Consolidation and Rig ‘Recycling’ are at the Forefront of a Supply-Chain Response

Commercial decision-making in offshore drilling companies is a tough challenge, involving not just ensuring safe, efficient, and continued operations in some incredibly challenging physical environments, but also taking a position on where the market may be in 3-4 years, a typical lead-time for a new rig delivery. Likewise, the choice between holding on to old assets in the hope that a recovery is ‘just around the corner’ versus choosing to ‘retire’ or ‘recycle’ a rig (the current favoured terms, with ‘scrapping’ absent from most company reporting in an increasingly environmentally-sensitive world) is a difficult trade-off. However, RigLogix data show the industry has not been sitting on its hands during the downturn, and through consolidation, rig retirements and re-purposing, a substantial effort has been made to address over-supply. Is it enough?

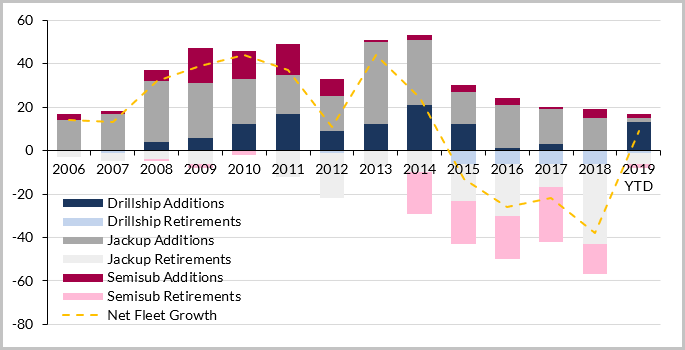

William Blake’s assertion that “hindsight is a wonderful thing” will perhaps be of little comfort to rig owners as they reflect on how the market has developed since 2014. Without question, the newbuild cycle witnessed in the ten years between 2005 and 2014 was over-done, and even without a cyclical industry downturn, would likely have put pressure on dayrates and utilisation. However, faced with the reality of the situation in the extended downturn seen since 2014, what has the industry done about it?

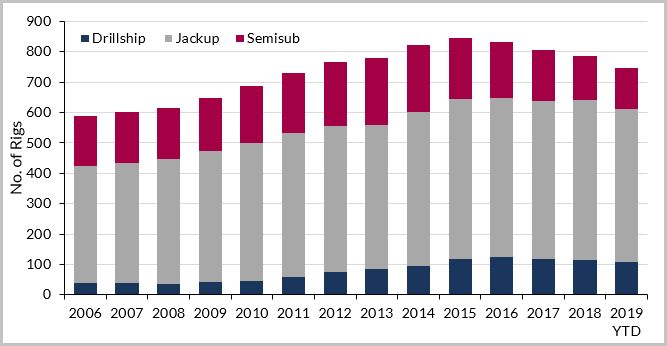

Global Offshore MODU Fleet (Competitive Units)

Source: RigLogix

Change In Global Offshore MODU Fleet (Competitive Units)

Source: RigLogix

Some 230 rig retirements have occurred between the start of 2014 and March 2019, the result of which has been an offshore drilling rig fleet in net decline since 2015. Rig deliveries have continued over this time (163, all but 6 of which were ordered pre-downturn) and whilst many owners have delayed deliveries to the maximum extent that they can, this overhang of deliveries for units ordered during the last cycle means that despite 230 rigs being retired, the net reduction in the total fleet is only 66 units.[i]

Rig utilisation for MODUs remains low at 54% on average, which suggests that without growth in demand there is substantially more trimming of the fleet required to bring utilisation to levels that may see dayrates improve. Yet there still remains further newbuild units to be delivered – according to Riglogix data, some 54 jackups, 13 drillships and 5 semisubs are scheduled for delivery in 2019, though most of these will ultimately be pushed into 2020.

Consolidation of the market will allow some further control of the fleet by contractors. Last year Transocean acquired Ocean Rig and immediately announced the scrapping of two units, following that up in early 2019 with the scrapping of two more. Prior to this, the company completed the acquisition of Songa Offshore and subsequently scrapped the Songa Trym and Songa Delta semisubmersibles. Ensco and Rowan (including the ARO JV with Aramco) also merged last year, creating the largest rig owner in terms of total units, and once the deal is completed it is likely that some attrition from the combined fleets will take place. In 2017 Ensco acquired Atwood Oceanics, and while a few Atwood jackups were cold stacked, only one Ensco semi has been retired since.

With some rig contractors in default on their newbuilds, we have seen some shipyards become rig owners. These shipyards have started to release some of the rigs at a discount to normal newbuild prices, either through direct sale or lease to rig contractors. Examples include Borr Drilling, which spent a total of $2 billion to purchase 14 jackups from Singapore’s PPL Shipyard and KeppelFELS, and Shelf Drilling, which in February 2019 announced the acquisition of two jackup rigs from China Merchants and the bareboat charter (with option to buy) of a further two jackups. A recovery in demand could see further such rigs acquired as a lower-cost route for rig contractors to expand fleets with newbuild units.

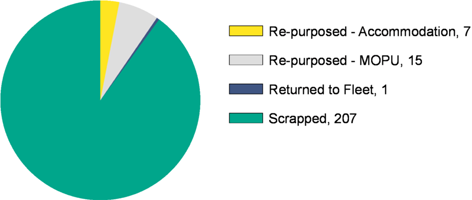

Most of the rigs removed are scrapped, with the steel content (usually more than 95% of the rig) cut up and recycled. Some rigs also find uses elsewhere in the offshore supply chain. Since 2014, a total 23 have been re-purposed for other uses such as accommodation units or mobile offshore production units (MOPUs).

Rig Retirements – Destination

Source: RigLogix

The re-launch of Westwood’s flagship Riglogix product this spring will feature a live ‘RigOutlook’ forecasting tool, allowing users to overlay rig supply with forecast drilling demand to build a forward view of utilisation and dayrates. At present, under Westwood’s base case scenario, there will remain a supply overhang for some time, with total number of working jackups, semi-submersibles and drillships reaching 410 in 2020. Assuming further scrapping of 10% of non-marketed rigs per year, this will bring utilisation levels for the global MODU fleet to an average of 65%. However, as noted in previous Westwood Insights, there is tighter supply in some markets and material inflation in dayrates. Contact the Riglogix team to find out more.

Steve Robertson, Director, Head of Rigs & Wells

srobertson@westwoodenergy.com

KEYFACT Energy

KEYFACT Energy