A record £2.6bn in subsidies for renewables Contracts for Difference paid out in 2025

David Turver

Introduction

The data is now available for subsidies paid under the Contract for Difference Scheme (CfDs) in calendar year 2025. The data comes from the Low Carbon Contract Company (LCCC).

A record total of £2.64bn was paid out in subsidies across a range of technologies, but the largest recipient was offshore wind, taking over £2bn of the total. There are some other interesting facts buried in the data that we can now explore.

How Do CfDs Work?

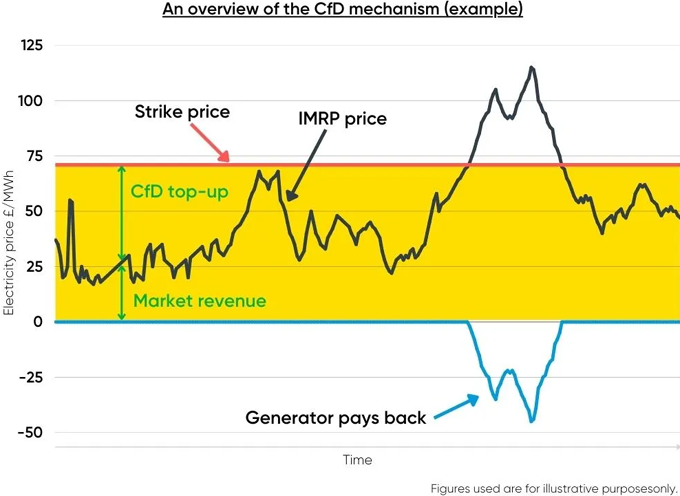

I am often asked how CfDs work, so it is worth giving a brief explanation before diving into the detail of the data. I have pulled Figure 1 below from the Renewable Exchange to illustrate how they work.

Figure 1 - How CfDs Work

The black line shows the market price (or reference price) of electricity on any given day. The red line is the CfD strike price and reflects how much the generator will get paid for its electricity, regardless of the market value. Note that in reality, as we shall see below, the average strike price for active offshore wind CfDs is over £150/MWh.

When the black line is below the red line, the generator receives the market price for the electricity generated plus a CfD top-up (subsidy) for the difference. On the rare occasions when the market price is above the strike price, the generator pays back money to the LCCC as illustrated by the blue line, so its net revenue is equal to the strike price.

Full Year Subsidies

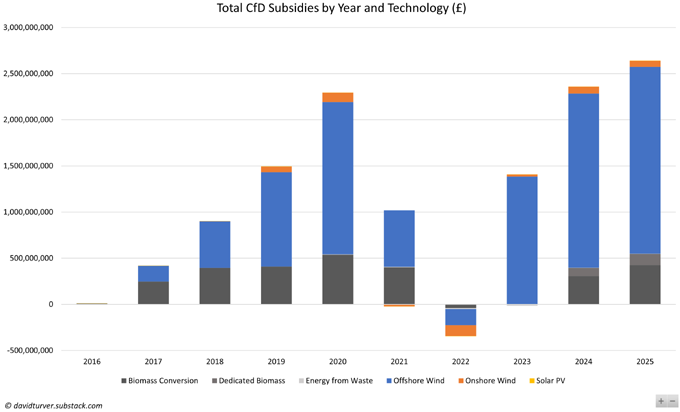

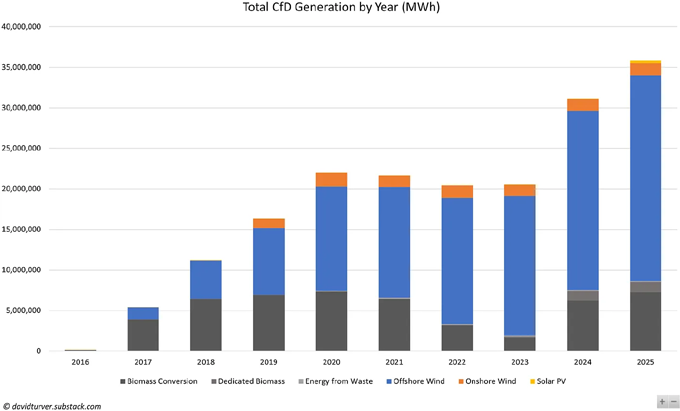

Figure 2 shows the full year subsidies since the scheme began in late 2016, broken down by technology type.

