Mitsubishi Corporation (“MC”) has agreed to acquire all equity interests in Aethon III LLC, Aethon United LP, and related entities and interests (collectively “Aethon”). This transaction marks MC’s entry into the U.S. shale gas business across the value chain, from upstream ownership through domestic sales and export of produced gas.

MC reached an agreement on January 16, 2026 with Aethon Energy Management and Aethon’s existing stakeholders, including Ontario Teachers’ Pension Plan, RedBird Capital Partners for a total equity investment of approximately USD 5.2 billion. The acquisition is expected to close in the first quarter of Japan's fiscal year (April to June of 2026), subject to customary regulatory approvals.

Building on MC’s established North American energy platform—which includes upstream shale gas development with Ovintiv in British Columbia, midstream marketing and logistics through CIMA Energy in Houston, LNG exports via LNG Canada and Cameron LNG, and power generation through Diamond Generating Corporation—this acquisition further strengthens MC’s integrated energy and power business.

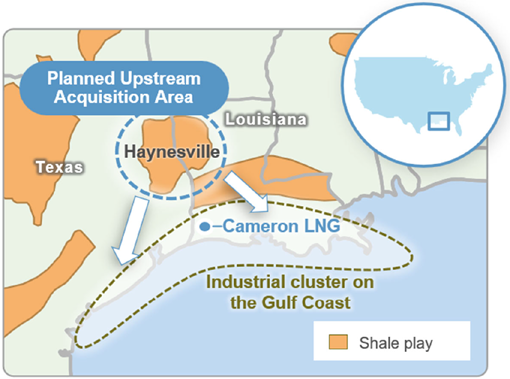

Aethon’s shale gas assets are primarily located in the Haynesville Shale formation, spanning Texas and Louisiana, and currently produce approximately 2.1 Bcf/d of natural gas (equivalent to about 15 million tons per year of LNG).

Haynesville is a major supply source of natural gas for the growing southern U.S. market and offers favorable access to multiple LNG export terminals, including Cameron LNG, where MC holds liquefaction capacity rights under a tolling agreement. Aethon’s natural gas is currently sold in the U.S. southern market, and part of this volume is being considered for export as LNG to Asia, including Japan, as well as to Europe.

Under its Corporate Strategy 2027, Leveraging Our Integrated Strength for the Future, MC has outlined a value creation framework of “Enhance,” “Reshape,” and “Create.” As part of “Create,” MC aims to drive growth through synergies across its existing business segments. This investment will not only strengthen the earnings base of MC’s natural gas and LNG businesses, but also accelerate efforts to build an integrated value chain in the United States—from upstream gas development to power generation, data center development, chemicals production, and related businesses.

KeyctFas Energy news: New Kid on the Block

If you would like to discover more about KeyFacts Energy, contact us today and we can arrange a 15-minute online meeting to review our database of over 2,600 continually updated 'country-specific' oil and gas and renewable energy profiles from a selection of 144 countries. Find out how you can instantly identify companies with operational activity in your chosen country, 'fine-tune' your news or company selection based on industry category, energy type or regional location and additionally benefit from one to one contact with us to ensure maximum online and social media exposure for your company.

KEYFACT Energy

KEYFACT Energy