Bahamas Petroleum Company plc, the oil and gas exploration company with a significant prospective resource in licences in The Commonwealth of The Bahamas, has raised US$7.1 million before expenses through a firm placing of 275,641,455 new ordinary shares of 0.002p each at a price of 2p each.

The Company considers that with the success of the Open Offer and the Placing, and when combined with the Conditional Convertible Note, it will likely have sufficient funds to undertake the drilling of an initial exploration well in The Bahamas during 2020, in accordance with the Company's licence commitments.

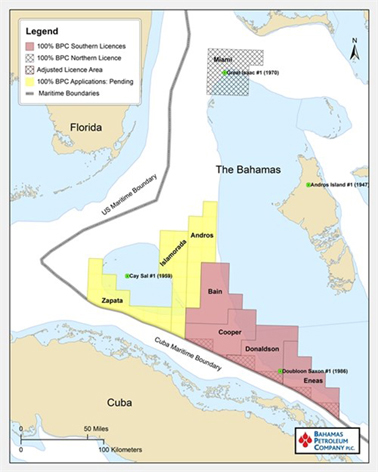

Map source: Bahamas Petroleum

Moreover, in addition to the proceeds from these activities the Company continues to pursue a farm-out as part of its overall funding strategy, and has received proposals for, and continues to develop and assess a number of other financing options. A decision to enact any of these other financing proposals will be taken, if required, based on the outcome of the farm-out process.

To the extent that a farm-out is successfully concluded on terms acceptable to the Company, the amount of capital available to the Company would likely materially increase, and would be additive to the funds raised through the Open Offer, the Placing and the Conditional Convertible Note. Such funding could be applied towards all or a considerable portion of the costs in respect of the intended drilling, or alternatively proceeds from any farm-out could be applied to a broader work programme than the current single well the Company intends to drill in 2020.

Simon Potter, Chief Executive Officer, commented:

"Our clear focus at Bahamas Petroleum is to drill an initial exploration well on our highly prospective acreage in The Bahamas during 2020, consistent with our obligations to the Government of The Bahamas. We have been working diligently to develop a coordinated funding strategy so as to ensure we have access to the funds necessary for drilling, as and when we need them. I am thus extremely pleased to advise all shareholders of our successful Open Offer and Placing, which, in aggregate, have raised approximately US$11.4 million. When combined with the proceeds we expect to receive from our Conditional Convertible Note, we will have secured the finance required for drilling activities, given our anticipated well cost is in the range of US$20 million to US$25 million. At the same time, we continue to maintain our cost focus, monitor a range of additional funding options, and progress our farm-in process, all with a view to strategically enhancing the overall financial capacity of the Company, whilst not being reliant on any particular outcome for drilling activities to be implemented.

I would like to thank existing shareholders for their continued support, commitment to the project and confidence in the ability of management to deliver on their behalf. The path taken to this point has not been straightforward but collectively we have stayed focused so as to realise the Company's goal - the management team understands the responsibility it bears and is determined to succeed. I also take this opportunity to welcome our new shareholders and I look forward to updating you all on our progress over the next six months as we ramp up for drilling operations. We strongly believe it will be an exciting time for our Company."

KEYFACT Energy

KEYFACT Energy