WTI (Feb) $59.44 +25c, Brent (Mar) $64.13 +37c, Diff -$4.69 +12c

USNG (Feb) $3.10 -3c, UKNG (Feb) 90.71p +2.22p, TTF (Feb) €33.375 -0.91

Oil price

Oil was up modestly last week and with US markets closed for Martin Luther King day only massive geopolitical upheaval will change much. At present that is focused on Greenland which shouldn’t be happening at all and of course Iran which is quiet, I suspect temporarily, US military presence in the Gulf continues to build.

More importantly how excited were you when you woke up this morning knowing that it is the first day of Dav-Oh, but then you probably aren’t one of the creatures that are shacked up in 5* hotels in the Swiss resort all paid for by your shareholders or worse, your electorate.

The cocktail party circuit goes on all week and the ‘good and the great’ will meet all their mates and spend other peoples money like sailors. It is a total disgrace and some of these industrialists and all the politicians should know better, not one ever stands up and reveals that the Emperor is wearing no clothes…

Prospex Energy

Prospex has announced that it is now in receipt of committed subscriptions totalling £1,346,050 for the offering of its unsecured Convertible Loan Notes.

Highlights

- Committed subscriptions of £1,346,050 (including the £985,000 previously announced on 12 January 2026) for the Company’s offering of unsecured Convertible Loan Notes of £1 each, due at the end of June 2028 (the “Loan Notes”).

- The proceeds from the Loan Notes have already funded the Company’s 37% share of the 3D‑seismic acquisition programme at the Selva Malvezzi production concession in Italy which will enable the next stage of the development of the asset which has major potential for the Company.

- The Loan Notes are convertible at 3p per ordinary share at any time at the election of the investor.

- Interest of 12% per annum is payable quarterly, with the first two interest payments on 31 March 2026 and 30 June 2026 to be capitalised and added to the loan principal rather than paid in cash.

- Loan principal to be repaid in three tranches at the end of December 2027, the end of March 2028 and the end of June 2028.

Forecast increased gas production from the drilling campaigns on all three of the Company’s production concessions is expected to cover the capital repayments.

- Net proceeds will be used to support the Company’s ongoing activities, including current and future capital expenditure requirements.

- Ongoing operational costs and overheads continue to be met from production income generated by the Company’s strategic asset portfolio.

Mark Routh, Prospex’s CEO, commented:

“The Board of Prospex is very grateful for the support from investors for the Loan Note offering. The proceeds from the Loan Notes have already funded the Company’s 37% share of the 3D-seismic acquisition programme at the Selva Malvezzi production concession in Italy, which was successfully completed by the operator last month.

“The Company enters 2026 with its ongoing commitments fully covered, securing its interests across its production and development concessions.”

Nothing new here but good to see the raise completed and the scene is set for the arrival of Tom Reynolds with a modest financing to keep him going for the current expenditure programme.

Use of Funds and Structure

The funds raised from the issue of the Loan Notes will fund the ongoing growth of the Company and its current and future capital expenditures. Ongoing operational expenditures and overheads are currently covered from production income from the Company’s portfolio of assets.

Selva Malvezzi

£800,000 of the net proceeds of the Loan Notes have been used to fund the Company’s 37% share of development costs in respect of the 3D-seismic acquisition programme, which was completed last month at the Selva Malvezzi concession, in the Po Valley in Italy. The Company is now up to date with its obligations in the Selva Malvezzi Joint Venture.

Viura

£200,000 of the Loan Notes already issued in December 2025 settled the balance of the June 2025 cash-call on Viura in northern Spain, which was not fulfilled in cash by the Company at that time. In order to assist the Company, HEYCO Energy Group, Inc. agreed that this £200,000 was converted into the Loan Notes.

Tarba – El Romeral

A total of £300,000 of the net proceeds is anticipated to be used for a new transformer at the El Romeral power plant in Carmona southern Spain, due for delivery in approximately 6 months, with a final payment of £235,000 due. The transformer was ordered in November 2025 and a 20% deposit of £65,000 has already been paid.