Figure 2 - Total CfD Subsidies by Year and Technology (£)

As well as 2025 being a record year overall, up from £2.4bn in 2024, the top four subsidy months were September to December 2025. Subsides in November 2025 were the highest month on record coming with a total of £311m. Biomass conversion, a euphemism for burning trees, was the second largest recipient of CfD subsidies, at over £428m. Dedicated biomass received a further £118m. Onshore wind received £67m and solar £0.1m.

Supporters of renewables often point out that when the market price of electricity is above the CfD strike price, then generators pay money back. This is true, but that was only significant in 2022 when a net £346m was repaid and compares to the net cost of the scheme of £12.2bn since inception.

Eigen Values is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Top-20 Subsidy Days

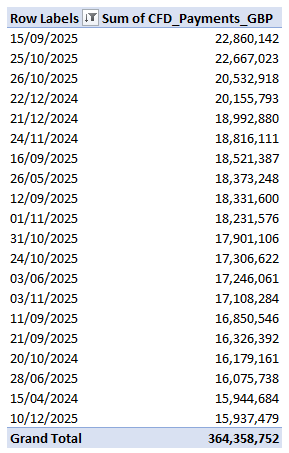

From the data, it is also possible to work out the Top-20 subsidy days since the scheme began. These are listed in Figure 3 below.

Figure 3 - Top-20 CfD Subsidy Days Since Inception

Fifteen of the top-20 subsidy days occurred in 2025, with the rest all coming from 2024. The day with the highest subsidy payments was 15 September 2025, with over £22.8m paid out in a single day. Offshore wind was the main recipient of this Government mandated largesse on that day, getting over £20.9m and biomass receiving over £1m in total.

The annual indexation of CfD strike prices with inflation means that as each year progresses, we are likely to see many more record subsidy days, especially if gas-prices remain in the 70-80p/therm level. Although subsidies may fall if carbon costs keep rising, driving up the market reference price.

Top CfD Subsidy Recipients

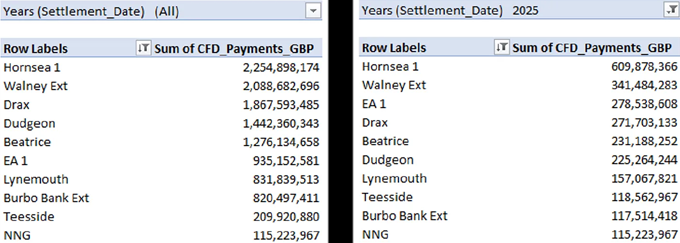

We can also see the top recipients of the subsidy largesse and the all-time Top-10 list is shown in Figure 4a below with the Top-10 for 2025 shown in Figure 4b.

Figure 4a and 4b - Top CfD Subsidy Recipients

Seven of the all-time Top-10 recipients are offshore wind farms. Hornsea 1 has received the most at £2.25bn, with Walney Extension coming second at £2.09bn. In third place is Drax that has been paid £1.87bn in CfD subsidy for burning trees. The other offshore wind farms in the Top-10 are Dudgeon, Beatrice, East Anglia One, Burbo Bank Extension. Neart na Gaoithe (NNG) is a new entry in 2025, having activated its CfD in April at the very high strike price of £162.82/MWh. Lynemouth and Teesside Biomass plants also make the Top-10.

The 2025 Top-10 is dominated by offshore windfarms, with Drax coming in at number four with Lynemouth in seventh place. Hornsea 1 received an astonishing £609.9m in subsides in 2025.

Generation

We can now work to explain why the subsidy payments have been rising. To begin with, we can look at total generation as shown in Figure 5.

