stake gives OIL proportional exposure to upstream production of extra-heavy crude in Carabobo, which has been producing since the early 2010s as part of Venezuela’s mixed company framework.

OIL’s participation is relatively minor in scale compared with other Indian upstream holdings such as ONGC Videsh’s interests, but it gives the company ongoing involvement in Venezuelan upstream hydrocarbons and contributes to India’s broader engagement with Venezuela’s oil sector.

KeyFacts Energy: Oil India Venezuela country profile

ONGC Videsh Limited (OVL) is the wholly owned overseas investment arm of Oil and Natural Gas Corporation Limited (ONGC), India’s flagship national oil company. Established in 1965, OVL is tasked with acquiring equity oil and gas assets abroad to bolster India’s energy security through diversification of hydrocarbon sources.

OVL is primarily engaged in the business of exploration, development, and production of oil and gas outside India. The company operates as a strategic player in the global energy landscape, acquiring interests in oil and gas fields across continents. As of recent years, ONGC Videsh has a presence in over 30 oil and gas projects across more than 15 countries, including Russia, Vietnam, Brazil, Colombia, Venezuela, Mozambique, and South Sudan.

Venezuela operations

ONGC Videsh has maintained significant upstream oil and gas interests in Venezuela through joint ventures with the Venezuelan state oil company PDVSA, focused on heavy oil production in the Orinoco Heavy Oil Belt and involving longstanding equity stakes acquired under Venezuela’s mixed-company framework.

In eastern Venezuela’s Orinoco Belt, ONGC Videsh holds a 40 % participating interest in the San Cristobal project, located in the Junín Norte block near Zuata, as part of a joint venture with PDVSA (which holds the remaining 60 %). This project, which was incorporated in the late 2000s, involves the development and production of heavy oil under a mixed company arrangement that reflects Venezuela’s requirement for majority state ownership while enabling foreign partners to participate in upstream operations.

Alongside San Cristobal, ONGC Videsh is a partner in the Carabobo-1 area of the Orinoco Belt through PetroCarabobo S.A., where it holds approximately 11 % equity through a subsidiary. The consortium that holds the 40 % non-PDVSA stake in Carabobo-1 also includes Spain’s Repsol and Indian firms Indian Oil Corporation and Oil India, with PDVSA’s affiliate Corporación Venezolana del Petróleo retaining the majority 71 % interest. First oil from Carabobo was achieved in late 2012 under an accelerated production plan, and the field contains substantial extra-heavy crude resources that require upgrading and processing infrastructure to turn them into marketable crude.

Operationally, these joint ventures have faced financial and commercial challenges due to Venezuela’s broader economic situation and international sanctions. ONGC Videsh has historically struggled to receive dividends owed by PDVSA for its share of production, with past arrangements involving crude-in-kind payments in lieu of cash and ongoing discussions about repayment of nearly half a billion dollars of unpaid dividends tied to output from the San Cristobal field. Venezuela has at times agreed to supply cargoes to help clear these dues, but the resolution has been gradual and subject to commodity pricing and export logistics.

KeyFacts Energy: ONGC Videsh Venezuela country profile

Petróleos de Venezuela, S.A. (PDVSA) is Venezuela’s state-owned oil and natural gas company and the central pillar of the country’s hydrocarbons sector. It was established in 1976 following the nationalisation of Venezuela’s oil industry, with a mandate to manage exploration, production, refining, transportation, and exports of the nation’s oil and gas resources on behalf of the state. PDVSA operates under the authority of the Venezuelan government and has historically been one of the largest oil companies in the world.

At its peak in the late 1990s, PDVSA produced more than 3 million barrels of oil per day and was widely regarded as a technically competent and commercially efficient national oil company. It played a key role in OPEC, managed extensive upstream operations, ran large domestic refining complexes, and owned international downstream assets, most notably CITGO Petroleum in the United States. PDVSA also oversaw the development of Venezuela’s vast Orinoco Oil Belt, home to the world’s largest proven crude oil reserves, primarily heavy and extra-heavy crude.

Venezuela operations

PDVSA controls virtually all of Venezuela’s oil reserves, concentrated primarily in the Orinoco Heavy Oil Belt, Lake Maracaibo, and the eastern offshore regions such as the Gulf of Paria and Cardón IV block.

PDVSA’s operations cover the full upstream and downstream value chain. In the upstream segment, it manages onshore heavy and extra-heavy crude production, offshore light crude fields, and natural gas extraction. The company operates the major Orinoco Belt projects, including Junín, Carabobo, and Hamaca blocks, often in joint ventures with foreign partners such as Chevron, Eni, ONGC Videsh, Oil India, and Repsol under the mixed company model, which allows foreign firms to hold minority stakes while PDVSA retains majority ownership. Heavy oil production in the Orinoco Belt is complemented by upgrading and partial refining to produce marketable crude blends suitable for export.

