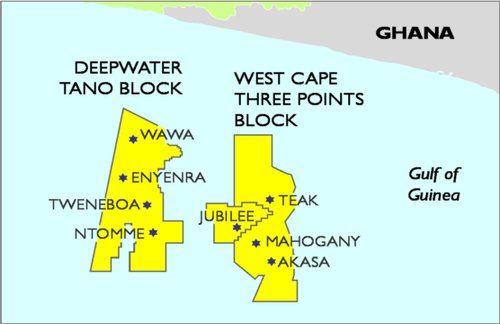

Kosmos Energy confirms that the license extensions for the West Cape Three Points and Deepwater Tano Petroleum Agreements, which cover the Jubilee and TEN fields in Ghana, have been formally ratified by the Ghanaian parliament. The licenses now extend to 2040.

The license extensions bring key benefits to Ghana including up to $2 billion in incremental investment as well as higher volumes of affordable gas from the fields for domestic power generation. Kosmos is pleased to have played a leading role in progressing, negotiating and executing these extensions. As part of the extensions, the amended Jubilee plan of development will include up to 20 additional wells in the field and, as a result, Kosmos expects to realize an increase in Jubilee 2P reserves.

At the Jubilee field, the J74 well that came online in early January is now fully ramped up. Gross daily production from the well is ~13,000 barrels of oil per day (bopd), increasing average gross Jubilee oil production to over 70,000 bopd in February month-to-date, in line with Kosmos expectations. The first well of the five-well 2026 drilling campaign, J75, has been drilled, encountering approximately 40 meters of net pay. J75 is expected to be completed in three zones, similar to the J74 and J72 wells, and is expected online around the end of the first quarter.

At the TEN fields, the partnership has signed this week a sale and purchase agreement (SPA) to acquire the floating production, storage and offloading vessel (FPSO) for a gross consideration of $205 million (~$40 million net to Kosmos) to be paid upon completion at the end of the first quarter of 2027. Signing of the SPA is expected to result in material operating expense reductions in 2026 onwards.

In Mauritania and Senegal, Phase 1 of the Greater Tortue Ahmeyim (GTA) LNG project shipped 3.5 gross LNG cargos in January. The field has averaged production of ~2.9 million tonnes per annum (mtpa) equivalent (vs. 2.7 mtpa nameplate capacity) year-to-date, highlighting the continued strong operating performance of the asset.

On the financial side of the business, in January, Kosmos successfully completed a $350 million Norwegian bond that was well supported by both existing and new investors. Kosmos used $100 million to repay borrowings under the Reserve Base Lending (RBL) facility with the remainder to be used to repurchase Kosmos' 2027 senior unsecured notes. The company has also started to hedge 2027 production with two million barrels of oil hedged with a floor of $60/barrel.

Andrew G. Inglis, Kosmos Energy's chairman and chief executive officer said:

"Parliamentary ratification of the license extensions in Ghana marks an important milestone for the country, and Kosmos is proud to have led the work with the Government of Ghana to execute these agreements. Jubilee is a world‑class oil field with significant remaining potential that can be unlocked through continued investment, regular drilling and high facility reliability, supported by the latest seismic acquisition and processing technologies.

"As the partnership advances the current drilling program, Jubilee production continues to rise in line with our expectations. With Jubilee output exceeding 70,000 bopd and GTA producing above nameplate capacity, Kosmos' total production has reached record levels."

"This improved performance, combined with the financial progress we are making, strengthens the resilience of the company and ensures we are well positioned to create long‑term value for our shareholders."

KeyFacts Energy: Kosmos Energy Ghana country profile

KEYFACT Energy

KEYFACT Energy