Figure 5 - CfD Generation by Technology and Year (MWh)

Generation also hit an all-time high in 2025, with a substantial increase to offshore wind generation to another annual high due to the activation of NNG. Total biomass generation also saw a significant increase in output. Even though 19 new solar farms activated their CfDs in 2025, their output is virtually undetectable generating just 0.8% of the total output.

CfD Strike Prices

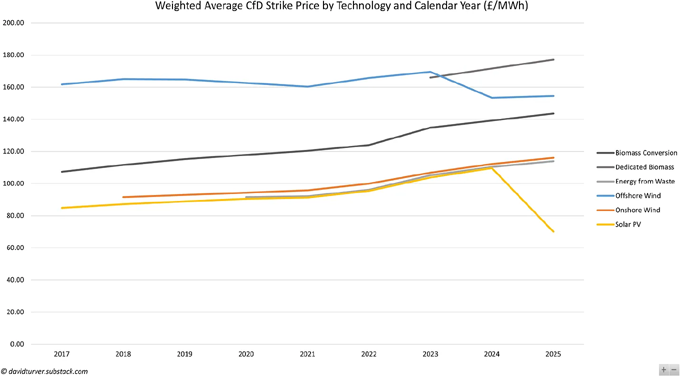

As can be seen in Figure 6, in general strike prices rise over time as they get indexed up with inflation in April each year.

Figure 6 - Weighted Average Strike Price by Technology (£ per MWh)

The strike price for Biomass Conversion has gone up each year since 2017 rising from £107/MWh to over £143/MWh last year. A similar picture emerges for onshore wind, with average strike prices rising from £92/MWh in 2018 to £116/MWh in 2025. Offshore wind prices fluctuated in the £162-166/MWh range from 2017 to 2022. Then there was a big jump in 2023 to £170/MWh before falling back to £153/MWh in 2024. The drop in 2024 can be explained by Hornsea Project 2 and Moray East activating their CfDs in March 2024, with lower than average strike prices. Strike prices rose again in 2025, partly as a result of indexation and partly because of the addition of NNG. The average strike price for solar power fell dramatically from £110/MWh in 2024 to £70/MWh in 2025. This is explained by the addition of the new solar farms discussed above.

CfD Reference Prices

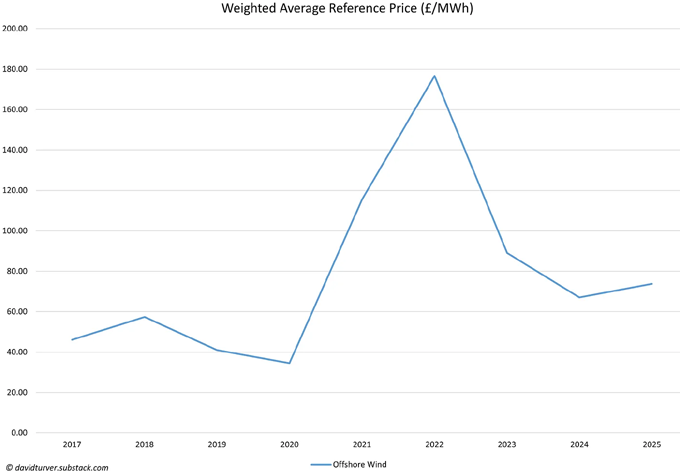

The weighted average reference price for the year (equivalent to the black line in Figure 1) has fluctuated a lot since 2017 as shown in Figure 7.

Figure 7 - Weighted Average Reference Price (£ per MWh)

The charts for offshore wind, onshore and solar are all very close, so for clarity this chart shows just the intermittent reference price for offshore wind. The various flavours of biomass use a different reference price called the Baseload Market Reference Price (BMRP) and we shall deal with separately.

