UK Government announces record low prices for offshore wind with the results of the CfD Round 3 auction.

Key points

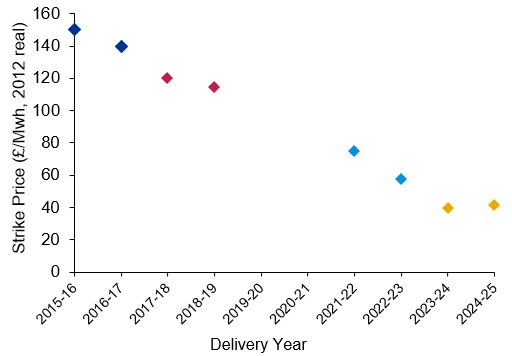

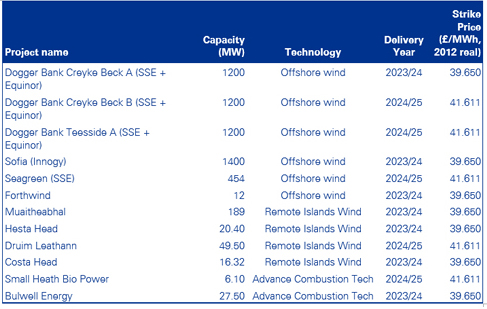

- The UK’s Third Contracts for Difference (CfD) auction has cleared at the record low price of £39.650/MWh for Delivery Year 2023/24 and £41.611/MWh in 2024/25 (2012 real).

- Six offshore wind, four remote islands wind and two Advanced Conversion Technology projects secured contracts.

- Government has secured 5.8GW of new capacity, without spending a penny of the £65m budget.

- This increases the challenge faced by other low carbon technologies to match the cost reductions achieved by offshore wind.

- The results open up the possibility for offshore wind to play a greater role in delivering Net Zero by 2050.

Strike prices awarded under CfD

Source BIES

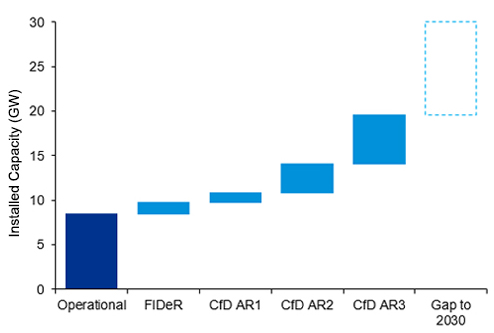

UK offshore wind capacity built out projection

Source: Renewable UK, BEIS

Today’s results demonstrate both dramatic cost reduction, and development of scale. With today’s awards, total offshore wind capacity supported under UK schemes has reached almost 20GW.

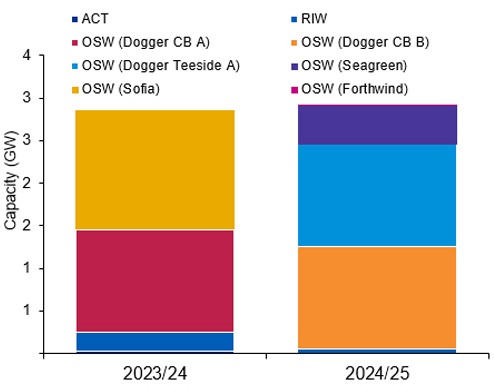

A variety of global offshore wind developers were successful in this round, but none more so than SSE and Equinor who were successful in securing 3.6GW of offshore wind projects, from the 6GW of contracts available.

This large commitment to the market is lead by their development of the Dogger Bank zone, which accommodates the Creyke Beck and Teesside projects. These developments are pioneering large scale projects, much further out to sea than has been seen previously in UK waters. Innogy’s adjacent Sofia development also secured a CfD.

East Anglia 3 (Scottish Power), Inch Cape (SDIC) and Moray West (EDPR) did not secure a CfD in this Allocation Round.

Capacity per Delivery Year

Source: KPMG analysis

The underlying influences

Allocation Round 3 made £65m of Contracts for Difference (CfD) subsidy available for Pot 2 technologies, with an overall cap set at 6GW in total. In practice, the auction was capacity constrained, with none of the Budget allocated, due to clearing prices below the Reference Price.

Entering the auction, 9.8GW of offshore wind projects were eligible to bid. A maximum (Administration) Strike Price of £56/MWh for offshore wind set the playing field well below the anticipated competitive range for many of the other Pot 2 technologies.

However, alongside offshore wind, 34MW of Advanced Combustion Technology projects were successful. The Remote Islands Wind projects (onshore wind on islands off the coast of Scotland), which were a new addition to Pot 2 in this round were also successful, securing 275MW; thereby strengthening the needs case for the transmission link.

The shadow on the water

The filing for Judicial Review submitted last month by Banks Renewables casts some uncertainty over the results. Until resolved, this uncertainty may prohibit developers from taking FID and may prolong their exposure to movement in macro economic factors such as foreign exchange and inflation, as well as development costs such as booking fees. This will be particularly challenging in the current climate, with Brexit uncertainty eating into the already tight margins required to achieve such low clearing prices.

Implications for UK generation

2.85GW of the capacity secured during this Allocation Round will become operational in 2023/24, with a further 2.9GW coming online in 2024/25.

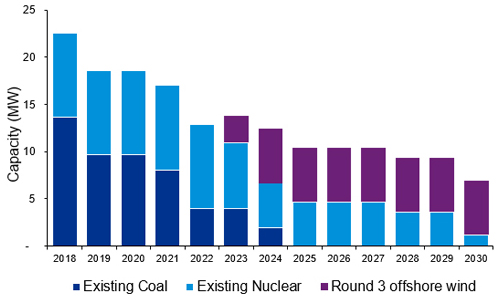

This capacity connects to the grid at a crucial time as 4GW of existing coal and 2.3GW of nuclear capacity is decommissioned over the same period. The intermittency of this new predominantly offshore wind capacity will simultaneously create opportunities for complementary flexible generation to provide grid stability. This may amplify interest in the T-4 Capacity Market auction planned for October of this year, which could bring forward the despatchable capacity required to fill the void.

The scale of these projects will promote the offshore wind supply chain, creating UK jobs and furthering Government's progression towards meeting its commitment to achieving Net Zero emissions by 2050.

This additional buoyancy in the offshore wind market is further welcomed ahead of The Crown Estate Round 4 seabed lease auctions which launch in Q4 of this year. Together these auctions are providing the foundation for growth towards the Sector Deal’s 30GW target by 2030 and, longer term, the Climate Change Committee’s recommendation of 75 GW of offshore wind by 2050.

New offshore wind to replace lost capacity

Source: BEIS

Official results

Source: KPMG l KeyFacts Energy: Renewable Energy news

KEYFACT Energy

KEYFACT Energy