In offshore areas, PDVSA produces light crude from fields such as Perla, Corocoro, and other smaller blocks, as well as associated natural gas for domestic consumption and liquefaction for export. The company also operates a network of gas processing plants and pipelines, connecting offshore production to domestic gas distribution systems. PDVSA’s downstream operations include refining through the Paraguaná, Puerto La Cruz, and El Palito complexes, petrochemical production, and the distribution of refined products both domestically and abroad.

PDVSA has historically relied on joint ventures and service contracts to attract foreign investment, technology, and capital, but political changes, nationalizations, and U.S. sanctions have significantly constrained its ability to invest and operate efficiently. Sanctions have limited exports, particularly to the U.S., and have complicated payments to foreign partners, requiring workarounds such as in-kind crude deliveries. Despite these challenges, PDVSA remains central to Venezuela’s economy, generating the majority of government revenue through oil exports to countries including China, India, and other nations willing to maintain trade relations.

PDVSA’s operations are defined by large-scale heavy oil development in the Orinoco Belt, light offshore crude and gas production, management of major refining complexes, and coordination with foreign partners, all within a complex geopolitical environment shaped by sanctions, economic pressures, and state control of the hydrocarbon sector.

Petropiar

Petropiar is a state‑majority oil and gas joint venture between the national oil company Petróleos de Venezuela, S.A. (PDVSA) and Chevron, with PDVSA holding the larger share. The project operates in the Orinoco Oil Belt (Hamaca area), one of the world’s largest extra‑heavy crude regions, producing heavy crude oil that is processed and upgraded into lighter, higher‑value synthetic crude. Petropiar’s facilities include both production and upgrading units designed to convert extra‑heavy crude into a product suitable for export and refining. Historically, output has been well below maximum technical capacity due to infrastructure, diluent supply and other operational challenges, but it remains one of the largest joint‑venture operations in the Venezuelan oil sector and a key contributor to the country’s crude oil production. Chevron’s presence in Petropiar and other PDVSA joint ventures has continued under special U.S. licensing arrangements despite sanctions, and PDVSA has planned to sustain Petropiar’s output even as Chevron’s U.S. license to operate in Venezuela expires, with production targets in the 100,000–138,000 barrels per day range under PDVSA’s management.

KeyFacts Energy: PDVSA Venezuela country profile

Perenco is a privately held Anglo-French oil and gas company founded in 1975 by Hubert Perrodo. Headquartered in London and Paris, the company operates in more than a dozen countries across Europe, Africa, Latin America, and Asia. Initially established as a marine services and drilling contractor, Perenco transitioned into upstream oil and gas exploration and production in the early 1980s. Today, it is one of the largest independent oil and gas producers in the world.

Perenco’s core business strategy revolves around acquiring and revitalizing mature or marginal fields that larger operators often abandon. It is known for integrating upstream operations with midstream infrastructure, such as pipelines, floating liquefied natural gas (FLNG) units, gas-to-power facilities, and export terminals—particularly in Africa. The company’s production portfolio includes both onshore and offshore assets, with a total output exceeding 450,000 barrels of oil equivalent per day.

Venezuela operations

Perenco has maintained operations in Venezuela primarily through acquisitions of mature onshore and offshore oil fields in western and northern Venezuela, particularly around Lake Maracaibo and the Perla offshore gas field. Perenco entered Venezuela in the early 2000s by taking over assets from larger operators divesting under Venezuela’s changing regulatory framework, and it has focused on maximising production from existing fields rather than large-scale new exploration.

The company operates both oil and natural gas assets. Onshore, in the Lake Maracaibo basin, Perenco manages a series of small to medium-sized heavy oil fields, employing enhanced oil recovery techniques to sustain production from ageing reservoirs. These operations are structured under contracts with PDVSA, which retains majority ownership in line with Venezuela’s legal requirement for majority state participation, allowing Perenco to operate fields under service or joint venture arrangements.

Offshore, Perenco holds a stake in the Perla gas field, one of Venezuela’s largest natural gas deposits in the Gulf of Venezuela. Perenco’s activities there involve the development of gas production and infrastructure to supply both domestic markets and LNG exports, often in collaboration with PDVSA or other foreign partners. The company has historically emphasised operational efficiency and the maintenance of production levels in mature fields, with a strategy that balances low capital expenditure with stable output.