Average offshore wind reference prices were in the range £41-57/MWh from 2017 to 2019. Prices plummeted in 2020 as gas prices and demand fell due to Covid. Prices rose in 2021 to an average of £115/MWh mainly due to the energy crisis that began in the second half of that year. Prices rose again in 2022 to £177/MWh as the energy crisis continued with Russia’s invasion of Ukraine before falling back somewhat to £89/MWh in 2023. Prices fell further in 2024 to £67/MWh before rising again in 2025 to £74/MWh. The increase in 2025 is explained by high gas prices in the early part of the year and rising carbon costs in the latter part of the year that have pushed up reference prices even though gas prices have fallen.

CfD Subsidies Per MWh

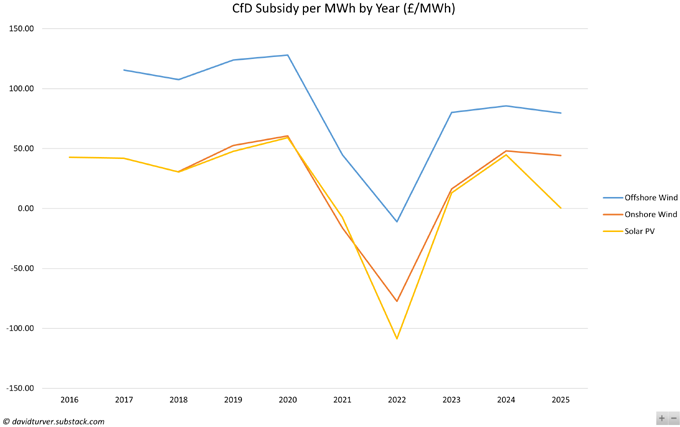

The difference between the strike price and the reference price allows us to calculate the subsidies received per MWh of generation as shown in in Figure 8.

Figure 8 - CfD Subsidy by Year and Technology (£ per MWh)

In 2022, all technologies paid back into the system on average, with negative subsidies per MWh generated. However, subsidies for wind rose back into positive territory in 2023 and remained high in 2024 and 2025. Subsidies per MWh for solar fell back in 2025 due to the addition of new solar farms at low strike prices.

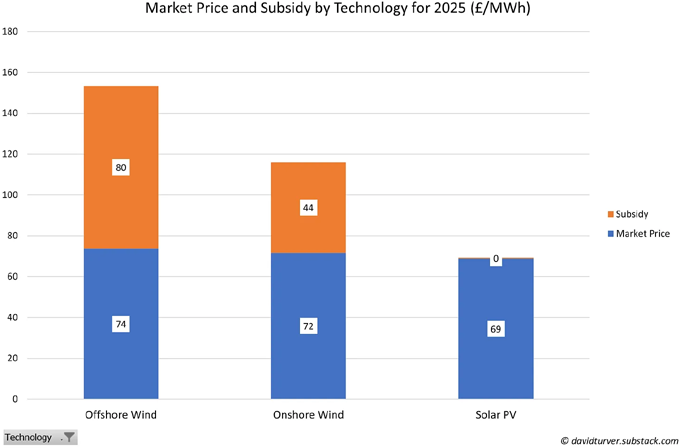

We can see the share of market revenue and subsidy revenue for each technology in 2024 set out in Figure 9 (note some totals slightly different from above due to rounding).

Figure 9 - Market Price and Subsidy 2024 (£ per MWh)

Offshore wind received subsidies of £80/MWh, which is more than the intermittent reference price of £67/MWh, meaning that on average CfD funded offshore wind farms got more of their revenue from subsidies (52%) than they got from selling their power on the market. Onshore wind received £44/MWh (38%) and solar got £0.41/MWh (1%) of their revenue from subsidies.