Further Loan Note Subscriptions from the Directors of the Company

In addition to the £25,000 already subscribed on 19 December 2025, Alasdair Buchanan has subscribed an additional £1,800 in cash. In addition to the £20,000 already subscribed on 19 December 2025, Andrew Hay has subscribed an additional £6,250 in cash.

United Oil & Gas

United has announced that the R/V Gyre, operated by TDI Brooks International, mobilised from Trinidad on Saturday 17 January 2026 and is now en-route to Jamaica to undertake the planned offshore surface geochemical exploration survey on the Walton Morant Licence.

The vessel is expected to arrive in Kingston, Jamaica in approximately five to six days. Upon arrival, the R/V Gyre will undergo pre-survey inspection and acceptance procedures, following which it will be prepared to commence offshore operations on or around 27 January 2026.

Once the offshore survey programme commences, the vessel will initially complete the multibeam echo sounder (MBES) survey. This will be followed by heat flow measurements and seabed piston coring operations.

Following completion of the offshore operations, recovered core samples will be shipped to TDI Brooks’ laboratory in the United States for detailed geochemical analysis. Preliminary results are expected approximately one to two months after completion of the survey, with final analysis expected around mid-2026. The offshore survey programme is designed to confirm the presence of thermogenic hydrocarbons and further de-risk the basin, providing key data to support future exploration activity on the Walton Morant Licence.

The Company expects to provide further updates as the survey progresses, including updates following commencement of offshore operations and following completion and review of the MBES survey, which will inform the final selection of piston coring locations.

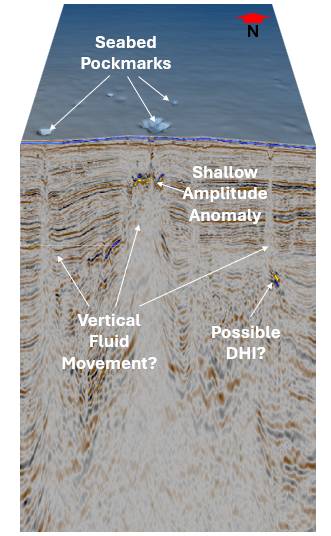

Piston Coring Target Areas – Illustrative Example

The image below illustrates an example of a potential piston coring target location (for illustrative purposes only and not to scale).

As shown, certain seabed features such as shallow depressions or pockmarks, some of which can extend to several hundred metres in diameter, can often be associated with hydrocarbons venting at the seafloor. These surface features may be linked to subsurface seismic features indicative of fluid migration, including vertical migration pathways (or fluid escape chimneys) and shallow amplitude anomalies which, in the image below, can be seen directly beneath the surface pockmarks, together with nearby seismic responses that may represent direct hydrocarbon indicators (DHIs) in the form of bright soft amplitude responses.

Figure 1. Seismic detail and overlying seabed character at an example target location for piston coring.

By targeting such features, the piston coring programme is intended to test for the presence of a thermogenic hydrocarbon signature in recovered seabed sediment. A positive result would provide direct evidence of an active petroleum system and materially derisk the prospectivity of the Walton Morant Licence.

Brian Larkin, CEO of United Oil & Gas, commented:

“This survey represents a key milestone in advancing our Jamaica exploration programme. With the R/V Gyre now en route, we are entering an important phase of data acquisition that is expected to significantly enhance our understanding of the basin.

The results will play a central role in de-risking the licence and informing future strategic decisions as we continue to unlock the potential value of over 7.1 billion barrels of unrisked prospective resources in this highly prospective offshore area.”

The UOG shareholders will be pleased to see another announcement from the company as they patiently wait for activity in Jamaica and whilst this is clearly good news it still means that there is a long wait for monetisation of the Walton Morant licence.

With analysis expected to be completed by around ‘mid-2026’ investors will need quite a lot more of that patience as once this information is gathered in the data room then the farm-out process can get going. Only then, and I assume later in the year will the gears really start to grind.

Walton Morant looks exciting indeed and I understand that there are interested parties in the mix, let’s hope that the data received from this survey keeps them in the process…

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy