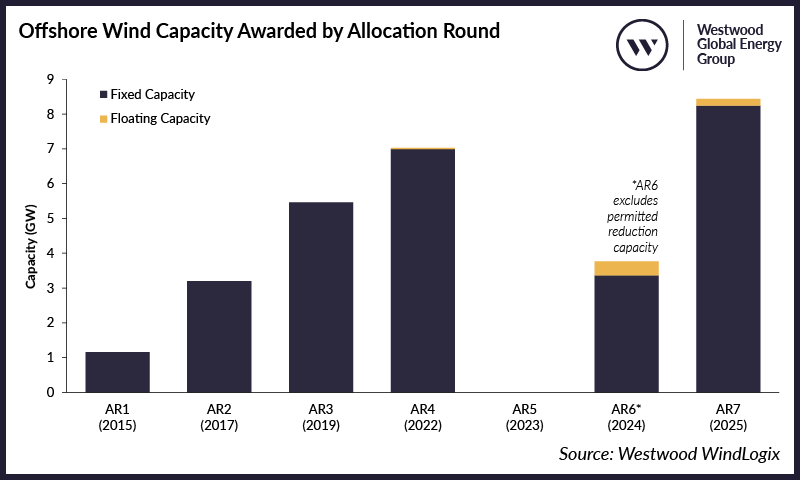

The results of the offshore wind section of the UK’s seventh Contract for Difference allocation round (CfD AR7) were announced on 14 January 2026. In total, 8.4GW of capacity was awarded in the auction, a strong result compared to the 3.8GW of fresh capacity awarded in AR6 and previous record of 7.0GW in AR4. RWE was the big winner, picking up 6.9GW of all capacity awarded, while the government dramatically utilised its new powers to increase the budget on offer mid-round from £900mn to nearly £1,800mn. Industry reaction to the outcome of the auction has generally been positive.

Offshore Wind Capacity Awarded by Allocation Round

Source: Westwood WindLogix

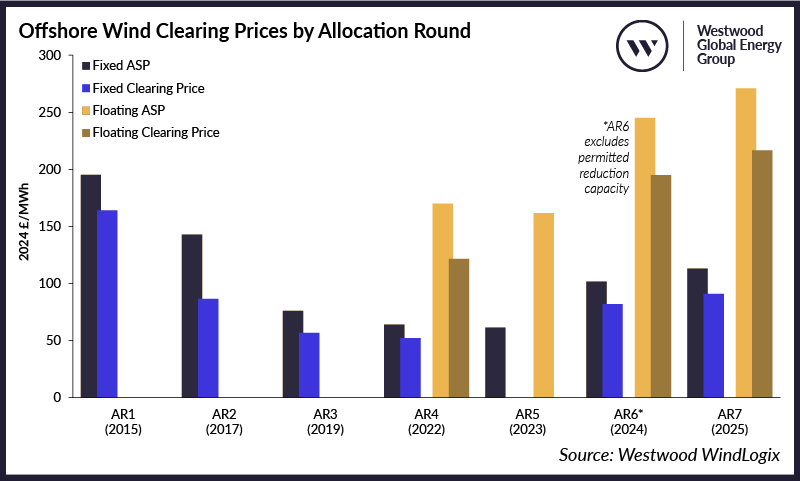

Six fixed-bottom projects equivalent to 8.2GW cleared the auction at a weighted average strike price of £90.91/MWh (up 11% y-o-y), compared to 3.4GW in AR6[1]. Five of the projects cleared at £91.20/MWh, while the one successful Scottish project, Berwick Bank Phase B, cleared at £89.49/MW, taking advantage of a new provision that allowed a separate clearing price for Scottish projects. Two floating wind projects equivalent to 193MW of floating wind cleared the auction at £216.49/MWh (up 11% y-o-y), compared to 400MW in AR6.

This result was towards the top end of expectations, with the 8.4GW awarded comfortably exceeding the record of 7.0GW in AR5. Clearing prices were also at the higher end of predictions, with both fixed and floating wind strike prices increasing by 11%, though both remained some 20% below maximum levels permitted (the Administrative Strike Price or ‘ASP’)[2].

This 11% figure understates the extent of the increase, as AR7 saw 20-year contracts on offer for the first time – rather than 15 years as had been the case previously – and effectively enabled developers to offer lower upfront bids with overall remuneration remaining the same due to the longer contract tenor. A previous government impact assessment of the reforms proposed and implemented for AR7 had suggested that extending CfD terms to 20 years could deliver a 12% reduction in strike price on a like-for-like basis (i.e. AR6 strike prices could have been 12% lower if 20 years contracts were on offer). Combining this 12% reduction to AR6 prices and the year-on-year increase of 11% observed in AR7 suggests an effective – albeit hypothetical – cost increase of more like 26%.