Load Factors

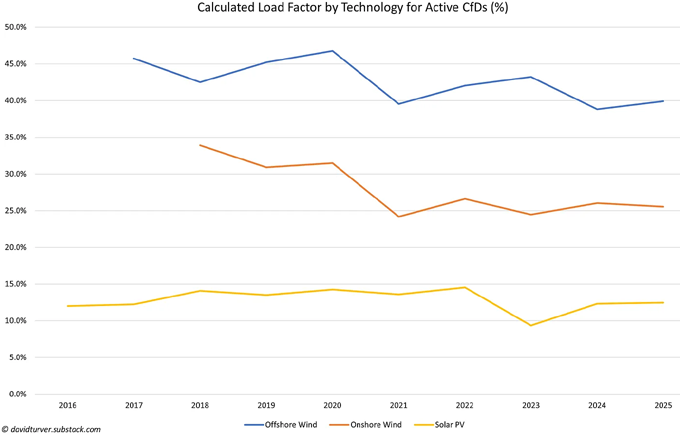

We can also calculate the average load factor for the main intermittent technologies funded by Contracts for Difference as shown in Figure 10.

Figure 10 - Load Factor by Technology (%)

We can see a general downtrend in the amount of electricity generated compared to nameplate capacity for all three technologies. However, offshore wind achieved a load factor of 39.9% in 2025, up from 2024’s record low. However, the average is skewed somewhat by Moray East that had a load factor of just 19.8%, probably reflecting a high level of curtailment during the year. Curtailment happens when wind is producing more power than there is demand or the grid can handle, so windfarms are asked to switch off.

CfD Subsidies for Biomass Plants

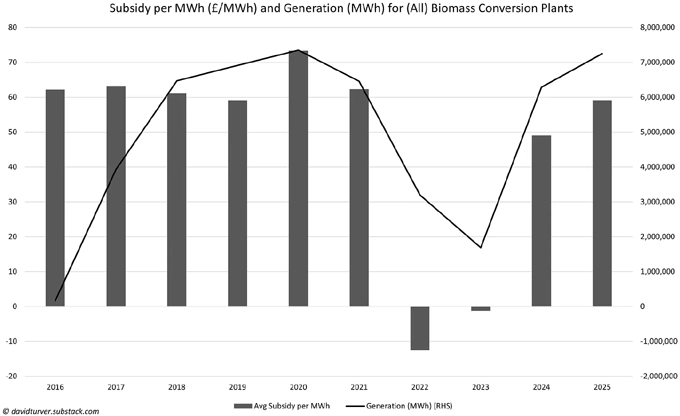

Moving back to biomass plants, we can see how much subsidy they received per MWh of generation and the relationship between subsidies and generation in Figure 11.

Figure 11 - Subsidies (£ per MWh) and Generation (MWh) for Biomass Plants

From 2016 to 2021 the subsidy for biomass plants was around £60/MWh, with a jump up to £73 during Covid. The energy crisis saw subsidies fall below zero as energy prices rose, but this meant generation fell too as the subsidies on offer were not generous enough. In 2024, subsidies rose to £49/MWh and again in 2025 to £59/MWh which stimulated generation to pick up again.

Conclusions

What conclusions can we draw from all this data? It is virtually certain that the overall subsidy payments will continue to rise in the coming years because more offshore wind farms are coming on stream that will push up the level of generation.

It is more difficult to predict strike prices. The new round of indexation coming in April will have the effect of pushing up the average strike price. However, other projects with lower strike prices such as Dogger Bank and Sofia may come online and activate their CfDs too which would push strike prices in the opposite direction.

Reference prices are even harder to predict because we do not know future gas or carbon prices which are the main drivers of reference prices. Higher gas prices would tend to reduce subsidies because the reference price goes up. Gas prices have fallen back recently but this reduction is being offset by rising carbon prices as the market anticipates alignment of the UK and EU Emissions Trading Schemes. Moreover, putting more offshore wind on the grid tends to reduce reference prices when it is most windy. Lower reference prices would tend to increase subsidies per MWh at the time when there is most generation.

It is sad to conclude that we are in for higher bills as the bill for Contracts for Difference continues to escalate. The offshore wind contracts awarded in AR7 were generally at higher strike prices than current reference prices, so it is likely our bills will continue to rise as Miliband drives forward with his Clean Power 2030 plan. By hook or by crook, AR7 must be stopped.

KEYFACT Energy

KEYFACT Energy