KeyFacts Energy: Perenco Venezuela country profile

Formed in 1987 by the merger of state-controlled oil sector companies, Repsol is now 100 percent privatized and publicly traded on both the Madrid and New York stock exchanges.

Repsol, S.A. is an integrated oil company headquartered in Madrid, Spain. The company engages in the exploration, development, and production of crude oil and natural gas worldwide. It has development and production assets in more than 20 countries, including the United States, Brazil, Trinidad and Tobago, Venezuela, Peru, and Bolivia; and exploration assets in the United States, Brazil, and Angola.

Venezuela operations

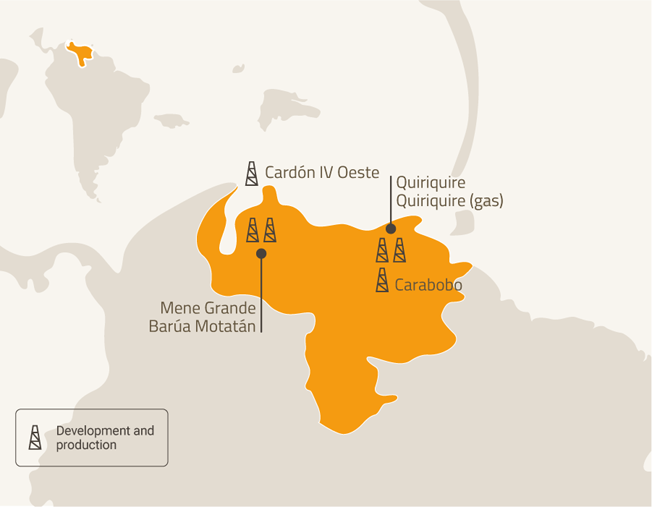

Repsol arrived in Venezuela in 1993 to develop their upstream business through various projects across the country. Since then, the company have managed several oil and gas assets in development and production phases in Venezuela, which has given them extensive experience with medium crude, light crude, and associated and non-associated gas. Examples include work with offshore gas in the Perla Field, the oil development projects in Petroquiriquire and Petrocarabobo, and the exploration and production of natural gas in the Quiriquire Block.

Main projects

Project Pearl

The Perla field (Cardón IV) is considered one of Repsol's major discoveries and is one of the largest offshore gas fields in Latin America. It currently produces 580 million cubic feet of gas per day.

Quirique Gas

Repsol have a 60% stake in the state of Monagas, in an area of 93 km² with a license to explore non-associated gaseous hydrocarbons in the Quiriquire Profundo block.

Petrocarabobo

This 383 km² area is intended for the development of heavy crude oil reserves in Carabobo Norte 1 and Carabobo 1 Centro, both belonging to the Carabobo 1 Project.

Petroquiriquire

Repsol hold a 40% stake in Petroquiriquire, alongside CVP, operating in Quiriquire (Monagas), Mene Grande and Barúa Motatán, located in the states of Zulia and Trujillo.

KeyFacts Energy: Repsol Venezuela country profile

Created in the 1980s, Tecpetrol has extensive experience in oil and gas exploration and production, as well as in gas transportation and distribution.

Tecpetrol carries out oil and gas exploration and production in Argentina, Ecuador, Mexico, Colombia, Bolivia, Peru and Venezuela.

Venezuela operations

Tecpetrol’s involvement in Venezuela’s oil and gas industry has been as a non-operating partner in upstream exploration and production activities, rather than as an operator of major fields. The company, which is part of the Techint Group and active across Latin America, entered Venezuela in the 1990s with joint venture interests in producing units in the Maracaibo Basin, notably through its participation in Baripetrol Mixed Enterprise, where it holds a minority share (around 17.5 %) alongside PDVSA and other partners in the Colón Unit. This participation means Tecpetrol has a stake in both oil and associated gas production in that area, contributing to local output on a proportionate basis but without serving as the operator. The company’s broader corporate disclosures list Venezuela among the countries where it holds exploration and production interests, reflecting its engagement in international upstream projects alongside its core operations in Argentina, Bolivia, Colombia, Ecuador, Mexico, and Peru.

KeyFacts Energy: Tecpetrol Venezuela country profile

KeyFacts Energy: Country Profile l News archive: Venezuela

If you would like to discover more about KeyFacts Energy, contact us today to arrange a 15-minute online meeting to review our database of over 2,600 continually updated 'country-specific' oil and gas and renewable energy profiles from a selection of 144 countries. Find out how you can instantly identify companies with operational activity in your chosen country, 'fine-tune' your news or company selection based on industry category, energy type or regional location and additionally benefit from one-to-one contact with us to ensure maximum online and social media exposure for your company.

KEYFACT Energy

KEYFACT Energy