Billy FitzHerbert - Middle East Regional Editor, Oxford Business Group

Billy FitzHerbert - Middle East Regional Editor, Oxford Business Group

The results of our most recent OBG Business Barometer: UAE CEO Survey arrive amid a flurry of global economic headlines. On July 23 the IMF announced a downward revision of global growth forecasts to 3.2%, citing the ongoing uncertainty stemming from escalating tariffs and tensions as the main drags on future growth. Meanwhile, on July 25 Mario Draghi, the president of the European Central Bank, suggested that a rate cut and a fresh round of quantitative easing measures to stimulate eurozone growth were on the horizon. Talk of an interest rate cut reflects moves in the US, where the Federal Reserve announced an interest rate cut of 25 basis points at its most recent meeting in late July.

Given the dirham’s dollar peg, and that the Central Bank of the UAE usually shadows the Federal Reserve’s interest rate changes, this reduction could be a significant event for the country’s banking sector and wider economy. A falling interest rate environment would likely spur a rethink among lenders, and banks may try to raise the contribution of non-interest income and move to fixed-rate loans – more broadly, the move could lead to cheaper credit and loan growth to individuals and companies.

While the IMF projected in April that the UAE’s growth would hit 2.8% in 2019, down from the 3.6% predicted last October, an IMF mission visiting at the end of that month concluded that green shoots were beginning to emerge, nourished by domestic credit growth, low unemployment figures and an increasing number of tourists. This is a sentiment that chimes with OBG’s assessment of the local market, and a view shared by many of the local businesspeople we meet with in the country on a daily basis. Issues do remain, – and notably the oversupply of real estate in Dubai and Abu Dhabi continues to cause concern – but several positive indicators and a raft of regulatory reforms point to a return to above 3% growth in 2020.

Reforms to the UAE’s economic framework improve business environment

Stimulus packages unveiled by Abu Dhabi and Dubai last year have continued to support expansion in those emirates, while the moves to relax foreign ownership rules across swathes of the national economy have been widely applauded. Some 122 economic activities across 13 sectors, including renewable energy, transport and storage, and manufacturing, have been opened to 100% foreign ownership for the first time.

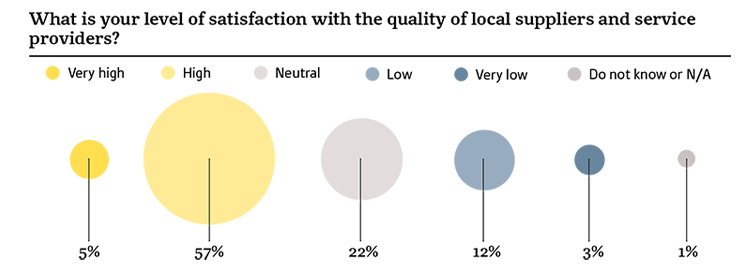

Furthermore, it was recently announced that the UAE gained two places on the global innovation index to 36th position. The country is also fast closing in on its National Agenda target of becoming the world’s best for ease of doing business, jumping 10 places to 11th position in the World Bank’s index for 2019. OBG can report similarly steadily improving metrics, as 62% of the CEOs we surveyed over the last six months said they were satisfied or very satisfied with the quality of local suppliers and service providers in the country, up from 58% at the end of 2018.

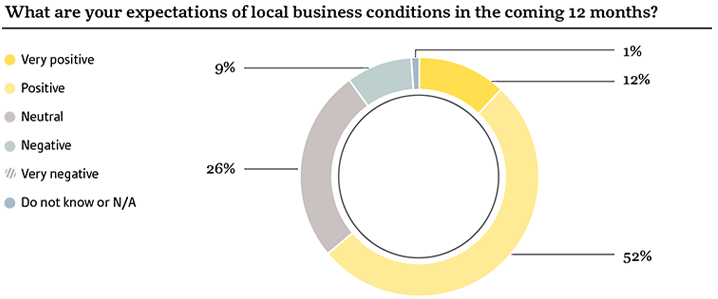

The full results of our latest survey reveal a generally upbeat and optimistic private sector, with 64% of respondents either positive or very positive about the country’s business environment over next 12 months. While this is down slightly from the 67% recorded in our last survey, the proportion of those who answered negative or very negative has fallen significantly, from 24% to 9%. Also of note is that when one aggregates answers received during the second half of the survey, the proportion of those selecting positive or very positive rises to 73%, indicating that sentiment is on an upward curve since the start of the year. Interestingly, the recent escalation of tensions in the Gulf appears to have had a muted impact on sentiment.

