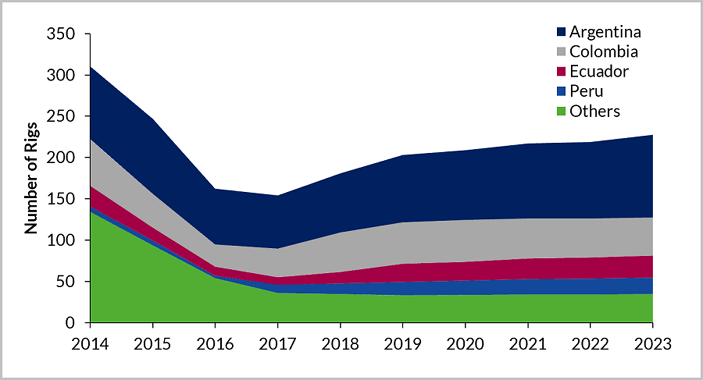

As the onshore drilling industry marches through the third year of recovery, two years ahead of the offshore sector, a pick up in tendering activity is gathering pace in pockets outside of North America. Within this context, Latin America has emerged as one of the focus regions for rig demand growth over the next five years. The Vaca Muerta shale play in Argentina has been an area of interest for international rig contractors for several years, and is expected to dominate activity in the region, with several large E&P companies, including ExxonMobil and Shell, having announced plans for full-scale developments in the play in recent months. Growing economic concerns and upcoming elections in Argentina increase the political will to further develop the reserves, although international E&P assessments of in-country risk are ongoing and may alter if the political situation deteriorates. While the Vaca Muerta is expected to provide the cornerstone for rig demand in Latin America, opportunities for rig contractors are also anticipated in Ecuador and Peru, offering three potential ‘hot spots’ for activity over the next five years.

Within the Vaca Muerta play, Shell’s planned development of the Sierra Blancas, Cruz de Lorena, and Coiron Amargo Sur Oeste blocks is likely to involve the drilling of over 300 wells in 38 locations across the blocks by 2025, while Exxon’s development project at the Bajo del Choique-La Invernada is anticipated to require over 90 wells drilled in the next five years. Westwood expects these projects to contribute to a 23% rise in the annual average number of rigs drilling in Argentina over 2019-2023.

Latin America Annual Rigs Drilling by Country

Source: Westwood Global Energy

Argentina – a global bright spot with growing economic concern

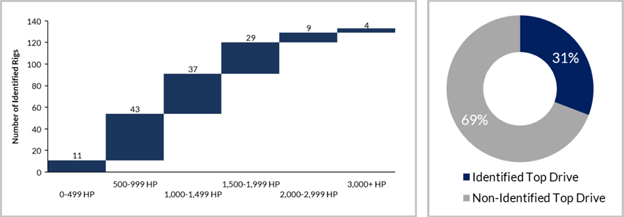

The anticipated ramp up of activity at the Vaca Muerta play will require continued commitment of the major E&Ps currently active in the country, but offers the potential to provide opportunity for rig contractors active in the sector with high-specification, high-horsepower units (1,500 HP and above). Helmerich & Payne, the third largest driller in the country, has recently announced the signing of a letter of intent for the deployment of its second super-spec FlexRig to drill in the basin, for example, with potential for further new units.

The current rig fleet in Argentina is comprised of a relatively small proportion of high specification units, with only 32% of identified rigs rated at 1,500 HP or above, and only 31% positively identified as being top drive-equipped. Large international contractors with high-end units already present in the country, including Ensign Energy Services and Nabors, are likely to be in a position to capitalise from the potential growth in rig demand, particularly given their strong presence in North America, as well as elsewhere in Latin America. Regionally-focused contractors, such as DLS Argentina, San Antonio International and Quintana Wellpro, may also experience increased demand for their high-specification units and benefit from improving day rates. Beyond the Vaca Muerta play, medium-term opportunity for rig contractors within Argentina may come from the Austral basin, where National Oil Company YPF and Compania General de Combustibles announced plans in March 2019 to invest $25m in unconventional exploration.

Argentina Identified Land Drilling Rig Fleet by HP Category and Top Drive Equipped Proportion

Source: Westwood Global Energy

Activity in wider Latin America

Outside of Argentina, the Llanos and Lower Magdalena Valley basins in Colombia have been a key area of focus for active E&Ps, providing opportunity for rig contractors including Pioneer Energy Services. Rig demand in the country is also expected to be sustained in the near-term by the development of a number of small fields, including Castilla, Jacana, and Tigana. Ecuador is expected to see sustained high levels of onshore drilling over the next five years, supported predominantly by the Ishpingo-Tiputini-Tambococha development, with PetroAmazonas having also announced plans to drill an additional 10 wells at the Sacha field, one of the largest producing onshore fields in Ecuador. Key contractors currently present in the country include Chinese NOCs CNPC and Sinopec, Hilong Oil Service & Engineering, Tuscany International Drilling, and Nabors. In Peru, the development of the Situche oil field (GeoPark), as well as activity in blocks 58 (CNPC) and 192 (Frontera Energy) is expected to drive an increase in demand for rigs, with PetroTal Corporation also planning to develop the Bretana oil field in Block 95.

While a relatively small region for rig demand; when compared with North America, Russia or Asia Pacific, Latin America is expected to contribute increasingly to global rig demand growth in the coming years, providing opportunity for rig contractors with high-specification units. While the Vaca Muerta will continue to dominate activity in the coming years, in-country risk appears to be increasing, although activity forecasts are currently expected to proceed as planned. Beyond Argentina, developments elsewhere in the region, notably in Ecuador and Peru, will also provide opportunities active contractors in the market.

Katy Smith, Analyst l ksmith@westwoodenergy.com

KeyFacts Energy Industry Directory: Westwood Global Energy

KEYFACT Energy

KEYFACT Energy