Highlights

- Lion has executed a farm-out agreement with existing partner OPIC East Seram Corporation (“OPIC”), a 100% indirect subsidiary of Taiwan based CPC Corporation, who will fund 88% of the drilling cost for the Bula Karang exploration well – due to be drilled in 2Q 2026

- In exchange, OPIC will earn an additional 15% participating interest in the East Seram PSC

- Lion’s net funding obligation will be 12% of the US$5.6 million well cost estimate (US$0.7 million), and post-well, it will hold a 45% interest in the PSC

- Recent US$1.2 million sale of Lion’s stake in Seram Non-Bula underwrites Lion’s funding obligations for the Bula Karang well

- The Bula Karang prospect, located close to the 20mmbb Bula Oil Field, hosts a P50 prospective resource of 12mmbo with the exploration well designed to allow early production in the event of success

- The offshore Bula Karang target is planned to be drilled from land – substantially reducing the estimated well cost

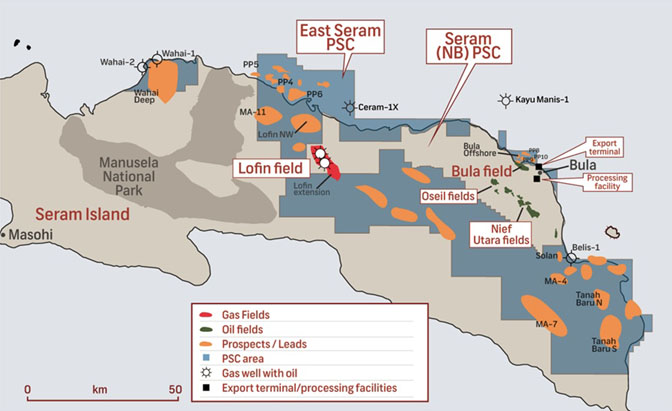

- Seram Island in Indonesia is well serviced by oil and gas infrastructure with refining, storage and export facilities situated near the target area

Mr Tom Soulsby, Lion’s Chairman, commented:

“The farm-out of the East Seram PSC to OPIC, a trusted and supportive subsidiary of Taiwan-based CPC Corporation, represents a great outcome for Lion. We now look forward to planning for and proceeding towards the drilling of a well to test the Bula Karang oil prospect. This well has the potential to be a game-changer for Lion, with numerous follow-up prospects high-graded in event of success. With the recent divestment of Lion’s minority interest in the Seram Non-Bula PSC, the company is pleased to have secured both funding and a substantial interest in this high-impact exploration event”

Lion Energy announces that its wholly-owned subsidiary Balam Energy has executed a Farm-out Agreement (“FOA”) with OPIC East Seram Corporation (“OPIC”), a 100% indirect subsidiary of Taiwanese based CPC Corporation, in relation to the East Seram Production Sharing Contract (PSC), Indonesia.

Following approval of the transaction by the Government of Indonesia, interest in the PSC will be:

Balam Energy Pte Ltd (100% owned by Lion Energy): 45%

OPIC East Seram Corporation: 55%

The shallow well will target the Bula Karang prospect, a high-ranked Plio-Pleistocene carbonate build-up located offshore Bula Bay. The P50 prospective resource1 is estimated at 12 million barrels of oil.

Key features of the Bula Karang prospect:

- Onshore drilling, offshore target: The well will be drilled from an onshore location to an offshore target, significantly reducing cost compared to a typical offshore well.

- Shallow vertical depth: The well has a relatively shallow vertical depth and with deviated well drilling allowing onshore production, any potential development is expected to have relatively low capital cost.

- Early oil production potential: The well plan supports early production in the event of success, allowing an early monetization outcome.

- Existing Infrastructure: Bula Karang is close to the producing Bula Oil Field (over 20mmbbl produced) and the Oseil Field (also over 20mmbbl produced and still in production) oil storage facilities. This proximity to established storage, processing and export facilities, provide a clear route to market for any discoveries.

- Planned spud date: Drilling is targeted for Q2 2026, meeting the PSC’s Year 8 well commitment.

- Long-term potential: a commercial discovery could extend the PSC term by 20 years, enabling further appraisal and exploration.

This farmout deal:

- Secures majority funding for the Bula Karang well, significantly reducing Lion’s exposure

- Leverages OPIC’s technical and financial capability.

- Targets a material 12 mmbo1 oil field resource with access to existing production infrastructure.

- Retains significant upside exposure for Lion through its 45% interest in the PSC.

Key terms of the agreement:

- Transfer: Balam to transfer 15% interest in East Seram PSC to OPIC

- Consideration: OPIC to fund 88% of the Bula Karang well subject to a cap of US$5.6 million (100% basis). Cost beyond US$5.6 million to be funded 45%-55% by Balam-OPIC

- Effective date: 1 Oct 2025

- Condition: approval by the Governement of Indonesia

- Operatorship: Balam to remain operator, with OPIC entitled to request operatorship at any time so long as it has 50% of more of the PSC

East Seram PSC and the Bula Karang prospect

Since acquiring the PSC in 2018, Lion has conducted an active exploration program. A 664 km offshore 2D survey targeting the Plio-Pleistocene foreland basin play in 2020 delineated an attractive shallow oil portfolio. Of significance, a well-defined reefal carbonate build-up, the Bula Karang prospect (previously named PP9), emerged from this seismic data.

Work continues on planning for a Q2 2026 well to test this highly attractive prospect which has a P50 (unrisked) prospective resource of 12 mmbbl oil in the primary objective reefal target with significant follow up options in the event of success. The chance of success is estimated at 38%. Additional secondary objective potential exists with possible oil in overlying sandstone reservoirs. The current plan consists of drilling a deviated well from an onshore location targeting the offshore crest of the Bula Karang structure. This will allow early commercialisation in the event of success, leveraging existing oil infrastructure on Seram Island.

Carbonate reef potential also exists with the nearby PP3 and PP10 prospects and combined P50 Prospective Resource of over 30 mmbbl recoverable (unrisked) is calculated for the play.

KeyFacts Energy: Lion Energy Indonesia country profile l KeyFacts Energy: Farm-in agreements

KEYFACT Energy

KEYFACT Energy