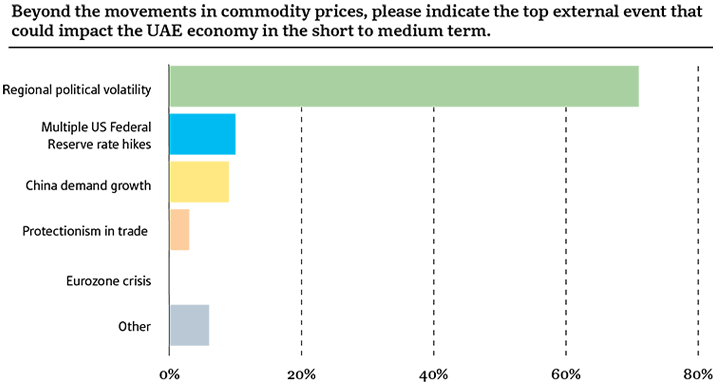

This being said, regional volatility remains by far the most pressing concern for CEOs: 71% identify it as the external event most likely to impact the UAE’s growth in the short to medium term. Somewhat surprisingly, this figure is only marginally higher than in our last survey, despite the escalation of tensions in the region over the past two months. This is of course is not to downplay the severe economic repercussions that any further escalation could have. As almost one-fifth of the world’s oil supply passes through the Strait of Hormuz, any disruption of traffic through the waterway would reverberate not just through regional economies, but globally too.

New deals strengthen economic ties between China and the UAE

While it is hard to look beyond regional volatility when analysing external risk, it is worth noting that the proportion who selected Chinese demand growth increased from 6% to 9.4%; this is the only answer that witnessed an increase in responses compared to six months ago. This illustrates the general concern over slowing Chinese output, as well as the quickly deepening economic ties between China and the UAE.

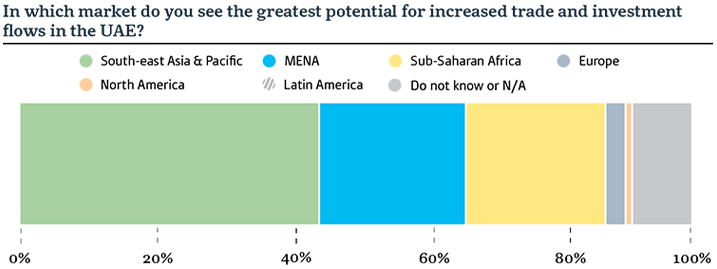

China is the world’s largest oil importer, and as such, the UAE has long been one of its key suppliers. However, recent times have seen the relationship widen in scope. In April the two countries signed $3.4bn worth of deals as part of the Belt and Road Initiative – China’s strategy to connect the markets between Asia and Europe via a far-reaching infrastructure investment programme – in which the UAE has emerged as an important player. In July the UAE-China Economic Forum was hosted in Beijing, with 500 people attending from both the private and public sector. The event concluded with the signing of 16 memoranda of understanding. It is little surprise, then, that the attention of the UAE’s CEOs is focused eastward, and almost half of those surveyed by OBG selected South-east Asia and the Pacific as the region most likely to drive trade and investment flows in the years to come.

This information was originally published by Oxford Business Group (OBG), the global publishing, research and consultancy firm. Copyright Oxford Business Group 2017. Published under permission by OBG. For economic news about UAE and other countries covered by OBG, click here.

KEYFACT Energy

KEYFACT Energy