International fleet conditions improve with onshore rig utilisation to tick past 50%, despite weakness in North America

Following a significant rebound in 2017-2018, the outlook for growth in the global land rig market in 2019 is more subdued, driven by low growth in the high volume North American fleet. While the market in North America remains subdued following the oil price decline in Q4 2018, and is constrained by limited pipeline takeaway capacity, particularly in Canada, international fleets continue to recover. The high volume markets in Asia and the Middle East are investing significantly in midstream infrastructure. New infrastructure and relatively robust Capex budgets are providing opportunities for rigs to enter/re-enter these geographies, and in some cases begin to introduce upward pressure on dayrates.

Within the MENA region, Algeria, Iraq and the UAE are expected to be among the fastest growing markets over the next two years. The wider region has a strong outlook, despite the OPEC decision to extend the December 2018 OPEC production cuts for a further nine months until March 2020, reducing some oil drilling. Elsewhere in international markets, a renewed production growth policy initiative in China is leading to new asset deployments and construction orders in that fleet. Argentina’s Vaca Muerta has been on the international radar for some years, and is an increasingly promising market for onshore drillers.

Post-2019, Westwood expects to see more pronounced and sustained growth in rig demand, including in North America where new pipeline capacity is anticipated. In the longer-term, key opportunities for growth in the global market will come from Asia-Pacific, Latin America, and MENA.

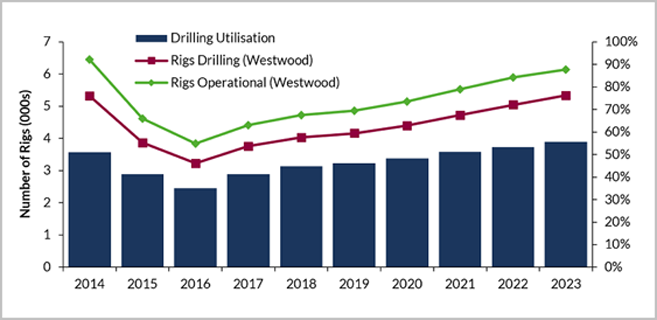

Global Rig Fleet and Drilling Utilisation, 2019-2023 (Source: Westwood Global Energy Group)

Key Conclusions

- Asia-Pacific is expected to be a key focus area for growth in rig demand, with China having announced plans to increase unconventional exploration and development, as well as enhance output at a number of large, existing fields. India has also announced fiscal incentives aimed at increasing production from existing fields.

- Westwood expects the number of rigs drilling in Latin America to rise by 16% over 2019-2023, driven by the development of the Vaca Muerta shale play in Argentina. Additional opportunity for the rig market will also come from planned developments in Ecuador and Peru, including the Ishpingo-Tiputini-Tambococha

- Sentiment within the North American market for the first half of 2019 has been cautious. In particular, the Canadian market has experienced challenging conditions, with widening price differentials and lack of access to market for Canadian crude.

- North American drilling activity and rig demand is forecast to remain relatively flat in 2019-2020, with the market expected to pick up from 2020 onwards. There is the potential for significant growth in rig demand in Canada, driven by the start-up and expansion of numerous planned oil sands projects; however, this outlook is heavily predicated on the required pipeline capacity being installed.

- MENA will also remain a key contributor to rig demand over 2019-2023 with activity forecast to increase across a number of fields in Iraq and Saudi Arabia, and the use of EOR techniques in Oman and Kuwait expected to contribute to demand for high-specification rigs.

- There appears to be an increased recognition within the industry of the need for drilling contractors to have a global footprint. This is particularly the case in the Middle East, where competition between international contractors and smaller, local contractors is increasing, and companies look to consolidate their presence in core markets with strong prospects for growth.

Find Out More

The World Land Drilling Rig Market Forecast 2019-2023 report is presented using the rig fleet data from Westwood’s online Global Land Drilling Rig Tool, as well as the onshore drilling and production data from Westwood’s SECTORS. The report contains detailed country and regional analysis of the market, including onshore wells drilled, operational rigs, rigs drilling by HP category (0-499 HP, 500-999 HP, 1,000-1,499 HP, 1,500-1,999 HP, 2,000-2,999 HP, and 3000+ HP), and rig utilisation. Analysis is based on a ten-year view of the market, with historic data covering the period 2014-2018, and forecast data for 2019-2023.

The report also provided detailed insight on:

- Macro-economic drivers and trends – including analysis of trends in drilling complexity and unconventional exploration and development, the North American land rig fleet evolution, and economic and political considerations impacting the market.

- Manufacturing – including a comprehensive overview of the supply chain, analysis of the leading original equipment manufacturers operating in the regional markets for key rig components, and rig equipment trends for top drives, as well as pad drilling and walking rig technology.

- Regional and national competitive landscape of identified rigs – matrix of drilling contractors operating in each region, indicating the overall size, composition, and countries of operation of each contractor’s fleet, as well as a competitive landscape by contractor type (indigenous, international, and NOC) for each country included in the report.

For sample pages or purchase options, please contact:

APAC, Leslie Kwek l EMEA, Phill Wickens l Americas & ROW, Ryan Becker

KEYFACT Energy

KEYFACT Energy