Tower Resources plc provides an update on operations on the Thali block in Cameroon and on well financing.

As disclosed in the Company's operational update in May, the Company received additional data from the original Total wells at NJOM1 and NJOM2, which indicated that further site preparation work would be required before the drilling rig for the NJOM-3 well is moved to site. The most suitable vessel to undertake this site preparation work is now en route to West Africa with the expectation that this work can be completed during September 2019.

The Company had previously agreed with Vantage to defer the commencement of its drilling contract in respect of the Topaz Driller until after Vantage's current charter to another oil company was completed. However, in the past few weeks a former sister rig to the Topaz Driller, the COSL Seeker, has become available in Cameroon after completing recent work for Addax. Given the difficulty in matching up the schedule of the Topaz Driller with availability of the site survey data, the Company yesterday signed a Letter of Intent ("LOI") to use the COSL Seeker rig to drill NJOM-3 instead of the Topaz Driller, and has released the Topaz Driller. The day rate and other terms of the COSL agreement are similar to the Vantage agreement, and while there may be some additional costs for the mobilisation of test equipment to the COSL Seeker on the current schedule, the Company also anticipates significant savings in the cost of rig mobilisation and demobilisation. In the aggregate, the Company does not presently anticipate a material change in the total cost of the well as a result of this change of rig.

The Company has notified the Societe Nationale de Hydrocarbures ("SNH") and the Government of Cameroon ("MINMIDT") of the changes to the well schedule, and does not anticipate any difficulty in proceeding with the well, despite the fact that the extension to the first Exploration Period of the company's Production Sharing Contract ("PSC") expires on 14 September 2019, since the well remains an operation in progress.

As previously disclosed, the NJOM3 well will be drilled to a total depth of 1,100 metres intersecting at least three reservoir zones already identified by the NJOM1B and NJOM2 discovery wells drilled on the Njonji structure by the previous operator Total. The well is designed to confirm the greater reservoir thicknesses observed on the reprocessed 3D seismic in the up-dip area of the structure, and also evaluate additional reservoirs that were not present in the areas where Total's wells are located. The NJOM3 well is designed to supplement Total's well data with a suite of measurement and logging tools and drill stem test ("DST") flows to surface. The Company's intention is then to suspend the well with a view to subsequent completion as one of four initial production wells on the structure, as envisaged in the Reserve Report prepared by Oilfield International Limited (OIL) on 31 October 2018. This first phase of development envisaged by the Reserve Report, aiming to exploit the 2C contingent resources (Pmean 18 million barrels oil, gross) already identified in the structure, aims to provide significant production to Tower in 2020.

In respect of well financing, the Company is continuing farm-out discussions with multiple parties who are currently undertaking due diligence, and the Company is hoping to bring at least one of these discussions to a conclusion in the near future, bearing in mind both the operational schedule outlined above and also that the Company's bridging loan facility agreement (the extension of which was announced on 30 July 2019) falls due for repayment at the end of August, subject to a grace period until 30 September 2019.

Map source: Tower Resources

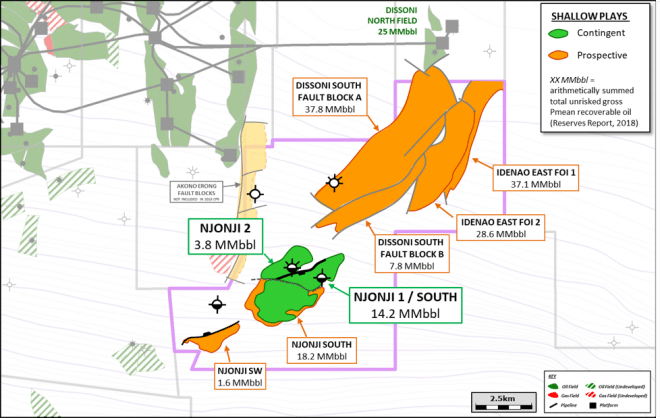

Following a comprehensive review of the subsurface dataset, including reprocessing of 3D seismic data by DMT Petrologic GmbH & Co KG, and detailed petrophysical analysis of wells in and around the block, Oilfield International Limited (OIL) were retained to conduct an assessment of the Thali licence prospectivity and produce a Reserve Report. In November 2018 the results of the independent Reserve Report conducted by Oilfield International Limited (OIL) were published, highlighting the actual and potential resources on the Thali licence and the associated Expected Monetary Value (EMV) of each of the identified prospects, as follows:

- Gross mean contingent resources of 18 MMbbls of oil across the proven Njonji-1 and Njonji-2 fault blocks and with a development contingency probability of 80% on first phase and 70% on second phase;

- Gross mean prospective resources of 20 MMbbls of oil across the Njonji South and Njonji South-West fault blocks;

- Gross mean prospective resources of 111 MMbbls of oil across four identified prospects located in the Dissoni South and Idenao areas in the northern part of the Thali licence;

- Calculated EMV10s of US$118 million for the contingent resources, and US$82 million for the prospective resources, respectively.

KEYFACT Energy

KEYFACT Energy