Offshore Wind Clearing Prices by Allocation Round

Source: Westwood WindLogix

Successful projects in the auction included the 1,380MW Berwick Bank Phase B wind farm, the initial phase of capacity covered by the controversial Berwick Bank consent, the as-yet-unconsented Dogger Bank South East and Dogger Bank South West projects (a combined 3GW) and the 92.5MW Pentland floating wind project, in which GB Energy has an ‘initial’ shareholding. The selection of the Dogger Bank South farms is particularly interesting, as they are the first unconsented projects to succeed in a CfD auction since a rule change prior to AR7 allowed for the bidding of projects with pending consent applications. A decision on those projects had been due in January 2026, but this was pushed back to April 2026 a few days before the CfD results were announced

Overall, RWE was the big winner of the auction, picking up 6.9GW of capacity (5.1GW on an equity basis). The concentration of so much capacity under one developer may be a cause for concern going forward, given the extent to which the UK’s offshore wind build-out will be tied to one company’s investment programme. Orsted’s recent difficulties may be instructive in this regard.

The winning projects in full were:

| Project Name | Capacity (MW) | Stakeholders | Consented? | Development Solution | Clearing Price (£/MWh) |

| Awel y Môr | 775 | RWE (60%), Stadtwerke München (30%), Siemens Financial Services (10%) | Yes | Fixed | £92.10 |

| Berwick Bank Phase B | 1,380 | SSE Renewables (100%) | Yes | Fixed | £89.49 |

| Dogger Bank South East | 1,500 | RWE (51%), Masdar (49%) | Decision due April 26 | Fixed | £92.10 |

| Dogger Bank South West | 1,500 | RWE (51%), Masdar (49%) | Decision due April 26 | Fixed | £92.10 |

| Norfolk Vanguard East | 1,545 | RWE (100%), pending 50% sale to KKR | Yes | Fixed | £92.10 |

| Norfolk Vanguard West | 1,545 | RWE (100%), pending 50% sale to KKR | Yes | Fixed | £92.10 |

| Erebus | 100 | TotalEnergies (80%), Simply Blue Group (20%) | Yes | Floating | £216.49 |

| Pentland | 92.5 | CIP (83%), Hexicon AB (10%), Eurus Energy (7%)* | Yes | Floating | £216.49 |

Successful Offshore Wind Projects in AR7

*GB Energy, the National Wealth Fund and the Scottish National Investment Bank also hold an undisclosed initial shareholding in Pentland.

Source: Westwood WindLogix

Despite the strong result, the outcome of AR7 largely foreclose any possibility of the UK having 43-50GW online by 2030 in line with Clean Power 2030[3]. However, the Clean Power 2030 target is expressed in such a way as to include ‘installed’, ‘under construction’ and ‘committed’[4] capacity. By this looser definition, the 43-50 GW target appears much more achievable, with four further allocation rounds (2026, 2027, 2028, 2029) left to award just over 6GW of capacity. From this perspective, with only a relatively modest 1.5GW needing to be awarded per annum, the challenge becomes one of maintaining the viability of the uncontracted pipeline and the attractiveness of entering the UK offshore wind sector. EnBW’s decision to withdraw from the 3GW Mona / Morgan projects, announced shortly after the results of AR7 were known, is perhaps an indication of this challenge.

While questions around Clean Power 2030 remain, AR7 is nonetheless likely to be regarded for now as a success by government and industry. For developers, it means the ability to progress projects, while for the supply chain, it secures a substantial pipeline of future work which may justify investment in production capacity. For the government, it represents a successfully executed process with a meaningful amount of capacity awarded at an acceptable price, seemingly justifying the substantial changes made to the auction award process prior to AR7. In the end, assuming projects can progress at the strike prices set, the round will represent a positive day for the industry.

Peter Lloyd-Williams, Senior Analyst – Offshore Wind

plloydwilliams@westwoodenergy.com

[1] Excluding ‘Permitted Reduction’ capacity to include only additive capacity.

[2] Comparison to the ASP is somewhat flattering, however. Government clearly stated at the outset of the auction that “ASPs [were set] meaningfully above expectations of clearing prices”.

[3] In Westwood’s analysis, around 10GW would have been needed in AR7 to have 43GW operational in 2030, assuming optimistic delivery assumptions.

[4] Defined as “projects that have secured a CfD but not yet become fully operational” in the language of the Clean Power 2030 report.

Original article l KeyFacts Energy Industry Directory: Westwood Global Energy

KEYFACT Energy

KEYFACT Energy